Minnesota Lease of Commercial Building

Description

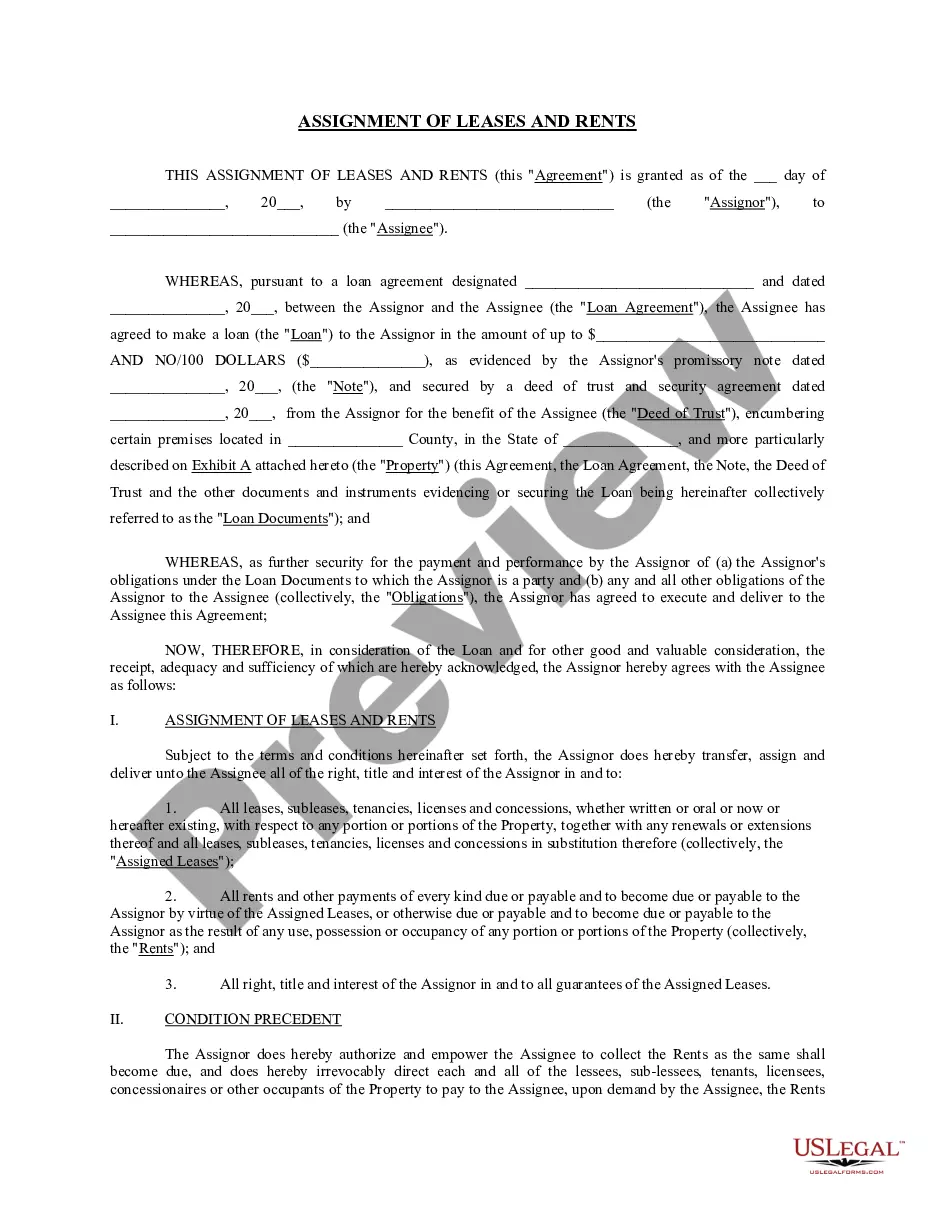

How to fill out Lease Of Commercial Building?

It is feasible to spend multiple hours on the web searching for the approved document format that complies with the federal and state standards you require.

US Legal Forms provides numerous authorized documents that are reviewed by experts.

It is easy to acquire or print the Minnesota Lease of Commercial Building from our offerings.

To obtain another version of the document, use the Search section to find the format that meets your needs and specifications.

- If you already possess a US Legal Forms account, you can Log In and hit the Download button.

- After that, you can complete, modify, print, or sign the Minnesota Lease of Commercial Building.

- Every authorized document you obtain is yours permanently.

- To get another duplicate of the obtained document, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure that you have selected the correct document format for the area/town of your choice.

- Check the form outline to guarantee you have chosen the right form.

