Minnesota Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncom petition Provisions: A Comprehensive Guide Introduction: The Minnesota Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncom petition Provisions is a legal document that outlines the terms and conditions for buying and selling stock in a close corporation in the state of Minnesota. This agreement is essential for shareholders of such corporations to have a clear understanding of their rights, obligations, and limitations when it comes to the transfer of stock. The Noncom petition Provisions included in the agreement ensure that shareholders do not engage in activities that could harm the corporation's interests during and after the stock transfer. This comprehensive guide will provide detailed insights into the different types and key aspects of Minnesota Shareholders Buy Sell Agreement with Noncom petition Provisions. Types of Minnesota Shareholders Buy Sell Agreement with Noncom petition Provisions: 1. Standard Agreement: This type of agreement sets the foundation for stock transfer and includes general provisions related to the buying and selling of stock in a close corporation. It covers the basic rights, restrictions, and obligations of shareholders regarding the transfer of shares. Additionally, it may contain noncom petition provisions that restrict shareholders from engaging in activities that may compete with the corporation. 2. Fixed Price Agreement: In this type of agreement, the purchase price for the stock is predetermined and clearly stated. This ensures that the shareholders have a predefined valuation method for the stock and eliminates potential conflicts or disputes during the buy-sell process. 3. Formula Agreement: A Formula Agreement establishes a specific formula or method for determining the purchase price of the stock. This may include a formula based on the corporation's book value, earnings, assets, or other pre-determined financial metrics. This type of agreement provides an objective approach to valuing the shares, reducing the chances of disagreements during the buy-sell process. Key Elements of a Minnesota Shareholders Buy Sell Agreement with Noncom petition Provisions: 1. Stock Transfer Process: The agreement should clearly outline the procedures and conditions for transferring shares. It should cover areas such as methods of notice, allowed transfer mechanisms (e.g., right of first refusal), and the timeframe within which the stock transfer should occur. 2. Valuation of Stock: The agreement should establish a valuation method for determining the price of the stock. This ensures fair and consistent treatment for all shareholders during stock transactions. Whether it's a fixed price or formula-based approach, this section should provide clarity on how the purchase price will be calculated. 3. Noncom petition Provisions: These provisions should outline restrictions on shareholders engaging in activities that compete with the corporation. It may limit shareholders from soliciting clients, starting similar businesses, or poaching employees for a specified period of time (typically after the stock transfer). 4. Dispute Resolution: A well-drafted agreement should contain a dispute resolution mechanism, such as mediation or arbitration, to allow parties to resolve conflicts arising from the agreement without resorting to lengthy and costly court proceedings. 5. Termination and Amendments: The agreement should clarify the conditions under which the agreement can be terminated, such as the withdrawal of a shareholder or the unanimous agreement of all shareholders. It should also specify the process for making amendments to the agreement, ensuring that any changes are mutually agreed upon. Conclusion: A Minnesota Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncom petition Provisions is a vital legal tool that protects the interests of shareholders and ensures a smooth stock transfer process in close corporations. By providing a comprehensive understanding of different types and key elements of this agreement, this guide aims to help shareholders and businesses navigate the complexities associated with stock transfer and noncom petition provisions effectively.

