Subject: Notice of Credit Limit — Conversion to C.O.D. Status [Minnesota Sample Letter] Dear [Customer's Name], We hope this letter finds you well. We are writing to inform you of an upcoming change to your credit terms with [Your Company Name]. As per our internal review, we have decided to revise your current credit limit and convert your account to Cash-On-Delivery (C.O.D.) status, effective [effective date]. At [Your Company Name], we constantly review our credit policies to ensure the financial stability of our business. After careful consideration of various factors, including your credit history and recent payment trends, we have determined that modifying your credit terms is necessary to protect both parties' interests. The new credit limit assigned to your account will be [new credit limit in dollars]. This means that all future orders placed with our company must be accompanied by full payment at the time of purchase or before the products are shipped. Consequently, we will no longer extend credit or allow delayed payments beyond the specified due dates. We understand that this change may require adjustments to your purchasing process, and we apologize for any inconvenience this may cause. However, please be assured that we are committed to delivering the same high-quality products and attentive service to meet your business needs. To facilitate smooth and uninterrupted transactions, we recommend the following options for making C.O.D. payments: 1. Pay by check or money order: Please make payments payable to [Your Company Name]. Include your invoice number(s) and account number(s) with each payment to ensure accurate and timely allocation. 2. Pay by credit card: We accept all major credit cards. To pay by credit card, please contact our accounting department at [phone number] to provide your card details securely. We kindly request your cooperation in adhering to these new credit terms to maintain a mutually beneficial relationship. Non-compliance with the C.O.D. requirement may result in delays in processing orders or declined shipments. If you believe there has been an error regarding your credit limit adjustment or wish to discuss alternative arrangements, please contact our credit department at [phone number] or [email address]. We will be more than happy to address any concerns or clarify any questions you may have. Thank you for your understanding and continued patronage. We value your business and look forward to serving you in the future. Sincerely, [Your Name] [Your Title/Position] [Your Company Name] [Your Company Address] [City, State, Zip] [Phone Number] [Email Address] Keywords: Minnesota sample letter, sample letter for credit limit notice, notice of credit limit conversion, C.O.D. status, credit terms, credit limit adjustment, payment options, Minnesota business, invoice, account number, check payment, money order, credit card payment.

