Minnesota Loan Agreement for Business

Description

How to fill out Loan Agreement For Business?

If you need to comprehensive, download, or print out legitimate document web templates, use US Legal Forms, the most important assortment of legitimate kinds, that can be found on-line. Utilize the site`s easy and convenient search to obtain the documents you need. Numerous web templates for organization and person uses are categorized by types and suggests, or key phrases. Use US Legal Forms to obtain the Minnesota Loan Agreement for Business in just a couple of mouse clicks.

In case you are currently a US Legal Forms buyer, log in in your bank account and click the Down load switch to find the Minnesota Loan Agreement for Business. You can even access kinds you in the past downloaded from the My Forms tab of your respective bank account.

If you are using US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for the proper town/region.

- Step 2. Utilize the Preview method to check out the form`s articles. Never forget about to read through the information.

- Step 3. In case you are not satisfied together with the develop, make use of the Search field towards the top of the display to get other versions of your legitimate develop format.

- Step 4. Once you have found the shape you need, click the Purchase now switch. Opt for the costs program you choose and include your credentials to register for the bank account.

- Step 5. Approach the purchase. You may use your Мisa or Ьastercard or PayPal bank account to accomplish the purchase.

- Step 6. Select the formatting of your legitimate develop and download it in your device.

- Step 7. Complete, change and print out or indication the Minnesota Loan Agreement for Business.

Each legitimate document format you purchase is your own property for a long time. You have acces to every develop you downloaded inside your acccount. Click on the My Forms section and select a develop to print out or download once more.

Contend and download, and print out the Minnesota Loan Agreement for Business with US Legal Forms. There are millions of professional and status-distinct kinds you can use for the organization or person needs.

Form popularity

FAQ

Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved. However, its terms - which can include a specific date of repayment, interest rate and repayment schedule - are more certain than those of an IOU.

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.

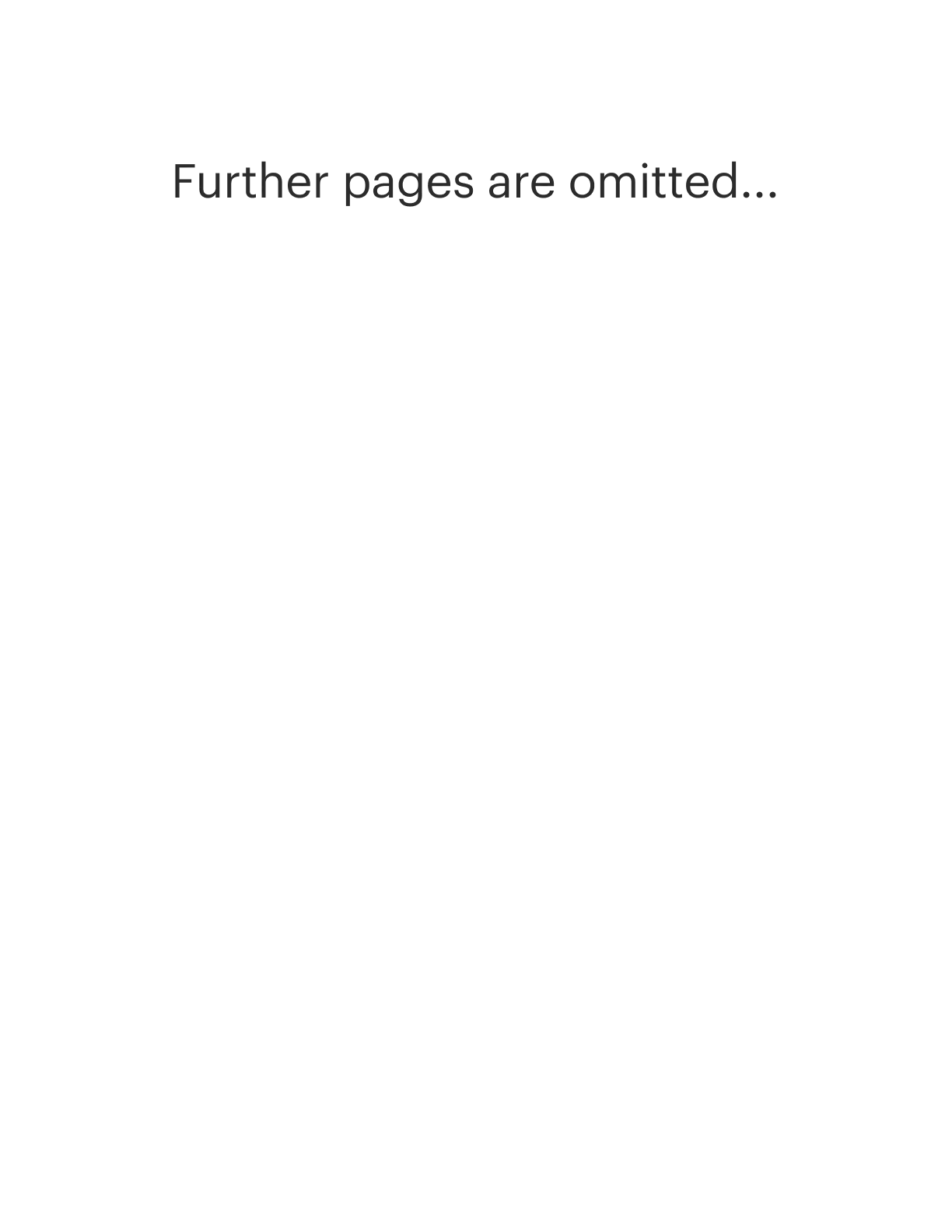

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

All loan agreements must specify general terms that define the legal obligations of each party. For instance, the terms regarding repayment schedule, default or contract breach, interest rate, loan security, as well as collateral offered, must be clearly outlined.

A personal loan agreement is a legally binding contract that defines the expectations for both a borrower and a lender. It can be drawn up with an official lender, like a bank or credit union, or used in a more informal situation, such as with a friend who's lending you an amount of money.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

How to Write a Business Loan Agreement Step 1 ? Set an Effective Date. ... Step 2 ? Identify the Parties. ... Step 3 ? Include the Loan Amount. ... Step 4 ? Create a Repayment Schedule. ... Step 5 ? Define Security Interests or Collateral. ... Step 6 ? Set an Interest Rate. ... Step 7 ? Late Payment Fees. ... Step 8 ? Determine Prepayment Options.