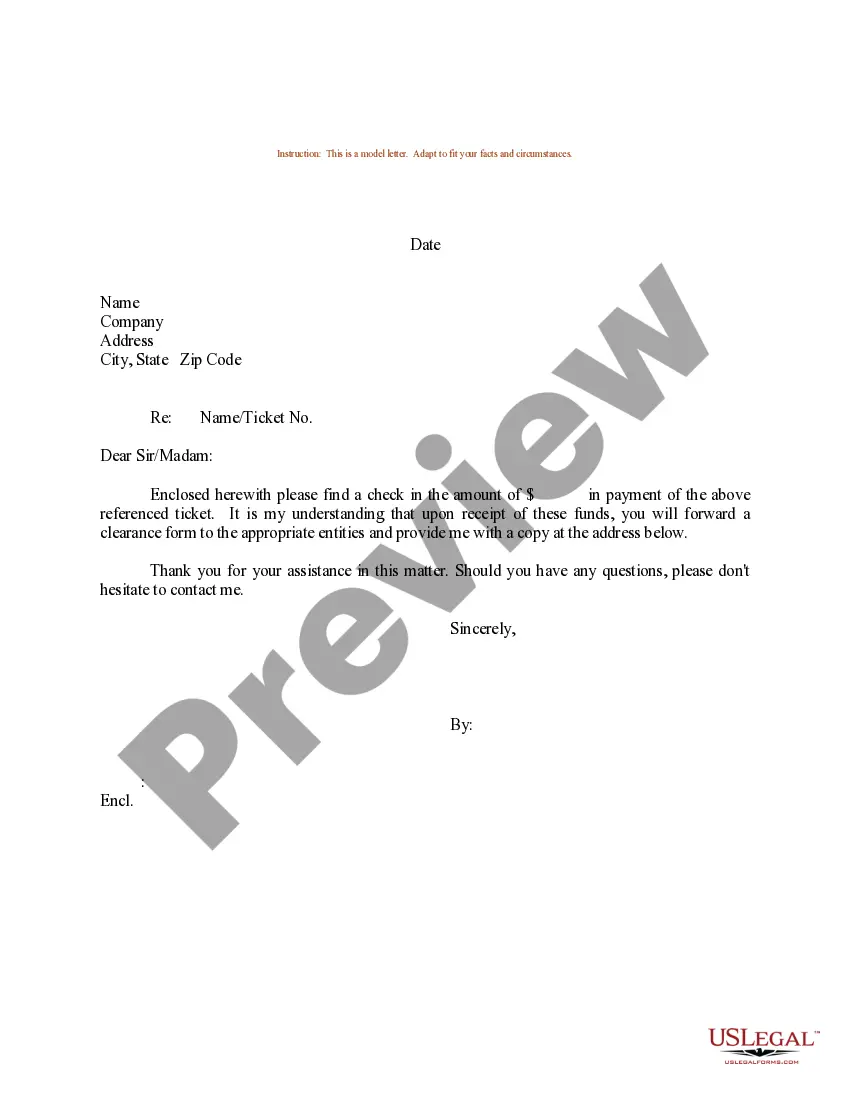

Minnesota Sample Letter for Insufficient Amount to Reinstate Loan

Description

How to fill out Sample Letter For Insufficient Amount To Reinstate Loan?

You can dedicate hours online trying to locate the legal document template that fulfills the state and federal requirements you need.

US Legal Forms provides a vast array of legal forms that have been reviewed by experts.

You can effortlessly obtain or print the Minnesota Sample Letter for Insufficient Amount to Reinstate Loan from our service.

If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure you've selected the correct document template for your specific area/state. Check the form description to verify that you've chosen the right one. If available, use the Review button to browse the document template as well. To find another copy of the form, utilize the Lookup field to discover the template that meets your needs and requirements. Once you've located the template you require, click Buy now to proceed. Choose the pricing plan you need, provide your details, and sign up for your account on US Legal Forms. Complete the transaction. You can use your Visa, Mastercard, or PayPal account to purchase the legal document. Select the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, revise, sign, and print the Minnesota Sample Letter for Insufficient Amount to Reinstate Loan. Access and print a wide variety of document templates through the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal requirements.

