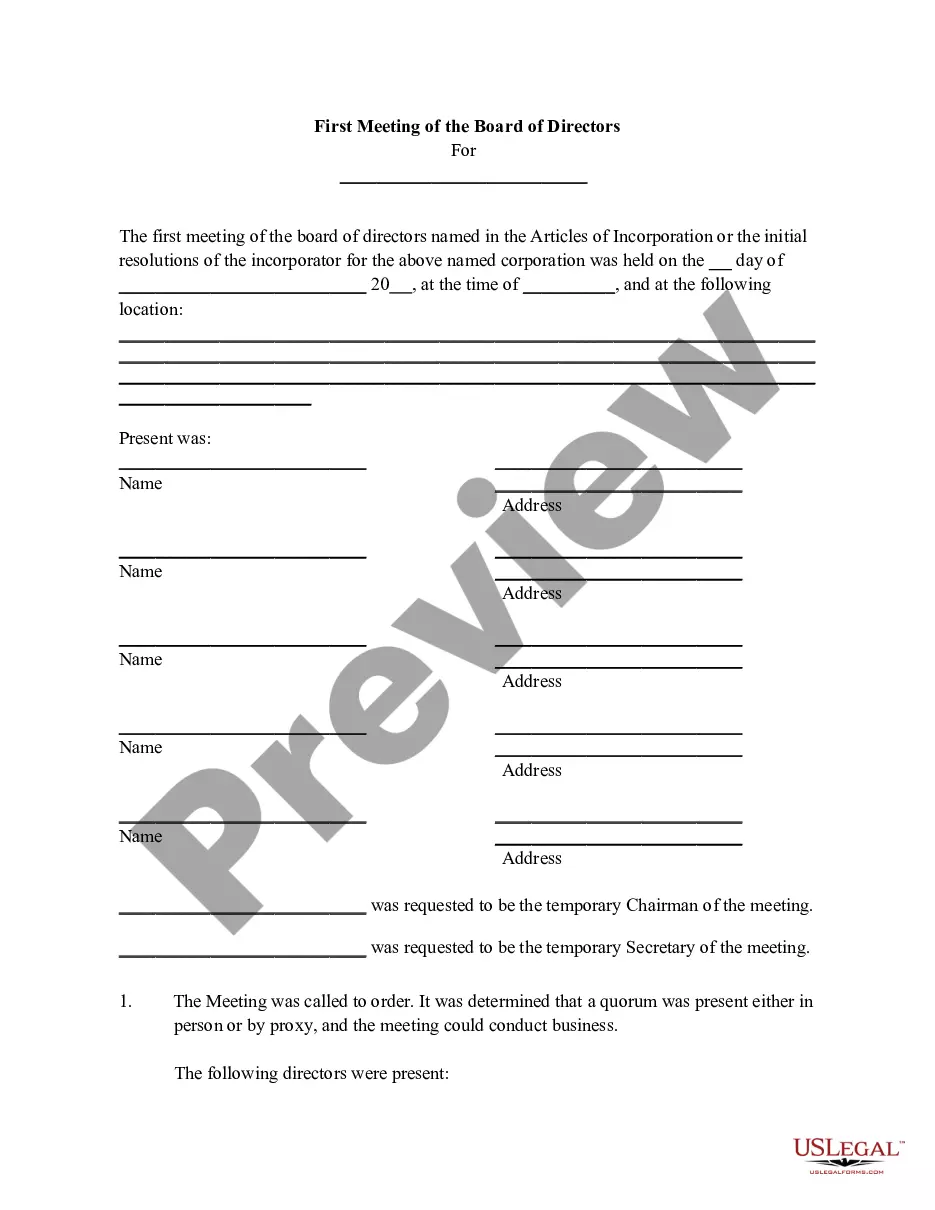

Title: Minnesota Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code Keywords: Minnesota, Minutes of Special Meeting, Board of Directors, Corporation, Stock Ownership Plan, Section 1244, Internal Revenue Code, Adoption, Types Introduction: In compliance with Minnesota corporate laws and regulations, this article provides a detailed description of the Minutes of Special Meeting of the Board of Directors (BOD) of (Name of Corporation) to Adopt a Stock Ownership Plan under Section 1244 of the Internal Revenue Code. This meeting serves as an official platform for the BOD to discuss and approve the implementation of a stock ownership plan in accordance with the specific legal framework provided by the Internal Revenue Code. Meeting Types: There are various types of Minnesota Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, including: 1. Annual Special Meeting: An annual meeting held by the BOD to formally address the adoption of the Stock Ownership Plan in accordance with Section 1244 of the Internal Revenue Code. This ensures compliance and aligns with the legal requirements set forth by the state of Minnesota. 2. Extraordinary Special Meeting: In certain situations necessitating prompt decision-making, an extraordinary special meeting may be convened. This meeting type is specifically called to address urgent matters concerning the adoption of the Stock Ownership Plan under Section 1244 of the Internal Revenue Code. Meeting Agenda and Topics: The Minutes of the Special Meeting of the BOD generally cover the following agenda items, relevant to the adoption of a Stock Ownership Plan under Section 1244 of the Internal Revenue Code: 1. Call to Order: The Chairperson or any designated member initiates the meeting by calling it to order, establishing a presence and ensuring a quorum is met to proceed with decision-making. 