Minnesota Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years

Description

How to fill out Testamentary Provisions For Charitable Remainder Annuity Trust For Term Of Years?

If you wish to obtain, download, or create lawful document templates, utilize US Legal Forms, the largest array of legal forms, available online.

Take advantage of the site’s user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by types and categories, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to locate alternative designs in the legal form template.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Use US Legal Forms to access the Minnesota Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and press the Download button to retrieve the Minnesota Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years.

- You can also view forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

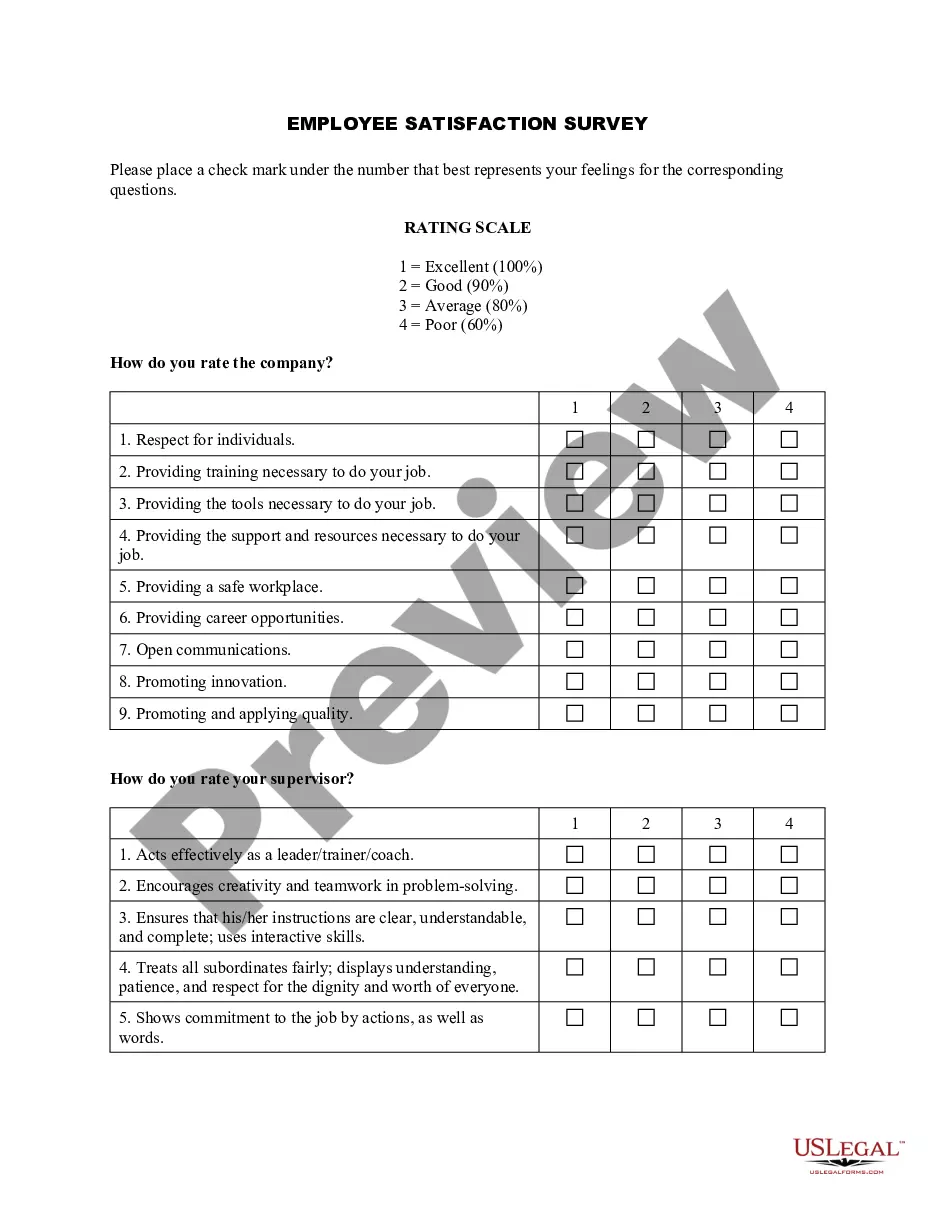

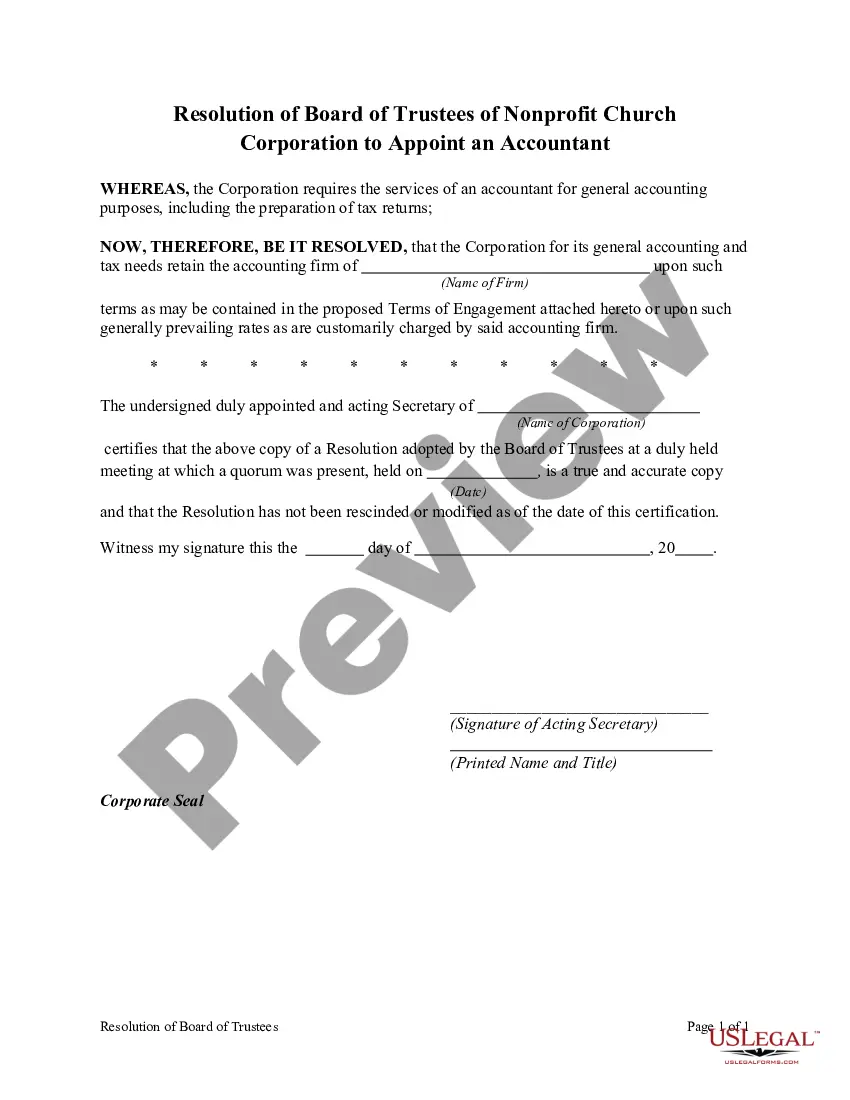

- Step 2. Utilize the Preview feature to review the form’s content. Remember to read the instructions.

Form popularity

FAQ

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

1. Charitable remainder unit trust (CRUT) pays the beneficiary a fixed percentage of the trust at least annually, often for life or a period up to 20 years.

How Long Can a Charitable Trust Last? Charitable Remainder Trusts can either last the lifetime of another beneficiary, or for a specified term (usually 20 years). At that point, any remaining value would go to your designated charitable organization. Learn more about Charitable Trust tax rules.

All trusts are required to contain at least the following elements:Trusts must identify the grantor, trustee and beneficiary. The grantor and trustee must be identified because they are parties to the contract.The trust res must be identified.The trust must contain the signature of both the grantor and the trustee.

