Minnesota Agreement to Form Partnership in Future to Conduct Business is a legal arrangement that outlines the intentions of two or more parties to enter into a business partnership in the future. This agreement serves as a precursor to a formal partnership agreement and helps establish the terms, conditions, and expectations of the potential partnership. The Minnesota Agreement to Form Partnership in Future to Conduct Business typically includes various key elements such as the names and addresses of the parties involved, the business activities or industry the partnership will engage in, the duration of the agreement, and the specific terms and conditions under which the parties will form the partnership in the future. Additionally, specific provisions may be added to address matters like the capital contributions of each partner, profit-sharing arrangements, decision-making processes, dispute resolution mechanisms, and exit strategies in case one party decides not to proceed with the partnership. There are different types of Minnesota Agreement to Form Partnership in Future to Conduct Business, including general partnerships, limited partnerships, and limited liability partnerships. 1. General Partnership: Under a general partnership, all partners have equal rights and responsibilities, and they share profits, losses, and liabilities equally. This type of partnership does not offer personal liability protection to partners. 2. Limited Partnership: A limited partnership includes both general and limited partners. General partners have unlimited liability and actively participate in managing the business, while limited partners have limited liability and are more passive investors. 3. Limited Liability Partnership (LLP): An LLP offers liability protection to all partners, shielding them from personal responsibility for business debts or liabilities resulting from the actions of other partners. This type of partnership is often favored by professionals such as accountants or lawyers. It is crucial to consult with an attorney experienced in partnership law when developing a Minnesota Agreement to Form Partnership in Future to Conduct Business. By doing so, the parties involved can ensure that all legal requirements are met and that the agreement accurately reflects their intended business relationship.

Minnesota Agreement to Form Partnership in Future to Conduct Business

Description

How to fill out Minnesota Agreement To Form Partnership In Future To Conduct Business?

You are able to spend several hours on the web trying to find the lawful papers format which fits the state and federal specifications you need. US Legal Forms supplies thousands of lawful forms that happen to be examined by professionals. It is simple to down load or print out the Minnesota Agreement to Form Partnership in Future to Conduct Business from the support.

If you currently have a US Legal Forms accounts, it is possible to log in and then click the Down load option. Next, it is possible to comprehensive, edit, print out, or sign the Minnesota Agreement to Form Partnership in Future to Conduct Business. Each and every lawful papers format you get is your own property forever. To acquire another backup associated with a bought form, check out the My Forms tab and then click the related option.

If you are using the US Legal Forms site initially, keep to the straightforward guidelines below:

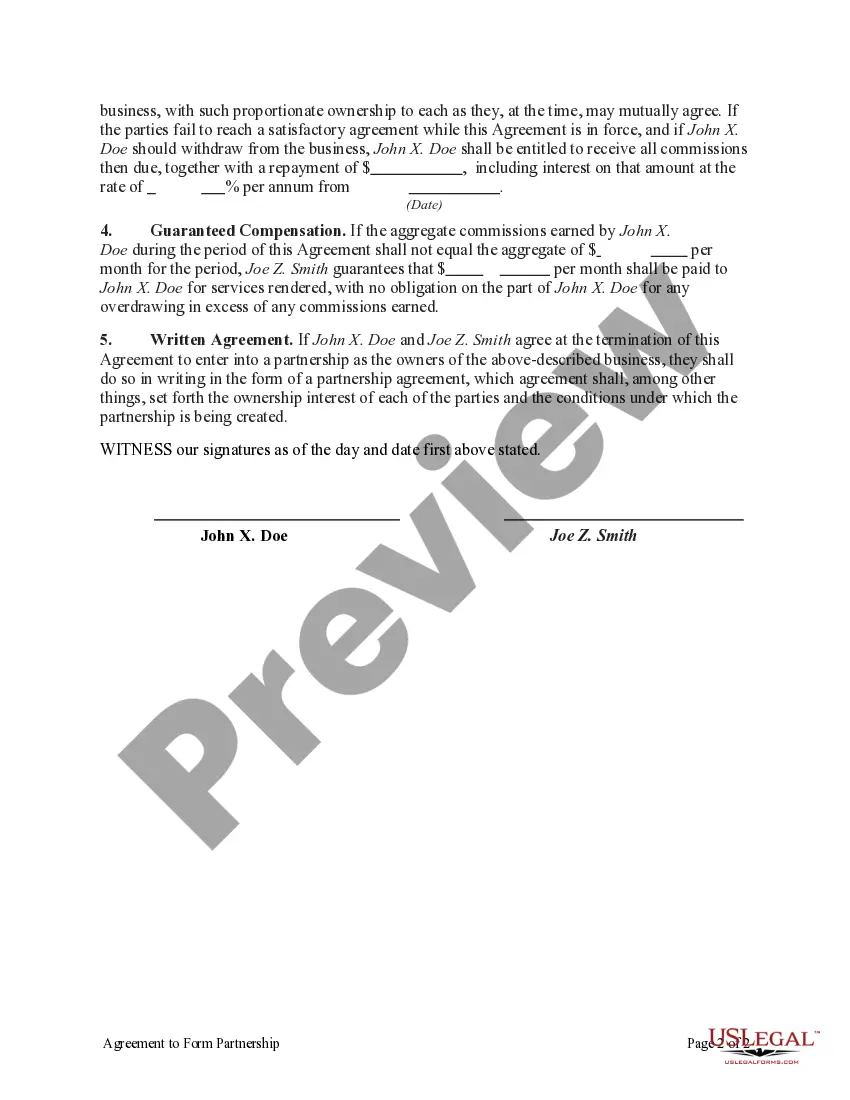

- First, be sure that you have chosen the correct papers format for your region/area of your liking. See the form information to ensure you have chosen the proper form. If readily available, utilize the Review option to look through the papers format as well.

- If you would like get another version of your form, utilize the Search area to obtain the format that suits you and specifications.

- After you have found the format you desire, click Get now to move forward.

- Select the prices plan you desire, key in your credentials, and register for your account on US Legal Forms.

- Total the deal. You should use your credit card or PayPal accounts to pay for the lawful form.

- Select the file format of your papers and down load it in your gadget.

- Make changes in your papers if required. You are able to comprehensive, edit and sign and print out Minnesota Agreement to Form Partnership in Future to Conduct Business.

Down load and print out thousands of papers templates while using US Legal Forms site, which provides the most important collection of lawful forms. Use expert and state-certain templates to take on your company or individual requirements.