2. Reading of Previous Minutes: The minutes from the previous meeting are read and approved or amended as necessary, confirming the accuracy of the discussions and decisions made. 3. Purpose of the Meeting: The BOD explains the purpose of the meeting, mainly focused on adopting a Stock Ownership Plan in accordance with Section 1244 of the Internal Revenue Code. 4. Presentation and Discussion of Stock Ownership Plan: A detailed presentation is made regarding the Stock Ownership Plan, incorporating aspects such as eligibility criteria, stock allocation, vesting period, and tax implications based on the Internal Revenue Code, Section 1244. 5. Q&A and Clarifications: Board members are given the opportunity to ask clarifying questions or seek further information about the proposed Stock Ownership Plan, ensuring a thorough understanding of all aspects. 6. Board Deliberation: The BOD engages in a discussion, evaluating the benefits, risks, and potential impact of the Stock Ownership Plan in consideration of the corporation's objectives and the provisions mentioned in Section 1244 of the Internal Revenue Code. 7. Adoption of Stock Ownership Plan: Upon thorough consideration and review, a resolution to adopt the Stock Ownership Plan is proposed. It requires a vote by the Board members for approval, following any necessary modifications based on the discussions held. 8. Adjournment: Once the resolution is approved, the meeting is adjourned, and the finalized Minutes are documented, signed, and stored as a legal record to demonstrate compliance with the Minnesota corporate law requirements and Section 1244 of the Internal Revenue Code. Conclusion: The Minnesota Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code provide a systematic and accurate record of the discussions, decisions, and resolutions taken by the BOD to implement a Stock Ownership Plan that aligns with legal guidelines. These meeting minutes serve as valuable evidence for corporate compliance and can be referred to whenever needed for future reference or audit purposes.

Minnesota Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Minnesota Minutes Of Special Meeting Of The Board Of Directors Of (Name Of Corporation) To Adopt Stock Ownership Plan Under Section 1244 Of The Internal Revenue Code?