- If you have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Minnesota Sample Letter for Insufficient Amount to Reinstate Loan.

- Every legal document template you acquire belongs to you indefinitely.

- To obtain another copy of the purchased form, go to the My documents tab and click the appropriate button.

Form popularity

FAQ

Reinstating a payment refers to the action of resuming your regular payment obligations after a missed or delayed payment. This typically involves making a payment to cover any amounts that were outstanding. By doing this, you can regain access to your loan benefits and protect your credit standing. If you're drafting a communication for this purpose, consider using a Minnesota Sample Letter for Insufficient Amount to Reinstate Loan to outline your intent clearly.

Having debt reinstated means that you are bringing your defaulted loan back into good standing. This often involves making a payment that covers the overdue amount, which might include fees or interest. By reinstating your debt, you can prevent further penalties and keep your account active. For those seeking to navigate this process, utilizing a Minnesota Sample Letter for Insufficient Amount to Reinstate Loan can be a helpful tool.

Writing a letter to explain your financial situation involves describing your current circumstances clearly and concisely. Be honest about your financial challenges and indicate any steps you're taking to improve your finances. You may want to refer to a Minnesota Sample Letter for Insufficient Amount to Reinstate Loan as an example of how to articulate your situation professionally and effectively.

The MN start-up program is designed to support small businesses and entrepreneurs in Minnesota by providing resources and financial assistance. This initiative helps individuals who may face credit challenges, giving them a pathway to secure funding and assistance. If you are facing difficulties, consider looking into related resources, including a Minnesota Sample Letter for Insufficient Amount to Reinstate Loan.

Explaining delinquent credit issues requires you to be transparent about what led to those problems. Offer specific examples and discuss any external factors that contributed to your situation. You might find it helpful to refer to a Minnesota Sample Letter for Insufficient Amount to Reinstate Loan, which can illustrate how you can discuss these issues constructively while demonstrating your willingness to improve.

When writing a letter to fix a credit report, you should first identify the inaccuracies you want to address. Provide all necessary documentation to support your claims, and clearly state why the error needs correction. A well-crafted Minnesota Sample Letter for Insufficient Amount to Reinstate Loan can serve as a guide, ensuring that your letter is professional and persuasive.

To write a letter explaining credit problems, start with a brief introduction that describes your current credit status. Then, detail the reasons behind your credit issues and emphasize the actions you have taken to rectify them. Utilizing a Minnesota Sample Letter for Insufficient Amount to Reinstate Loan can help structure your letter effectively while demonstrating your accountability.

Writing a letter of explanation for bad credit involves clearly stating your credit issues, providing context, and outlining the steps you have taken to improve your situation. It's essential to be honest and focus on how you are managing your finances now. Consider including a Minnesota Sample Letter for Insufficient Amount to Reinstate Loan to show your commitment to resolving your credit situation.

Statute 580.30 in Minnesota deals with the foreclosure process and provides important protections for homeowners. This statute outlines the requirements for mortgage lenders and assists homeowners in understanding their rights during financial distress. It specifies how lenders must handle the communication regarding insufficient amounts needed to reinstate a loan. For those facing challenges, referencing the Minnesota Sample Letter for Insufficient Amount to Reinstate Loan through platforms like uslegalforms can clarify processes and help formulate a proper response.

The Head Start program in Minnesota aims to support early childhood education for low-income families. This federally funded initiative offers comprehensive services that promote children's development through education, health, and family engagement. By focusing on school readiness, Head Start helps children gain essential skills before entering kindergarten. Families can also benefit from financial support resources, such as the Minnesota Sample Letter for Insufficient Amount to Reinstate Loan, if they encounter challenges in securing loans.