Minnesota Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions

Description

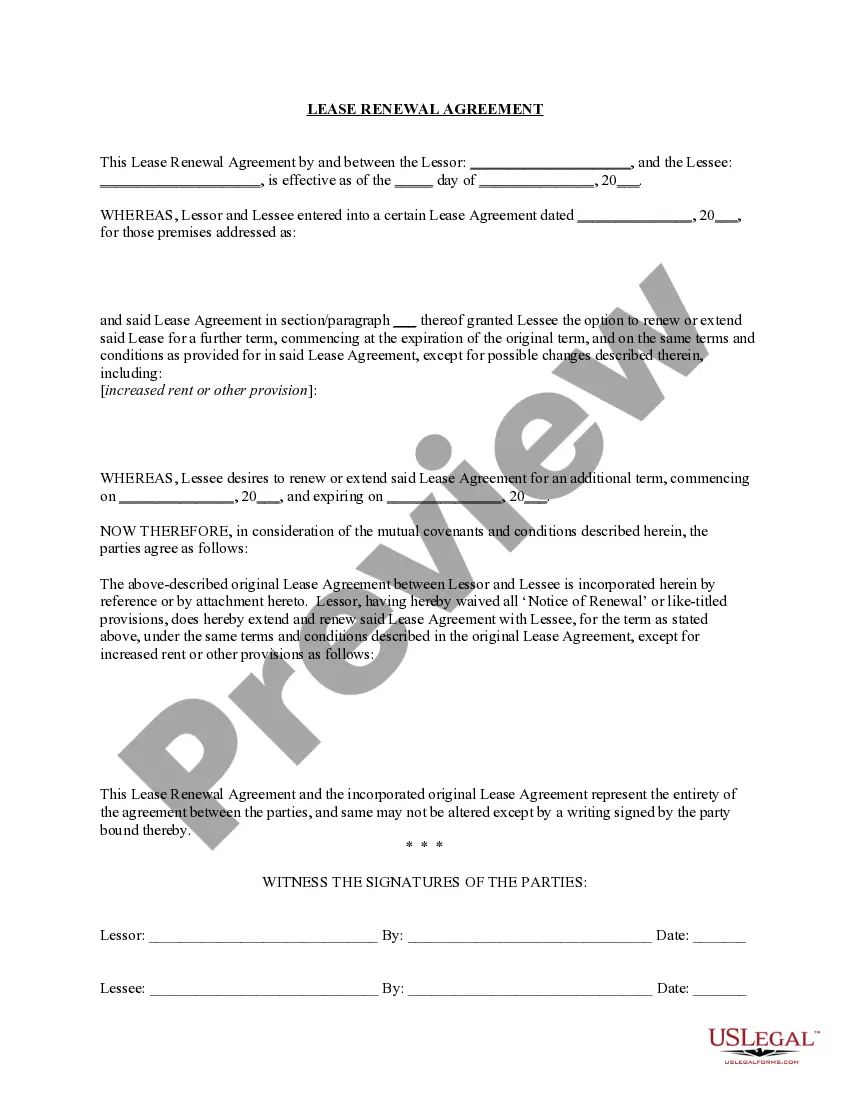

How to fill out Minnesota Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Noncompetition Provisions?

It is possible to invest several hours on-line trying to find the legitimate document web template which fits the federal and state needs you will need. US Legal Forms supplies 1000s of legitimate varieties that are analyzed by pros. It is possible to download or print out the Minnesota Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions from your service.

If you currently have a US Legal Forms accounts, you may log in and then click the Acquire key. Following that, you may complete, change, print out, or indicator the Minnesota Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions. Every single legitimate document web template you buy is the one you have permanently. To have one more backup associated with a obtained develop, proceed to the My Forms tab and then click the corresponding key.

Should you use the US Legal Forms internet site the very first time, adhere to the straightforward directions below:

- Initial, be sure that you have selected the best document web template to the area/city of your choosing. See the develop information to make sure you have selected the appropriate develop. If offered, take advantage of the Preview key to check from the document web template at the same time.

- In order to discover one more variation of the develop, take advantage of the Lookup area to discover the web template that meets your needs and needs.

- Upon having discovered the web template you desire, click on Buy now to continue.

- Select the rates program you desire, enter your references, and register for your account on US Legal Forms.

- Total the purchase. You may use your bank card or PayPal accounts to purchase the legitimate develop.

- Select the structure of the document and download it for your gadget.

- Make modifications for your document if required. It is possible to complete, change and indicator and print out Minnesota Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions.

Acquire and print out 1000s of document web templates making use of the US Legal Forms website, which offers the largest assortment of legitimate varieties. Use specialist and state-specific web templates to tackle your small business or person needs.