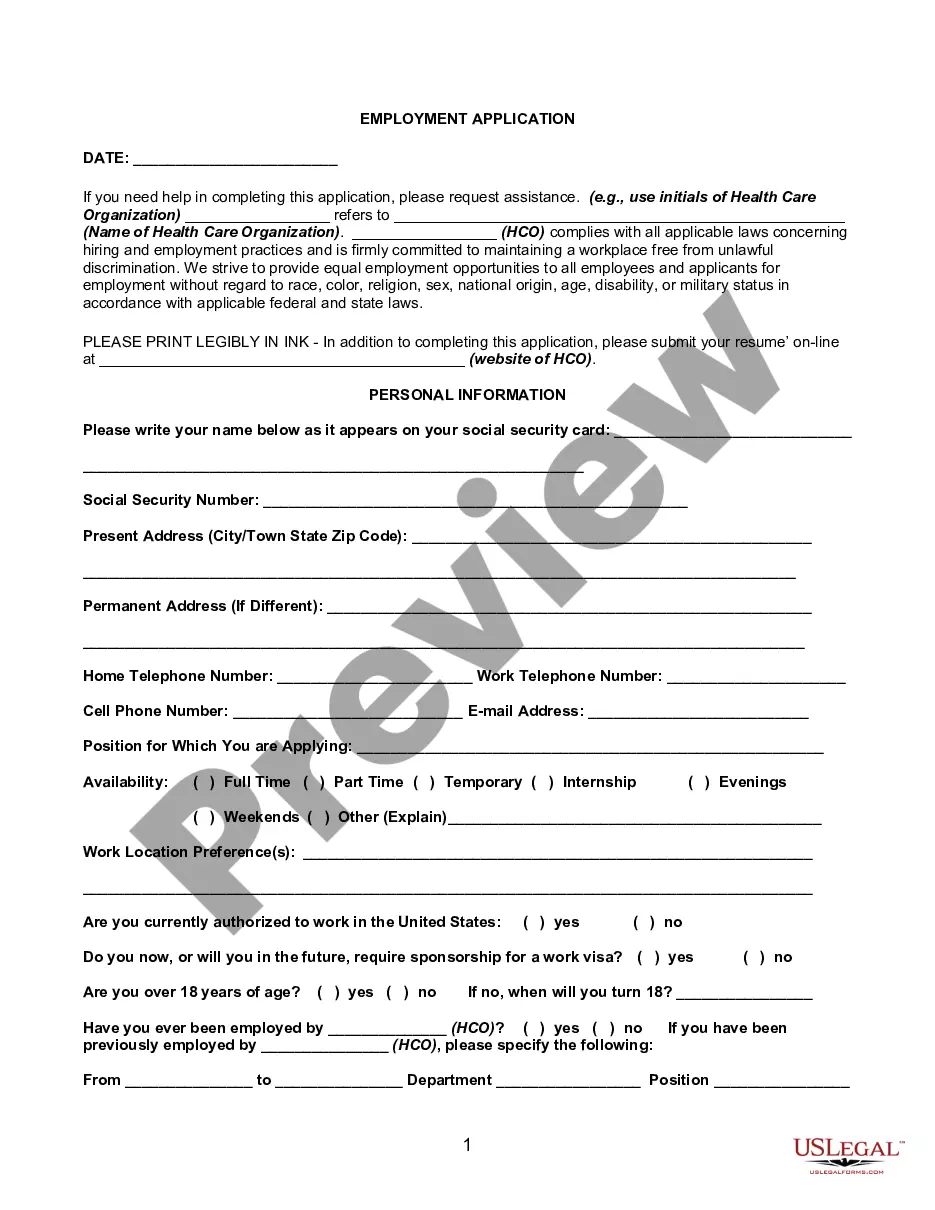

If you need to full, obtain, or produce legitimate file layouts, use US Legal Forms, the most important variety of legitimate kinds, that can be found on the web. Make use of the site`s basic and handy lookup to find the papers you will need. Different layouts for enterprise and specific reasons are sorted by classes and says, or search phrases. Use US Legal Forms to find the Minnesota Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code in a number of click throughs.

If you are already a US Legal Forms client, log in to your account and click the Download key to have the Minnesota Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code. Also you can accessibility kinds you in the past saved in the My Forms tab of the account.

If you use US Legal Forms the first time, follow the instructions below:

- Step 1. Make sure you have chosen the form for that appropriate city/land.

- Step 2. Take advantage of the Review solution to check out the form`s articles. Never forget about to see the description.

- Step 3. If you are not happy using the form, make use of the Research industry on top of the display screen to get other types of your legitimate form web template.

- Step 4. Once you have found the form you will need, click the Acquire now key. Pick the pricing prepare you favor and include your credentials to sign up on an account.

- Step 5. Process the purchase. You may use your charge card or PayPal account to perform the purchase.

- Step 6. Find the formatting of your legitimate form and obtain it on your own system.

- Step 7. Comprehensive, revise and produce or sign the Minnesota Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code.

Every legitimate file web template you buy is your own forever. You have acces to every form you saved with your acccount. Click the My Forms portion and choose a form to produce or obtain yet again.

Compete and obtain, and produce the Minnesota Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code with US Legal Forms. There are millions of skilled and condition-particular kinds you can use for your enterprise or specific requires.

