Minnesota Sample Letter for Tax Return for Supplement

Description

How to fill out Sample Letter For Tax Return For Supplement?

Are you currently within a place that you require papers for either company or specific uses nearly every day time? There are a lot of legal file themes available on the net, but getting ones you can trust isn`t straightforward. US Legal Forms delivers a huge number of type themes, just like the Minnesota Sample Letter for Tax Return for Supplement, which can be created to satisfy federal and state needs.

In case you are already knowledgeable about US Legal Forms web site and have a free account, basically log in. Afterward, you are able to obtain the Minnesota Sample Letter for Tax Return for Supplement web template.

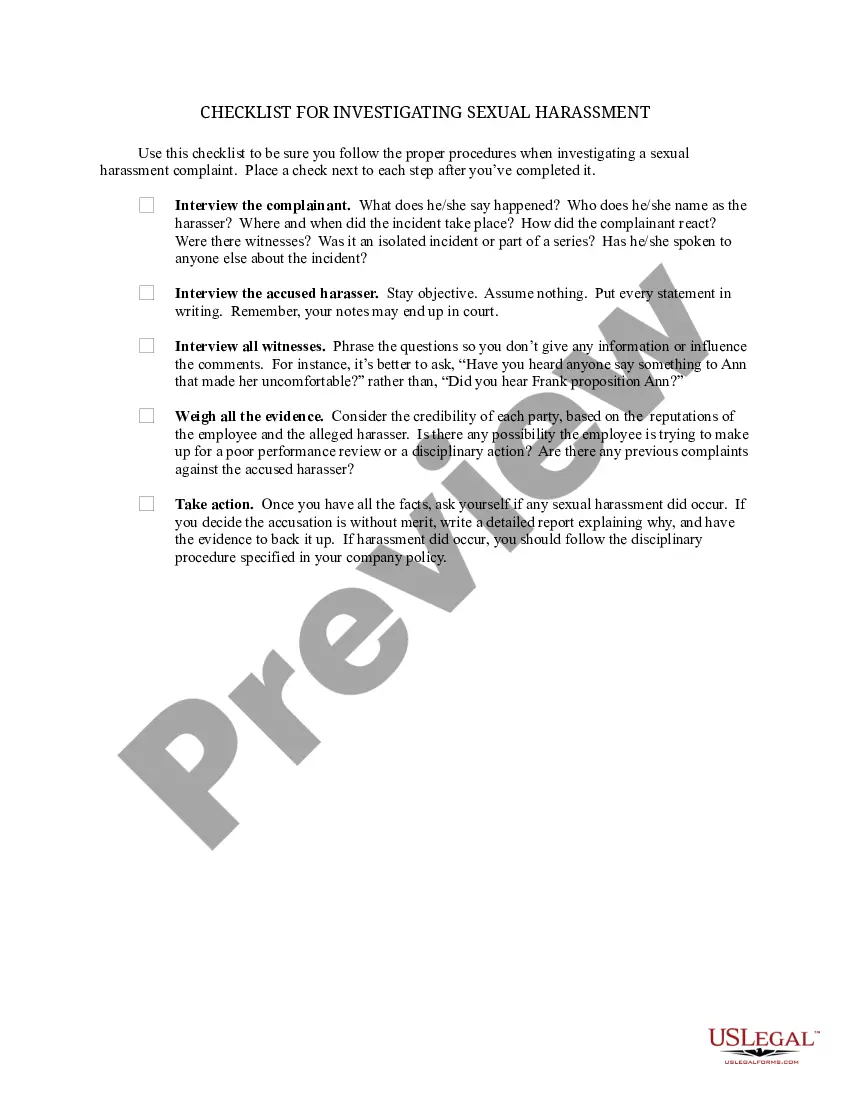

Should you not offer an accounts and want to begin using US Legal Forms, follow these steps:

- Obtain the type you require and ensure it is for the correct city/area.

- Take advantage of the Review button to check the form.

- Browse the information to actually have selected the correct type.

- In the event the type isn`t what you are looking for, make use of the Search field to find the type that meets your needs and needs.

- Whenever you discover the correct type, just click Purchase now.

- Select the rates prepare you desire, fill out the desired information and facts to create your bank account, and buy the order with your PayPal or bank card.

- Decide on a hassle-free document structure and obtain your backup.

Find all the file themes you have purchased in the My Forms food list. You can get a further backup of Minnesota Sample Letter for Tax Return for Supplement at any time, if needed. Just click on the necessary type to obtain or print the file web template.

Use US Legal Forms, the most extensive variety of legal varieties, in order to save some time and avoid blunders. The service delivers appropriately made legal file themes which can be used for a variety of uses. Generate a free account on US Legal Forms and commence producing your life a little easier.

Form popularity

FAQ

The percentage method is used if your bonus comes in a separate check from your regular paycheck. Your employer withholds a flat 22% (or if over $1 million, 37% which is the highest rate of income tax).

The rate for supplemental wages up to $1 million subject to a flat rate remains unchanged from 2022, at 22%.

If 22% was withheld from your supplemental wages, you might get a refund at the end of the year. However, experts say that if you received enough supplemental income to put you into a higher income tax bracket, you might owe the IRS money at the end of the year.

CHANGES IN LOCAL TAX RATES Beginning on October 1, 2023 there will be two additional sales taxes totaling 1% applied to the seven-county metro area. The counties included are Anoka, Carver, Dakota, Hennepin, Ramsey, Scott and Washington.

Medicare continues at 1.45% on all earnings subject to Medicare, with an additional Employee Contribution Rate of 0.9% when the annual earnings subject to Medicare is $200,000 and above. Minnesota supplemental tax rate will remain unchanged at 6.25%.

Supplemental income tax is assessed on supplemental wages (e.g., bonuses, commissions, etc.). The federal supplemental withholding tax is 22%. The supplemental income tax is not in addition to standard income tax rates.

Federal payroll tax rates for 2023 are: Social Security tax rate: 6.2% for the employee plus 6.2% for the employer. Medicare tax rate: 1.45% for the employee plus 1.45% for the employer. Additional Medicare: 0.9% for the employee when wages exceed $200,000 in a year.

Your bonus will be taxed the same as your regular pay, including income taxes, Medicare, and Social Security.