Minnesota Release from Liability under Guaranty is a legal document that releases a guarantor from any liability or obligation regarding a debt or performance guarantee. It is an important legal protection for individuals and businesses involved in guarantee agreements. This release is utilized when parties want to terminate the guaranty or absolve the guarantor from any further obligations. The Minnesota Release from Liability under Guaranty allows for a swift and efficient resolution when a guarantor wishes to be released from their obligations or when the parties involved want to terminate the guaranty agreement. It is crucial to ensure that all parties involved thoroughly understand the terms outlined in the release and that it is executed in compliance with Minnesota state laws. There are several types of Minnesota Release from Liability under Guaranty, each serving different purposes: 1. Full Release: This type of release absolves the guarantor from any past, present, or future liabilities related to the guarantee. It completely eliminates the guarantor's obligations and relieves them from any potential claims or demands. 2. Limited Release: In some cases, parties may agree to a partial release of liability. This type of release narrows down the guarantor's obligations but does not fully absolve them from all responsibilities. The specific terms and limitations of this release must be clearly defined within the agreement. 3. Conditional Release: A conditional release from liability under guaranty imposes certain conditions or requirements that must be fulfilled for the guarantor to be released. These conditions can include the payment of a certain amount, fulfillment of certain obligations, or any other agreed-upon terms. 4. Unilateral Release: This release is executed solely by the creditor, releasing the guarantor from their obligations under the guaranty agreement. The guarantor does not need to provide consent or sign the release document. It is essential to consult with a legal professional when drafting or executing a Minnesota Release from Liability under Guaranty to ensure compliance with state laws and fairness to all parties involved. The release should clearly outline the terms, conditions, and scope of liability release to avoid any potential disputes or misunderstandings in the future.

Minnesota Release from Liability under Guaranty

Description

How to fill out Minnesota Release From Liability Under Guaranty?

Are you presently in the place where you require files for possibly business or personal functions almost every day time? There are a lot of lawful papers templates available on the Internet, but getting kinds you can rely is not easy. US Legal Forms provides thousands of form templates, like the Minnesota Release from Liability under Guaranty, which can be composed to fulfill state and federal needs.

If you are previously acquainted with US Legal Forms internet site and also have a free account, basically log in. Following that, you are able to obtain the Minnesota Release from Liability under Guaranty web template.

Unless you provide an account and would like to begin using US Legal Forms, follow these steps:

- Obtain the form you need and ensure it is for your proper city/area.