Form popularity

FAQ

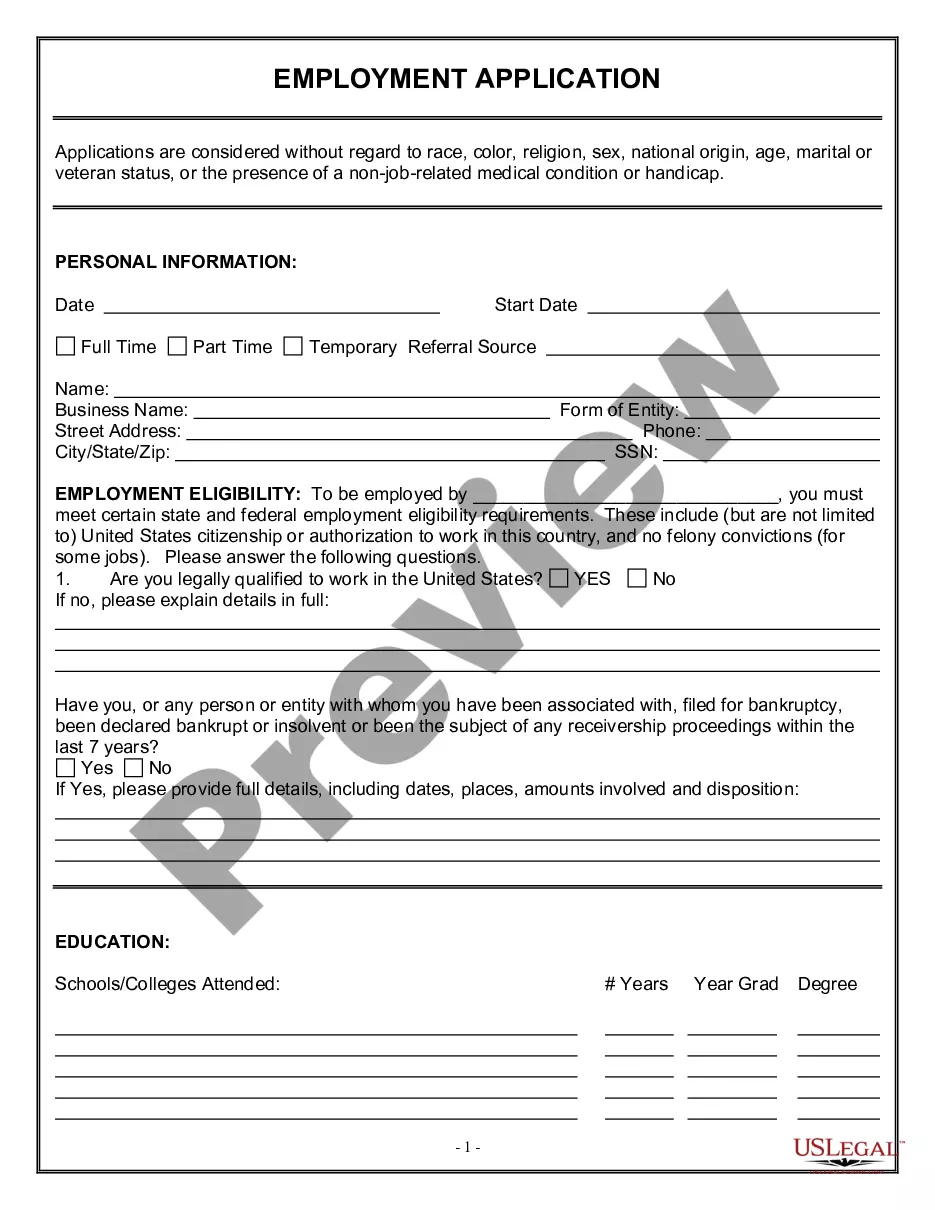

1244 losses are allowed for NOL purposes without being limited by nonbusiness income. An annual limitation is imposed on the amount of Sec. 1244 ordinary loss that is deductible. The maximum deductible loss is $50,000 per year ($100,000 if a joint return is filed) (Sec.

Section 1244 stock refers to the tax treatment of qualified restricted shares. Section 1244 stock allows firms to report certain capital losses as ordinary losses for tax purposes. This lets new or smaller companies take advantage of lower effective tax rates and increased deductions.

HW: How are gains from the sale of § 1244 stock treated? losses? The general rule is that shareholders receive capital gain or loss treatment upon the sale or exchange of stock. However, it is possible to receive an ordinary loss deduction if the loss is sustained on small business stock (A§ 1244 stock).

To qualify under Section 1244, these five requirements must be adhered to:The stock must be acquired in exchange for cash or property contributed to the corporation.The corporation must issue the stock directly to the investors.The corporation must be an actual, operating company.More items...?

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

Under Section 1244, an individual stockholder of a corporation can claim an ordinary (rather than capital) loss of up to $50,000 per year (or $100,000 for on a joint return) from the sale or worthlessness of Section 1244 stock. For most stockholders, an ordinary loss is much more beneficial than a capital loss.

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...

The determination of whether stock qualifies as Section 1244 stock is made at the time of issuance. Section 1244 stock is common or preferred stock issued for money or other property by a domestic small business corporation (which can be a C or S corporation) that meets a gross receipts test.

Section 1244 of the Internal Revenue Code allows eligible shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than a capital loss. Eligible investors include individuals, partnerships and LLCs taxed as partnerships.