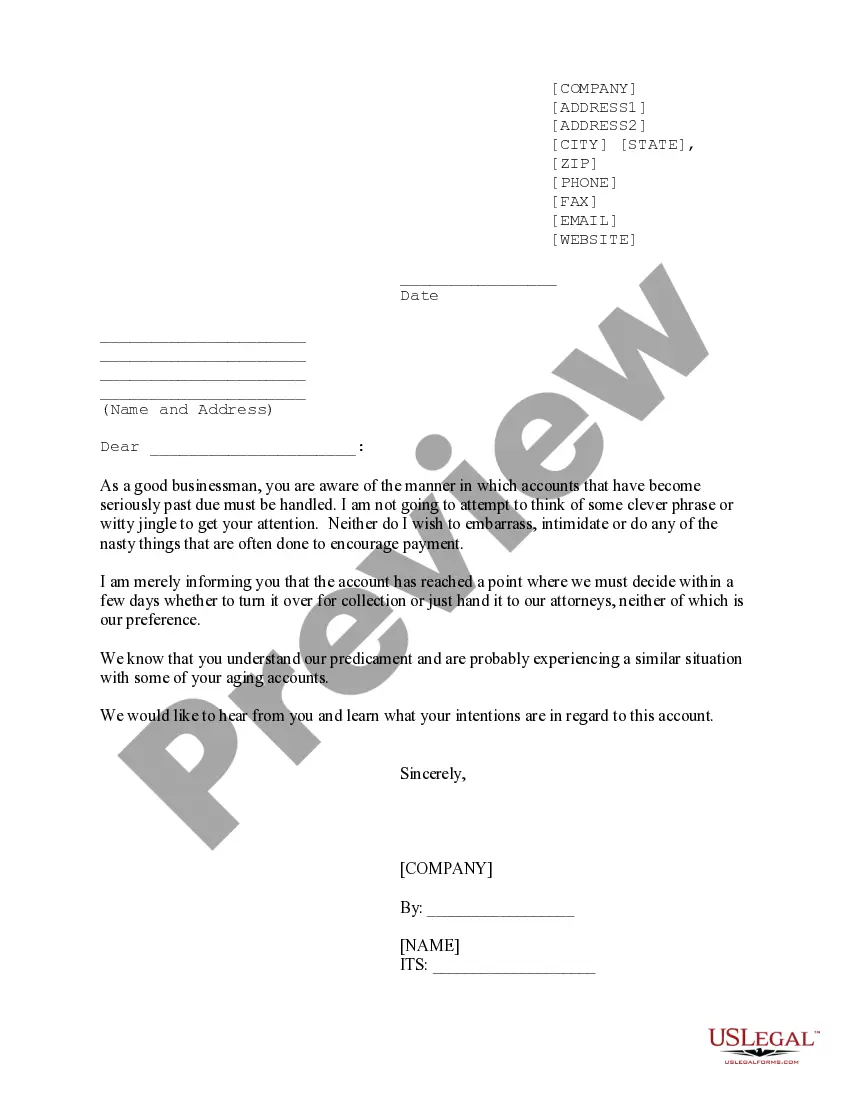

Minnesota Sample of a Collection Letter to Small Business in Advance

Description

How to fill out Sample Of A Collection Letter To Small Business In Advance?

If you aim to be thorough, acquire, or generate valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s straightforward and user-friendly search to locate the documents you need.

A variety of templates for business and personal uses are organized by categories and states or keywords.

Step 4. Once you have found the form you need, click on the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to complete the transaction. Step 6. Select the format of your legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Minnesota Sample of a Collection Letter to Small Business in Advance. Each legal document template you acquire is yours permanently. You will have access to every form you saved in your account. Click on the My documents section and choose a form to print or download again. Be proactive and download, and print the Minnesota Sample of a Collection Letter to Small Business in Advance using US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to find the Minnesota Sample of a Collection Letter to Small Business in Advance with just a few clicks.

- If you are currently a US Legal Forms member, Log In to your account and press the Download button to obtain the Minnesota Sample of a Collection Letter to Small Business in Advance.

