Minnesota Deed Conveying Property to Charity with Reservation of Life Estate

Description

How to fill out Deed Conveying Property To Charity With Reservation Of Life Estate?

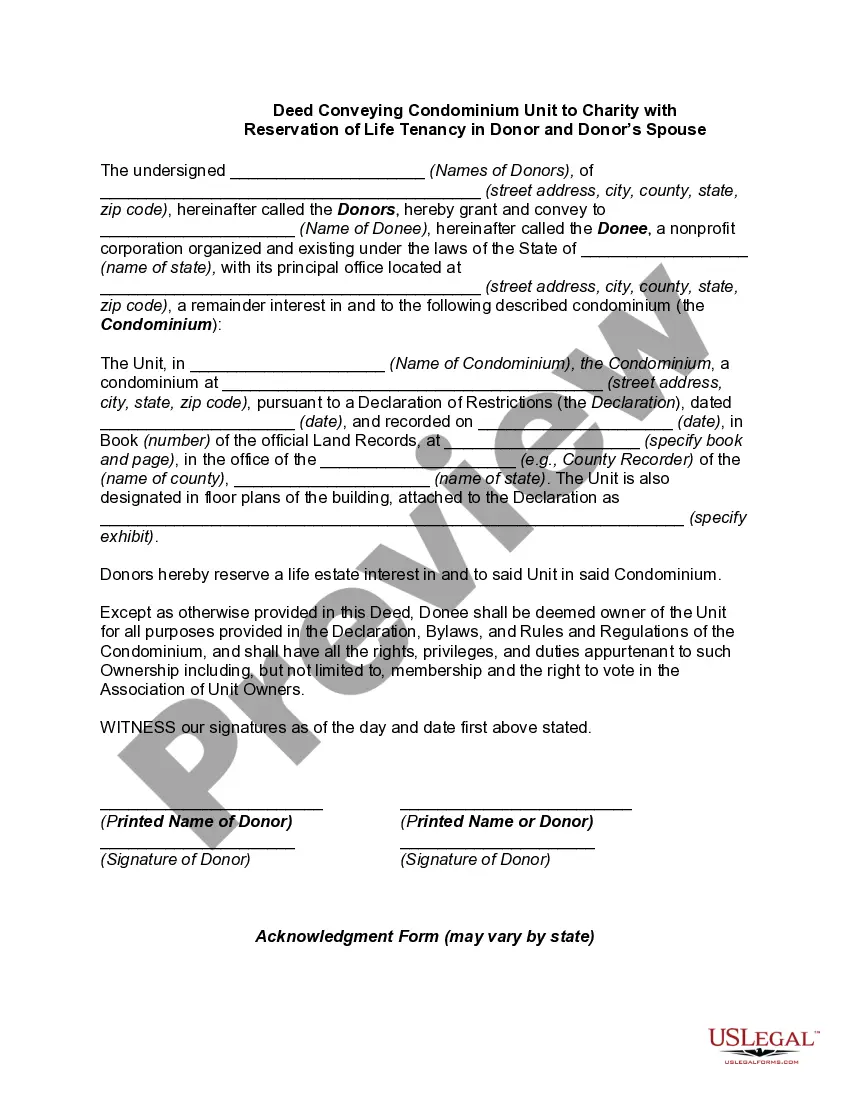

Discovering the right legal record design can be a have a problem. Naturally, there are a lot of layouts available on the Internet, but how would you obtain the legal form you need? Make use of the US Legal Forms internet site. The service delivers a large number of layouts, for example the Minnesota Deed Conveying Property to Charity with Reservation of Life Estate, which can be used for enterprise and personal requirements. Each of the varieties are examined by experts and meet federal and state needs.

When you are previously registered, log in for your bank account and click on the Acquire key to have the Minnesota Deed Conveying Property to Charity with Reservation of Life Estate. Use your bank account to appear with the legal varieties you possess purchased previously. Go to the My Forms tab of the bank account and acquire another duplicate in the record you need.

When you are a new user of US Legal Forms, here are straightforward instructions that you should follow:

- Very first, make certain you have chosen the proper form for your town/county. You can check out the form using the Preview key and read the form outline to ensure this is the right one for you.

- When the form will not meet your preferences, make use of the Seach area to find the proper form.

- Once you are positive that the form is acceptable, click on the Get now key to have the form.

- Opt for the pricing prepare you would like and enter the essential details. Build your bank account and pay for the transaction with your PayPal bank account or bank card.

- Pick the submit format and download the legal record design for your device.

- Complete, modify and printing and indicator the received Minnesota Deed Conveying Property to Charity with Reservation of Life Estate.

US Legal Forms is definitely the most significant collection of legal varieties for which you can see different record layouts. Make use of the company to download professionally-produced papers that follow express needs.

