Minnesota Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss

Description

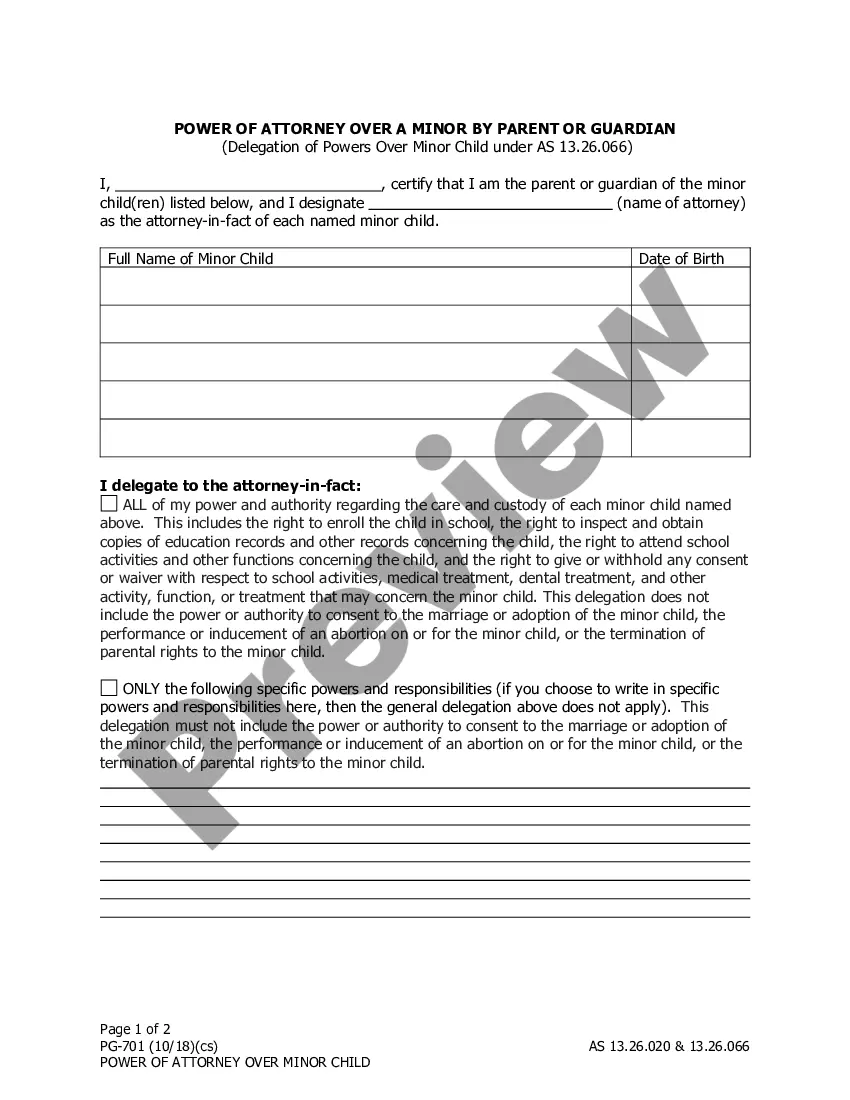

How to fill out Jury Instruction - 10.10.4 Business Loss Vs. Hobby Loss?

US Legal Forms - among the largest libraries of authorized types in the States - gives a wide array of authorized record web templates you may obtain or print. Using the web site, you will get a large number of types for organization and personal purposes, sorted by classes, says, or keywords.You can find the most recent models of types much like the Minnesota Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss within minutes.

If you have a monthly subscription, log in and obtain Minnesota Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss from the US Legal Forms catalogue. The Download button will show up on each and every kind you see. You get access to all previously downloaded types in the My Forms tab of your accounts.

If you would like use US Legal Forms the first time, listed here are basic directions to obtain started out:

- Ensure you have picked the correct kind for your city/region. Click on the Review button to review the form`s content material. See the kind explanation to actually have selected the appropriate kind.

- If the kind doesn`t satisfy your specifications, take advantage of the Lookup field on top of the display screen to discover the the one that does.

- In case you are happy with the form, validate your selection by visiting the Get now button. Then, choose the pricing strategy you like and give your credentials to register for the accounts.

- Process the deal. Use your Visa or Mastercard or PayPal accounts to accomplish the deal.

- Pick the structure and obtain the form on the device.

- Make alterations. Fill up, edit and print and signal the downloaded Minnesota Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss.

Each design you added to your bank account lacks an expiration day and is also yours forever. So, if you would like obtain or print yet another version, just check out the My Forms section and click on the kind you require.

Gain access to the Minnesota Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss with US Legal Forms, probably the most comprehensive catalogue of authorized record web templates. Use a large number of skilled and state-distinct web templates that meet up with your organization or personal requires and specifications.