Title: Enhance Your Business Credit with Minnesota Sample Letter for New Business with Credit Application Introduction: When starting a new business venture in Minnesota, it is crucial to establish a strong credit profile. One effective way to achieve this is by utilizing a Minnesota sample letter for new business with a credit application. This letter outlines the necessary information for potential creditors to evaluate and assess your business's creditworthiness. By using relevant keywords in your credit application, you can strengthen your chances of obtaining favorable credit terms. Let us explore the essential components of a Minnesota sample letter for new business with a credit application, along with different types available. 1. Key Components of a Minnesota Sample Letter for New Business with Credit Application: — Business Information: Include your business name, address, phone number, email address, and legal entity type (sole proprietorship, corporation, LLC, etc.). — Contact Person: Provide details of a primary contact person responsible for credit inquiries, usually the owner, manager, or an authorized representative. — Business Structure: Describe the nature of your business, its products or services, years in operation, and any noteworthy business affiliations. — Financial Information: Share your business's financial statements, such as profit and loss statements, balance sheets, and cash flow statements. Include tax returns for the past few years if available. — Bank References: Include the names and contact information for your business's current and previous banking relationships, along with account numbers, if applicable. — Trade References: Provide a list of vendors, suppliers, or business partners you have established credit relationships with in the past. Include their contact information and references. — Credit Limit Request: Specify the desired credit limit for your business and mention its purpose, be it to fund inventory purchases, equipment investments, or operational expenses. — Personal Guarantee: State whether you are willing to personally guarantee the business's credit obligations and provide relevant personal financial information if required. 2. Types of Minnesota Sample Letters for New Business with Credit Application: — Standard Credit Application: This type covers a general credit application format, suitable for businesses seeking credit from various creditors. — Industry-Specific Credit Application: Some industries may have specific requirements, such as construction, manufacturing, or healthcare. This type tailors the credit application accordingly. — Limited Credit Application: If your business seeks credit with certain limitations, such as a short-term loan or a specific trade credit arrangement, this version addresses those needs. — Credit Application with Bank Referral: Catered towards businesses interested in establishing credit through a referral from their bank, this letter highlights the existing banking relationship and recommends them accordingly. — Business Credit Application for Sole Proprietorship: Designed explicitly for sole proprietorship, this letter focuses on personal credit history, in addition to business details. Conclusion: A well-composed Minnesota sample letter for new business with a credit application can significantly impact your business's credit outlook. By providing all the necessary information and using relevant keywords, you can present your business as a reliable candidate for credit. Choose the most appropriate type of letter that suits your business needs and industry specifications, ensuring that it caters to your unique requirements. Utilize this valuable tool to enhance your business credit profile and pave the way for future financial growth.

