Minnesota Loan Agreement for Personal Loan is a legally binding contract that outlines the terms and conditions for borrowing and repayment of funds between a lender and a borrower within the state of Minnesota. This agreement ensures both parties are protected and aware of their rights and obligations. The main purpose of a Minnesota Loan Agreement for Personal Loan is to establish the loan amount, interest rate, repayment schedule, and any additional fees or charges associated with the loan. It is crucial that both the lender and borrower thoroughly understand the terms, as it will serve as a reference point throughout the loan period. Specifically in Minnesota, there are different types of loan agreements for personal loans depending on the lending institution and the purpose of the loan. Some common types include: 1. Standard Personal Loan Agreement: This is a general agreement suitable for various personal loan purposes such as debt consolidation, home improvements, medical expenses, or education financing. It establishes the loan amount, interest rate, repayment terms, and any collateral requirements. 2. Payday Loan Agreement: For borrowers facing short-term cash flow issues, a payday loan agreement outlines a small loan typically due on the borrower's next payday. The agreement includes the loan amount, fees, and the borrower's authorization to debit their bank account for repayment. 3. Installment Loan Agreement: This type of agreement is commonly used for larger personal loans that are repaid over a fixed period through equal installments. It specifies the loan amount, interest rate, number of payments, and the repayment schedule. 4. Personal Line of Credit Agreement: With a personal line of credit agreement, the borrower has access to a specific credit limit and can withdraw funds as needed. This flexible agreement outlines the terms, interest rate, repayment terms, and any fees associated with the line of credit. In all variants of a Minnesota Loan Agreement for Personal Loan, it is important for both parties to review and understand the agreement in its entirety before signing. Parties should pay particular attention to the interest rate, repayment schedule, any penalties for late payments or early repayment, and other specific terms and conditions tailored to their loan needs. By carefully considering the terms outlined in the Minnesota Loan Agreement for Personal Loan, borrowers and lenders can establish a transparent and fair arrangement that protects the rights and interests of both parties involved.

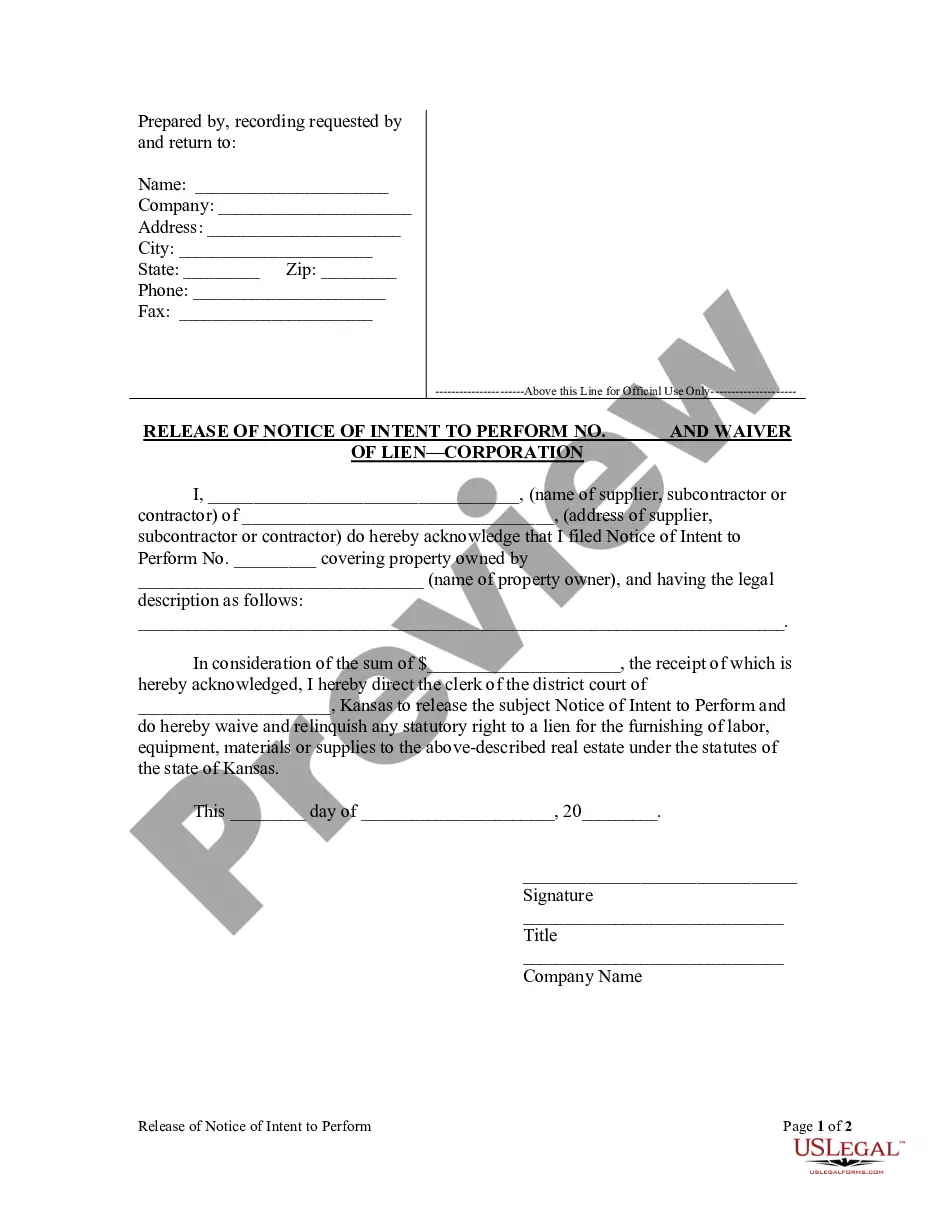

Minnesota Loan Agreement for Personal Loan

Description

How to fill out Minnesota Loan Agreement For Personal Loan?

Discovering the right lawful papers web template could be a have a problem. Naturally, there are plenty of web templates available on the Internet, but how would you get the lawful form you require? Use the US Legal Forms site. The service provides thousands of web templates, including the Minnesota Loan Agreement for Personal Loan, which can be used for enterprise and personal requirements. Every one of the forms are checked out by specialists and satisfy state and federal needs.

When you are already registered, log in to your accounts and then click the Down load option to get the Minnesota Loan Agreement for Personal Loan. Make use of accounts to appear from the lawful forms you might have ordered earlier. Visit the My Forms tab of your respective accounts and acquire yet another version of your papers you require.

When you are a new end user of US Legal Forms, listed below are basic directions that you should comply with:

- First, make certain you have chosen the appropriate form for your personal metropolis/county. You may examine the form while using Review option and read the form outline to guarantee it will be the right one for you.

- In the event the form is not going to satisfy your needs, use the Seach industry to obtain the correct form.

- Once you are certain the form is acceptable, click the Acquire now option to get the form.

- Select the costs strategy you would like and type in the needed details. Make your accounts and pay for the transaction using your PayPal accounts or credit card.

- Select the data file file format and acquire the lawful papers web template to your device.

- Comprehensive, change and printing and sign the acquired Minnesota Loan Agreement for Personal Loan.

US Legal Forms will be the largest collection of lawful forms where you can see different papers web templates. Use the company to acquire skillfully-made paperwork that comply with state needs.