Minnesota Accident Policy

Description

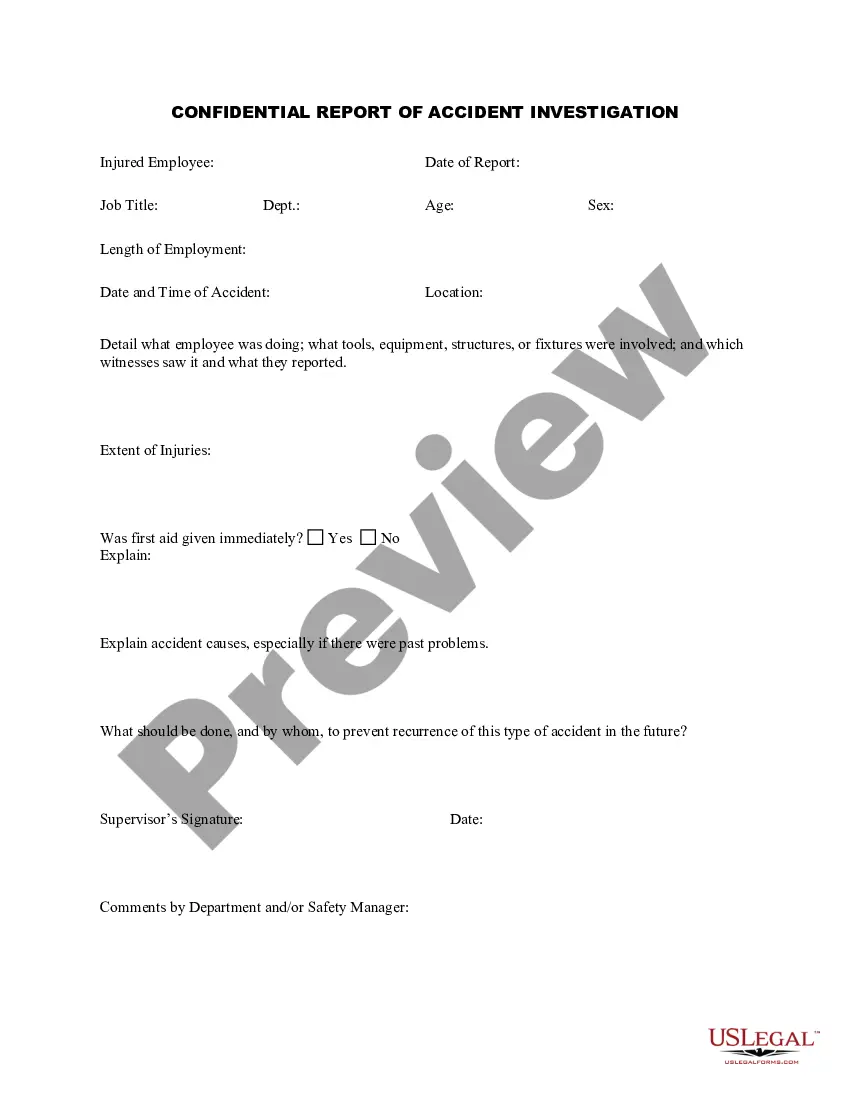

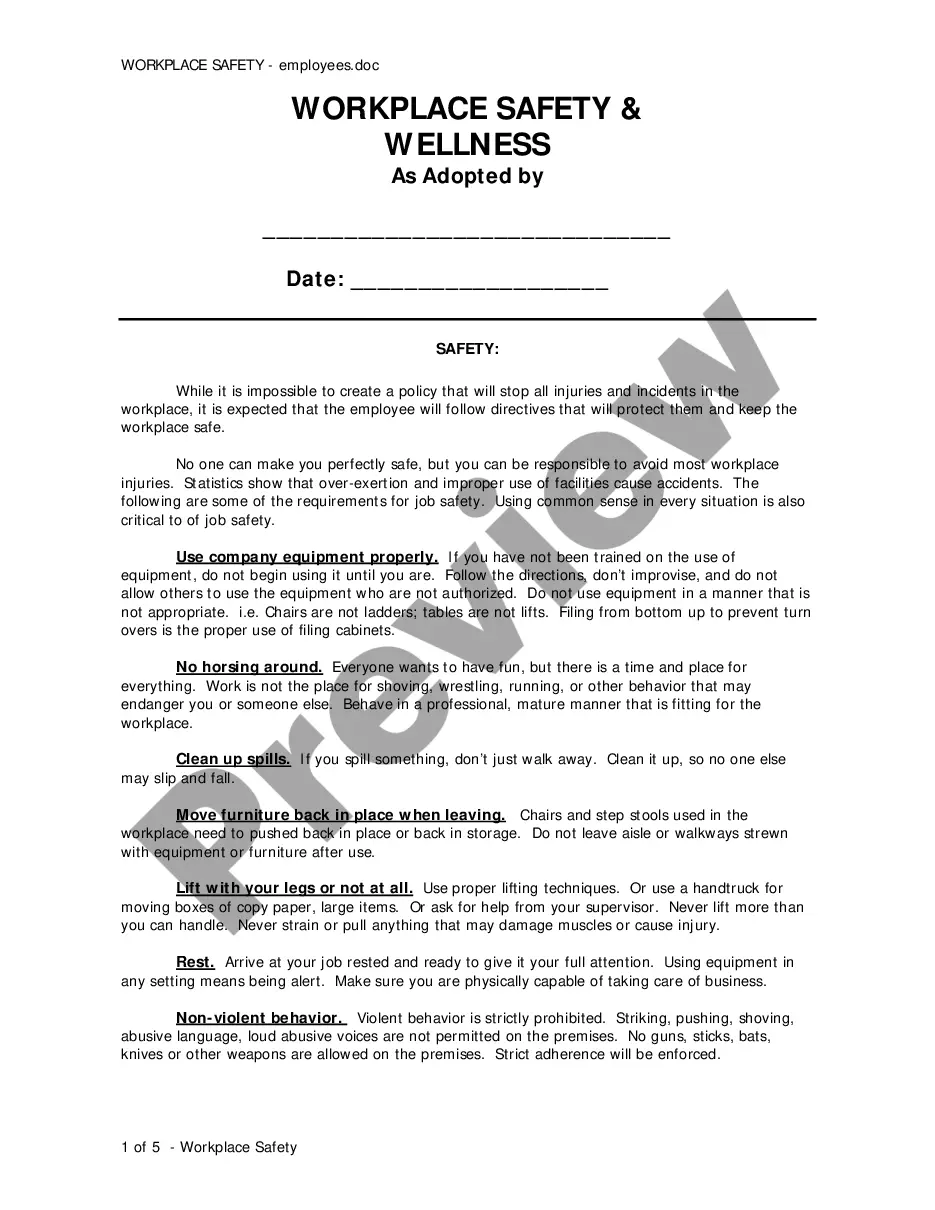

How to fill out Accident Policy?

You can spend hours on the web attempting to locate the official document template that fulfills the state and federal requirements you require. US Legal Forms provides a vast array of legal forms that have been assessed by professionals.

You can download or print the Minnesota Accident Policy from the service.

If you possess a US Legal Forms account, you can Log In and click the Obtain button. After that, you can complete, modify, print, or sign the Minnesota Accident Policy. Each legal document template you acquire is yours permanently.

Choose the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Select the format of your document and download it to your device. Make modifications to your document if needed. You can complete, adjust, and sign and print the Minnesota Accident Policy. Access and print a multitude of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- To obtain another copy of a purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Review the form summary to confirm you have selected the right form.

- If available, use the Review button to examine the document template as well.

- Should you wish to find a different version of your form, use the Search box to locate the template that fits your needs.

- Once you have identified the template you desire, click Buy now to proceed.

Form popularity

FAQ

If the other driver is at fault, their insurance company must pay for your vehicle damage promptly, including any deductible, even if you don't carry collision insurance in your own automobile insurance policy.

Minnesota is a "no-fault" car insurance state, which means your own car insurance pays for certain losses after an accident, no matter who caused the crash. Your options for pursuing a claim against anyone else are limited when you're injured in a car accident, unless your injuries meet a certain threshold.

