A Minnesota Qualifying Subchapter-S Revocable Trust Agreement is a legal document that allows an individual, often referred to as the granter or settler, to create a trust for the purpose of managing and distributing their assets while they are alive and after their death. This type of trust is specifically designed to meet the requirements set forth by the Minnesota state laws in order to qualify as a Subchapter S trust for federal tax purposes. A Minnesota Qualifying Subchapter-S Revocable Trust Agreement offers various benefits and features to the granter. Firstly, it allows for the management of assets within the trust during the granter's lifetime, making it an effective tool for estate planning and asset protection. Additionally, this type of trust agreement allows for the avoidance of probate, ensuring a smooth transition of assets to the designated beneficiaries after the granter's passing. The Minnesota Qualifying Subchapter-S Revocable Trust Agreement may also provide flexibility to the granter, as it can be modified or revoked during their lifetime. This flexibility ensures that the granter can adapt the trust agreement to changes in their circumstances or objectives. It is worth mentioning that there may be different types or variations of a Minnesota Qualifying Subchapter-S Revocable Trust Agreement. These may include specific provisions related to the distribution of assets, the appointment of trustees or successor trustees, and the management of trust assets. Some variations may also include provisions for special types of trusts, such as charitable remainder trusts or special needs trusts, which serve specific purposes depending on the granter's desires and circumstances. To summarize, a Minnesota Qualifying Subchapter-S Revocable Trust Agreement is a legally binding document that enables individuals in Minnesota to create a trust to manage and distribute their assets during their lifetime and after their passing. It offers benefits such as asset protection, probate avoidance, and flexibility in modifying or revoking the trust agreement. It is important to consult with an attorney or legal professional to understand the specific requirements and options available for a Minnesota Qualifying Subchapter-S Revocable Trust Agreement tailored to one's unique circumstances.

Minnesota Qualifying Subchapter-S Revocable Trust Agreement

Description

How to fill out Minnesota Qualifying Subchapter-S Revocable Trust Agreement?

US Legal Forms - among the greatest libraries of lawful varieties in the USA - delivers a wide range of lawful file web templates you may down load or produce. Utilizing the web site, you may get a huge number of varieties for enterprise and personal functions, categorized by types, suggests, or keywords.You can get the most up-to-date models of varieties much like the Minnesota Qualifying Subchapter-S Revocable Trust Agreement within minutes.

If you currently have a subscription, log in and down load Minnesota Qualifying Subchapter-S Revocable Trust Agreement through the US Legal Forms local library. The Download option can look on each form you look at. You get access to all formerly delivered electronically varieties in the My Forms tab of the accounts.

If you wish to use US Legal Forms the very first time, listed below are straightforward guidelines to help you started out:

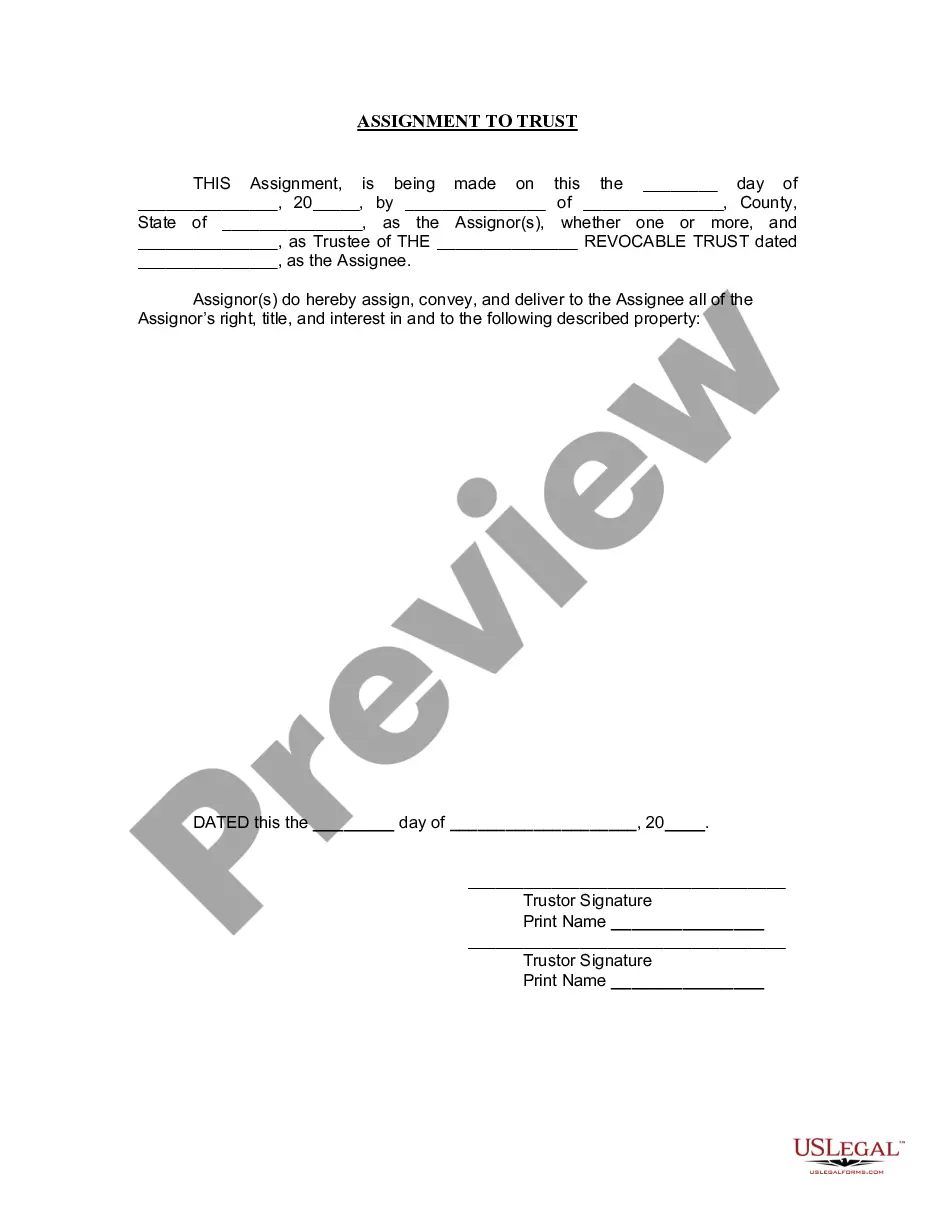

- Be sure to have chosen the right form to your area/area. Select the Review option to analyze the form`s articles. See the form description to actually have selected the proper form.

- In the event the form doesn`t satisfy your specifications, make use of the Look for industry near the top of the display to find the one who does.

- Should you be satisfied with the form, confirm your selection by visiting the Purchase now option. Then, opt for the costs strategy you favor and give your references to sign up to have an accounts.

- Procedure the purchase. Make use of charge card or PayPal accounts to accomplish the purchase.

- Pick the structure and down load the form in your system.

- Make modifications. Complete, edit and produce and sign the delivered electronically Minnesota Qualifying Subchapter-S Revocable Trust Agreement.

Every design you added to your account lacks an expiration day and is your own permanently. So, if you wish to down load or produce an additional backup, just check out the My Forms portion and click around the form you will need.

Get access to the Minnesota Qualifying Subchapter-S Revocable Trust Agreement with US Legal Forms, the most substantial local library of lawful file web templates. Use a huge number of professional and express-certain web templates that meet your company or personal requirements and specifications.