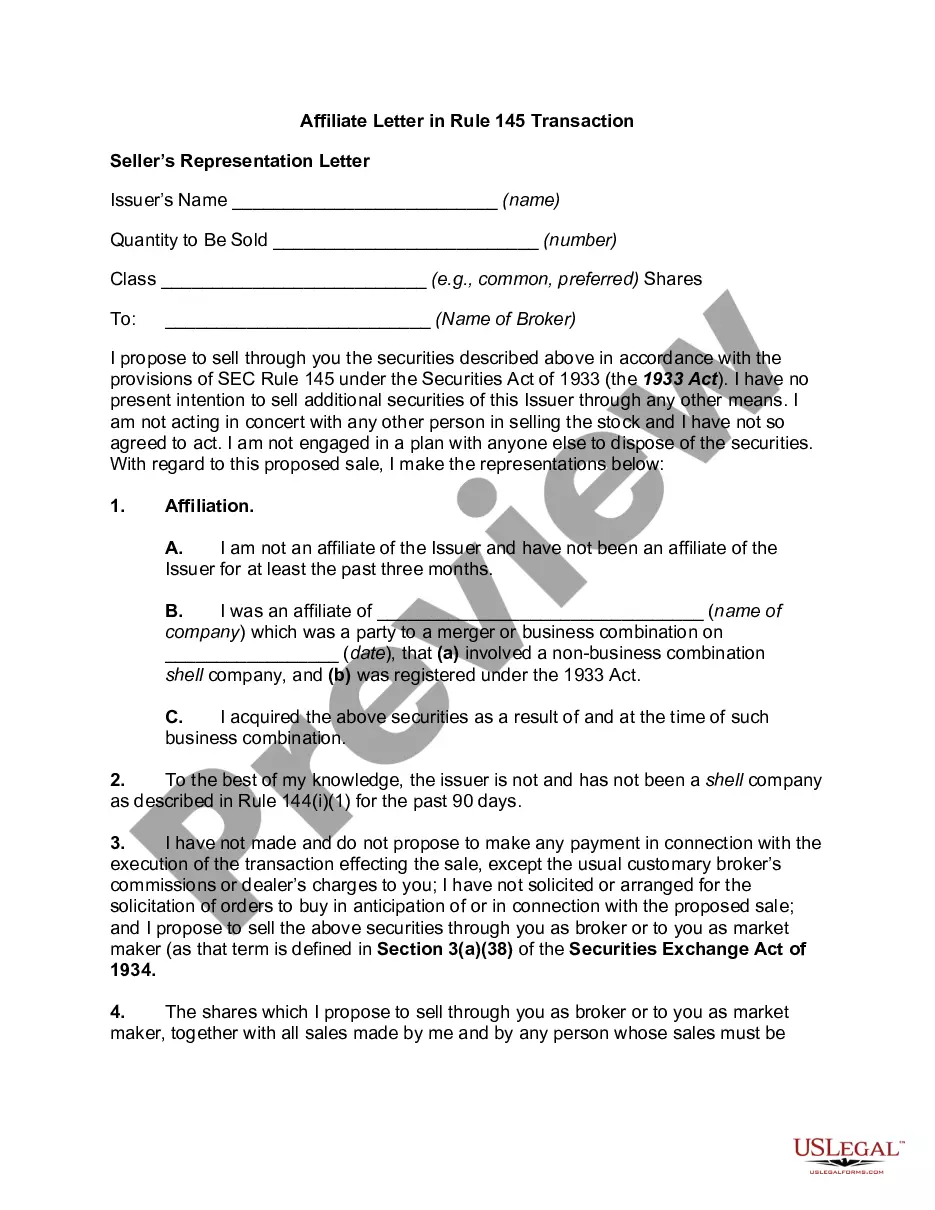

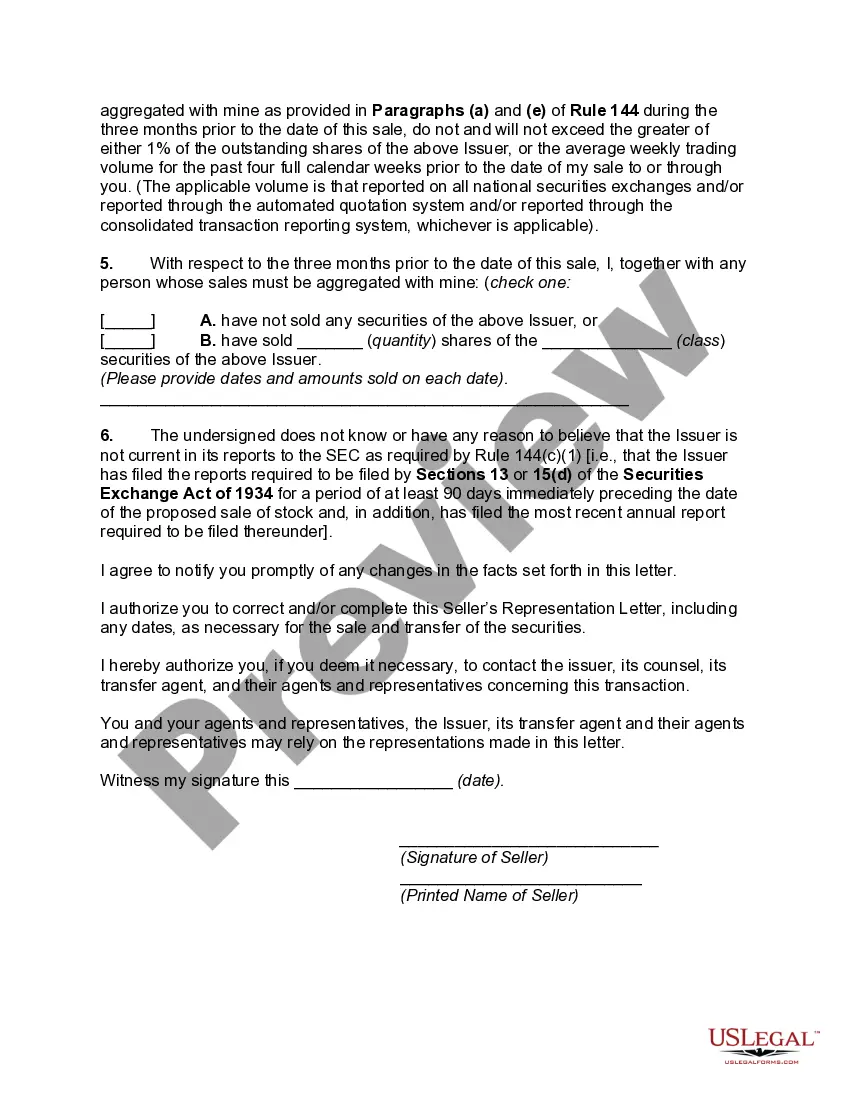

The Minnesota Affiliate Letter in Rule 145 Transaction is a document required under the Securities and Exchange Commission (SEC) Rule 145 when a company in Minnesota is involved in an affiliate transaction. This letter is filed to notify the SEC of the transaction and provide relevant information about the parties involved. In Rule 145 Transaction, an affiliate refers to an individual or entity that has a close relationship with the company, such as a director, officer, or controlling shareholder. The purpose of the Minnesota Affiliate Letter is to disclose the potential conflicts of interest that may arise in these transactions and ensure transparency in order to protect the interests of both the company and its shareholders. The content of the Minnesota Affiliate Letter in Rule 145 Transaction typically includes: 1. Identification of the Parties: The letter starts by identifying the company, its affiliates involved in the transaction, and any non-affiliated parties that may be affected. 2. Description of the Transaction: It provides a detailed explanation of the nature of the transaction, including the type of securities involved, the financial terms, and any other relevant details regarding the exchange or transfer of shares. 3. Purpose and Rationale: The letter outlines the purpose and rationale behind the transaction, explaining why it is being pursued and how it aligns with the company's strategic goals. 4. Terms and Conditions: It includes a comprehensive list of the terms and conditions of the transaction, such as pricing, timing, and any specific requirements or limitations. 5. Potential Conflicts of Interest: This section discloses any potential conflicts of interest that may arise due to the affiliate relationship and how the company intends to manage and mitigate these conflicts. 6. Legal Opinions: The Minnesota Affiliate Letter may include legal opinions from the company's counsel, stating that the transaction complies with all applicable laws and regulations. Types of Minnesota Affiliate Letters in Rule 145 Transaction can vary depending on the nature of the transaction and parties involved. However, some common examples include: 1. Stock Option Exercise: When an affiliate exercises stock options granted by the company, a Minnesota Affiliate Letter is filed to document the exercise and issuance of new shares. 