Minnesota LLC Operating Agreement for Husband and Wife is a legally binding document that outlines the rights, responsibilities, and obligations of a husband and wife who co-own a Limited Liability Company (LLC) in the state of Minnesota. This agreement serves as a comprehensive guide for the management and operation of the LLC and helps to avoid potential disputes or misunderstandings between the spouses. The Minnesota LLC Operating Agreement for Husband and Wife addresses various important aspects of the LLC, such as ownership percentages, capital contributions, profit and loss allocation, decision-making authority, and dispute resolution mechanisms. It is designed to establish clear guidelines on how the LLC will be run and how the couple's interests will be protected. There are two main types of Minnesota LLC Operating Agreements for Husband and Wife: 1. Single-Member LLC Operating Agreement: This type of agreement is suitable when only one spouse owns the LLC, with the other spouse acting in a supporting role or as a silent partner. The agreement will outline the sole member's rights and responsibilities, including decision-making powers, profit distribution, and management of the LLC. 2. Multi-Member LLC Operating Agreement: In cases where both spouses actively participate in managing the LLC and share ownership, a multi-member operating agreement is necessary. This agreement will detail the rights and obligations of each spouse, their respective ownership percentages, voting power, and any specific roles they may have within the LLC. Key provisions typically included in a Minnesota LLC Operating Agreement for Husband and Wife are: 1. Capital Contributions: Clearly define the initial and additional contributions made by each spouse to the LLC. 2. Allocations of Profits and Losses: Specify how profits and losses will be shared between the spouses, which can be based on their ownership percentages or customized according to their agreement. 3. Decision-Making: Establish the decision-making process, including voting rights, procedures, and any requirements for unanimous consent on major decisions. 4. Management Roles and Responsibilities: If both spouses are actively involved in managing the LLC, outline their specific roles, responsibilities, and authority. 5. Transfer of Ownership: Address the conditions and procedures for the transfer or sale of LLC membership interests, including any restrictions or approvals required. 6. Dissolution and Liquidation: Describe the process for winding up the LLC's affairs in the event of a divorce, death, or the desire to terminate the LLC. It is essential to consult with a qualified attorney who specializes in business law to ensure compliance with Minnesota's specific legal requirements and to tailor the operating agreement to the couple's unique circumstances. A well-drafted operating agreement will provide a solid foundation for a successful and harmonious partnership between spouses operating an LLC in Minnesota.