Minnesota Sample Letter for New Business with Credit Application

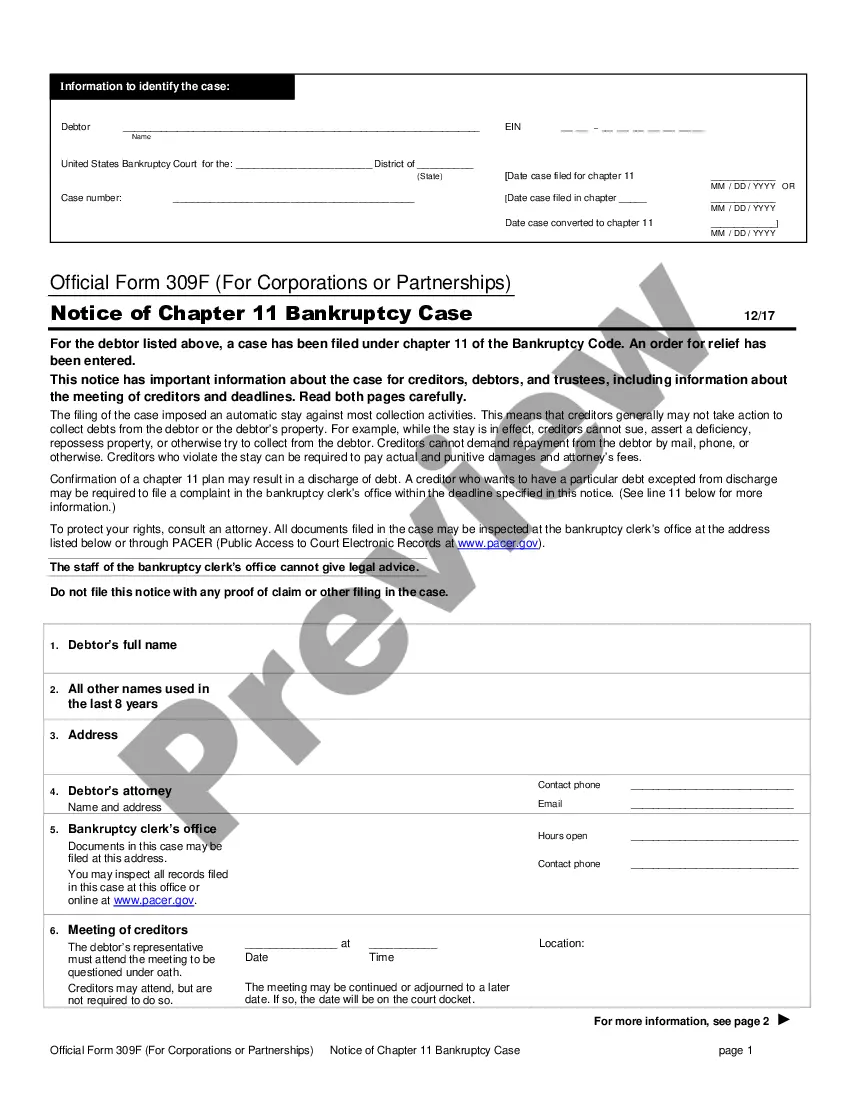

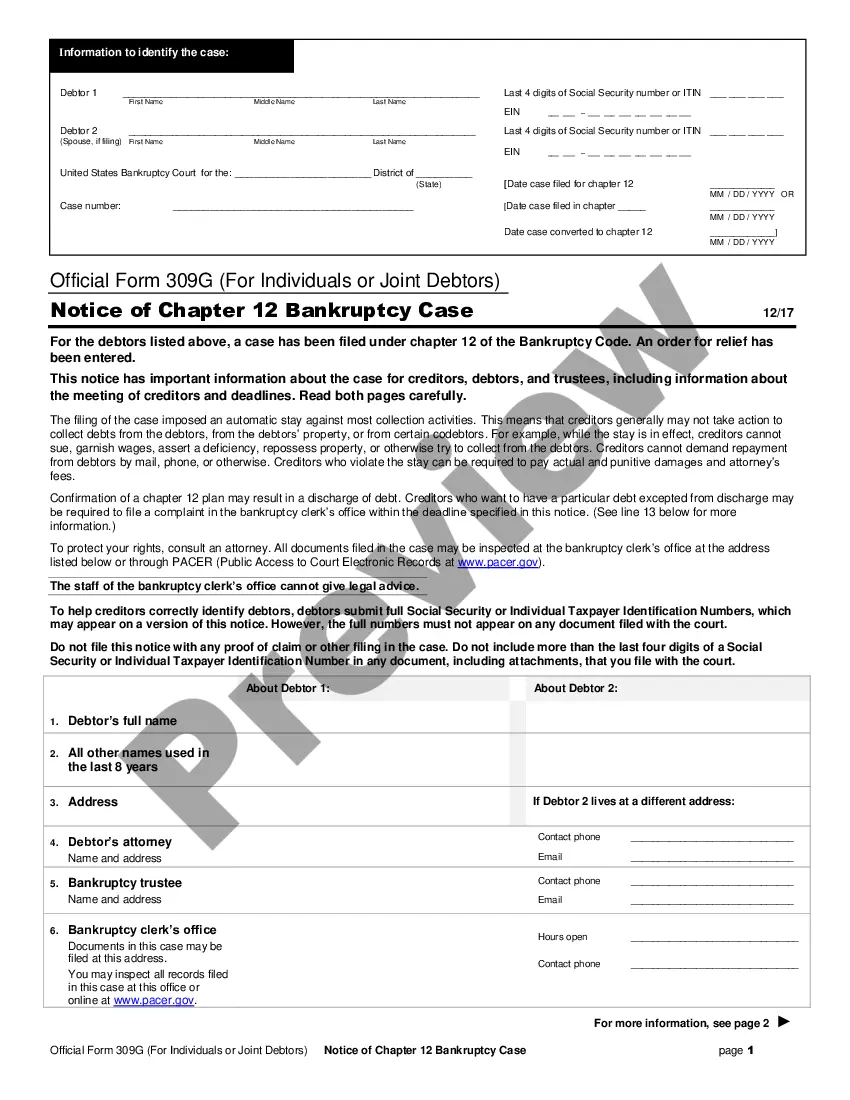

Description

How to fill out Minnesota Sample Letter For New Business With Credit Application?

If you wish to total, acquire, or printing legitimate record templates, use US Legal Forms, the greatest variety of legitimate forms, which can be found on the Internet. Use the site`s simple and easy handy search to obtain the papers you want. Numerous templates for organization and specific reasons are categorized by classes and says, or key phrases. Use US Legal Forms to obtain the Minnesota Sample Letter for New Business with Credit Application with a few click throughs.

In case you are already a US Legal Forms buyer, log in for your bank account and click the Download option to get the Minnesota Sample Letter for New Business with Credit Application. Also you can gain access to forms you earlier delivered electronically inside the My Forms tab of the bank account.

If you work with US Legal Forms for the first time, refer to the instructions under:

- Step 1. Make sure you have chosen the shape for your right area/country.

- Step 2. Use the Preview choice to check out the form`s articles. Don`t neglect to learn the outline.

- Step 3. In case you are unsatisfied with all the type, take advantage of the Research industry towards the top of the monitor to find other models of the legitimate type design.

- Step 4. Once you have found the shape you want, click on the Acquire now option. Select the costs strategy you choose and add your qualifications to sign up on an bank account.

- Step 5. Approach the purchase. You may use your charge card or PayPal bank account to complete the purchase.

- Step 6. Select the structure of the legitimate type and acquire it in your system.

- Step 7. Complete, revise and printing or indicator the Minnesota Sample Letter for New Business with Credit Application.

Every single legitimate record design you buy is your own property forever. You possess acces to each type you delivered electronically within your acccount. Go through the My Forms area and decide on a type to printing or acquire yet again.

Contend and acquire, and printing the Minnesota Sample Letter for New Business with Credit Application with US Legal Forms. There are many professional and state-particular forms you may use for your personal organization or specific requirements.