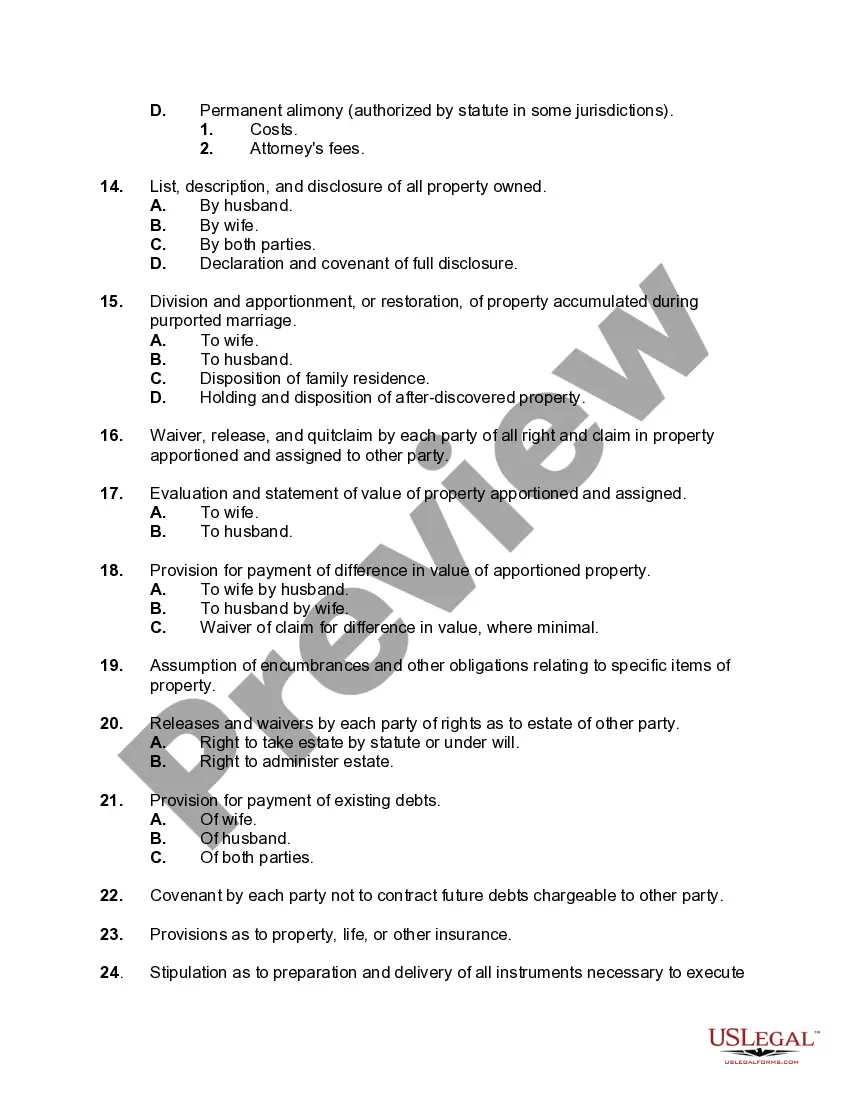

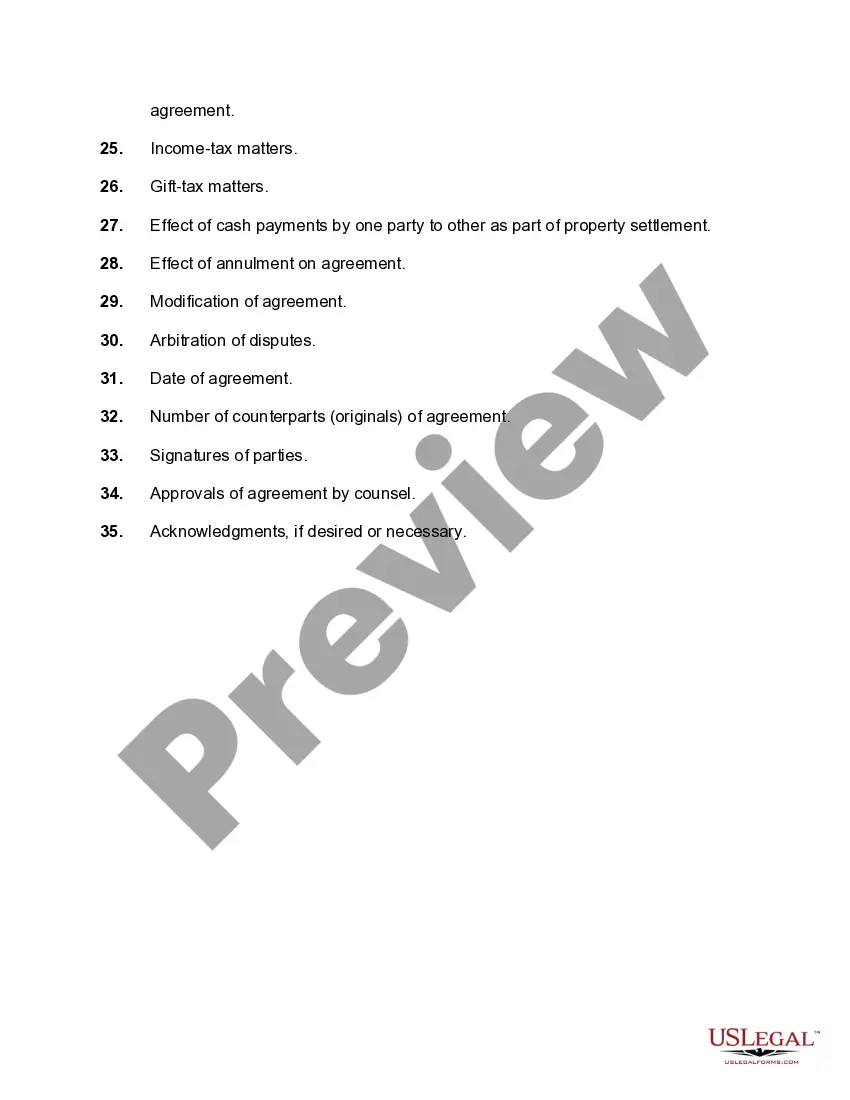

The Minnesota Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage is a vital resource for individuals seeking guidance and clarity during a divorce or annulment process in Minnesota. This checklist outlines the key points to be addressed and considered when drafting an agreement for the division or restoration of property in connection with a marriage annulment proceeding. The checklist covers various important aspects involved in property division, ensuring a fair and equitable resolution for both parties involved. It is crucial to consult this checklist while drafting an agreement to ensure that all relevant matters are considered and addressed appropriately. Here are some of the key matters covered in the Minnesota Checklist: 1. Identification and Valuation of Assets: The checklist emphasizes the need to identify and value all assets owned by the couple, including real estate properties, bank accounts, investments, retirement accounts, vehicles, and personal belongings. A thorough inventory of assets is necessary to ensure a fair distribution. 2. Liabilities and Debts: In addition to assets, the checklist reminds individuals to consider and address any outstanding debts, loans, mortgages, and other financial obligations incurred during the marriage. Proper allocation of liabilities is essential to prevent future conflicts. 3. Marital vs. Non-Marital Property: Minnesota is an "equitable distribution" state, which means that marital property is subject to division while non-marital property, which generally includes assets owned before the marriage, may be retained by the original owner. The checklist highlights the importance of identifying and distinguishing between marital and non-marital property. 4. Division of Marital Property: The checklist provides guidance on how to fairly divide marital property. It encourages individuals to consider factors such as the duration of the marriage, each party's financial situation, contributions to the acquisition of assets, and other relevant circumstances to determine an equitable distribution. 5. Spousal Support and Maintenance: The checklist suggests addressing the matter of spousal support, also known as alimony or maintenance. It encourages individuals to consider factors such as the length of the marriage, the income and earning potential of each spouse, and any economic disparities that may exist when determining whether financial support is necessary. 6. Insurance Policies and Benefits: The checklist advises individuals to review and address insurance policies, including health, life, and disability insurance, and their beneficiaries. Additionally, it suggests considering the division of any retirement benefits, pension plans, or social security benefits accumulated during the marriage. 7. Tax Considerations: It is crucial to consider the potential tax implications of property division. The checklist suggests consulting a tax professional to understand the tax consequences of certain decisions, such as the sale of property or the distribution of retirement accounts. By following the Minnesota Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage, individuals can ensure a comprehensive and fair resolution during the divorce or annulment process. Adhering to this checklist can help avoid future disputes and provide a strong foundation for the individuals involved to move forward with their lives.

