Title: Understanding Minnesota Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act Introduction: In Minnesota, individuals who are facing debt collection issues have a legal protection called the Fair Debt Collection Practices Act (FD CPA). This legislation safeguards consumers from unfair and deceptive practices employed by debt collectors. When dealing with a debt collector, it is essential to be aware of your rights and responsibilities. To ensure compliance with the FD CPA, you can utilize a Minnesota Sample Letter to Debt Collector. This article aims to provide a detailed description of what it entails and briefly highlight different types available. 1. What is the Minnesota Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act? The Minnesota Sample Letter to Debt Collector is a template that individuals can use to communicate with debt collectors while asserting their rights under the Fair Debt Collections Practices Act. By using this letter, consumers are able to easily convey their concerns, request validation of the debt, and demand appropriate action from the debt collector. 2. Key Elements of the Minnesota Sample Letter: — Identity Verification: Include personal information such as name, address, and contact details to ensure accurate identification. — Debt Validation: Request the debt collector to provide written proof of the debt's legitimacy, including information about the original creditor, amount owed, and payment history. — Dispute Acknowledgment: Insist on a written acknowledgment if the debt collector agrees that a dispute exists, ensuring they halt collection efforts until the matter is resolved. — Cease and Desist: If the debtor believes the debt is either mistaken, unverifiable, or past the statute of limitations, they can request the cease and desist of all communication from the debt collector. — Remedial Actions: Outline the necessary steps the debt collector must take to rectify any violations of the FD CPA and inform them that legal action may be pursued if they fail to comply. 3. Types of Minnesota Sample Letters to Debt Collectors: — Debt Validation Letter: This letter is used to request comprehensive information about the debt in question, seeking proof of its validity. — Cease and Desist Letter: It is employed when requesting the debt collector to stop all communication regarding the debt, especially if it is believed to be invalid or if the debtor wants to handle the matter legally. — Dispute Letter: When disputing the legitimacy of the debt or any inaccuracies in its details, this type is sent to assert the debtor's rights and request a resolution. Conclusion: Utilizing the Minnesota Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act empowers individuals to assert their rights and negotiate with debt collectors effectively. By understanding the key elements mentioned above and selecting the appropriate type of letter, debtors can protect themselves against unfair practices and potential violations of the FD CPA in the state of Minnesota.

Minnesota Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act

Description

How to fill out Minnesota Sample Letter To Debt Collector Re Fair Debt Collection And Practices Act?

You can invest several hours on-line trying to find the legal file web template that suits the federal and state needs you will need. US Legal Forms gives a huge number of legal forms which can be examined by experts. It is possible to down load or print out the Minnesota Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act from my service.

If you currently have a US Legal Forms bank account, it is possible to log in and click the Download button. Afterward, it is possible to full, edit, print out, or sign the Minnesota Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act. Every legal file web template you buy is yours permanently. To have one more version for any bought develop, go to the My Forms tab and click the corresponding button.

Should you use the US Legal Forms web site for the first time, follow the easy recommendations beneath:

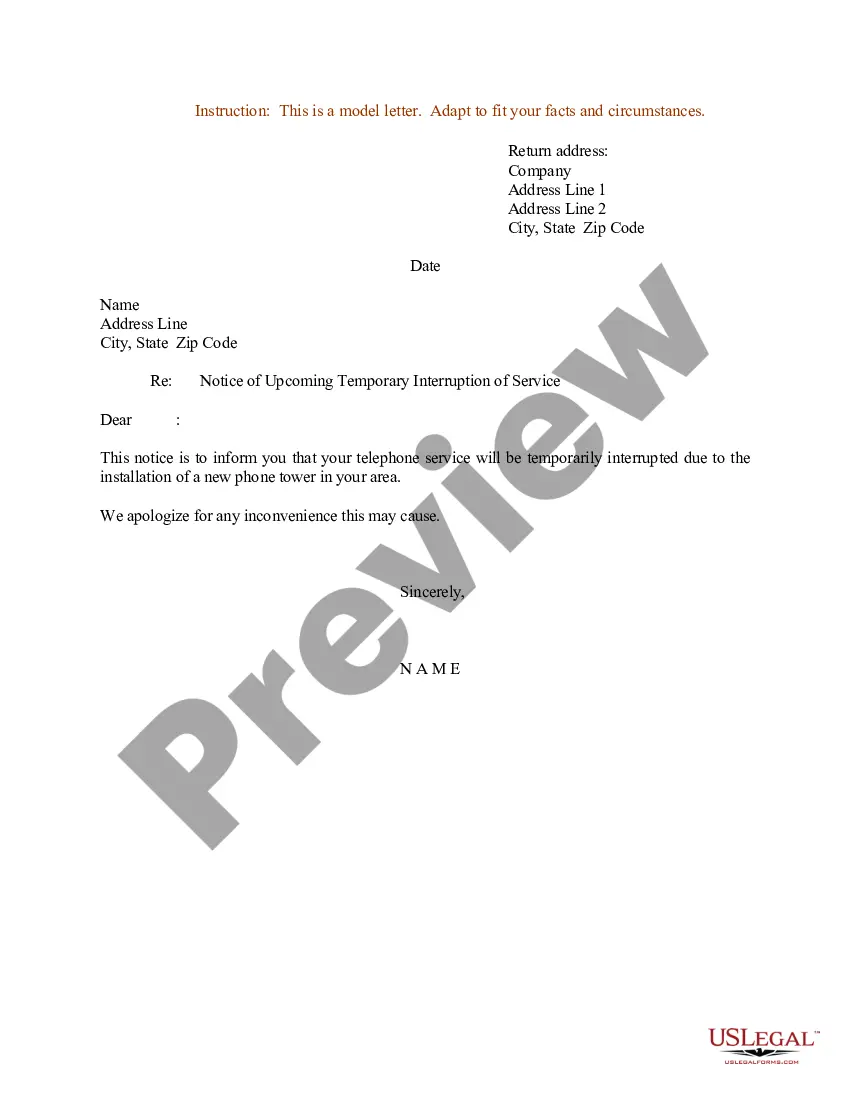

- First, make sure that you have selected the best file web template for the county/town of your choice. Browse the develop description to ensure you have selected the right develop. If offered, utilize the Preview button to search throughout the file web template too.

- If you would like get one more variation of the develop, utilize the Lookup industry to get the web template that suits you and needs.

- Upon having discovered the web template you would like, simply click Get now to continue.

- Pick the pricing prepare you would like, type your references, and sign up for a merchant account on US Legal Forms.

- Complete the transaction. You can use your charge card or PayPal bank account to purchase the legal develop.

- Pick the file format of the file and down load it in your product.

- Make adjustments in your file if required. You can full, edit and sign and print out Minnesota Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act.

Download and print out a huge number of file themes while using US Legal Forms Internet site, which offers the biggest variety of legal forms. Use specialist and condition-certain themes to deal with your small business or individual demands.