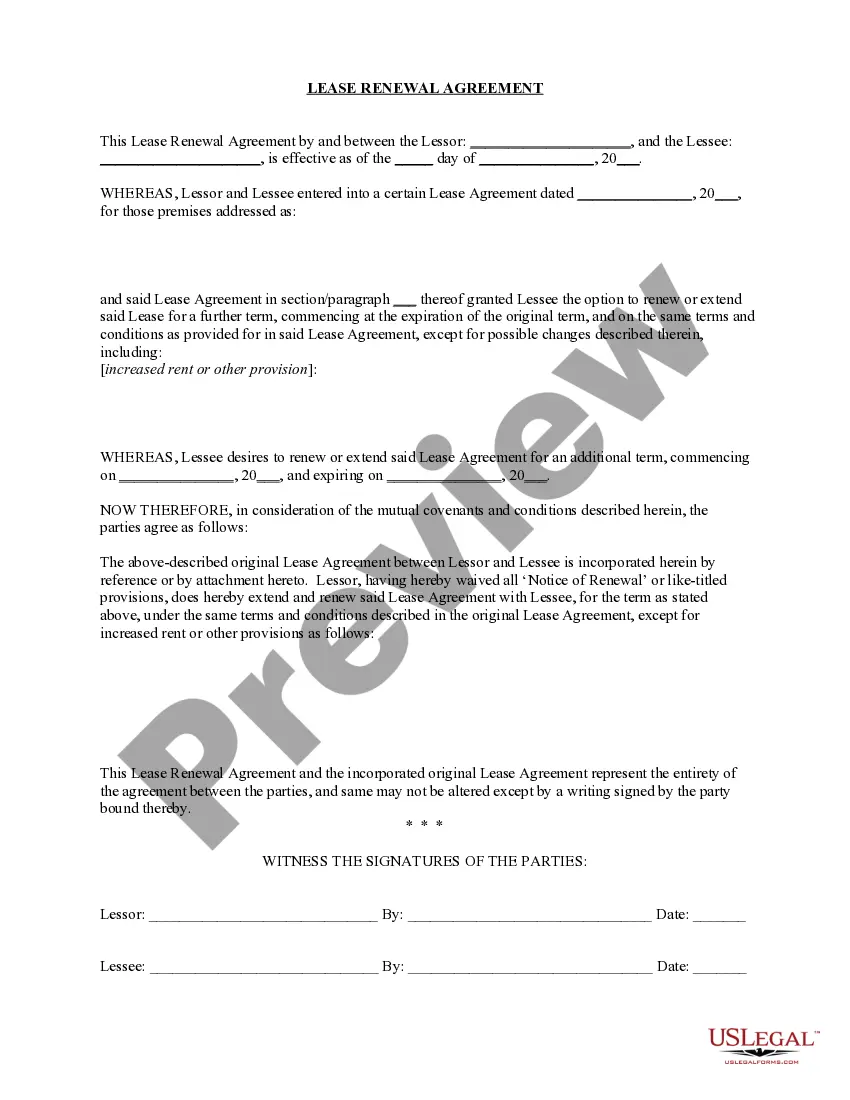

Minnesota Investment Letter — Intrastate Offering is a legal document that outlines the terms and conditions of a security offering within the state of Minnesota. This type of offering is limited to residents and businesses located within the state, ensuring compliance with state regulations and protecting investors. The Minnesota Investment Letter — Intrastate Offering provides comprehensive information about the investment opportunity, the issuer, and the associated risks involved. Keywords: Minnesota, Investment Letter, Intrastate Offering, security offering, residents, businesses, compliance, regulations, investors, investment opportunity, issuer, risks. Types of Minnesota Investment Letter — Intrastate Offering: 1. Equity Offering: An intrastate offering of equity allows businesses in Minnesota to raise capital by selling shares of ownership to qualified individual and institutional investors within the state. The investment letter details the rights and privileges attached to the equity offering, such as voting rights, dividends, and potential capital appreciation. 2. Debt Offering: In an intrastate debt offering, businesses or municipalities in Minnesota can issue bonds or notes to raise funds for various purposes. The investment letter provides potential investors with a detailed description of the debt offering, including interest rates, repayment terms, and any collateral attached to the debt instrument. 3. Real Estate Offering: Real estate developers and investment firms in Minnesota may use the intrastate offering to attract local investors interested in real estate projects. The investment letter for a real estate offering provides information about the development plan, projected returns, and potential risks involved in investing in the specific real estate project. 4. Renewable Energy Offering: Minnesota's commitment to renewable energy has created opportunities for intrastate offerings related to clean energy projects. The investment letter for a renewable energy offering explains the nature of the project, expected energy generation, available incentives, and potential long-term returns. 5. Start-up Offering: Start-up companies based in Minnesota seeking early-stage funding can utilize the intrastate offering to attract local investors. The investment letter for a start-up offering includes details about the company's business plan, market potential, management team, and the potential risks and rewards associated with investing in a start-up venture. 6. Municipal Offering: Intrastate offerings can also apply to municipalities within Minnesota that need to raise funds for infrastructure projects or public services. The investment letter in a municipal offering outlines the purpose of the funds, the repayment structure, and the potential impact of the project on the community. It is essential for investors considering a Minnesota Investment Letter — Intrastate Offering to carefully review the document, seek professional advice if necessary, and ensure they meet the eligibility requirements outlined within the offering. The investment letter serves as a crucial tool for both issuers and investors, fostering transparency and compliance in the intrastate investment process.

Minnesota Investment Letter - Intrastate Offering

Description

How to fill out Minnesota Investment Letter - Intrastate Offering?

US Legal Forms - one of the largest libraries of legal forms in the United States - gives a wide range of legal file layouts it is possible to download or produce. Using the internet site, you can find a large number of forms for business and personal purposes, sorted by groups, states, or search phrases.You can get the most recent types of forms much like the Minnesota Investment Letter - Intrastate Offering in seconds.

If you already have a monthly subscription, log in and download Minnesota Investment Letter - Intrastate Offering through the US Legal Forms local library. The Download key will show up on each kind you see. You gain access to all formerly saved forms within the My Forms tab of your respective account.

If you wish to use US Legal Forms for the first time, listed here are basic recommendations to obtain started:

- Be sure to have chosen the best kind to your city/county. Select the Review key to check the form`s information. Browse the kind explanation to ensure that you have selected the proper kind.

- When the kind does not match your needs, take advantage of the Search area towards the top of the display screen to obtain the one which does.

- In case you are happy with the form, verify your choice by visiting the Purchase now key. Then, pick the pricing prepare you like and offer your references to register to have an account.

- Process the transaction. Utilize your credit card or PayPal account to accomplish the transaction.

- Select the format and download the form in your gadget.

- Make alterations. Fill out, edit and produce and sign the saved Minnesota Investment Letter - Intrastate Offering.

Each and every web template you added to your money does not have an expiry day and it is the one you have for a long time. So, if you wish to download or produce one more version, just visit the My Forms area and click about the kind you will need.

Get access to the Minnesota Investment Letter - Intrastate Offering with US Legal Forms, probably the most extensive local library of legal file layouts. Use a large number of skilled and condition-particular layouts that meet your small business or personal requirements and needs.