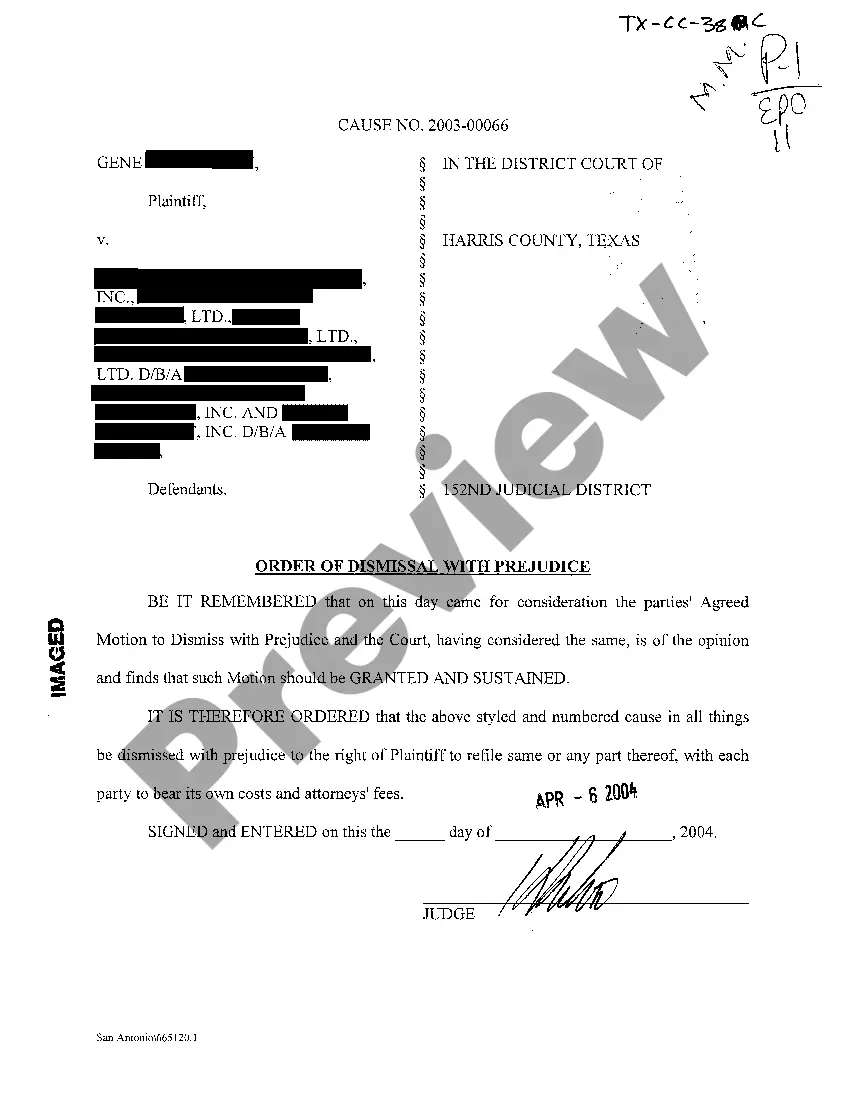

Minnesota Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status

Description

How to fill out Minnesota Sample Letter For Notice Of Credit Limit - Conversion To C.O.D. Status?

If you have to complete, download, or print legal document web templates, use US Legal Forms, the biggest assortment of legal varieties, that can be found on-line. Utilize the site`s simple and handy research to discover the papers you require. Numerous web templates for company and specific reasons are categorized by classes and suggests, or key phrases. Use US Legal Forms to discover the Minnesota Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status within a couple of mouse clicks.

When you are currently a US Legal Forms consumer, log in for your profile and then click the Obtain button to have the Minnesota Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status. You may also gain access to varieties you previously saved from the My Forms tab of your respective profile.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for your proper metropolis/land.

- Step 2. Take advantage of the Review method to look through the form`s content material. Never forget to read the explanation.

- Step 3. When you are not happy together with the develop, utilize the Search discipline towards the top of the display to discover other versions of the legal develop format.

- Step 4. Once you have located the shape you require, click the Purchase now button. Pick the pricing strategy you prefer and include your qualifications to sign up to have an profile.

- Step 5. Method the purchase. You should use your credit card or PayPal profile to perform the purchase.

- Step 6. Choose the format of the legal develop and download it in your gadget.

- Step 7. Full, change and print or indication the Minnesota Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status.

Each legal document format you acquire is yours forever. You possess acces to every single develop you saved in your acccount. Select the My Forms section and choose a develop to print or download yet again.

Compete and download, and print the Minnesota Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status with US Legal Forms. There are many expert and status-distinct varieties you may use for the company or specific demands.

Form popularity

FAQ

Respected Sir/Madam, I like to state that my name is (Name) and, I hold a (name of credit card) credit card with your bank having credit card number (credit card number). I am writing this letter to ask you to kindly increase the limit of my credit card.

To, (Name of the Vendor), (Address of the Vendor) Date: // (Date) Subject: Request for Issuance of credit note Dear Sir/Madam, With reference to the material supplied by your company against our purchase order no. , you are requested to provide us credit note for (Amount).

The card which I am using has a limit that cannot exceed (Amount of money). It is pertinent to mention here that I have expanded my business and need to make a transaction of amount more than its defined limit. Therefore, you are requested to please increase the limit of my credit card from ($xyz to %abc).

Call your card issuer. Call the number on the back of your card and ask a customer service representative whether you're eligible for a higher credit limit. The rep may ask the reason for your request, as well as whether your income has gone up recently.

You can increase your Self Visa® Credit Card's credit limit by adding money to your Credit Builder Account. More specifically, once you've made enough savings progress in your Credit Builder Account you will see an alert in your account dashboard that you are eligible to increase your credit limit.

Respected Sir/ Madam, My name is (Name) and I do hold a cash credit limit in your branch i.e. (Branch Name) bearing account number (Account number). I look forward to your kind and quick support. In case of any queries, you may contact me at (Contact number).

A request for additional credit can take up to 30 days to review, or it may only take a few minutes. Once your request for a higher credit limit is approved, you'll typically have access to your new credit line immediately. If you're denied, you can try again in six months or a year if your situation has improved.

Creditors will review your credit, income and payment history on a regular basis moving forward. If they feel you can afford an increase and refrain from abusing the added spending power, they may automatically grant a credit limit increase without you asking.

Increasing your credit limit can lower credit utilization, potentially boosting your credit score. A credit score is an important metric lenders use to determine a borrower's ability to repay. A higher credit limit can also be an efficient way to make large purchases and provide a source of emergency funds.

No matter the reason, lowering your credit limit likely won't be a good move for your credit score. If you're going to apply for an important loan, such as an auto loan or mortgage, you might want to hold off in case lowering the limit negatively impacts your credit utilization rate and scores.