[Your Name] [Your Title] [Company Name] [Company Address] [City, State, ZIP] [Date] [Employee Name] [Employee Address] [City, State, ZIP] Dear [Employee Name], RE: MINNESOTA EMPLOYEE AUTOMOBILE EXPENSE ALLOWANCE I hope this letter finds you well. We are pleased to inform you that as a valued employee of [Company Name], effective from [start date], you will be eligible to receive an automobile expense allowance to assist with the costs associated with your vehicle usage for business purposes within the state of Minnesota. The automobile expense allowance is designed to cover a portion of the expenses incurred by employees who use their personal vehicles for business-related travel. This allowance is in addition to your regular salary and is a reflection of our commitment to supporting you in performing your job duties efficiently and effectively. The specific terms and conditions of the Minnesota Employee Automobile Expense Allowance are as follows: 1. Allowance Amount: The monthly allowance will be a fixed rate of [dollar amount] per month. This amount will be taxable and subject to regular payroll deductions. 2. Eligibility Criteria: To qualify for the automobile expense allowance, you must meet the following criteria: a. Possess a valid driver's license issued by the state of Minnesota. b. Maintain automobile insurance coverage that meets the minimum state requirements. c. Agree to adhere to all applicable traffic laws and company policies during business-related travel. d. Submit accurate and timely mileage reports, as per the company's guidelines. 3. Reimbursement Method: The automobile expense allowance will be paid to you monthly, typically with your regular salary, and will be included in your paycheck. 4. Expense Documentation: It is your responsibility to maintain accurate records of your business-related mileage. You will be required to submit monthly mileage reports, detailing each trip's purpose, starting and ending locations, and total mileage. Failure to provide accurate documentation may result in the adjustment or suspension of the allowance. 5. Expense Limitations: The automobile expense allowance is intended to cover reasonable and necessary expenses related to business travel. It does not cover personal commuting costs or non-business-related travel expenses. Please note that the Minnesota Employee Automobile Expense Allowance is subject to review and potential adjustment periodically at the company's discretion. You will be notified in advance of any changes or updates to the allowance. If you have any queries or require further clarification regarding this allowance, please do not hesitate to reach out to the Human Resources department. We appreciate your dedication and commitment to [Company Name] and value your contributions to our organization. Your professionalism and willingness to go above and beyond are truly valued and recognized. Thank you for your attention to this matter, and please signify your understanding and acceptance of the terms and conditions by signing and returning a copy of this letter. Yours sincerely, [Your Name] [Your Title] [Company Name]

