Minnesota Post Bankruptcy Petition Discharge Letter

Description

How to fill out Post Bankruptcy Petition Discharge Letter?

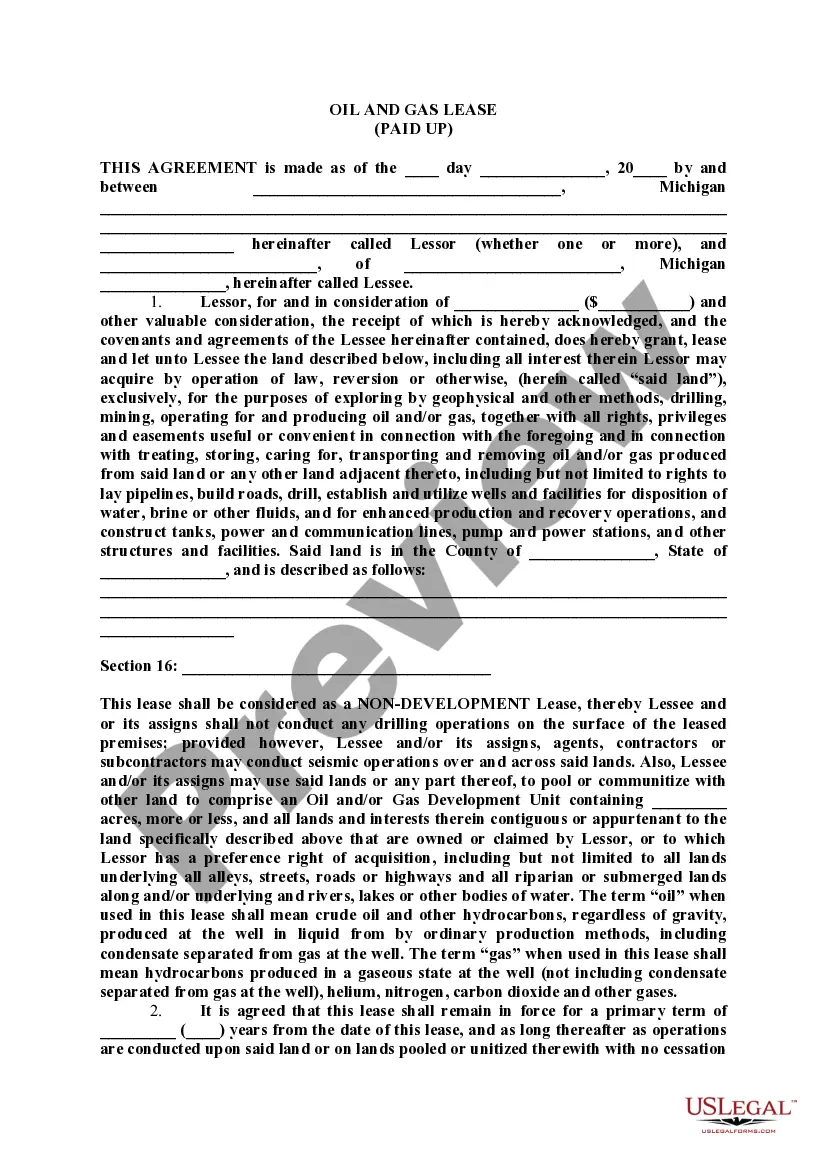

Are you presently inside a placement the place you need to have papers for either company or person uses almost every time? There are a lot of authorized file templates available on the Internet, but finding types you can rely on is not simple. US Legal Forms delivers a large number of develop templates, just like the Minnesota Post Bankruptcy Petition Discharge Letter, which are composed to meet federal and state specifications.

When you are presently informed about US Legal Forms internet site and have a merchant account, basically log in. Next, it is possible to acquire the Minnesota Post Bankruptcy Petition Discharge Letter template.

Should you not offer an accounts and would like to begin using US Legal Forms, adopt these measures:

- Obtain the develop you will need and make sure it is for the appropriate area/county.

- Make use of the Review option to examine the shape.

- Look at the explanation to actually have chosen the correct develop.

- In case the develop is not what you`re looking for, utilize the Research area to obtain the develop that meets your needs and specifications.

- Once you get the appropriate develop, simply click Get now.

- Pick the pricing prepare you want, fill out the desired details to create your bank account, and pay money for your order utilizing your PayPal or Visa or Mastercard.

- Choose a convenient file file format and acquire your backup.

Find every one of the file templates you might have bought in the My Forms menus. You can obtain a further backup of Minnesota Post Bankruptcy Petition Discharge Letter anytime, if needed. Just go through the essential develop to acquire or print out the file template.

Use US Legal Forms, the most substantial selection of authorized types, to save time as well as stay away from errors. The service delivers appropriately manufactured authorized file templates that you can use for a range of uses. Make a merchant account on US Legal Forms and start producing your daily life a little easier.

Form popularity

FAQ

Give your name, address and court number (to be taken from the latest correspondence about your bankruptcy). The court may check with the Official Receiver that you are entitled to an automatic discharge. You should receive a certificate confirming your discharge within about four weeks.

A "discharge letter" is a term used to describe the order that the bankruptcy court mails out toward the end of the case. The order officially discharges (wipes out) qualifying debt, such as credit card and utility bill balances, medical debt, and personal loans.

Assuming that everything goes according to schedule, you can expect to receive your bankruptcy discharge (the court order that wipes out your debts) about 60 days after your 341 meeting of creditors hearing, plus a few days for mailing.

The bankruptcy is reported in the public records section of your credit report. Both the bankruptcy and the accounts included in the bankruptcy should indicate they are discharged once the bankruptcy has been completed. To verify this, the first step is to get a copy of your personal credit report.

A bankruptcy discharge, also known as a discharge in bankruptcy, refers to a permanent court order that releases a debtor from personal liability for certain types of debts. It is sometimes referred to simply as a discharge and comes at the end of a bankruptcy.

The bankruptcy is reported in the public records section of your credit report. Both the bankruptcy and the accounts included in the bankruptcy should indicate they are discharged once the bankruptcy has been completed. To verify this, the first step is to get a copy of your personal credit report.

Closing a Chapter 7 Bankruptcy After DischargeA Chapter 7 case will remain open after the discharge if the Chapter 7 trustee appointed to the matter needs additional time to sell assets or if the case involves litigation.

Since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing.