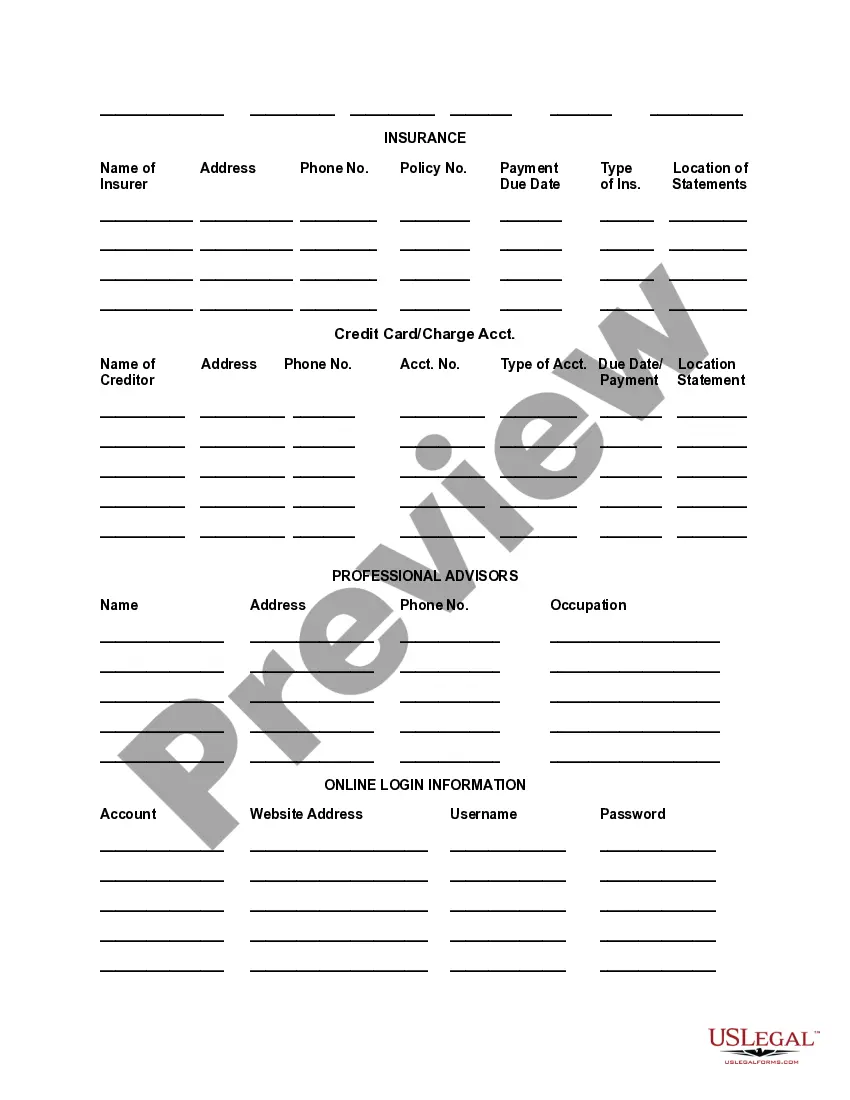

Minnesota Personal Financial Information Organizer

Description

How to fill out Personal Financial Information Organizer?

Locating the appropriate legal document format can be a challenge. Naturally, numerous templates are accessible online, but how can you acquire the legal form you require? Utilize the US Legal Forms website.

This service offers thousands of templates, including the Minnesota Personal Financial Information Organizer, which can be utilized for both business and personal needs. All forms are reviewed by professionals and comply with state and federal regulations.

If you are currently registered, Log In to your account and click the Download button to access the Minnesota Personal Financial Information Organizer. Use your account to browse the legal forms you have previously purchased. Navigate to the My documents section of your account to retrieve another copy of the document you require.

Select the file format and download the legal document format to your device. Complete, edit, print, and sign the acquired Minnesota Personal Financial Information Organizer. US Legal Forms boasts the largest collection of legal forms where you can find a variety of document templates. Take advantage of the service to download professionally crafted papers that meet state requirements.

- First, ensure you have selected the correct form for your city/state.

- You can review the form using the Review button and read the form description to confirm it is suitable for you.

- If the form does not meet your criteria, utilize the Search field to find the right form.

- Once you are certain the form is appropriate, click on the Get now button to acquire the form.

- Choose the pricing plan you prefer and input the required information.

- Create your account and place an order using your PayPal account or credit card.

Form popularity

FAQ

A key difference between financial planners and wealth managers is that wealth managers manage literal wealth, while financial planners manage the finances of everyday clients who want to get ahead.

Financial planners: what they do A financial planner guides you in meeting your current financial needs and long-term goals. That typically means assessing your financial situation, understanding what you want your money to do for you (both now and in the future) and helping create a plan to get you there.

When you're looking for guidance in a more general aspect of your financial life, working with a financial planner is a better option than choosing a financial advisor. They can provide a more comprehensive scope of services that encompass just about everything you hope to accomplish.

Certified Financial Planner (CFP) Hold a bachelor's degree, plus 3 years experience. Personal Financial Specialist (PFS) Have 75 hours personal financial planning education; also, hold a CPA, which requires a degree, plus 2 years experience.

Key Takeaways. A financial planner is a professional who helps individuals and organizations create a strategy to meet long-term financial goals. "Financial advisor" is a broader category that can also include brokers, money managers, insurance agents, or bankers.

Becoming a financial planner requires a bachelor's degree, along with courses in investments, taxes, estate planning, and risk management. If you're comfortable with sales, are great with people, have excellent analytical and communication skills, and can work independently, financial planning may be right for you.

The daily schedule of a financial advisor includes prospecting, servicing current clients, administrative tasks, financial planning, and continuing education. In addition to providing financial guidance, a large part of a financial advisor's career is managing relationships.

Your Personal Financial Organizer is a take-action booklet intended to help you put your finances and budget in order as a first step to preparing an effective savings strategy. The sooner you start saving, the more time your money will have to work for you. Page 4. 2 YOUR PERSONAL FINANCIAL ORGANIZER.

A financial planner is a professional who helps individuals and organizations create a strategy to meet long-term financial goals. "Financial advisor" is a broader category that can also include brokers, money managers, insurance agents, or bankers. There is no single body in charge of regulating financial planners.