- You can also access forms you have previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

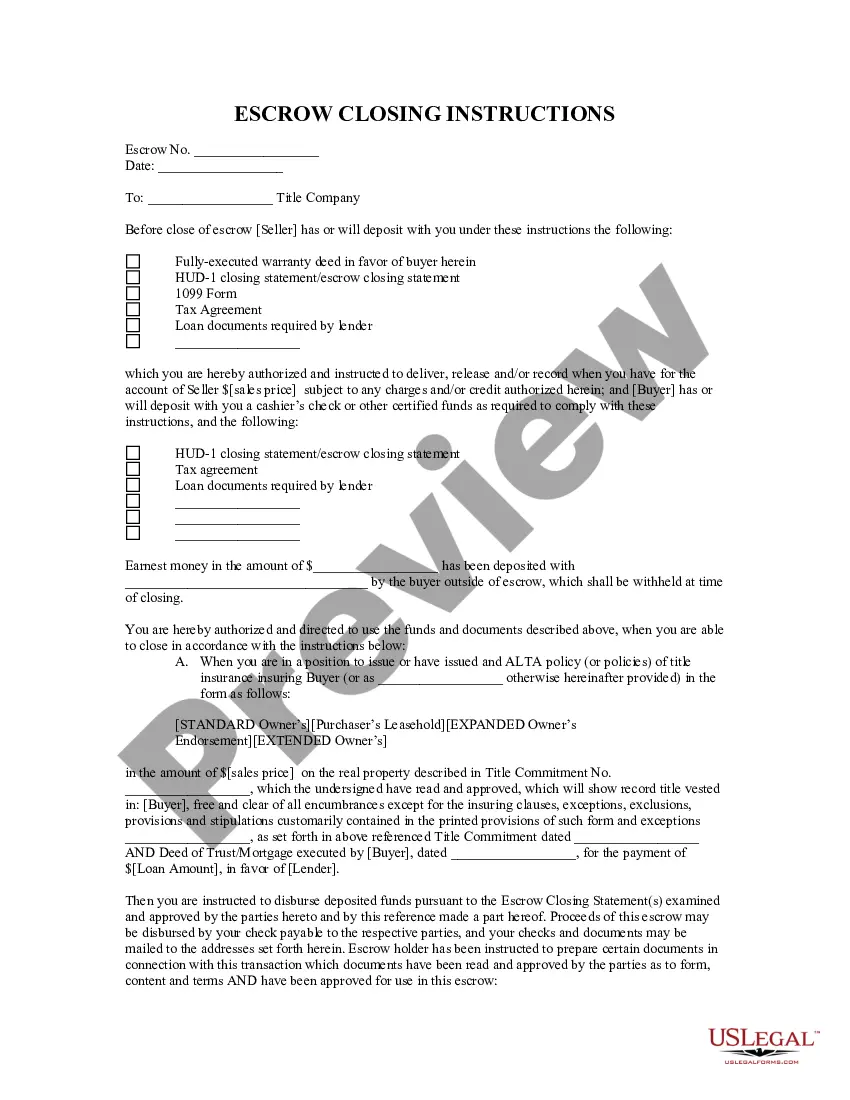

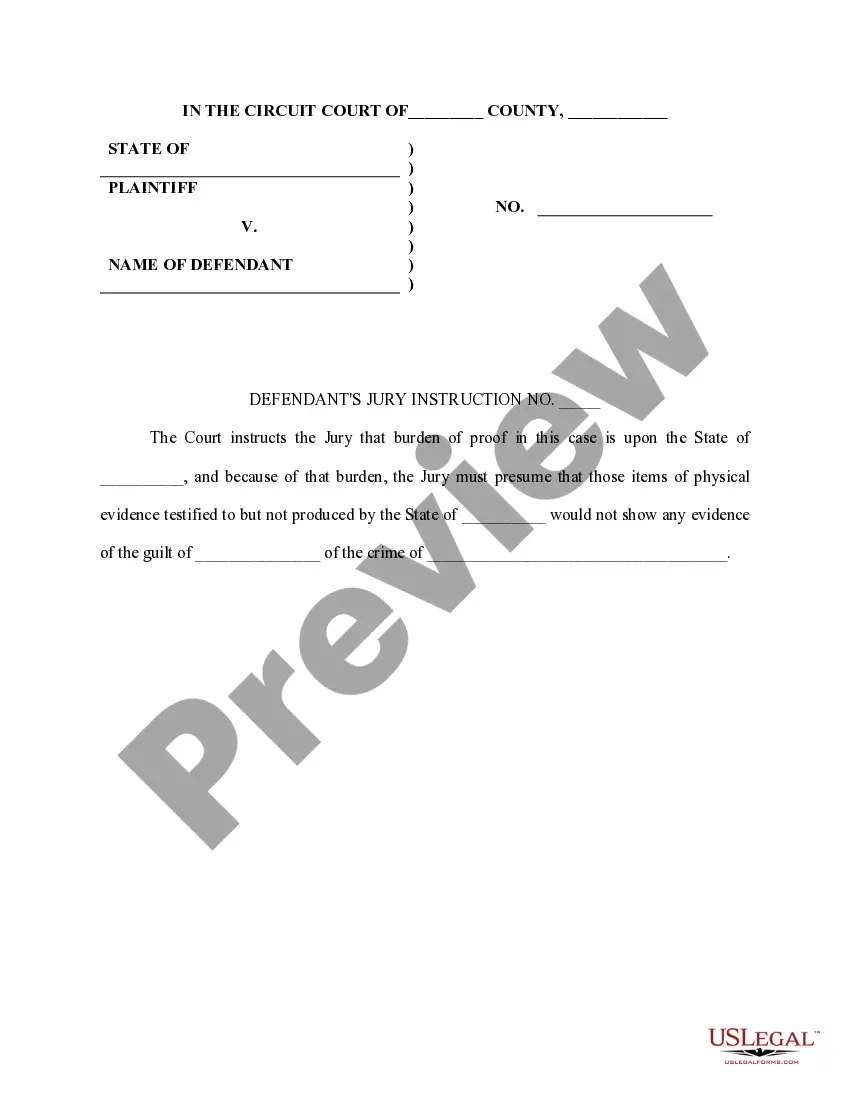

- Step 2. Use the Preview option to review the form’s details. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

A 609 letter refers to a request under the Fair Credit Reporting Act that allows consumers to seek validation of their debts. This letter requests that the creditor provide evidence of the debt and its compliance with credit reporting laws. It is crucial to understand how to use a 609 letter in conjunction with a Minnesota Sample of a Collection Letter to Small Business in Advance to enhance your position when dealing with debt collection. Having these tools at hand empowers you in financial negotiations.

Writing a letter of debt collection involves stating the debt amount, including relevant account details, and a call to action for payment. Be straightforward and specific about payment terms, while maintaining a respectful and professional tone. A Minnesota Sample of a Collection Letter to Small Business in Advance can guide you in structuring your letter effectively. Always conclude by offering assistance if the debtor needs clarification.

To write an effective collection letter, start with a clear statement of the debt owed, including the amount and due date. Be polite but firm, outlining the consequences of non-payment, while also providing options for resolution. Utilizing a Minnesota Sample of a Collection Letter to Small Business in Advance ensures you cover essential elements and strengthens your request for payment. Strive for clarity and professionalism in your tone.

Debt validation letters can be effective tools for consumers seeking to verify the legitimacy of a debt. When you send a debt validation letter, it prompts the creditor to provide proof that the debt is valid and enforceable. This process is often necessary before crafting a Minnesota Sample of a Collection Letter to Small Business in Advance. Knowing when and how to use validation letters helps protect you from unwarranted claims.

