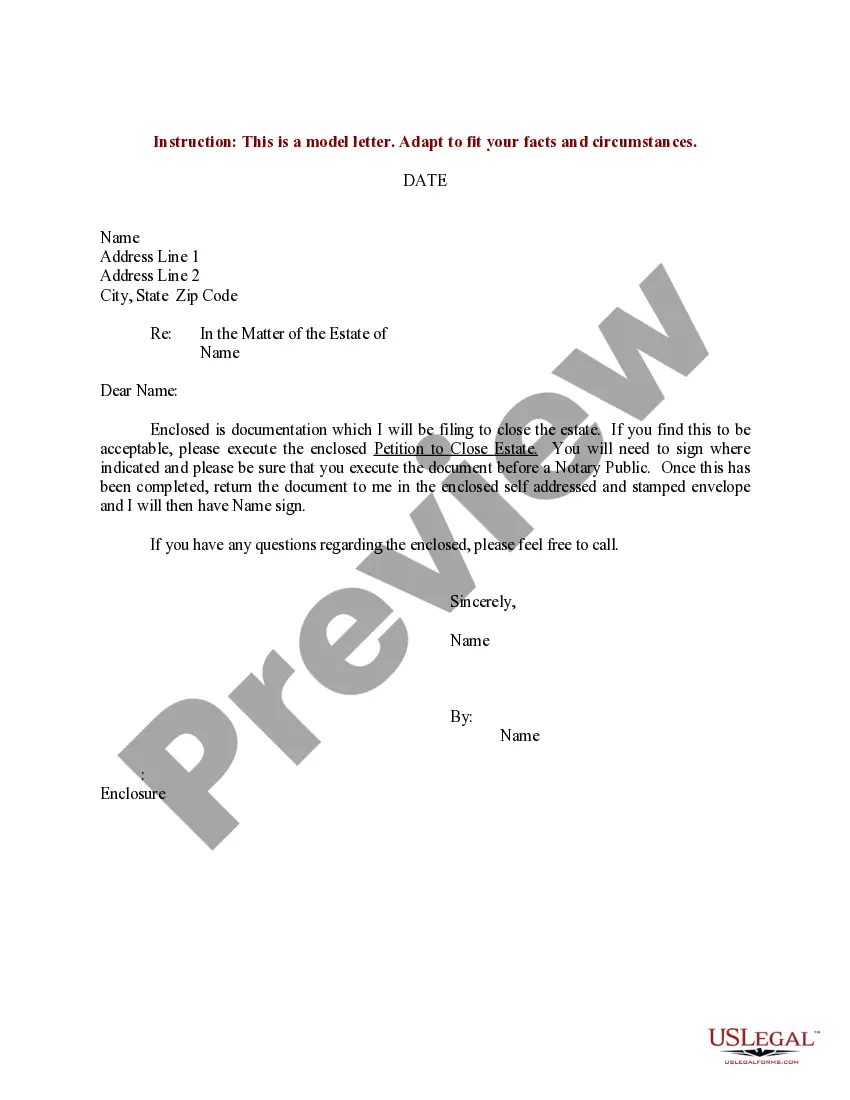

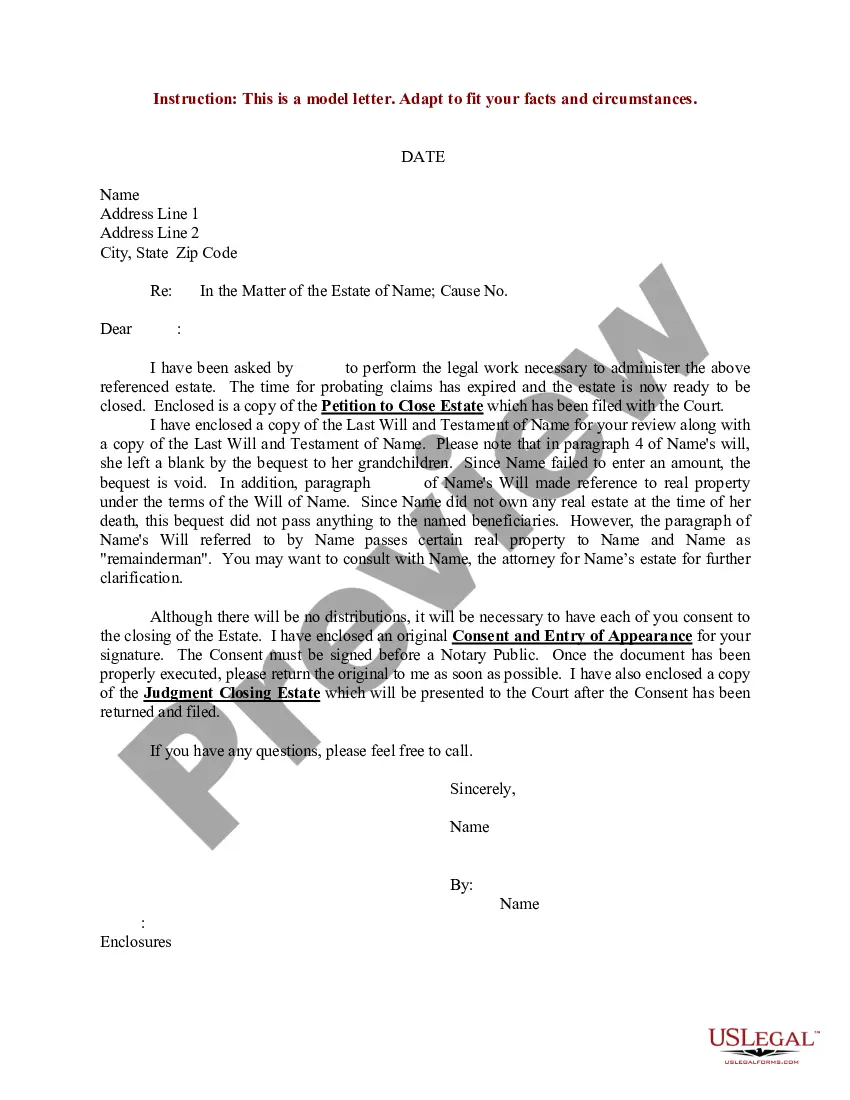

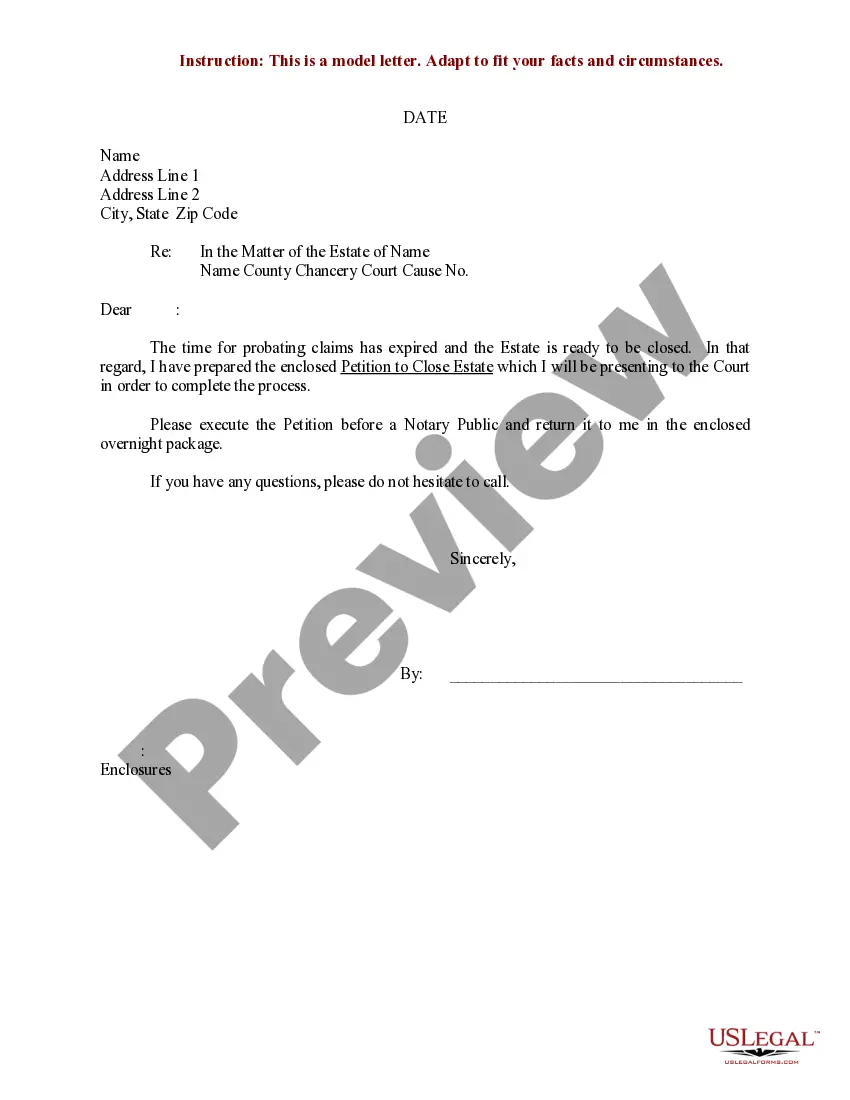

Minnesota Sample Letter for Closing of Estate

Description

How to fill out Sample Letter For Closing Of Estate?

If you want to comprehensive, down load, or printing legal file themes, use US Legal Forms, the largest collection of legal varieties, which can be found on-line. Make use of the site`s basic and handy look for to discover the papers you need. Different themes for enterprise and person functions are categorized by types and states, or keywords. Use US Legal Forms to discover the Minnesota Sample Letter for Closing of Estate with a few clicks.

When you are presently a US Legal Forms customer, log in to your bank account and click the Down load key to get the Minnesota Sample Letter for Closing of Estate. Also you can gain access to varieties you formerly delivered electronically inside the My Forms tab of the bank account.

If you work with US Legal Forms the very first time, follow the instructions below:

- Step 1. Make sure you have selected the shape for that correct city/country.

- Step 2. Make use of the Preview solution to look over the form`s information. Do not overlook to learn the outline.

- Step 3. When you are not satisfied together with the form, use the Lookup area near the top of the display screen to find other variations of the legal form template.

