Minnesota Sample Letter for Purchase of Loan

Description

How to fill out Sample Letter For Purchase Of Loan?

If you want to be thorough, acquire, or print authentic document templates, utilize US Legal Forms, the largest repository of legitimate forms available online.

Take advantage of the site's straightforward and convenient search functionality to find the documents you need.

Various templates for business and personal purposes are categorized by types and claims, or keywords.

Step 4. After you have located the form you want, click the Purchase now button. Choose your preferred payment method and enter your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to access the Minnesota Sample Letter for Purchase of Loan with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download option to retrieve the Minnesota Sample Letter for Purchase of Loan.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, please follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

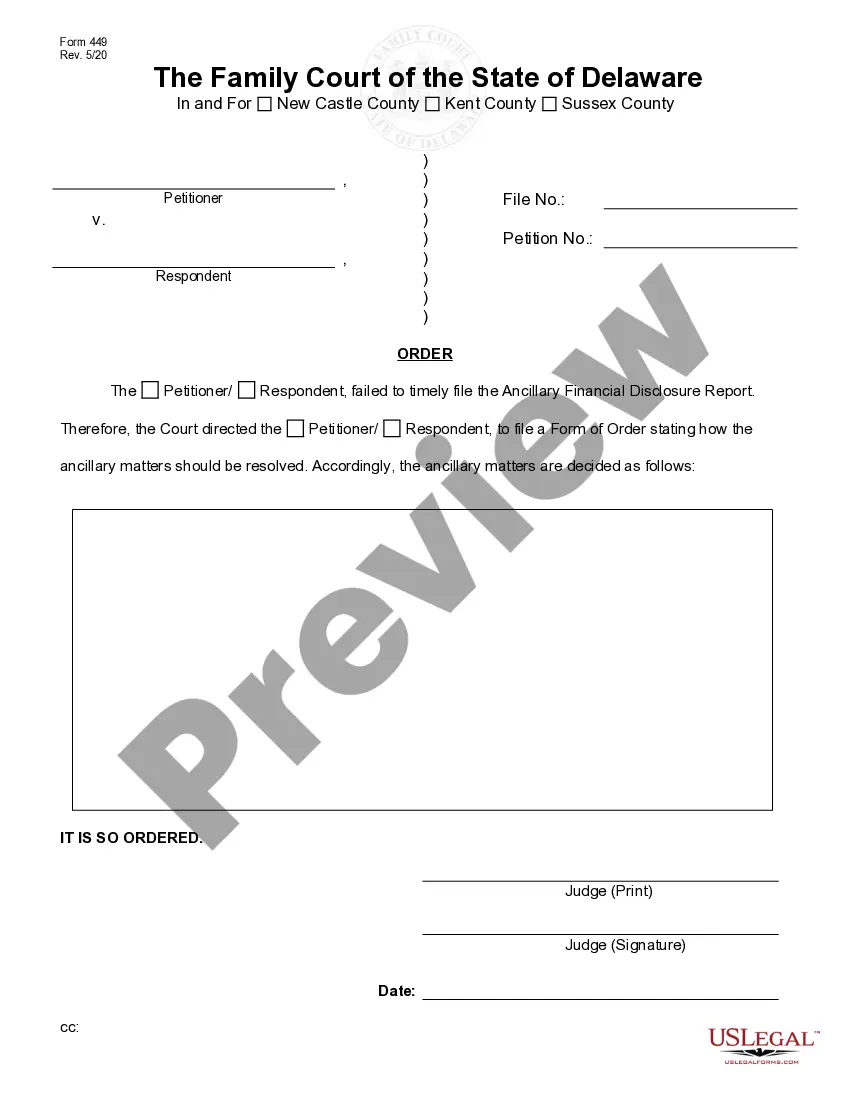

- Step 2. Use the Preview option to review the form's content. Don't forget to check the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find alternative forms in the same legal format.

Form popularity

FAQ

Writing a simple letter of agreement involves outlining the terms you and the other party agree to. Start by clearly stating the parties involved, the purpose of the agreement, and the specific terms agreed upon. Make sure to include any important dates and signatures for validation. Utilizing a Minnesota Sample Letter for Purchase of Loan can streamline this process and ensure clarity in your arrangement.

To write a letter for a mortgage, start by clearly stating your intent to apply for a mortgage. Include your personal information, details about the property you are interested in, and the loan amount you seek. You may also mention any financial information that supports your request. For a well-structured request, consider using a Minnesota Sample Letter for Purchase of Loan as a helpful guide.

Filling an agreement form can seem daunting, but it is straightforward with the right approach. First, gather all necessary information, including terms of the agreement and the involved parties' details. Then, use a Minnesota Sample Letter for Purchase of Loan as a template to ensure you include all key elements, such as signatures and dates. Once you complete the form, review it carefully to confirm that it reflects your intentions clearly and accurately.

The Minnesota start-up program offers essential financial assistance and resources for first-time home buyers ready to purchase a home. This program includes down payment assistance and favorable loan terms to ease your path into homeownership. By utilizing a Minnesota Sample Letter for Purchase of Loan, you can illustrate your commitment and make the application process smoother. Engaging with US Legal Forms can provide valuable resources to help you navigate this program effectively.

The time it takes to receive a preapproval letter can vary, but typically, you can expect a response within a few days to a week. To speed up the process, gather all necessary documents, including your credit history and income verification. Using a Minnesota Sample Letter for Purchase of Loan can help communicate your intent clearly to lenders. This letter demonstrates your seriousness, potentially accelerating your preapproval.

Loan documents are documents provided and requested by lenders for the purpose of providing a loan. They are typically statements of personal and financial information of the borrower to approve a loan. These documents are used by the lenders to evaluate whether or not they will provide you with a loan.

Identity proof (copy of passport/voter ID card/driving license/Aadhaar) Address proof (copy of passport/voter ID card/driving license/Aadhaar) Bank statement of previous 3 months (Passbook of previous 6 months. Latest salary slip/current dated salary certificate with the latest Form 16.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

A Written Statement is like a promissory note from the mortgage lender that they will approve the loan/issue a Clear-to-Close if the borrower/buyer can clear all of the conditions that the mortgage underwriter is requesting.

Sometimes a contingency clause is attached to an offer to purchase real estate and included in the real estate contract. Essentially, a contingency clause gives parties the right to back out of the contract under certain circumstances that must be negotiated between the buyer and seller.