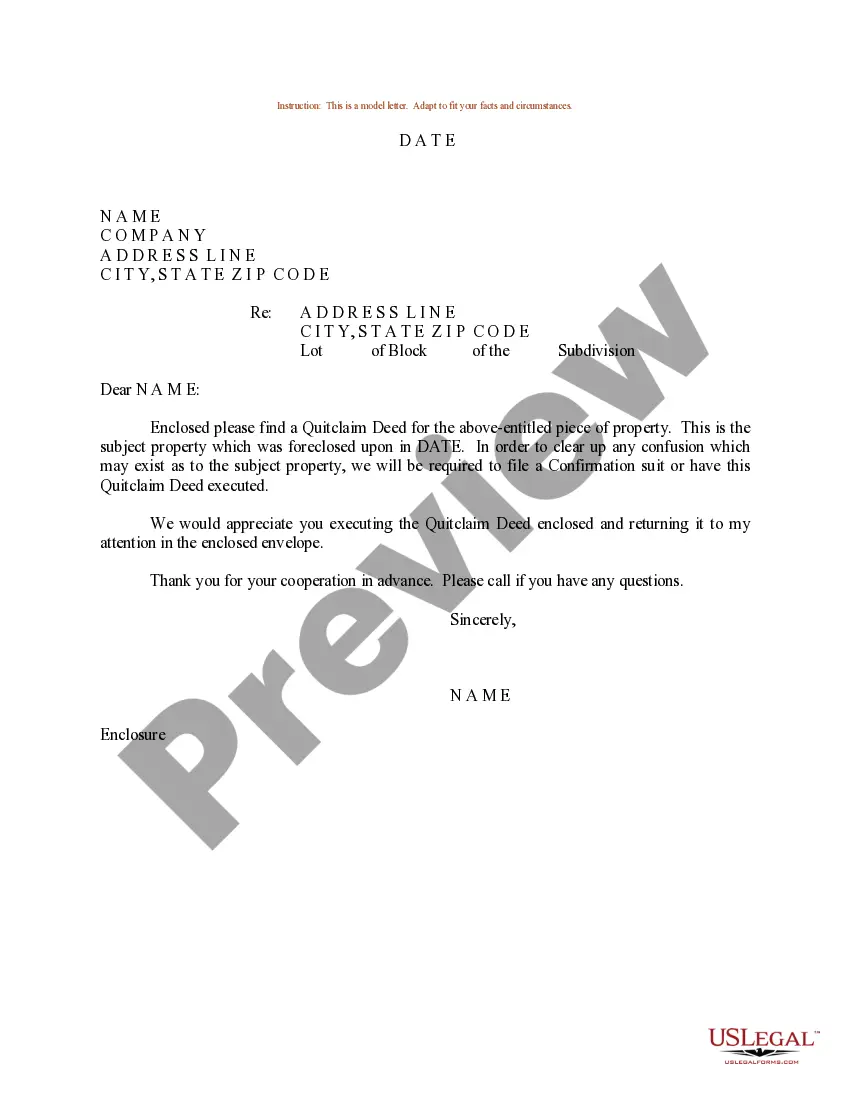

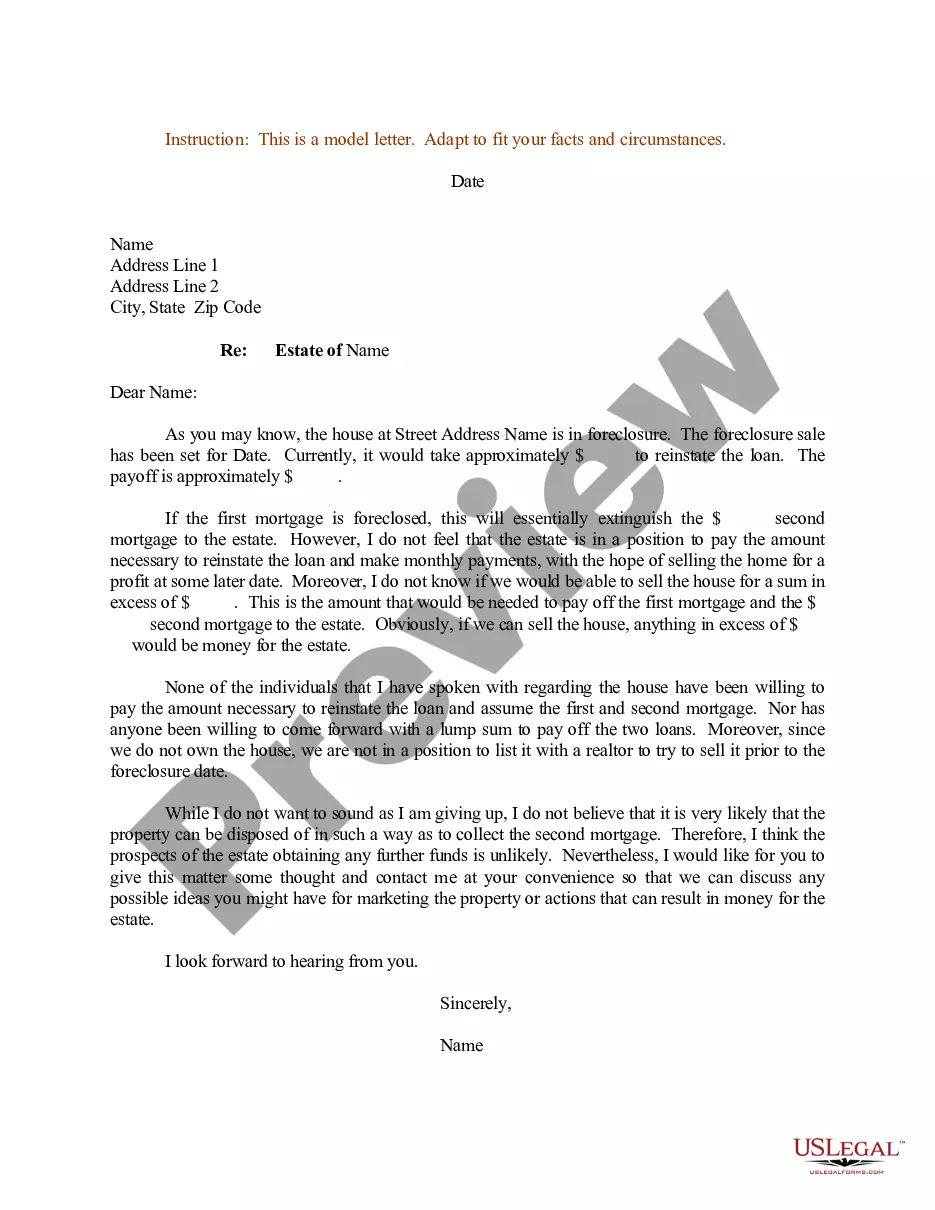

Minnesota Sample Letter for Judicial Foreclosure

Description

How to fill out Sample Letter For Judicial Foreclosure?

If you need to complete, acquire, or print out authorized file templates, use US Legal Forms, the most important assortment of authorized forms, which can be found on the web. Make use of the site`s simple and easy handy research to discover the files you need. Numerous templates for company and specific functions are categorized by types and claims, or search phrases. Use US Legal Forms to discover the Minnesota Sample Letter for Judicial Foreclosure in just a handful of mouse clicks.

When you are presently a US Legal Forms buyer, log in to your profile and then click the Acquire switch to get the Minnesota Sample Letter for Judicial Foreclosure. You can also access forms you earlier downloaded inside the My Forms tab of the profile.

If you use US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have selected the form for your proper town/nation.

- Step 2. Use the Review option to examine the form`s content material. Never forget to learn the description.

- Step 3. When you are unsatisfied together with the kind, make use of the Lookup discipline on top of the monitor to find other versions in the authorized kind format.

- Step 4. Once you have identified the form you need, select the Buy now switch. Choose the prices prepare you choose and add your credentials to sign up for an profile.

- Step 5. Method the financial transaction. You can use your credit card or PayPal profile to finish the financial transaction.

- Step 6. Select the format in the authorized kind and acquire it on your product.

- Step 7. Total, change and print out or indicator the Minnesota Sample Letter for Judicial Foreclosure.

Each authorized file format you acquire is yours forever. You have acces to every single kind you downloaded with your acccount. Click on the My Forms portion and choose a kind to print out or acquire once again.

Contend and acquire, and print out the Minnesota Sample Letter for Judicial Foreclosure with US Legal Forms. There are thousands of professional and state-certain forms you may use to your company or specific requirements.

Form popularity

FAQ

Step 2: Notice of Sale or Order of Sale In a judicial foreclosure, once the court has issued their judgment granting the foreclosure, the clerk of the court will prepare an Order of Sale directing the sheriff or constable to sell the property at auction.

Judicial foreclosure - involves sale of the mortgaged property under the supervision of a court; initiated by a lawsuit; available in every state. non-judicial foreclosure - involves sale of the mortgage property without court supervision; available in many, but not all, states.