- Step 4. When you have found the shape you need, select the Get now key. Opt for the costs prepare you prefer and include your accreditations to sign up on an bank account.

- Step 5. Process the deal. You may use your credit card or PayPal bank account to complete the deal.

- Step 6. Select the structure of the legal form and down load it on the device.

- Step 7. Full, change and printing or indication the Minnesota Sample Letter for Closing of Estate.

Each and every legal file template you buy is your own permanently. You may have acces to every single form you delivered electronically in your acccount. Click on the My Forms area and pick a form to printing or down load once more.

Remain competitive and down load, and printing the Minnesota Sample Letter for Closing of Estate with US Legal Forms. There are many skilled and condition-particular varieties you may use for your personal enterprise or person requirements.

Form popularity

FAQ

Account transcripts, which reflect transactions including the acceptance of Form 706 and the completion of an examination, may be an acceptable substitute for the estate tax closing letter.

After the informal probate has been fully administered, the personal representative should file an "Unsupervised Personal Representative's Statement to Close Estate" with the Probate Court. No other forms need to be filed with the Probate Court to informally close administration.

There's no easy way to say how long Minnesota probate should take, but one year is a good rule of thumb. An estate that includes a clear will and beneficiaries who can get along may take less than a year whereas one that involves taxes, challenges, multiple attorneys, or other complications can drag on much longer.

An estate tax closing letter is a form letter that the Internal Revenue Service (IRS) will send to you after your IRS Form 706 has been reviewed and accepted. Form 706 is a rather lengthy return that the executor of an estate will file after the death of an individual.

An estate tax return is required if the gross value of the estate is over a certain threshold. For individuals who passed in 2023, the threshold was $12.92 million. Almost anything belonging to the deceased with a tangible cash value is included in the value of the estate.

Until the decedent's assets are transferred to beneficiaries, any income earned on the assets will be reported on Form 1041. For all three of the above returns, the IRS generally has three years from the date the returns were filed to audit the returns.

Once the letter has been received, it makes it clear to the executor of the estate that it can proceed with finalizing the estate administration process. The receipt of the closing letter is often needed to meet requirements for state law probate proceedings.