Minnesota Worksheet - Escrow Fees

Description

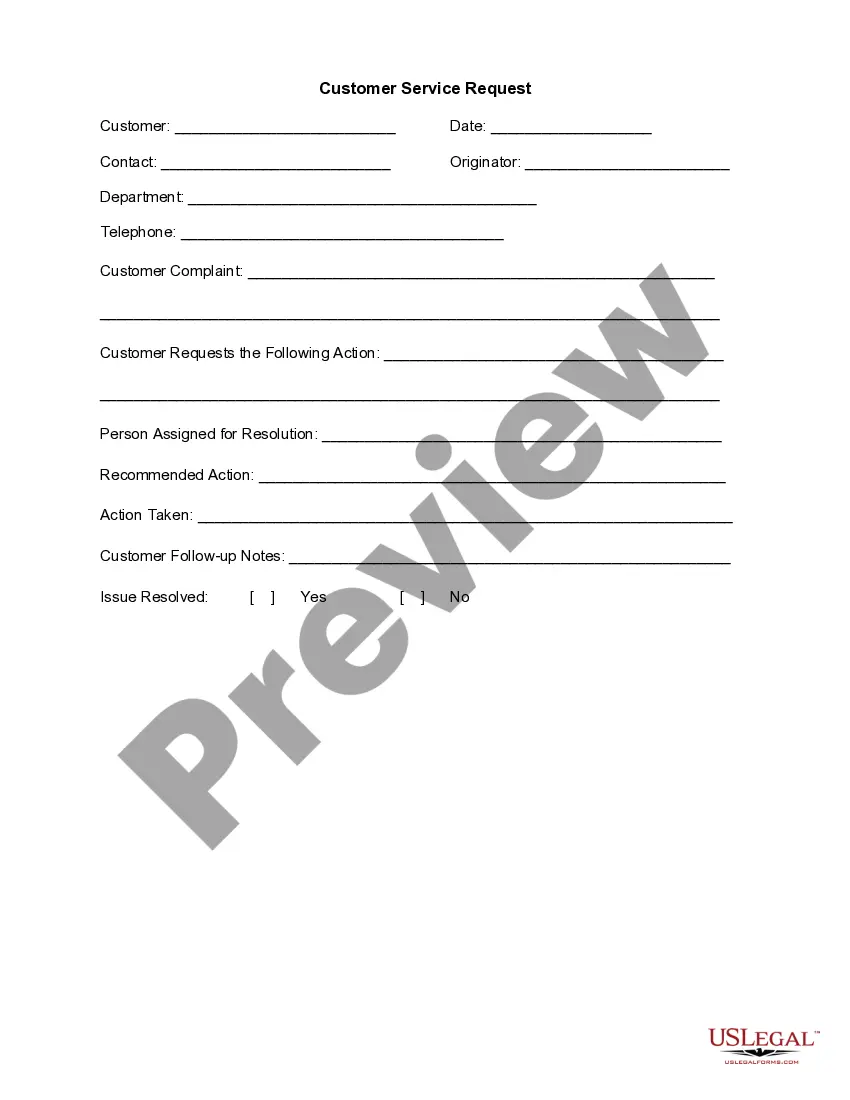

How to fill out Worksheet - Escrow Fees?

US Legal Forms - one of many biggest libraries of legal varieties in the United States - offers a wide array of legal papers themes it is possible to obtain or print. Making use of the web site, you may get thousands of varieties for company and person functions, categorized by groups, states, or keywords.You can find the latest models of varieties like the Minnesota Worksheet - Escrow Fees within minutes.

If you have a registration, log in and obtain Minnesota Worksheet - Escrow Fees from your US Legal Forms local library. The Acquire option will show up on every single type you perspective. You gain access to all formerly saved varieties within the My Forms tab of your own bank account.

If you would like use US Legal Forms the very first time, allow me to share easy instructions to get you began:

- Ensure you have picked the right type to your city/area. Click the Preview option to review the form`s information. See the type explanation to actually have selected the right type.

- If the type doesn`t fit your requirements, utilize the Look for discipline at the top of the monitor to find the the one that does.

- When you are pleased with the form, confirm your choice by clicking on the Acquire now option. Then, opt for the pricing strategy you favor and supply your qualifications to sign up for the bank account.

- Approach the transaction. Make use of your bank card or PayPal bank account to complete the transaction.

- Pick the formatting and obtain the form on the gadget.

- Make changes. Fill out, modify and print and sign the saved Minnesota Worksheet - Escrow Fees.

Each and every template you included with your money lacks an expiry day and is the one you have permanently. So, if you would like obtain or print another duplicate, just proceed to the My Forms portion and then click about the type you need.

Gain access to the Minnesota Worksheet - Escrow Fees with US Legal Forms, the most considerable local library of legal papers themes. Use thousands of skilled and status-certain themes that fulfill your organization or person demands and requirements.

Form popularity

FAQ

What Is An Escrow Account? In real estate, escrow is typically used for two reasons: To protect the buyer's good faith deposit so the money goes to the right party ing to the conditions of the sale. To hold a homeowner's funds for property taxes and homeowners insurance.

The closings costs typically range between 2-4% of the purchase price, but several factors influence this. Some buyers will ask the sellers to pay for their closing costs, and many sellers will agree to pay up to 3% of the purchase price towards the buyer's closing costs.

If the escrow balance is insufficient to cover your costs (perhaps your taxes or insurance premiums have increased), the lender can require you to make up any shortage. Usually, you get to choose between paying a lump sum, or making up the shortage during the next year by paying a higher monthly escrow fee.

To have your escrow account removed from your mortgage, you'll likely need: Less than 80% LTV on a conventional loan (no more than 90% LTV for a VA loan) No delinquencies within the last year and ? depending on your investor ? no 60-day delinquencies within the last 2 years. No loan modifications.

Negotiate escrow fees Escrow fees are not fixed or regulated by law. They are negotiable between the buyer and seller, and sometimes with the escrow company. You can try to lower the escrow fees by asking for discounts, waiving some optional services, or splitting the fees with the other party.

The Bottom Line: Escrow Is Mutually Beneficial, But Not Free These fees pay for third-party services that help you sell your home or complete the tasks required to successfully close your loan.

Typically, this cost is split between the buyer and seller, although it can be negotiated that one party will pay all or nothing. There is no specific rule for who pays the escrow fees, so speak to the seller of your future home or your real estate agent to work out who will pay.

When people use the term ?cash back at closing? today, it equates to a closing cost credit. This credit goes from the seller to the buyer at closing and is also known as seller concessions. In a nutshell, the seller is reducing the amount of cash a buyer needs to close, all in an effort to sell the home.