Minnesota Sample Letter for Employee Automobile Expense Allowance

Description

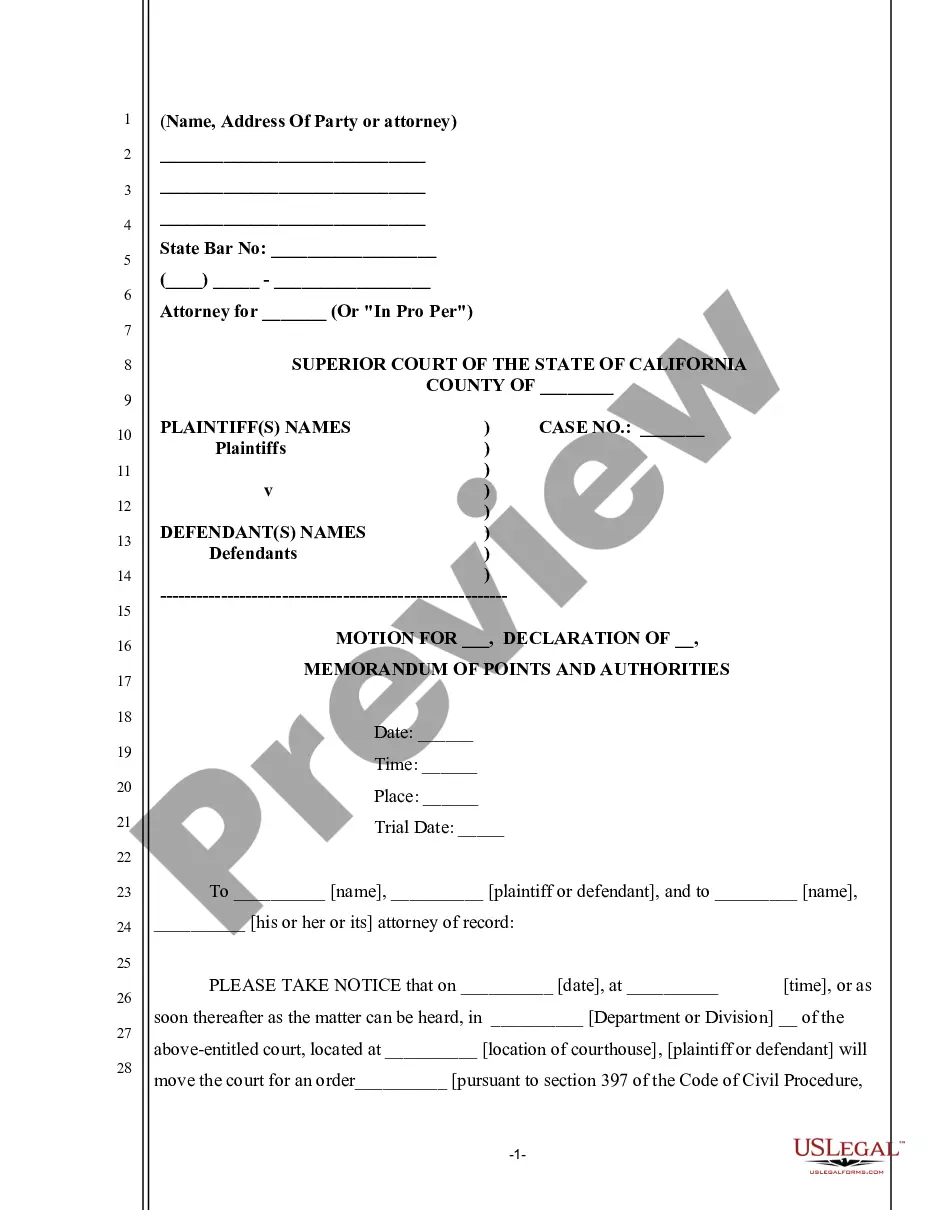

How to fill out Minnesota Sample Letter For Employee Automobile Expense Allowance?

You are able to commit hrs online looking for the legitimate document format that fits the federal and state requirements you want. US Legal Forms provides 1000s of legitimate kinds that are evaluated by pros. You can actually download or printing the Minnesota Sample Letter for Employee Automobile Expense Allowance from your services.

If you have a US Legal Forms bank account, you may log in and click on the Obtain key. Following that, you may total, change, printing, or sign the Minnesota Sample Letter for Employee Automobile Expense Allowance. Each legitimate document format you buy is the one you have eternally. To acquire another version associated with a bought develop, proceed to the My Forms tab and click on the corresponding key.

If you are using the US Legal Forms site initially, stick to the basic guidelines listed below:

- Very first, make certain you have chosen the proper document format for that area/metropolis of your choosing. Look at the develop outline to make sure you have selected the right develop. If accessible, use the Review key to check through the document format also.

- In order to locate another version of your develop, use the Research area to get the format that suits you and requirements.

- Upon having located the format you would like, simply click Purchase now to continue.

- Choose the prices prepare you would like, type your qualifications, and sign up for a merchant account on US Legal Forms.

- Complete the purchase. You can use your credit card or PayPal bank account to pay for the legitimate develop.

- Choose the structure of your document and download it in your device.

- Make changes in your document if needed. You are able to total, change and sign and printing Minnesota Sample Letter for Employee Automobile Expense Allowance.

Obtain and printing 1000s of document templates while using US Legal Forms site, that offers the largest assortment of legitimate kinds. Use specialist and state-certain templates to handle your small business or person needs.

Form popularity

FAQ

A car allowance is a one-time cash sum you can use to buy a personal vehicle. The choice of vehicle is usually up to you. Yet, your employer may give you the minimum specifications for the vehicle. These specifications may include age, CO2 emissions, number of seats and more.

I (name) working in (department) of your reputed company having employee ID (mention your employee ID number) and I am writing this letter in reference to the night shift allowance. I shall be highly obliged if you could kindly proceed with the night shift allowance in my name.

Request letter for NYSC allowanceI want to bring to your kind notice that I have not received my Federal Government allowance till now. I'm serving in Abia State with State Code: AB/20A/33. It has happened to me for the first time.

Responsibility Allowances are a formal means of recognition and remuneration for temporary. changes in the level of duties and responsibilities that employees agree to undertake when business needs dictate.

Here are few other great methods.Try asking for a percentage increase.Use a formula based on your age.If your allowance is based on chore completion, consider asking for a raise in the price of tasks that are more difficult or require more time.Your allowance should generally reflect your responsibilities.More items...

A standard vehicle allowance is a monthly compensation for the costs of using a motor vehicle for work. This payment is typically part of a paycheck. It's up to the employee whether to put that money toward a car payment or to use it to defray gas expense, wear and tear, and other car costs.

A car allowance is a set amount that you give to your employees to cover a period of time. This car allowance is intended to cover typical costs of owning a vehicle, such as maintenance, wear-and-tear, insurance, fuel and depreciation.

A standard car allowance is considered taxable income because it does not substantiate business use. A mileage reimbursement, however, remains non-taxable as long as it does not exceed the vehicle reimbursement amount determined by the IRS business mileage rate.

Type a letter to request a responsibility allowance. Include your address and the date in a business letter format. Add "Human Resources" as a title along with contact information on the left hand side of your letter. Address the request to the director of the Human Resources department in your company.

2021 Average Car Allowance The average car allowance in 2021 is $575. And, believe it or not, the average car allowance in 2020 was also $575. This allowance may be greater for different positions in the company. Executives for example may receive an allowance of around $800.