The Minnesota Borrowers Certification of Inventory is a crucial document used in the lending industry to verify the accuracy and condition of inventory held by borrowers in the state of Minnesota. This certification serves as proof of the existence, quantity, and value of the inventory, and enables lenders to assess the lending risk involved. In order to provide comprehensive information on the Minnesota Borrowers Certification of Inventory, it is important to mention the different types of certifications that may exist within this context, including: 1. General Borrowers Certification of Inventory: This is a standard certification used by various borrowers in Minnesota, regardless of industry or sector. It requires borrowers to thoroughly inspect and document their inventory, ensuring it is properly valued and accounted for. The general certification covers a wide range of inventory types, such as raw materials, finished goods, work in progress, and other relevant stock items. 2. Industry-Specific Borrowers Certification of Inventory: Some industries may have specific requirements or regulations that necessitate a tailored certification. For instance, the manufacturing sector may have unique inventory items, such as machinery, equipment, or specialized components. Therefore, a borrower from this sector may need to submit an industry-specific certification that accurately accounts for these assets. 3. Agriculture Borrowers Certification of Inventory: Given the significance of the agricultural sector in Minnesota, there exists a unique certification for borrowers involved in farming or other related activities. This certification focuses on inventory specific to agriculture, including livestock, crops, feed, and other farm supplies. It ensures that the lender has an accurate understanding of the borrower's agricultural assets and their reported value. The Minnesota Borrowers Certification of Inventory serves several important purposes. Firstly, it provides lenders with valuable information to judge the borrower's ability to repay loans and meet financial obligations, by assessing the value and liquidity of their inventory. Additionally, it safeguards the lender's interests by preventing fraudulent activities, such as inflating inventory values or misrepresenting the existence of certain assets. Keywords: Minnesota, Borrowers Certification of Inventory, lending industry, accuracy, condition, existence, quantity, value, lending risk, Minnesota borrowers, inventory, stock items, raw materials, finished goods, work in progress, specific requirements, regulations, industry-specific, manufacturing sector, agriculture, livestock, crops, feed, farm supplies, loans, financial obligations, fraudulent activities.

