Subject: Minnesota Sample Letter for Distribution of Estate to Church Dear [Church Name or Reverend], RE: Distribution of Estate to [Church Name] I hope this letter finds you in good health and high spirits. I am writing to provide you with a detailed description of the process and requirements for distributing the estate of [Deceased Person] to [Church Name], in accordance with the laws of Minnesota. [Deceased Person's Full Name], a devoted member of our church community, recently passed away, leaving behind [his/her] estate to be disbursed among the beneficiaries. In [his/her] last will and testament, [Deceased Person] expressed [his/her] sincere desire to allocate a portion of their assets to [Church Name] to support the church's mission and endeavors. To initiate the process of distributing the estate to [Church Name], the following steps need to be undertaken: 1. Appointment of an Executor: An executor, nominated in the will or appointed by the court, is responsible for managing the deceased person's assets and ensuring that the distribution aligns with the wishes outlined in the will. If an executor has already been appointed, the person should inform the church in writing, along with any relevant contact information. 2. Probate Process: Minnesota has specific laws and procedures for probate, the legal process by which a deceased person's estate is settled. It is imperative that the executor promptly initiates the probate process, as any delays may impact the distribution timeline. If the estate proceeds through a formal probate process, the executor is required to submit necessary documents, including the will, to the court. 3. Notice to Beneficiaries: Once the probate process begins, the executor must notify all beneficiaries mentioned in the will. In this case, [Church Name] is considered a beneficiary, and it is essential to ensure that the church's legal name and address are accurately stated in the notification letter. 4. Inventory and Valuation of Assets: The executor is responsible for preparing an inventory of all assets owned by the deceased person and determining their value. It is essential to provide a comprehensive list of assets to the court, including real estate, personal property, investments, and any funds in bank accounts. 5. Estate Taxes: Depending on the size of the estate, there may be estate tax implications. It is crucial for the executor and any professional advisors to consult with a qualified tax professional to ensure compliance with Minnesota’s estate tax laws and to evaluate any potential tax liabilities. 6. Beneficiary Designations: If there are other named beneficiaries in the will, the church may need to coordinate with them for the distribution process. Each beneficiary should receive a comprehensive description of the process and an estimate of when they can expect their portion of the estate to be disbursed. Please note that this letter serves as an informational guide and does not constitute legal advice. It is strongly recommended that the church consult a qualified attorney specializing in estate law to ensure compliance with all applicable Minnesota statutes and regulations. If you have any questions or require further assistance, please do not hesitate to reach out to the designated executor or the legal counsel representing the estate. We are deeply grateful for [Deceased Person]'s generous contribution to [Church Name], and we wholeheartedly appreciate your cooperation in this matter. The funds received will be utilized to strengthen and support our church's ongoing ministry, enabling us to continue serving our congregation and the broader community. On behalf of [Church Name] and all its members, I extend our deepest condolences for the loss of [Deceased Person]. Our thoughts and prayers are with the family during this difficult time. May God bless you abundantly. Sincerely, [Your Name] [Your Title/Role] [Your Contact Information] --- Types of Minnesota Sample Letters for Distribution of Estate to Church: 1. Formal Distribution Letter: This letter follows a standard business format and includes a detailed description of the estate distribution process to [Church Name]. It is commonly used when there are multiple beneficiaries and complex estates. 2. Informal Distribution Letter: This letter, while still conveying crucial information, may have a more personal and empathetic tone. It can be used when the estate's distribution is straightforward, and there are no expected complications or disputes among beneficiaries. Note: It is advisable to consult with an attorney or legal professional to determine the most appropriate type of letter based on the specific circumstances of the estate and the preferences of the deceased person's family.