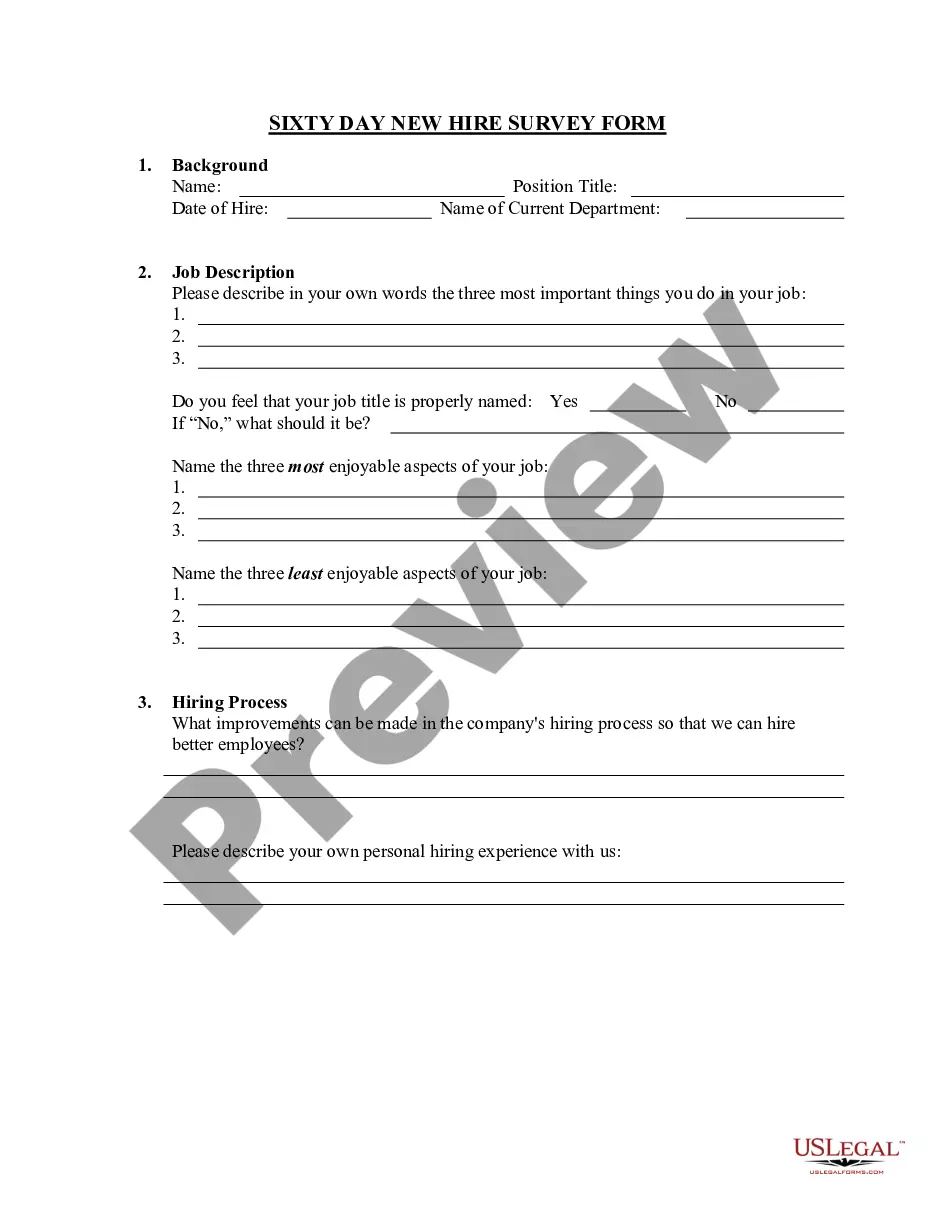

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.

While the process varies by state, in general lenders pursue the following course of action to initiate a judicial foreclosure: Notice of intent: Once a mortgage is unpaid for 120 days, the lender informs the borrower by mail that foreclosure proceedings will begin.

The order of payment in a foreclosure is; the cost of the sale (advertising, attorney fees, trustee fees, etc.), any special assessment taxes and general taxes, the first mortgage, whatever is recorded next.

The sale is followed by a redemption period, which is usually six months. ingly, assuming there is no bankruptcy filing, a typical foreclosure by advertisement (including the typical six month redemption period) generally takes around eight to nine months.

What Is the Foreclosure Process in Minnesota? If you default on your mortgage payments in Minnesota, the lender may foreclose using a judicial or nonjudicial method.

Judicial foreclosure refers to foreclosure proceedings that take place through the court system. This type of foreclosure process often occurs when a mortgage note lacks a power of sale clause, which would legally authorize the mortgage lender to sell the property if a default occurred.