A bookkeeper is a person whose job is to keep the financial records for a business

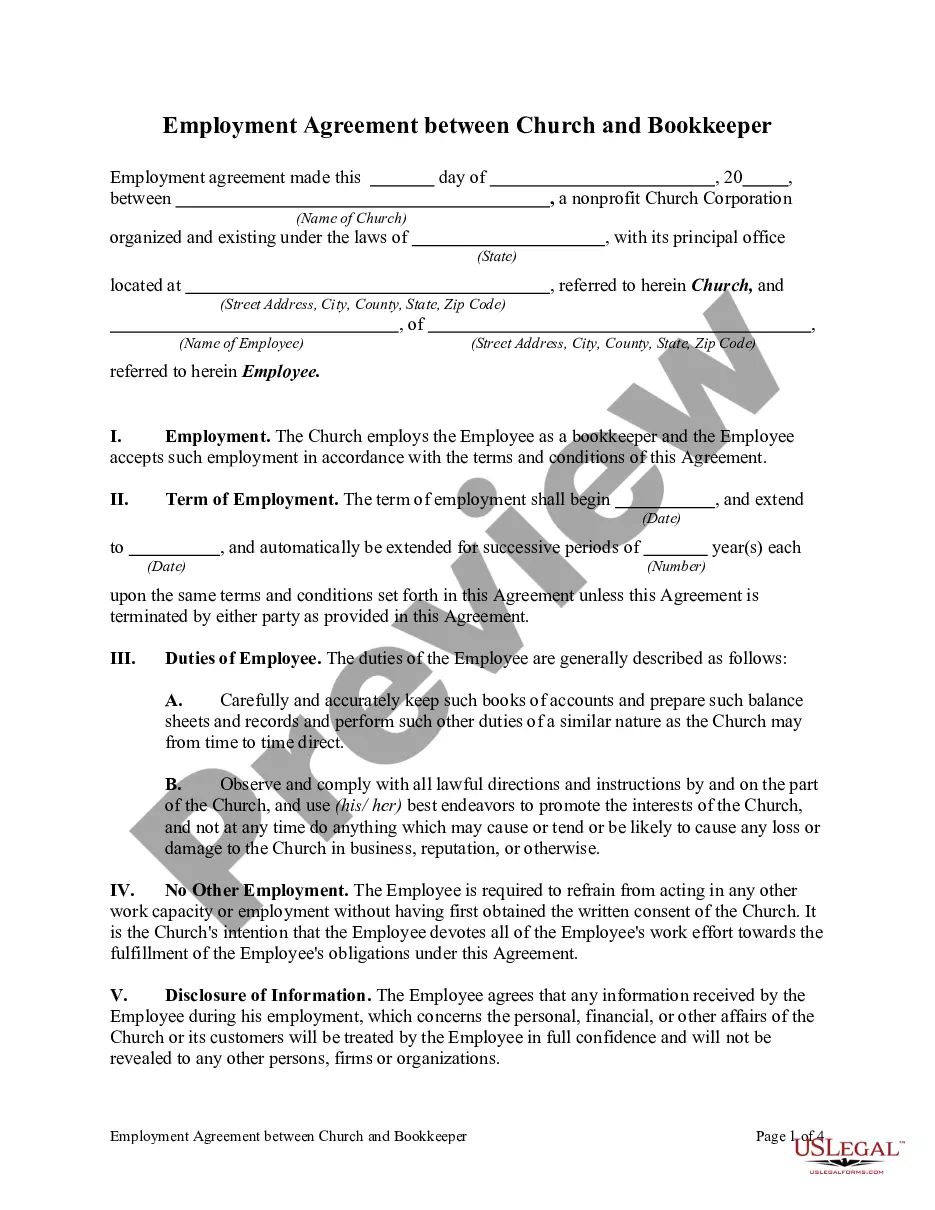

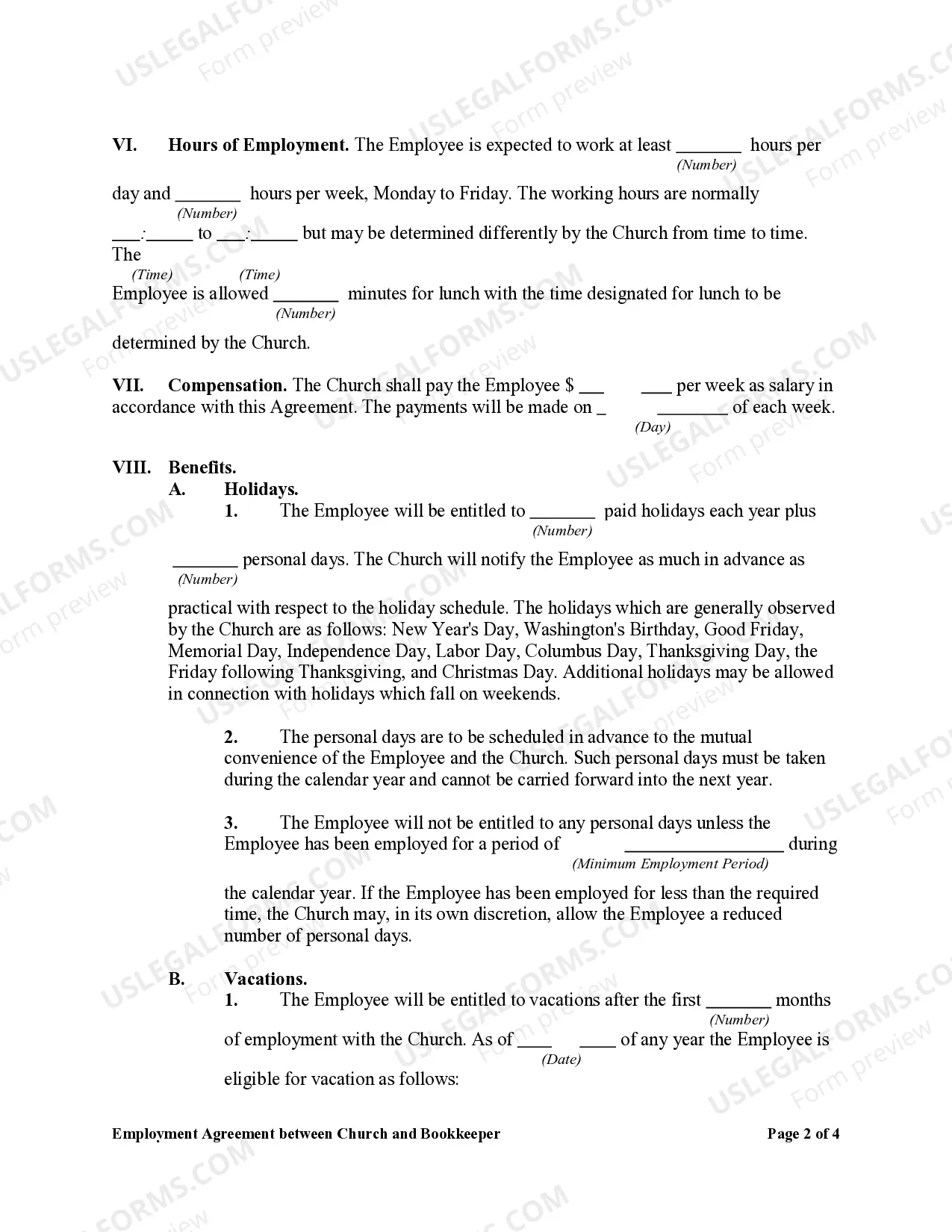

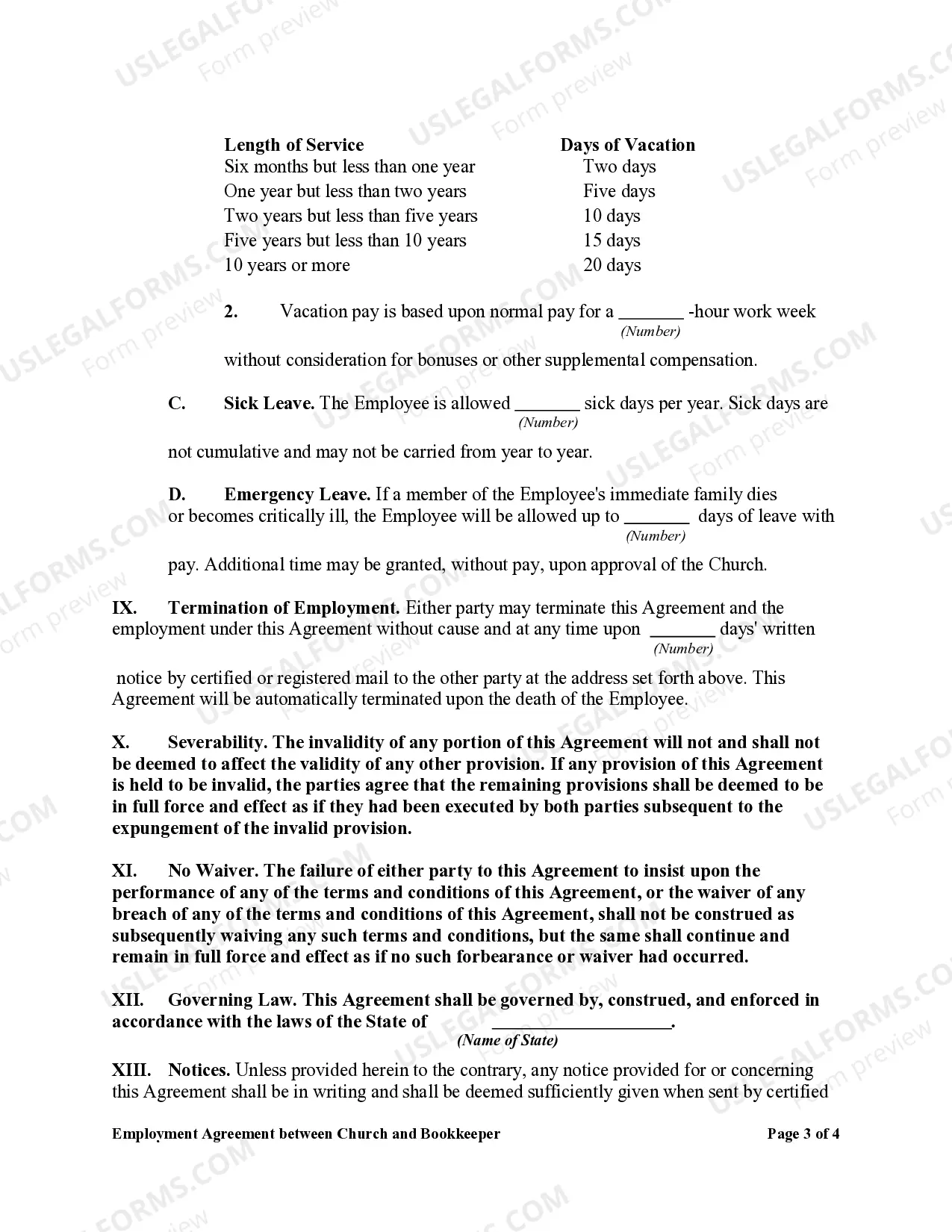

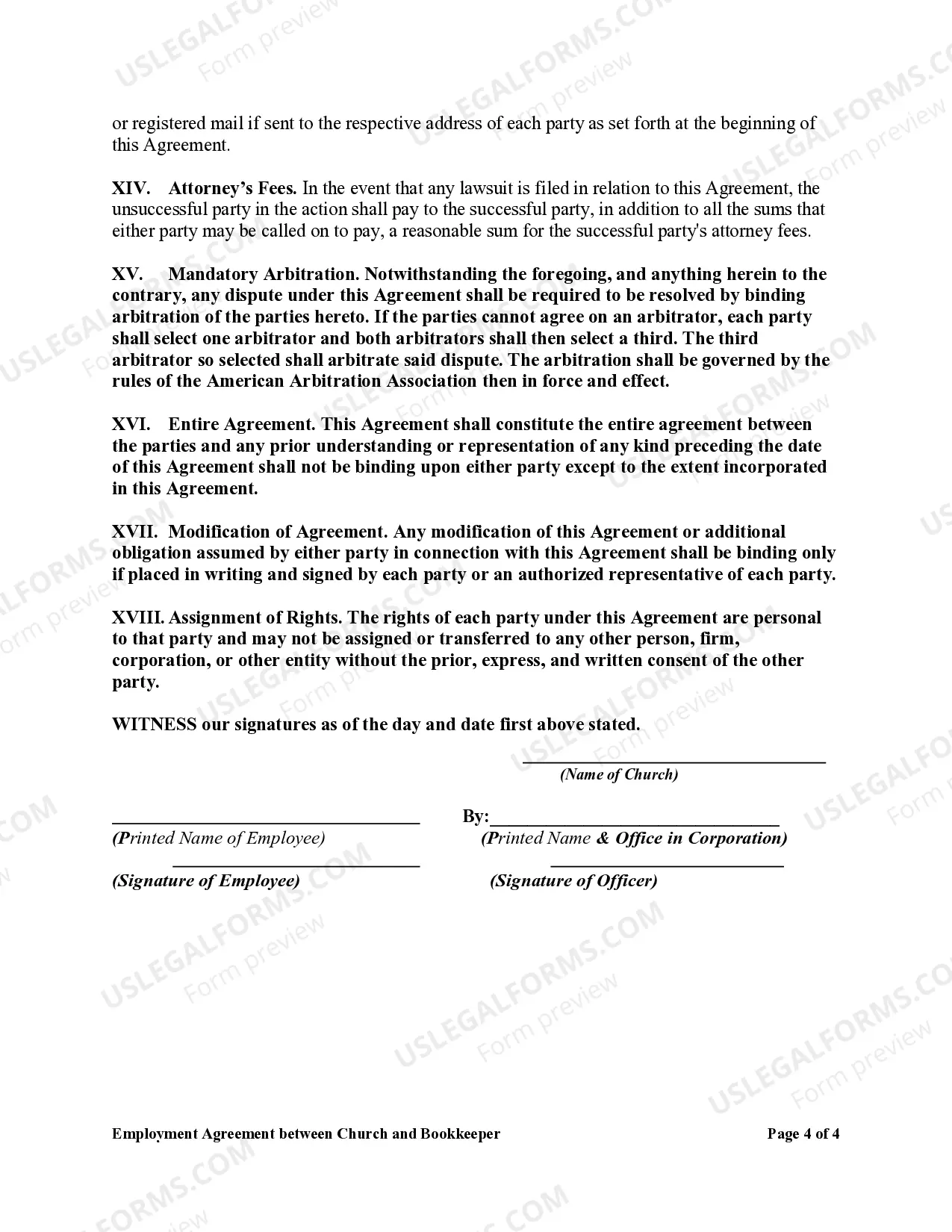

Minnesota Employment Agreement between Church and Bookkeeper: A Comprehensive Guide Introduction: An employment agreement is a crucial legal document that outlines the terms and conditions of employment between a church and a bookkeeper in the state of Minnesota. This agreement ensures that both parties have a clear understanding of their rights and obligations, providing a solid foundation for a positive working relationship. This article aims to provide a detailed description of what a Minnesota Employment Agreement between Church and Bookkeeper entails, incorporating relevant keywords for clarity. Key Elements of a Minnesota Employment Agreement between Church and Bookkeeper: 1. Parties Involved: The agreement should clearly state the names of the church and bookkeeper entering into the employment relationship. 2. Effective Date: It is vital to include the date on which the agreement becomes effective. 3. Job Title and Description: A precise job title and a detailed description of the bookkeeper's responsibilities should be provided to avoid any confusion. 4. Compensation: This section outlines the bookkeeper's salary or wage rate, payment frequency, and any additional benefits they may be entitled to, such as health insurance or retirement plans. 