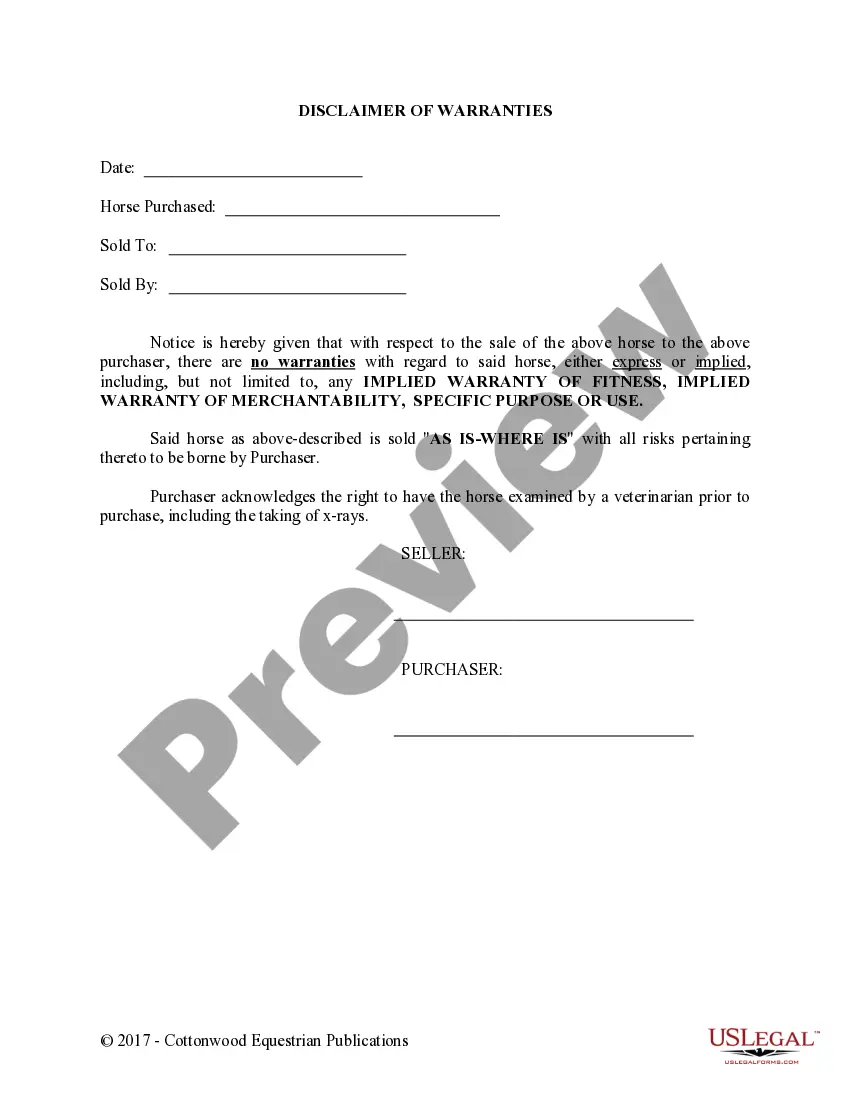

- Make use of the Review option to examine the shape.

- Browse the outline to actually have chosen the appropriate form.

- When the form is not what you`re trying to find, make use of the Search discipline to find the form that meets your needs and needs.

- Whenever you discover the proper form, click on Get now.

- Select the rates program you desire, submit the desired information and facts to generate your account, and pay money for an order utilizing your PayPal or Visa or Mastercard.

- Pick a practical file format and obtain your duplicate.

Locate each of the papers templates you may have bought in the My Forms food selection. You can aquire a additional duplicate of Minnesota Release from Liability under Guaranty whenever, if needed. Just go through the required form to obtain or print the papers web template.

Use US Legal Forms, one of the most substantial collection of lawful forms, to conserve time and steer clear of errors. The service provides expertly produced lawful papers templates that can be used for a selection of functions. Produce a free account on US Legal Forms and initiate producing your way of life a little easier.

Form popularity

FAQ

What are the steps in removing a guarantor from the mortgage?Contract your mortgage broker to review your financial situation.Arrange a bank valuation.Confirm the total loan amount.Make sure you meet the lender's criteria.Submit a partial release, or internal refinance.Wait 5-8 days for the bank to process.More items...

In case of non-payment, a guarantor is liable to legal action. If the lender files a recovery case, it will file the case against both the borrower and the guarantor. A court can force a guarantor to liquidate assets to pay off the loan," added Mishra.

A Release of Guarantee Form is a document that allows a guarantor to free themselves from being financially and/or legally bound to a contract. This is common for loan agreements and lease documents after expiration or when the contract has been fully satisfied.

A guarantee can be released by agreementeither be made as a deed or be supported by sufficient consideration. In some cases, when a guarantee is released, the guaranteed party will return the guarantee document to the guarantor.

Revocation of specific guaranteesThe guarantor normally cannot voluntarily revoke a specific guarantee because a creditor who has entered into an irrevocable transaction on the strength of a guarantee should not be deprived of his security by its subsequent revocation or cancellation.

If a guarantor contacts the company to revoke the guaranty, best practices indicate that some consideration should be given for release of the guaranty and such release/revocation should be documented in writing by all parties involved.

In the same way, a guarantee produces a legal effect wherein one party affirms the promise of another (usually to pay) by promising to themselves pay if default occurs. At law, the giver of a guarantee is called the surety or the "guarantor".

A Release of Guarantee Form is a document that allows a guarantor to free themselves from being financially and/or legally bound to a contract. This is common for loan agreements and lease documents after expiration or when the contract has been fully satisfied.

If you are a guarantor and no longer wish to be, you must obtain the consent or agreement from the landlord before you will be released from your liabilities, which, if the rent is in arrears, the landlord is unlikely to agree to.