The Minnesota Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage is a vital resource for individuals seeking guidance and clarity during a divorce or annulment process in Minnesota. This checklist outlines the key points to be addressed and considered when drafting an agreement for the division or restoration of property in connection with a marriage annulment proceeding. The checklist covers various important aspects involved in property division, ensuring a fair and equitable resolution for both parties involved. It is crucial to consult this checklist while drafting an agreement to ensure that all relevant matters are considered and addressed appropriately. Here are some of the key matters covered in the Minnesota Checklist: 1. Identification and Valuation of Assets: The checklist emphasizes the need to identify and value all assets owned by the couple, including real estate properties, bank accounts, investments, retirement accounts, vehicles, and personal belongings. A thorough inventory of assets is necessary to ensure a fair distribution. 2. Liabilities and Debts: In addition to assets, the checklist reminds individuals to consider and address any outstanding debts, loans, mortgages, and other financial obligations incurred during the marriage. Proper allocation of liabilities is essential to prevent future conflicts. 3. Marital vs. Non-Marital Property: Minnesota is an "equitable distribution" state, which means that marital property is subject to division while non-marital property, which generally includes assets owned before the marriage, may be retained by the original owner. The checklist highlights the importance of identifying and distinguishing between marital and non-marital property. 4. Division of Marital Property: The checklist provides guidance on how to fairly divide marital property. It encourages individuals to consider factors such as the duration of the marriage, each party's financial situation, contributions to the acquisition of assets, and other relevant circumstances to determine an equitable distribution. 5. Spousal Support and Maintenance: The checklist suggests addressing the matter of spousal support, also known as alimony or maintenance. It encourages individuals to consider factors such as the length of the marriage, the income and earning potential of each spouse, and any economic disparities that may exist when determining whether financial support is necessary. 6. Insurance Policies and Benefits: The checklist advises individuals to review and address insurance policies, including health, life, and disability insurance, and their beneficiaries. Additionally, it suggests considering the division of any retirement benefits, pension plans, or social security benefits accumulated during the marriage. 7. Tax Considerations: It is crucial to consider the potential tax implications of property division. The checklist suggests consulting a tax professional to understand the tax consequences of certain decisions, such as the sale of property or the distribution of retirement accounts. By following the Minnesota Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage, individuals can ensure a comprehensive and fair resolution during the divorce or annulment process. Adhering to this checklist can help avoid future disputes and provide a strong foundation for the individuals involved to move forward with their lives.