Minnesota Letter of Notice to Borrower of Assignment of Mortgage

Description

How to fill out Letter Of Notice To Borrower Of Assignment Of Mortgage?

Are you within a position where you need to have papers for possibly company or personal purposes just about every day time? There are a lot of legal document templates accessible on the Internet, but finding ones you can rely is not straightforward. US Legal Forms gives thousands of develop templates, such as the Minnesota Letter of Notice to Borrower of Assignment of Mortgage, that are written to meet federal and state demands.

When you are already acquainted with US Legal Forms internet site and also have an account, merely log in. Following that, you are able to down load the Minnesota Letter of Notice to Borrower of Assignment of Mortgage template.

Unless you have an profile and want to begin using US Legal Forms, adopt these measures:

- Obtain the develop you require and make sure it is for your right area/state.

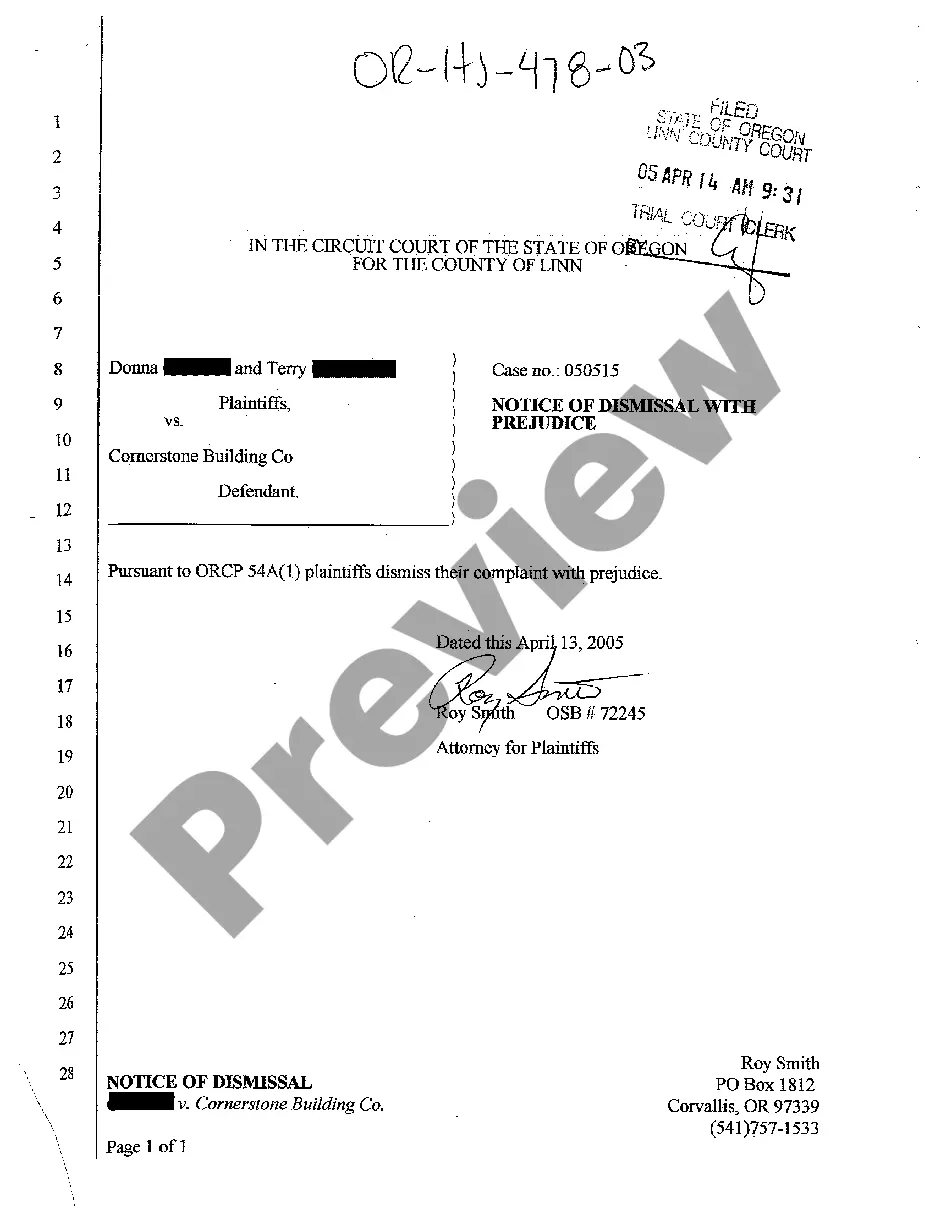

- Use the Preview key to check the shape.

- Browse the explanation to actually have selected the appropriate develop.

- In the event the develop is not what you are searching for, utilize the Research discipline to obtain the develop that fits your needs and demands.

- Once you find the right develop, just click Acquire now.

- Select the prices prepare you would like, complete the necessary information to generate your money, and purchase an order utilizing your PayPal or credit card.

- Decide on a handy data file formatting and down load your duplicate.

Get all of the document templates you possess purchased in the My Forms menus. You can get a further duplicate of Minnesota Letter of Notice to Borrower of Assignment of Mortgage any time, if possible. Just click the needed develop to down load or print out the document template.

Use US Legal Forms, the most comprehensive assortment of legal types, in order to save time and stay away from blunders. The services gives appropriately created legal document templates that you can use for an array of purposes. Create an account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

Doing so allows your mortgage provider to ensure future financial liquidity so that it can keep extending home loans to other borrowers. Under such a scenario, your original loan holder basically ?flips? the mortgage and assigns its security rights in a home to the new owner of the note instead.

A recorded mortgage must be discharged by a certificate signed by the mortgagee, his personal representatives or assigns, acknowledged or proved and certified as prescribed by the chapter on ?recording transfers,? stating that the mortgage has been paid, satisfied, or discharged.

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

An assignment of mortgage documents the transfer of a mortgage from an original lender or borrower to another person or entity. Lenders regularly sell mortgages to other lenders. Less often, a borrower transfers the mortgage to someone else who assumes the mortgage.

If it does not have an assignment or failed to record it as required by state law, this may result in the dismissal of the foreclosure action. Recording rules may require that the foreclosing party record the assignment before starting the foreclosure.

The purpose of the mortgage or deed of trust is to provide security for the loan that's evidenced by a promissory note. Loan Transfers. Banks often sell and buy mortgages from each other. An "assignment" is the document that is the legal record of this transfer from one mortgagee to another.