Minnesota Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan

Description

How to fill out Security Agreement In Personal Property Fixtures Regarding Securing A Commercial Loan?

Choosing the right legitimate record template can be quite a have difficulties. Obviously, there are a variety of templates available online, but how do you discover the legitimate type you will need? Make use of the US Legal Forms website. The service offers a huge number of templates, such as the Minnesota Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan, that you can use for enterprise and personal requires. Every one of the varieties are inspected by specialists and satisfy state and federal demands.

In case you are already listed, log in to your accounts and then click the Down load switch to obtain the Minnesota Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan. Utilize your accounts to search with the legitimate varieties you may have acquired previously. Go to the My Forms tab of your own accounts and acquire one more copy of the record you will need.

In case you are a whole new customer of US Legal Forms, here are basic instructions that you can comply with:

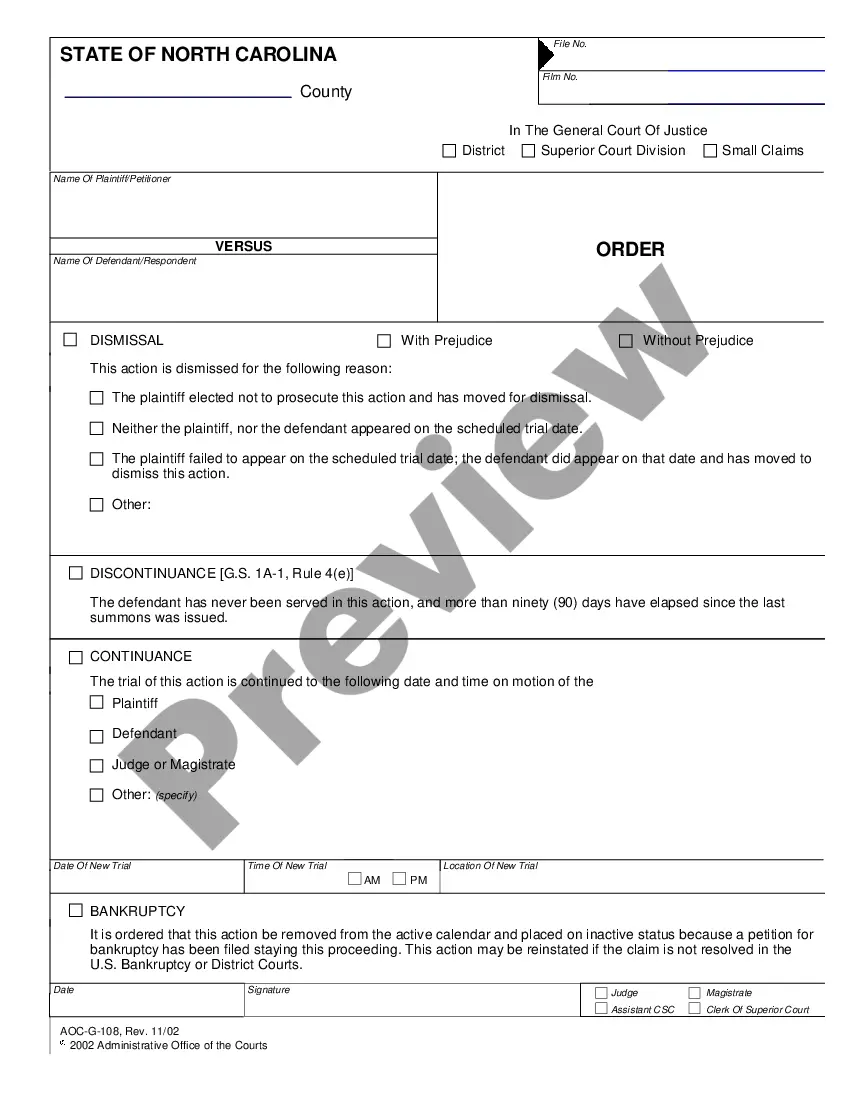

- First, be sure you have selected the proper type for your area/area. You can check out the form making use of the Review switch and study the form description to ensure this is the right one for you.

- In case the type is not going to satisfy your requirements, utilize the Seach field to find the right type.

- When you are certain the form is suitable, select the Get now switch to obtain the type.

- Select the rates plan you want and type in the essential info. Design your accounts and buy the transaction using your PayPal accounts or Visa or Mastercard.

- Pick the file structure and down load the legitimate record template to your gadget.

- Total, change and print out and sign the obtained Minnesota Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan.

US Legal Forms is the largest library of legitimate varieties that you can find a variety of record templates. Make use of the service to down load professionally-manufactured paperwork that comply with condition demands.

Form popularity

FAQ

Something you own. It may be a financial item like money, bonds, shares or a bank account or physical item like a house, land or a car. that is put up to guarantee a loan. If the loan is not repaid, the lender may sell the asset to get its money back.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A ?SECURITY AGREEMENT? is an agreement that. creates or provides for an interest in personal property. that secures payment or performance of an obligation.

With reference to lending, security or collateral, is an asset that is pledged by the borrower as protection in case he or she defaults on the repayment, not paying some or all back.

In a secured transaction, the Grantor (typically a borrower but possibly a guarantor or surety) assigns, grants and pledges to the grantee (typically the lender) a security interest in personal property which is referred to as the collateral. Examples of typical collateral are shares of stock, livestock, and vehicles.

Collateral loans come in many forms. For example, mortgages are collateral loans, and the real estate is collateral on the loan. The lender holds a lien on the mortgaged property, a mechanism that gives another entity conditional rights to your collateral if you default on the terms of the agreement.