Generally, if a trust beneficiary is the owner of all interests in a trust (both the income and remainder interests), the trust terminates, and the beneficiary has access to the trust principal. If the merger doctrine doesn't apply under governing state law, a court order may be required to terminate the trust.

Testamentary trusts are discretionary trusts established in Wills, that allow the trustees of each trust to decide, from time to time, which of the nominated beneficiaries (if any) may receive the benefit of the distributions from that trust for any given period.

How Long Can a Charitable Trust Last? Charitable Remainder Trusts can either last the lifetime of another beneficiary, or for a specified term (usually 20 years). At that point, any remaining value would go to your designated charitable organization. Learn more about Charitable Trust tax rules.

A testamentary trust is a trust contained in a last will and testament. It provides for the distribution of all or part of an estate and often proceeds from a life insurance policy held on the person establishing the trust. There may be more than one testamentary trust per will.

Perpetual trusts have existed for charitable purposes all the way back to Benjamin Franklin and John Adams. Up until recently, trusts were subject to a limit on duration based on the life span of all the people alive when it was created plus 21 years typically about 100 years.

Testamentary Trusts are created under a Will and therefore come into effect only after the death of the person who made the Will, the testator....The types of assets held in a Testamentary TrustInvestments;Land or property;Cash; and.Other valuable assets, including paintings, furniture and jewelleries.