Minnesota Monthly Retirement Planning is a comprehensive resource and guide for individuals residing in Minnesota who are looking for expert advice and guidance in planning their retirement. Whether you are approaching retirement, have recently retired, or want to ensure a financially stable retirement, Minnesota Monthly Retirement Planning caters to all stages of retirement planning. With a focus on local insights and customized solutions for Minnesotans, Minnesota Monthly Retirement Planning offers a wide range of services and resources to help individuals make informed decisions about their financial future. It covers various aspects of retirement planning, including investment strategies, tax planning, healthcare costs, social security benefits, estate planning, and more. One of the key features of Minnesota Monthly Retirement Planning is its team of experienced financial advisors who specialize in retirement planning. These professionals have a deep understanding of the Minnesota market and can provide personalized advice based on individuals' unique goals and circumstances. They stay up-to-date with the latest regulations, market trends, and financial products, ensuring clients receive tailored strategies to maximize their retirement savings. Minnesota Monthly Retirement Planning also provides educational content through articles, blog posts, and newsletters. These resources cover a wide range of topics and aim to enhance readers' knowledge about retirement planning. From tips on budgeting and saving to advice on managing retirement accounts and minimizing tax burdens, the content caters to the specific challenges and opportunities faced by retirees in Minnesota. In addition to general retirement planning, Minnesota Monthly Retirement Planning offers specialized programs to cater to different needs. Some various types of retirement planning offered by the platform may include: 1. Early Retirement Planning: For individuals who wish to retire before the traditional retirement age, this program focuses on strategies to accumulate enough savings and investments to sustain a longer retirement period. 2. Social Security Optimization: This program helps individuals understand the best strategies for claiming social security benefits to maximize their lifetime income while considering factors such as life expectancy, income needs, and spousal benefits. 3. Late-stage Retirement Planning: Designed for individuals who are close to retirement or have already retired, this program focuses on managing assets, creating sustainable income streams, and preserving wealth while considering long-term care expenses. 4. Estate Planning: Minnesota Monthly Retirement Planning offers guidance on estate planning to ensure individuals can pass on their assets to their loved ones efficiently, minimize taxes, and protect their legacies. 5. Healthcare and Long-Term Care Planning: This program addresses the rising costs of healthcare and provides strategies to manage medical expenses during retirement, including long-term care options and insurance coverage. Minnesota Monthly Retirement Planning strives to keep individuals informed and empowered to make the best decisions for their retirement years. By offering personalized advice, educational content, and specialized programs, this resource ensures that every Minnesotan can confidently plan their retirement and enjoy a financially secure future.