2. Merger or Acquisition: In cases where an affiliate is involved in a merger or acquisition, the Minnesota Affiliate Letter notifies the SEC about the transaction, providing details about the terms, structure, and potential impacts on shareholders. 3. Share Repurchase: If a company repurchases its shares from an affiliate, the Minnesota Affiliate Letter discloses the details of the repurchase agreement, including pricing and the rationale behind the transaction. In summary, the Minnesota Affiliate Letter in Rule 145 Transaction is a filing required for transactions involving affiliates in Minnesota. It ensures transparency and disclosure of potential conflicts of interest, safeguarding the interests of shareholders and promoting a fair and regulated marketplace.

Minnesota Affiliate Letter in Rule 145 Transaction

Description

How to fill out Minnesota Affiliate Letter In Rule 145 Transaction?

Choosing the right lawful document design can be quite a have difficulties. Needless to say, there are tons of templates available on the net, but how would you obtain the lawful develop you require? Make use of the US Legal Forms website. The service provides a large number of templates, including the Minnesota Affiliate Letter in Rule 145 Transaction, which can be used for company and private requires. Every one of the kinds are checked out by professionals and meet state and federal needs.

In case you are presently listed, log in to your bank account and click on the Download switch to have the Minnesota Affiliate Letter in Rule 145 Transaction. Make use of your bank account to appear throughout the lawful kinds you may have ordered in the past. Go to the My Forms tab of your bank account and obtain an additional duplicate in the document you require.

In case you are a new consumer of US Legal Forms, listed here are simple recommendations that you should adhere to:

- Initial, make certain you have chosen the correct develop for the metropolis/region. You can look over the form making use of the Preview switch and read the form description to guarantee it will be the right one for you.