5. Working Hours: The agreement should specify the bookkeeper's regular working hours, including any applicable overtime provisions. 6. Duration and Termination: The agreement should clearly define whether the employment is permanent or for a fixed term and outline the termination rights and procedures for both parties. 7. Confidentiality and Non-Disclosure: This section emphasizes the bookkeeper's obligation to maintain the confidentiality of sensitive church information or records. 8. Intellectual Property: Any intellectual property created or utilized by the bookkeeper during their employment should be addressed, ensuring it remains the property of the church. 9. Leave and Benefits: This section covers aspects such as vacation, sick leave, and other benefits, including any provisions for religious observances or holidays. 10. Code of Conduct: The agreement may include a provision outlining the conduct expected from the bookkeeper, which aligns with the church's values and principles. Types of Minnesota Employment Agreements between Church and Bookkeeper: 1. Full-Time Employment Agreement: This agreement is suitable when the bookkeeper will work a standard full-time schedule, typically 35-40 hours per week. 2. Part-Time Employment Agreement: This agreement applies when the bookkeeper will work fewer hours compared to full-time employment, often on a regular schedule. 3. Fixed-Term Employment Agreement: When a church requires a bookkeeper for a specific project or timeframe, a fixed-term agreement specifies the duration of the employment. 4. At-Will Employment Agreement: This type of agreement indicates that either party can terminate the employment at any time and for any lawful reason, without the need for a specific notice period. Conclusion: A Minnesota Employment Agreement between Church and Bookkeeper is a valuable document that protects the interests of both parties involved in the employment relationship. By clearly defining terms, rights, and obligations, this agreement fosters a professional and harmonious working environment. Church leaders and bookkeepers should consider consulting legal experts to ensure the agreement aligns with relevant Minnesota employment laws and regulations.Minnesota Employment Agreement between Church and Bookkeeper: A Comprehensive Guide Introduction: An employment agreement is a crucial legal document that outlines the terms and conditions of employment between a church and a bookkeeper in the state of Minnesota. This agreement ensures that both parties have a clear understanding of their rights and obligations, providing a solid foundation for a positive working relationship. This article aims to provide a detailed description of what a Minnesota Employment Agreement between Church and Bookkeeper entails, incorporating relevant keywords for