Minnesota Monthly Retirement Planning

Description

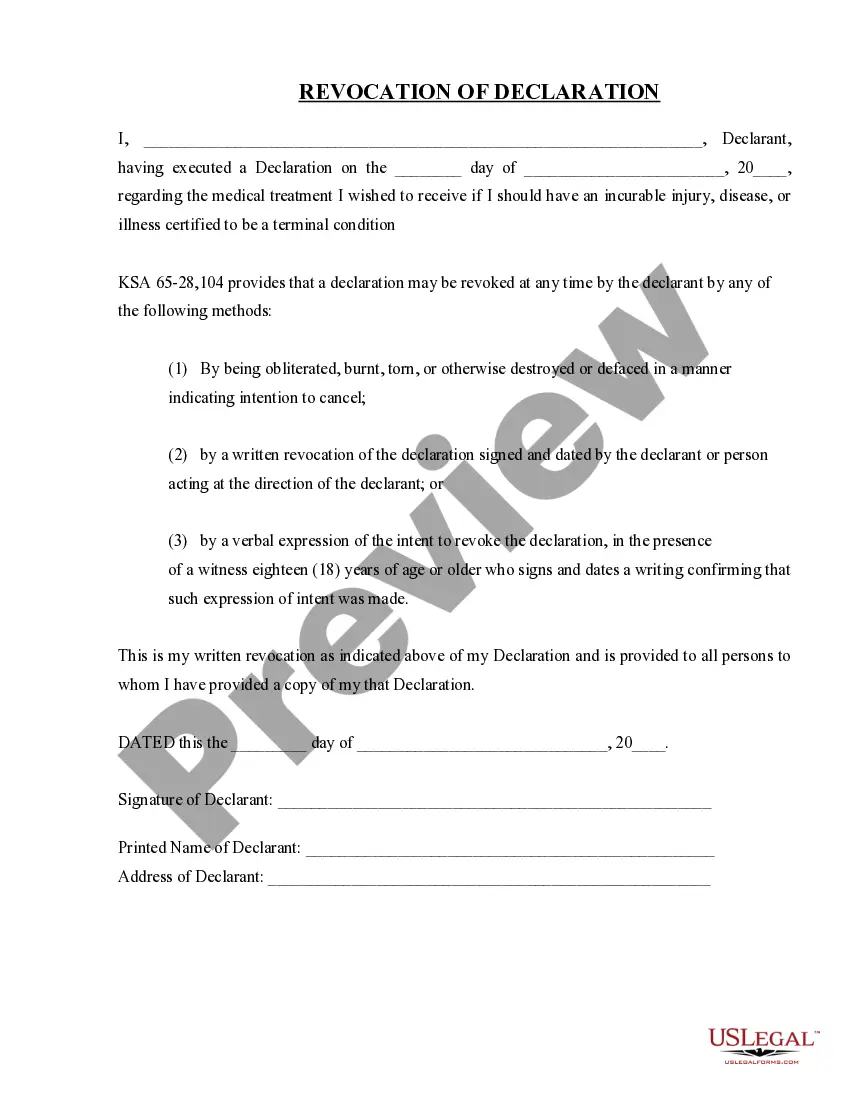

How to fill out Minnesota Monthly Retirement Planning?

US Legal Forms - one of the greatest libraries of legal types in the United States - gives a variety of legal document layouts you may obtain or print out. Utilizing the site, you may get thousands of types for business and individual reasons, categorized by classes, says, or key phrases.You can get the most recent models of types such as the Minnesota Monthly Retirement Planning in seconds.

If you already have a registration, log in and obtain Minnesota Monthly Retirement Planning in the US Legal Forms catalogue. The Download option can look on every type you view. You have accessibility to all previously saved types from the My Forms tab of your own bank account.

If you want to use US Legal Forms the very first time, here are simple recommendations to get you started out:

- Ensure you have picked out the correct type for your city/county. Select the Review option to review the form`s content material. See the type description to actually have chosen the proper type.

- In case the type does not satisfy your needs, take advantage of the Look for industry towards the top of the display screen to discover the one which does.

- In case you are pleased with the form, affirm your decision by clicking on the Acquire now option. Then, select the prices plan you want and offer your credentials to register on an bank account.

- Procedure the financial transaction. Make use of charge card or PayPal bank account to complete the financial transaction.

- Choose the formatting and obtain the form in your gadget.

- Make adjustments. Fill up, revise and print out and signal the saved Minnesota Monthly Retirement Planning.

Each web template you included with your bank account does not have an expiration date and is your own forever. So, if you would like obtain or print out one more version, just go to the My Forms area and click on on the type you require.

Obtain access to the Minnesota Monthly Retirement Planning with US Legal Forms, one of the most extensive catalogue of legal document layouts. Use thousands of professional and express-distinct layouts that fulfill your company or individual requirements and needs.

Form popularity

FAQ

Your disability benefit is the product of your years of allowable PERA service and your average salary during your five highest-paid years of consecutive service or your total years of service if between three and five. You receive 1.7 percent for each year of ser- vice multiplied by this average salary.

Your retirement benefit is calculated using a formula with three factors: Service credit (Years) multiplied by your benefit factor (percentage per year) multiplied by your final monthly compensation equals your unmodified allowance. Service Credit - Total years of employment with a CalPERS employer.

Retirement Eligibility RequirementsAge 65 with five or more years of service credit, or.At least age 62, meet the Rule of 80 (combined age and years of service credit equal at least 80), and have at least five years of service credit.

While some may prefer to apply in person at their local Social Security office, an increasing number of retirees are finding it easier and more convenient to claim their benefits by retiring online at .

You should apply no later than the month in which you want your benefits to start. You can file up to four months before that, which gives Social Security ample time to process your application. As the minimum age to collect retirement benefits is 62, the earliest you can apply is when you reach 61 years and 9 months.

Step 1: Define Your Retirement.Step 3: Evaluate Your Health Now.Step 4: Determine When to Collect Social Security.Step 5: Network Through Social Media and Other Methods.Step 6: Decide How Much You Want (or Need) to Work.Step 7: Create a Retirement Budget.Step 8: Find New Ways to Cut Your Expenses (Start Saving More)More items...

Full retirement benefit: Typically at age 66. Reduced retirement benefit: age 55 or later, assuming you have 3 years of service.

Your retirement benefit is calculated using a formula with three factors: Service credit (Years) multiplied by your benefit factor (percentage per year) multiplied by your final monthly compensation equals your unmodified allowance. Service Credit - Total years of employment with a CalPERS employer.

Steps to apply for a monthly retirement benefitDetermine your retirement date. The retirement date is the date you want your benefit to begin.Contact MSRS. As you near retirement, contact MSRS.Contact other plan providers.Fill out forms.Collect your documents.Submit forms and documents to MSRS.Receive first payment.

You are vested in PERA after 36 months of public service (60 months for members hired after June 2010). Being vested means you qualify for benefits at the minimum allowable age.