Minnesota Llc Operating Agreement

Description

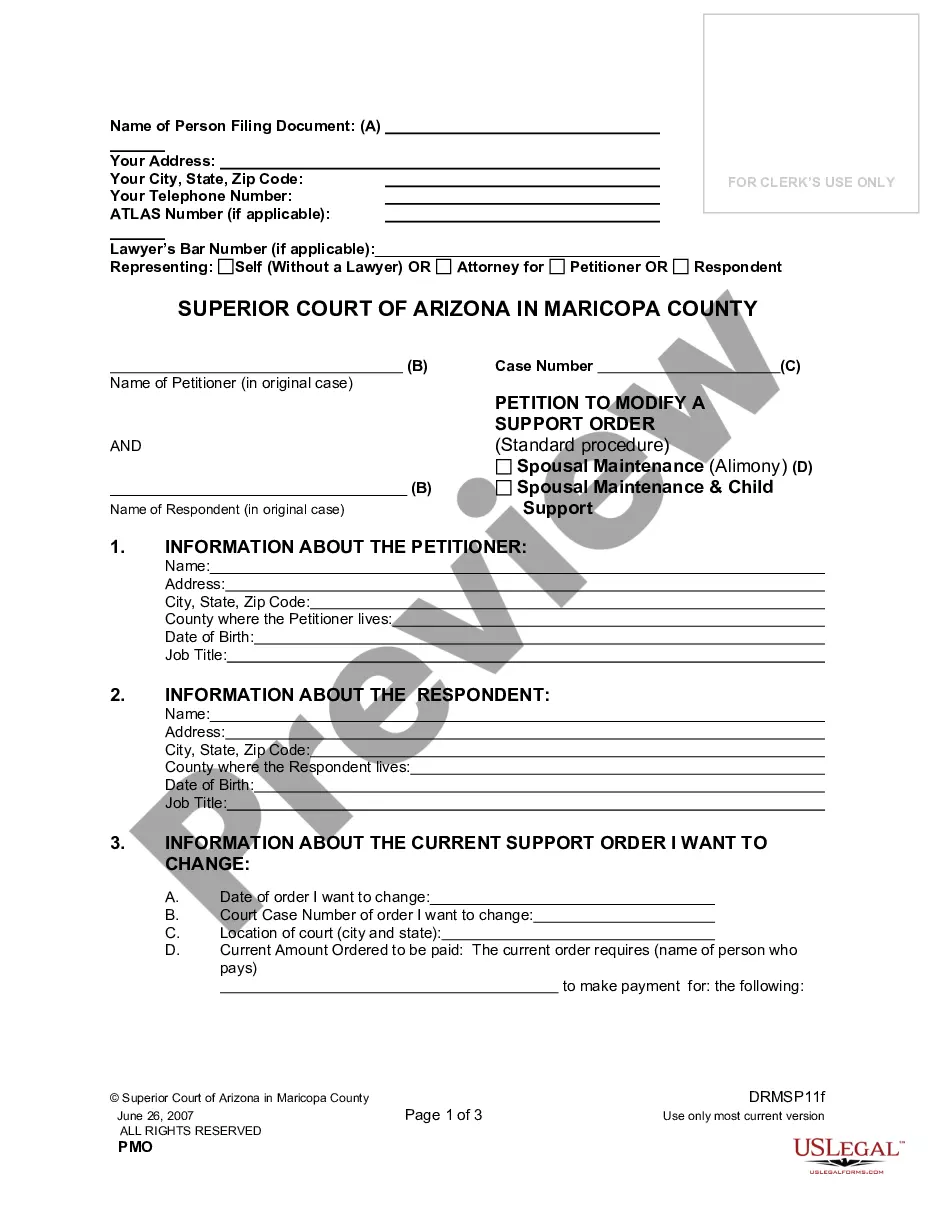

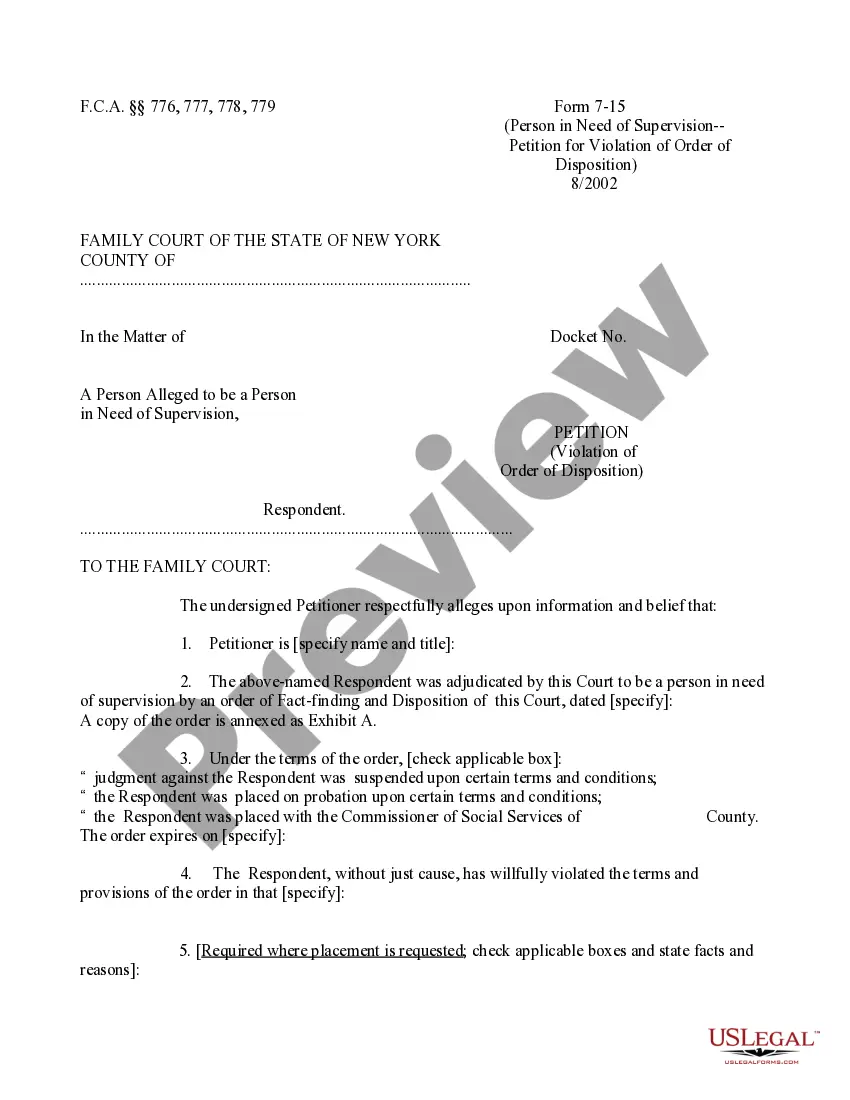

How to fill out Minnesota LLC Operating Agreement For Husband And Wife?

Finding the right lawful papers design might be a have difficulties. Needless to say, there are tons of templates available on the Internet, but how do you get the lawful develop you will need? Make use of the US Legal Forms web site. The support offers thousands of templates, such as the Minnesota LLC Operating Agreement for Husband and Wife, which you can use for enterprise and private demands. Each of the forms are checked out by professionals and fulfill state and federal needs.

If you are previously registered, log in to the account and click the Acquire key to obtain the Minnesota LLC Operating Agreement for Husband and Wife. Use your account to appear from the lawful forms you may have purchased previously. Proceed to the My Forms tab of your account and get another copy of your papers you will need.

If you are a brand new customer of US Legal Forms, listed below are basic recommendations that you can adhere to:

- First, make sure you have selected the appropriate develop for the town/area. It is possible to look through the shape while using Preview key and study the shape explanation to ensure it will be the best for you.

- In the event the develop fails to fulfill your needs, utilize the Seach field to discover the appropriate develop.

- Once you are certain the shape is acceptable, click the Purchase now key to obtain the develop.

- Select the rates strategy you desire and enter in the necessary info. Make your account and pay money for your order with your PayPal account or bank card.

- Choose the file formatting and acquire the lawful papers design to the device.