clarity. Key Elements of a Minnesota Employment Agreement between Church and Bookkeeper: 1. Parties Involved: The agreement should clearly state the names of the church and bookkeeper entering into the employment relationship. 2. Effective Date: It is vital to include the date on which the agreement becomes effective. 3. Job Title and Description: A precise job title and a detailed description of the bookkeeper's responsibilities should be provided to avoid any confusion. 4. Compensation: This section outlines the bookkeeper's salary or wage rate, payment frequency, and any additional benefits they may be entitled to, such as health insurance or retirement plans. 5. Working Hours: The agreement should specify the bookkeeper's regular working hours, including any applicable overtime provisions. 6. Duration and Termination: The agreement should clearly define whether the employment is permanent or for a fixed term and outline the termination rights and procedures for both parties. 7. Confidentiality and Non-Disclosure: This section emphasizes the bookkeeper's obligation to maintain the confidentiality of sensitive church information or records. 8. Intellectual Property: Any intellectual property created or utilized by the bookkeeper during their employment should be addressed, ensuring it remains the property of the church. 9. Leave and Benefits: This section covers aspects such as vacation, sick leave, and other benefits, including any provisions for religious observances or holidays. 10. Code of Conduct: The agreement may include a provision outlining the conduct expected from the bookkeeper, which aligns with the church's values and principles. Types of Minnesota Employment Agreements between Church and Bookkeeper: 1. Full-Time Employment Agreement: This agreement is suitable when the bookkeeper will work a standard full-time schedule, typically 35-40 hours per week. 2. Part-Time Employment Agreement: This agreement applies when the bookkeeper will work fewer hours compared to full-time employment, often on a regular schedule. 3. Fixed-Term Employment Agreement: When a church requires a bookkeeper for a specific project or timeframe, a fixed-term agreement specifies the duration of the employment. 4. At-Will Employment Agreement: This type of agreement indicates that either party can terminate the employment at any time and for any lawful reason, without the need for a specific notice period. Conclusion: A Minnesota Employment Agreement between Church and Bookkeeper is a valuable document that protects the interests of both parties involved in the employment relationship. By clearly defining terms, rights, and obligations, this agreement fosters a professional and harmonious working environment. Church leaders and bookkeepers should consider consulting legal experts to ensure the agreement aligns with relevant Minnesota employment laws and regulations.