Form popularity

FAQ

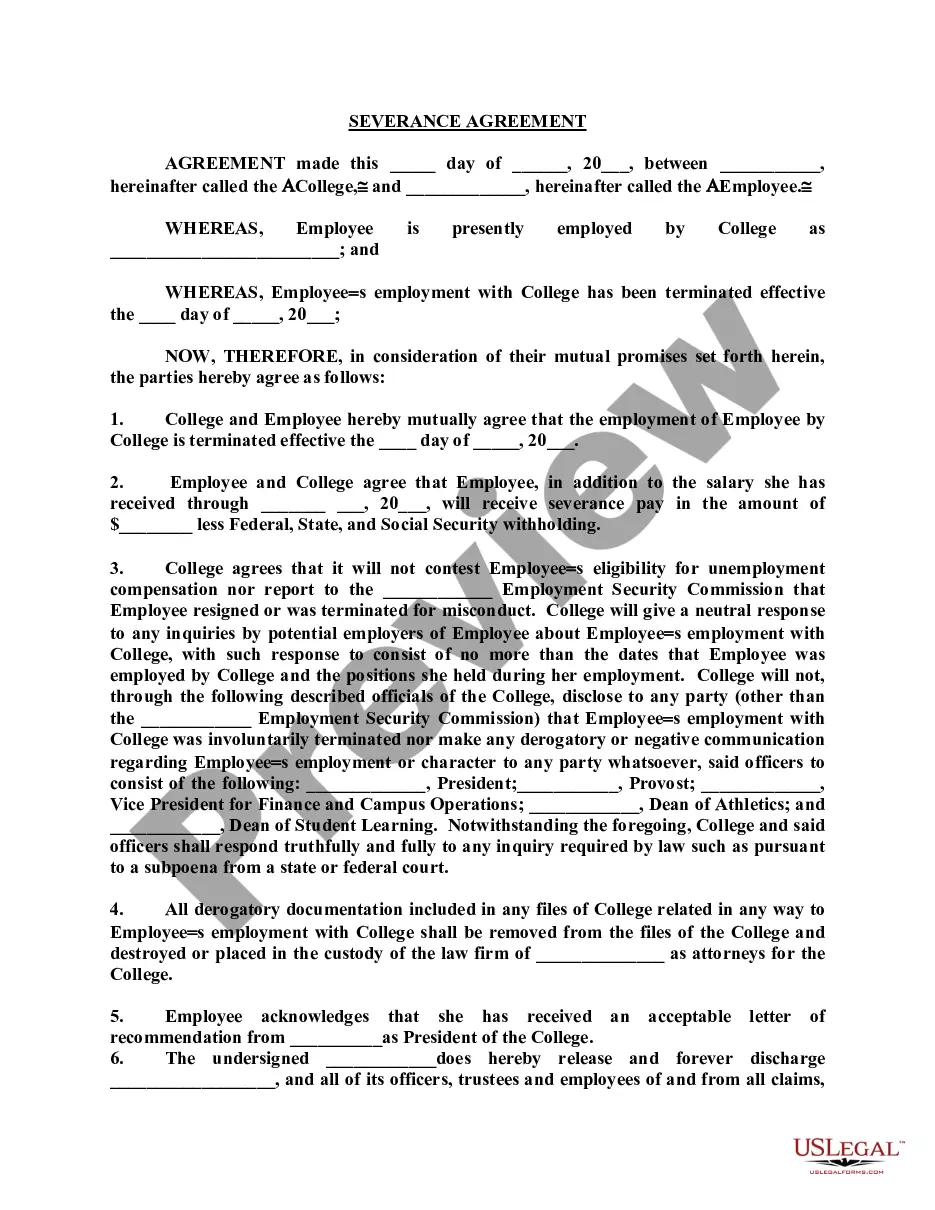

Because joint tenancy provides the right of survivorship, you may sometimes see it as ?joint tenancy with right of survivorship? and abbreviated JTWROS. In a tenancy in common, there is no right of survivorship. This means that property ownership does not automatically pass to the surviving owners.

Under joint tenancy, when a joint tenant passes away, the surviving joint tenant becomes the owner of the deceased tenant's share in the property. Joint tenants are said to have a ?right of survivorship? because they acquire ownership interest automatically after the other joint tenant passes away.

Disadvantages of joint tenants with right of survivorship JTWROS accounts involving real estate may require all owners to consent to selling the property. Frozen bank accounts. In some cases, the probate court can freeze bank accounts until the estate is settled.