- Complete, change and print and indicator the obtained Minnesota LLC Operating Agreement for Husband and Wife.

US Legal Forms may be the most significant collection of lawful forms where you can find various papers templates. Make use of the service to acquire appropriately-produced papers that adhere to condition needs.

Form popularity

FAQ

If you choose to set up your LLC with just one spouse as a member, you can classify it as a sole proprietorship or a corporation. If your LLC has more than one member, you can classify it as a partnership or corporation.

Note: If an LLC is owned by husband and wife in a non-community property state, the LLC should file as a partnership. LLCs owned by a husband and wife are not eligible to be "qualified joint ventures" (which can elect not be treated as partnerships) because they are state law entities.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

MCA means a Member Control Agreement adopted pursuant to Section 322B. 37 of Chapter 322B. operating agreement or bylaws means the bylaws adopted under Chapter 322B, pursuant to Section 322B. 603, which might be confusingly titled Operating Agreement.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?

Every Minnesota LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

What should an LLC operating agreement include?The legal name of the company.Any fictitious business names or DBAs.The company address.Name and address of your registered agent (who accepts legal service of process on your behalf.) Every LLC must have a registered agent under state law.

The form and contents of operating agreements vary widely, but most will contain six key sections: Organization, Management and Voting, Capital Contributions, Distributions, Membership Changes, and Dissolution.