Form popularity

FAQ

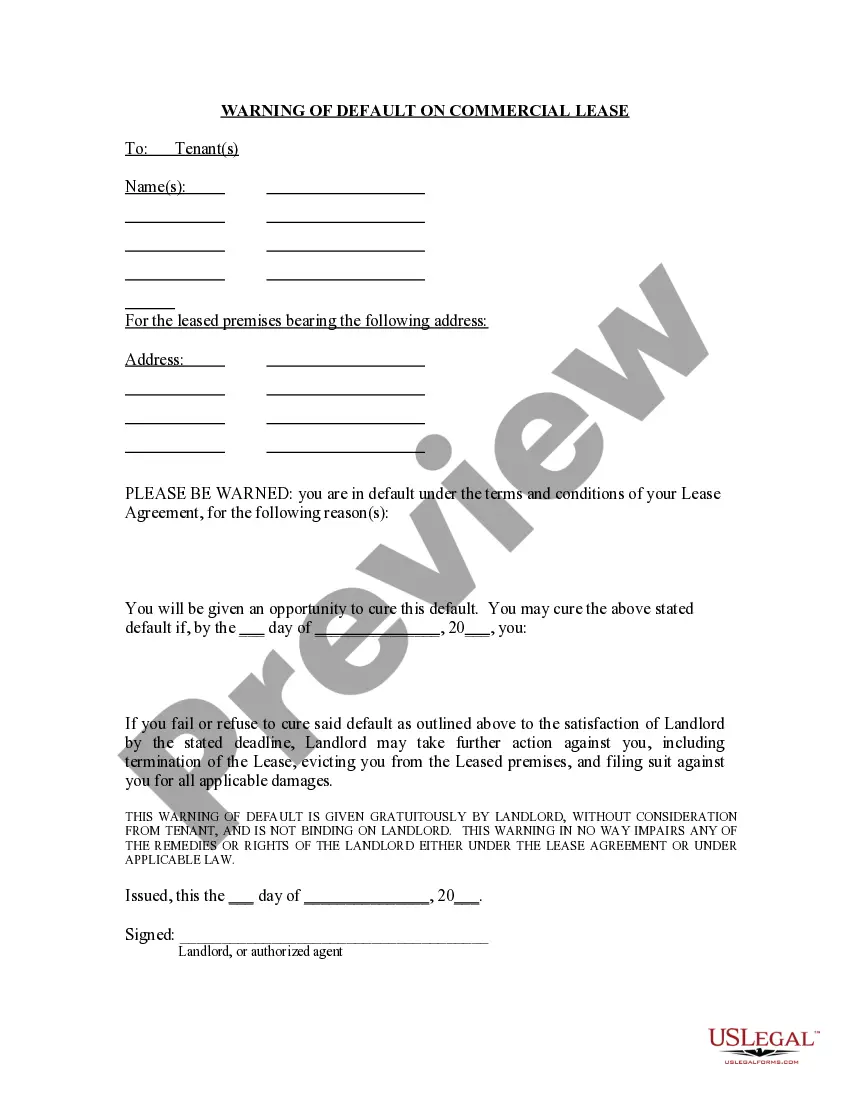

Five Essential Elements of a Commercial Lease AgreementParties Clause. Every commercial lease agreement should contain the complete and accurate names of the landlord and tenant.Premises Clause. You must correctly identify the commercial property being leased.Rent Clause.Term Clause.Use Clause.

A lease structure often depends on the landlord's preference and what is common in the market place. Some leases push all the expenses to the tenant's side of the ledger, while other leases push all the expenses to the landlord's side; and then there are many lease types in the middle.

Triple Net Lease Arguably the favorite among commercial landlords, the triple net lease, or NNN lease makes the tenant responsible for the majority of costs, including the base rent, property taxes, insurance, utilities and maintenance.

3 Types of Commercial Real Estate LeasesGross Lease/Full Service Lease. In a gross lease, the tenant's rent covers all property operating expenses.Net Lease. The net lease is a highly adjustable commercial real estate lease.Modified Gross Lease/Modified Net Lease.

Commercial leases are typically three to five years. That guarantees enough rental income for the landlords to recoup their investment. Leases are often negotiable, but for a commercial lease, landlords frequently allow customization of the space for the sake of the renting business.

This lease structure makes the tenant responsible for the majority of costs. Specifically, the tenant pays the base rent, property but also taxes, insurance, utilities, and maintenance. This even includes standard property repairs associated with the commercial space being occupied.

A Triple Net Lease (NNN Lease) is the most common type of lease in commercial buildings. In a NNN lease, the rent does not include operating expenses. Operating expenses include utilities, maintenance, property taxes, insurance and property management.

A Triple Net Lease (NNN Lease) is the most common type of lease in commercial buildings. In a NNN lease, the rent does not include operating expenses. Operating expenses include utilities, maintenance, property taxes, insurance and property management.

And, how the most common retail leases are structured: Single net lease. A single net lease, or net lease, is an arrangement where the tenant pay for utilities and property taxes.