Minnesota is a No-Fault state for claims for car accidents, trucking accidents, and some pedestrian and motorcycle accidents. The purpose of the No-Fault law is to get certain losses paid quicklywithout the need for a lawsuit.

Get Legal Assistance in Minnesota After a Car, Truck, Motorcycle or Drunk Driver AccidentStop the vehicle.Turn off the engine.Get out of the vehicle.Call 911.Collect information from all parties.Do not sign anything.Seek medical attention.Contact your insurance company.More items...

Minnesota is a no-fault state. This means we have a statute that allows people injured in car accidents in Minnesota to get some medical treatment, some wage loss, and some replacement expenses regardless of fault.

The insurance company is required to pay you for the cost of repair or the value of your vehicle, whichever is less. For example, if the cost to repair your car is $2,000, but fair market value for your vehicle is only $1,500, they are legally obligated to pay you only $1,500.

In certain situations, you can bring a lawsuit directly against the at-fault driver in an auto accident: You must have sustained at least $4,000 in reasonable medical expenses; or. You must have suffered 60 days of disability, permanent injury, or permanent disfigurement because of the car accident.

Here are some other facts about no-fault: No-fault is a Minnesota law. It was established to help ease the burden of courts and to ensure prompt treatment for accident victims. No-fault IS the Personal Injury Protection (PIP) on your policy, sometimes referred to as Basic Economic Loss Benefits.

Car insurance after an at-fault collision in Minnesota A serious incident like an at-fault crash could remain on your insurance record for up to three years!