The 777 rule is a guideline that suggests consumers should keep records of all communication with debt collectors. This includes any collection letters or calls to ensure legal compliance and protect your rights. By understanding this rule, you can better respond when using a Minnesota Sample of a Collection Letter to Small Business in Advance. It's essential to know your rights and obligations when dealing with debt collection.

In Minnesota, the statute of limitations for most debts is six years, meaning creditors generally have up to six years to pursue legal action. After this period, the debt becomes uncollectible in court. Utilizing a Minnesota Sample of a Collection Letter to Small Business in Advance can help you act within that timeframe, ensuring you communicate effectively before it's too late.

When communicating with a debt collector, avoid making promises you cannot keep, admitting to the debt without understanding your rights, or using hostile language. It’s essential to remain calm and assertive while stating your position. By having a Minnesota Sample of a Collection Letter to Small Business in Advance, you can navigate these conversations more effectively and know what to say.

To create a collection letter, start with a clear subject line and include essential details like the debtor's name, amount owed, and payment terms. Use a polite yet firm tone, and make sure to reference your expectations for payment. Utilize a Minnesota Sample of a Collection Letter to Small Business in Advance to structure your correspondence, ensuring your message is clear and legal.

Debt collection in Minnesota must comply with both federal and state laws. Collectors cannot engage in harassment, make false statements, or threaten legal action they do not intend to pursue. A Minnesota Sample of a Collection Letter to Small Business in Advance can help ensure that your communication is compliant and professional, protecting your rights as a creditor.

In Minnesota, there is no specific minimum amount for debt collection. However, many creditors prefer to pursue debts that exceed $50, as smaller amounts may not justify the time and effort involved. With a Minnesota Sample of a Collection Letter to Small Business in Advance, you can outline the debt clearly, regardless of the amount, helping you to communicate effectively.