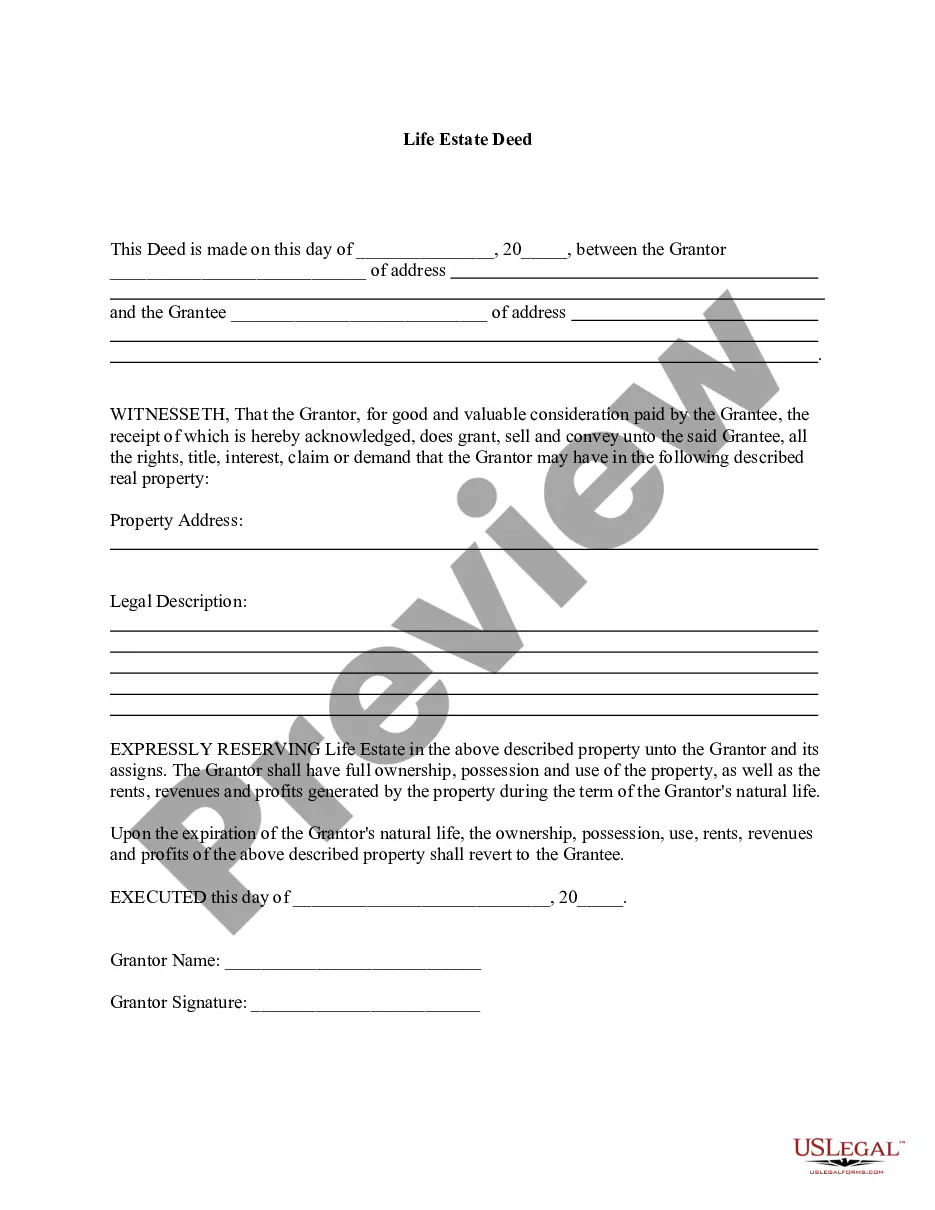

Minnesota Deed Transfer A general warranty deed is used to transfer an interest in real estate in Minnesota in most real estate transactions. A Minnesota warranty deed conveys real property with warranty covenants to the buyer. It requires an acknowledgement of the grantor's signature.

Minnesota life tenants share the exclusive possession and control of the real property between themselves during their joint lifetimes. Minnesota life tenants also have the exclusive right to receive the rents and profits from a property subject to a life estate, even if they no longer reside on such property.

The marriage requirement is the primary distinction between TBE and joint tenancy. The people holding TBE must be married or, in some states, in a domestic partnership. Those holding a joint tenancy can be two or more people, related or not. In a TBE, both people have equal, 100% interest in the property.

A life tenant does not have complete control over the property because they do not own the whole bundle of rights. The life tenant cannot sell, mortgage or in any way transfer or encumber the property. If either party wants to sell the property, both the life tenant and remainderman must agree.

As of 2022, Minnesota has two kinds of property ownership if there are multiple owners: joint tenancy and tenancy-in-common. Under both ownership systems, all owners have a right to access all the property and no single owner can prohibit another owner from any part of the property without their consent.