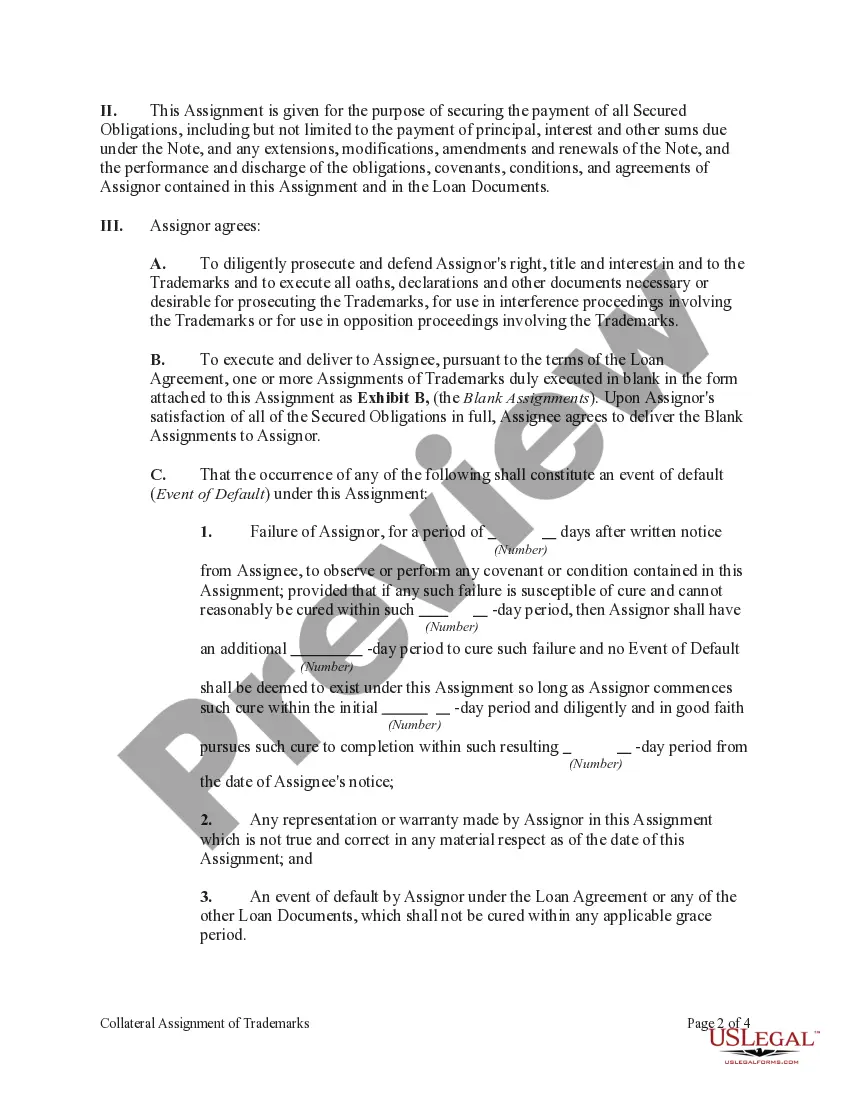

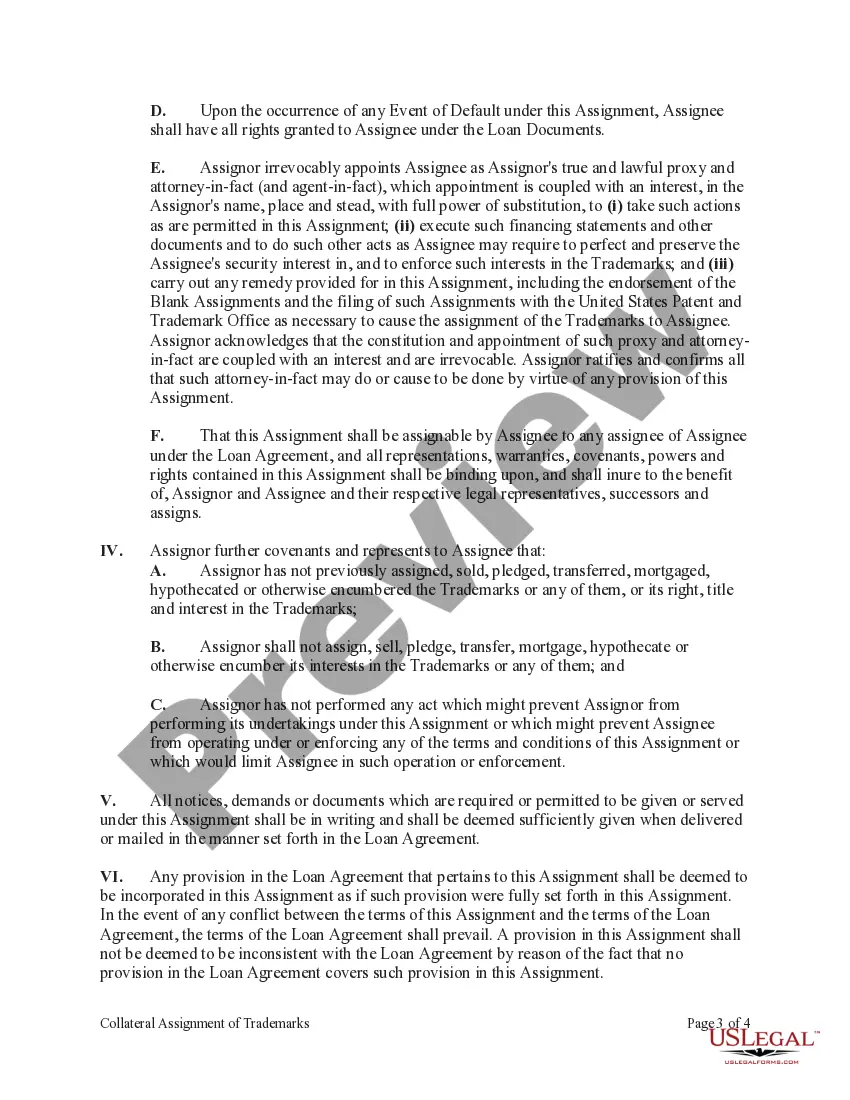

Minnesota Collateral Assignment of Trademarks is a legal agreement that allows a person or entity to transfer ownership rights and interests of a trademark as collateral for a loan or debt. This assignment serves as a security interest, assuring the lender that they have a claim on the trademark in case of default. In Minnesota, there are various types of Collateral Assignment of Trademarks, including: 1. General Collateral Assignment of Trademarks: This type of assignment encompasses all current and future trademarks owned by the assignor. It provides the lender with a broad claim on the assignor's trademark assets. 2. Specific Collateral Assignment of Trademarks: With this assignment, the assignor transfers ownership rights of a particular trademark or a group of trademarks to the lender as collateral. It allows the lender to secure its interest only in the specified trademarks. 3. Intellectual Property Collateral Assignment: This form of assignment covers not only trademarks but also other forms of intellectual property, such as patents, copyrights, and trade secrets. It provides comprehensive security to the lender by allowing them to claim multiple types of intellectual property in case of default. 4. Partial Collateral Assignment of Trademarks: When an assignor only wants to pledge a portion of their trademark rights as collateral, they can opt for a partial assignment. This type of assignment enables the assignor to retain some control and ownership over their trademarks while securing the lender's interest. 5. Future Collateral Assignment of Trademarks: In situations where an assignor expects to acquire additional trademarks in the future, this assignment allows them to pledge those future trademarks as collateral for a loan or debt. It provides flexibility for the assignor and helps secure financing based on anticipated trademark assets. Minnesota Collateral Assignment of Trademarks is a complex legal document that requires careful drafting to ensure the rights of both the assignor and the lender are protected. Consulting with an experienced intellectual property attorney is crucial to understanding the specific requirements and implications of such an assignment.

