Minnesota Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another

Description

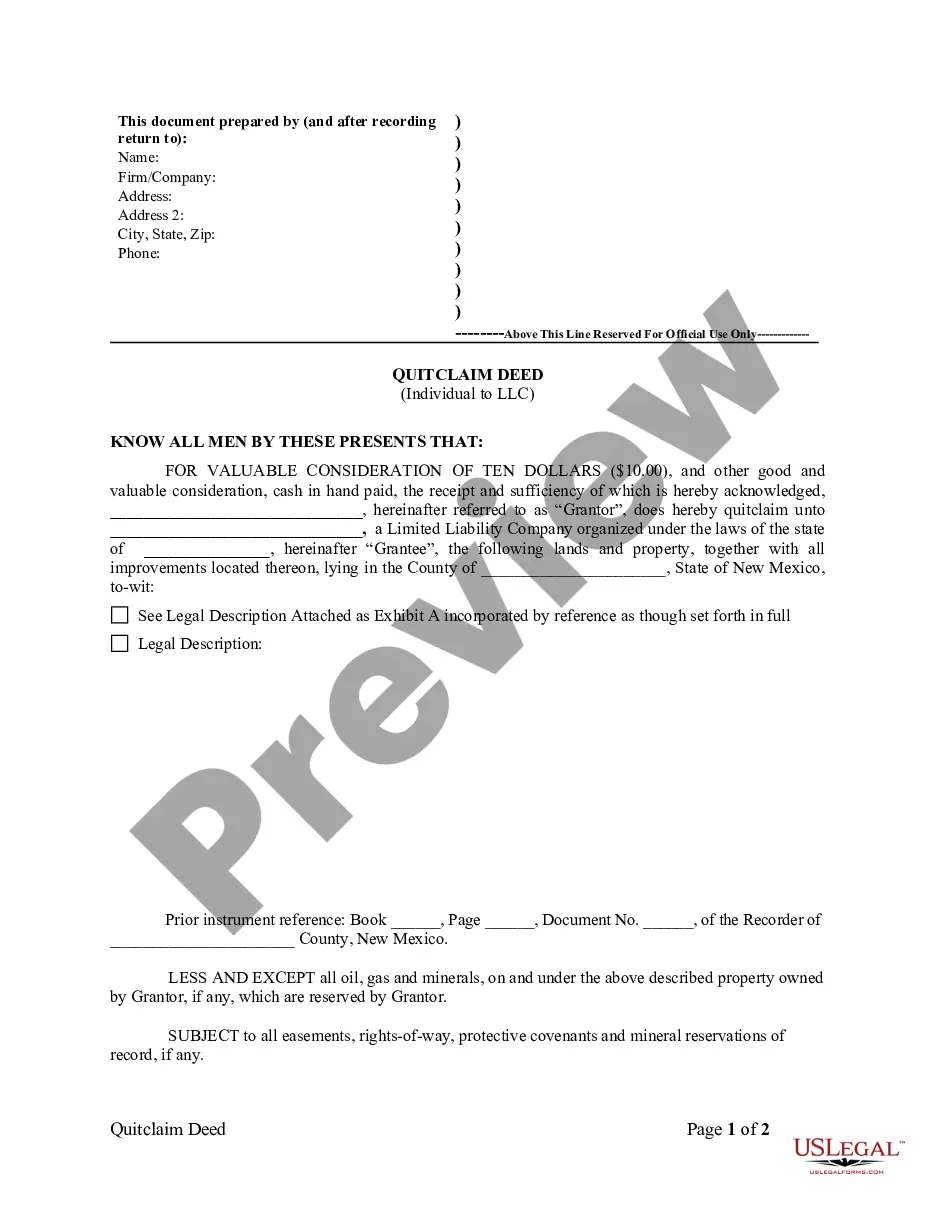

How to fill out Promissory Note And Security Agreement With Regard To The Sale Of An Automobile From One Individual To Another?

Have you ever been in a position where you require documents for either business or personal purposes on a daily basis.

There are numerous legitimate document templates available online, but locating those that you can trust is challenging.

US Legal Forms provides thousands of form templates, including the Minnesota Promissory Note and Security Agreement with Respect to the Sale of an Automobile from One Individual to Another, crafted to comply with state and federal requirements.

Once you find the appropriate form, click Purchase now.

Choose the pricing plan you desire, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Minnesota Promissory Note and Security Agreement with Respect to the Sale of an Automobile from One Individual to Another template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/region.

- Utilize the Review button to inspect the form.

- Check the outline to confirm that you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

Typically, promissory notes are not considered securities under most regulations. They are classified more as instruments of debt rather than investment vehicles. However, in certain contexts, such as the Minnesota Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, understanding these distinctions is important for compliance and effective negotiation.

To obtain your promissory note, you can create one using templates or online services like USLegalForms. These platforms offer customizable options that cater to the specific needs of your transaction. For the Minnesota Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, ensure your note includes all necessary details to protect your interests.

A promissory note is not the same as a security agreement. While a promissory note represents a borrower's promise to repay a sum, a security agreement involves securing that promise with collateral. If you are engaging in the Minnesota Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, it is crucial to understand these differences for effective documentation.

Filling out a promissory demand note is similar to a standard promissory note but allows the lender to demand repayment at any time. For a Minnesota Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, write the names of both parties clearly and outline the amount, payment demands, and any conditions. This ensures that both parties understand their rights and obligations.

Promissory notes must be written clearly, outlining the repayment amount, terms, and parties involved. In Minnesota, it should also be signed by the borrower to enforce its legal standing. When drafting a Minnesota Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, remember to include the security details to protect the lender’s interests. Utilizing platforms like uslegalforms can help simplify the process of creating compliant and comprehensive agreements.

Yes, a handwritten promissory note is legal in Minnesota, provided it meets certain conditions. The note must include essential details like the borrower's and lender's names, repayment terms, and total amount borrowed. When creating a Minnesota Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, ensuring clarity and completeness in the document strengthens its validity.

To write a simple promissory note, begin by clearly stating the total amount being borrowed. Include the borrower's name, the lender's name, and the date the note is created. Specify the repayment terms, including the due date and interest rates, if any. For individuals involved in the sale of an automobile, drafting a Minnesota Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another can safeguard both parties' interests.

To draft a promissory note for a car, begin by listing the borrower's and lender's names, the amount borrowed, and the vehicle being used as collateral. Clearly state the payment plan, including installment amounts, due dates, and any interest rates. By following this format, you can create a solid Minnesota Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, ensuring that both parties are protected throughout the transaction.

A promissory note in connection with the sale of a vehicle acts as a written promise to repay a specified amount over time. This document clarifies the buyer's responsibilities regarding payment and ensures that the seller has a legal claim to the payment until the note is fulfilled. When dealing with a Minnesota Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, including this note can provide peace of mind.

In Minnesota, a promissory note does not necessarily need to be notarized to be enforceable. However, notarizing the document can provide added security and ease in proving the authenticity of the signatures involved. Utilizing a Minnesota Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another can be enhanced by notarization, making it more reliable.