- In the event the develop does not meet your expectations, utilize the Seach area to find the correct develop.

- Once you are certain that the form would work, click the Purchase now switch to have the develop.

- Select the rates program you would like and enter the necessary information. Make your bank account and purchase the transaction making use of your PayPal bank account or bank card.

- Select the document formatting and obtain the lawful document design to your system.

- Total, edit and print and indication the acquired Minnesota Affiliate Letter in Rule 145 Transaction.

US Legal Forms may be the biggest catalogue of lawful kinds for which you can discover a variety of document templates. Make use of the service to obtain professionally-produced paperwork that adhere to status needs.

Form popularity

FAQ

Rule 144(a)(3) identifies what sales produce restricted securities. Control securities are those held by an affiliate of the issuing company. An affiliate is a person, such as an executive officer, a director or large shareholder, in a relationship of control with the issuer.

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

Rule 145 is an SEC rule that allows companies to sell certain securities without first having to register the securities with the SEC. This specifically refers to stocks that an investor has received because of a merger, acquisition, or reclassification.

Rule 147, as amended, has the following requirements: the company must be organized in the state where it offers and sells securities. the company must have its principal place of business in-state and satisfy at least one doing business requirement that demonstrates the in-state nature of the company's business.

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

The Commission raised the Form 144 filing thresholds so that affiliates must file Form 144 if their proposed sales in reliance on Rule 144 within a three-month period exceed 5,000 shares or $50,000. Non-affiliates no longer need to file Form 144.

The term affiliate is defined in Rule 405 under the Act as a person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, an issuer.

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

The term affiliate is defined in Rule 405 under the Act as a person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, an issuer.