Minnesota Sample Letter for Distribution of Estate to Church

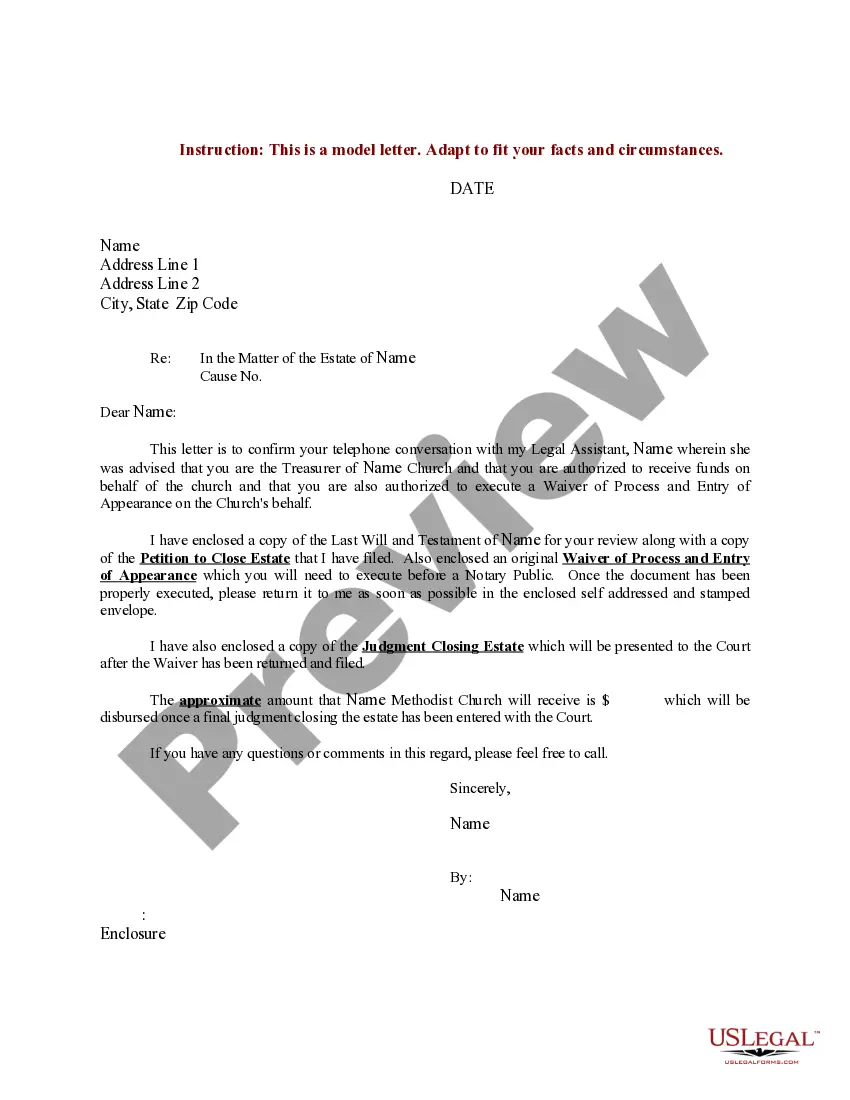

Description

How to fill out Minnesota Sample Letter For Distribution Of Estate To Church?

If you need to comprehensive, obtain, or printing legitimate document themes, use US Legal Forms, the greatest variety of legitimate forms, that can be found online. Utilize the site`s simple and convenient research to obtain the files you want. Different themes for enterprise and individual purposes are sorted by groups and states, or search phrases. Use US Legal Forms to obtain the Minnesota Sample Letter for Distribution of Estate to Church in a couple of click throughs.

In case you are presently a US Legal Forms buyer, log in in your profile and click on the Acquire option to obtain the Minnesota Sample Letter for Distribution of Estate to Church. You can even access forms you previously acquired within the My Forms tab of your profile.

If you use US Legal Forms initially, follow the instructions under:

- Step 1. Make sure you have selected the shape for the correct town/country.

- Step 2. Use the Review method to check out the form`s content material. Do not forget about to read the information.

- Step 3. In case you are not satisfied using the develop, use the Lookup discipline near the top of the screen to discover other models in the legitimate develop format.

- Step 4. After you have located the shape you want, click the Buy now option. Select the rates plan you choose and include your references to sign up to have an profile.

- Step 5. Method the financial transaction. You can utilize your bank card or PayPal profile to complete the financial transaction.

- Step 6. Choose the format in the legitimate develop and obtain it on the system.

- Step 7. Complete, revise and printing or indicator the Minnesota Sample Letter for Distribution of Estate to Church.

Every single legitimate document format you acquire is your own forever. You may have acces to each and every develop you acquired inside your acccount. Go through the My Forms area and choose a develop to printing or obtain again.

Contend and obtain, and printing the Minnesota Sample Letter for Distribution of Estate to Church with US Legal Forms. There are millions of specialist and express-certain forms you may use to your enterprise or individual demands.