Minnesota Borrowers Certification of Inventory

Description

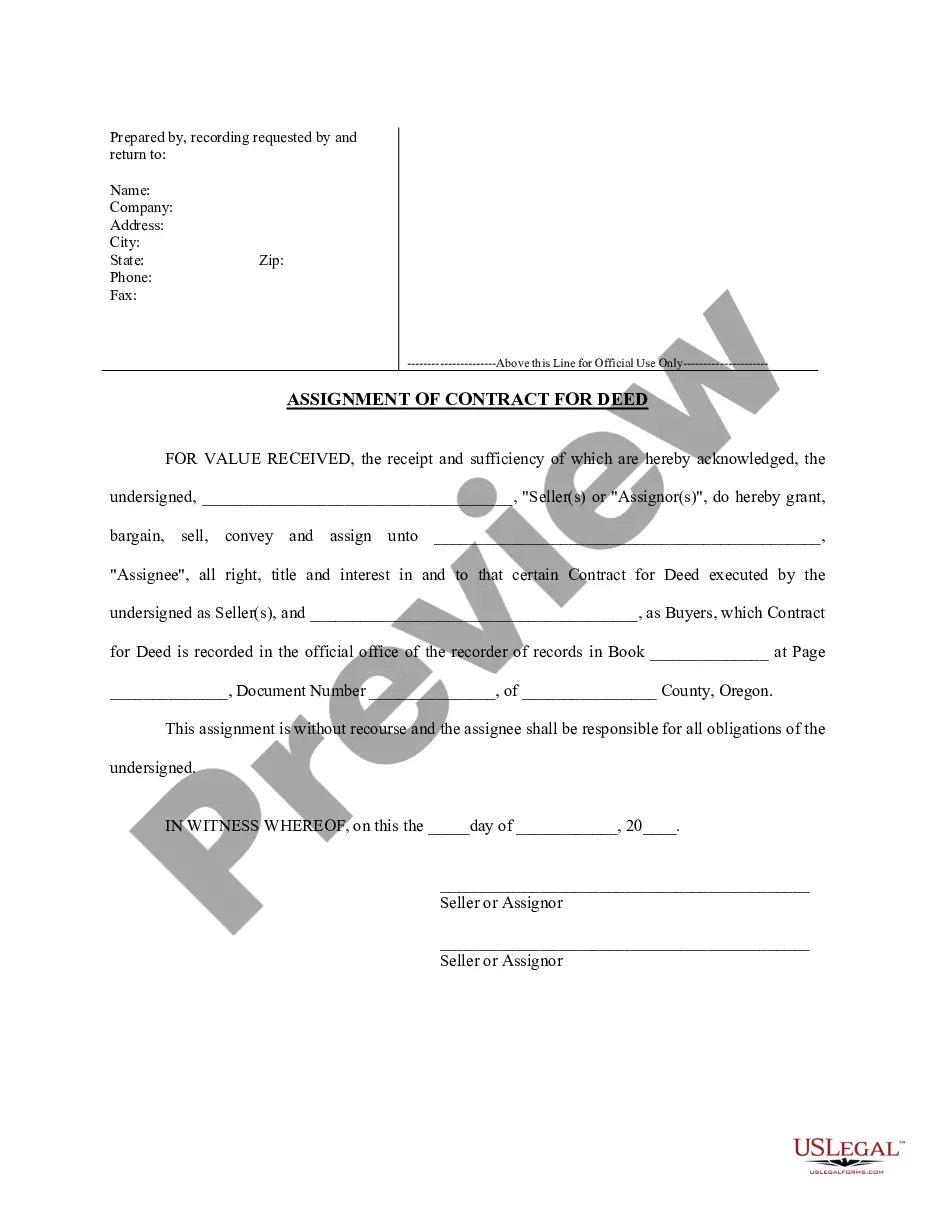

How to fill out Borrowers Certification Of Inventory?

If you need to comprehensive, down load, or produce legal record layouts, use US Legal Forms, the most important collection of legal varieties, which can be found on the Internet. Use the site`s easy and handy lookup to discover the documents you need. A variety of layouts for business and specific reasons are categorized by categories and claims, or keywords. Use US Legal Forms to discover the Minnesota Borrowers Certification of Inventory in a handful of click throughs.

If you are already a US Legal Forms client, log in for your bank account and click on the Acquire option to obtain the Minnesota Borrowers Certification of Inventory. You may also accessibility varieties you in the past delivered electronically in the My Forms tab of your respective bank account.

If you work with US Legal Forms the very first time, follow the instructions below:

- Step 1. Make sure you have chosen the shape to the proper area/land.

- Step 2. Use the Review method to examine the form`s content. Never overlook to read the outline.

- Step 3. If you are unhappy together with the type, take advantage of the Research discipline on top of the display screen to discover other versions of your legal type format.

- Step 4. Once you have identified the shape you need, click on the Get now option. Select the pricing program you like and add your references to sign up for the bank account.

- Step 5. Process the deal. You can utilize your Мisa or Ьastercard or PayPal bank account to complete the deal.

- Step 6. Select the formatting of your legal type and down load it on your device.

- Step 7. Total, edit and produce or indicator the Minnesota Borrowers Certification of Inventory.

Every legal record format you buy is your own property eternally. You might have acces to each type you delivered electronically within your acccount. Click the My Forms segment and select a type to produce or down load yet again.

Be competitive and down load, and produce the Minnesota Borrowers Certification of Inventory with US Legal Forms. There are millions of professional and state-distinct varieties you can use for your personal business or specific needs.

Form popularity

FAQ

Summary. This certificate of borrower (limited liability company) is a form of officer's certificate delivered by a borrower (that is organized as a limited liability company) to the lender at the closing of an acquisition loan transaction.

Such information includes, but is not limited to, employment history and income, account balances, credit history, copies of income tax returns, rent history, utility payments, phone payments and cable payments, payoff requests, and verification of mortgage.

The first is that you certify that all information you have given ? on the application, and in subsequent paperwork ? is true and complete. Secondly, you are authoring the release of credit, employment, and other information as needed to process and close your home loan.

Such information includes, but is not limited to, employment history and income; bank, money market and similar account balances; credit history; and copies of income tax returns.

I hereby authorize the Lender/Broker to verify my past and present employment earnings records, bank accounts, stock holdings, and any other asset balances that are needed to process my mortgage loan application.

Borrower's Signature Authorization. Borrower Signature Authorization is a document signed by the applicant authorizing the lender to obtain and verify information and documentation from third parties that is needed in connection with the application for mortgage loan.

Summary. This certificate of borrower (limited liability company) is a form of officer's certificate delivered by a borrower (that is organized as a limited liability company) to the lender at the closing of an acquisition loan transaction. This template includes practical guidance and drafting notes.