Minnesota Collateral Assignment of Trademarks is a legal agreement that allows a person or entity to transfer ownership rights and interests of a trademark as collateral for a loan or debt. This assignment serves as a security interest, assuring the lender that they have a claim on the trademark in case of default. In Minnesota, there are various types of Collateral Assignment of Trademarks, including: 1. General Collateral Assignment of Trademarks: This type of assignment encompasses all current and future trademarks owned by the assignor. It provides the lender with a broad claim on the assignor's trademark assets. 2. Specific Collateral Assignment of Trademarks: With this assignment, the assignor transfers ownership rights of a particular trademark or a group of trademarks to the lender as collateral. It allows the lender to secure its interest only in the specified trademarks. 3. Intellectual Property Collateral Assignment: This form of assignment covers not only trademarks but also other forms of intellectual property, such as patents, copyrights, and trade secrets. It provides comprehensive security to the lender by allowing them to claim multiple types of intellectual property in case of default. 4. Partial Collateral Assignment of Trademarks: When an assignor only wants to pledge a portion of their trademark rights as collateral, they can opt for a partial assignment. This type of assignment enables the assignor to retain some control and ownership over their trademarks while securing the lender's interest. 5. Future Collateral Assignment of Trademarks: In situations where an assignor expects to acquire additional trademarks in the future, this assignment allows them to pledge those future trademarks as collateral for a loan or debt. It provides flexibility for the assignor and helps secure financing based on anticipated trademark assets. Minnesota Collateral Assignment of Trademarks is a complex legal document that requires careful drafting to ensure the rights of both the assignor and the lender are protected. Consulting with an experienced intellectual property attorney is crucial to understanding the specific requirements and implications of such an assignment.