Minnesota Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance is a legal document designed to outline the terms and conditions of a retirement plan for employees in Minnesota, which is funded by life insurance policies. This type of retirement plan is commonly offered to high-ranking executives, key employees, or individuals with specialized skills in an organization. The Minnesota Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance provides details about the retirement benefits, contributions, and distributions. It is an essential agreement that safeguards both the employer and the employee by establishing clear guidelines and expectations. Keywords: Minnesota, Employment Agreement, Nonqualified Retirement Plan, Life Insurance, Retirement Benefits, Contributions, Distributions, Executives, Key Employees, Organization. Different types of Minnesota Employment Agreements with Nonqualified Retirement Plans Funded with Life Insurance may include: 1. Defined Benefit Plan: This type of retirement plan guarantees a specific monthly benefit amount upon retirement. The benefit is determined by a formula that considers factors such as years of service and average salary. 2. Defined Contribution Plan: Unlike a defined benefit plan, a defined contribution plan specifies the contributions made by the employer and possibly the employee. The final retirement benefit depends on the performance of the investments in the plan. 3. Supplemental Executive Retirement Plan (SERP): SERPs are designed specifically for executives and key employees, providing additional retirement benefits beyond what is offered by a traditional retirement plan. These plans are usually nonqualified, meaning they do not comply with ERICA (Employee Retirement Income Security Act) regulations. 4. Deferred Compensation Plan: This type of plan allows employees to defer a portion of their salary or bonus into the retirement plan, thereby reducing taxable income in the current year. The deferred funds, along with employer contributions, grow tax-deferred until retirement. 5. Split Dollar Life Insurance Plan: In a split dollar life insurance plan, the employer and employee share the costs and benefits of a life insurance policy. The policy can be used not only for retirement benefits but also for other purposes, such as protection for the employee's family in the event of their death. 6. Cash Balance Plan: A cash balance plan is a hybrid retirement plan that combines elements of defined benefit and defined contribution plans. It provides employees with a hypothetical account balance that grows based on employer contributions and a predetermined interest credit rate. Each of these Minnesota Employment Agreements with Nonqualified Retirement Plans Funded with Life Insurance has its own distinct features, benefits, and eligibility criteria. Employers and employees should carefully consider their specific circumstances and consult legal and financial professionals to select the most suitable plan.

Minnesota Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance

Description

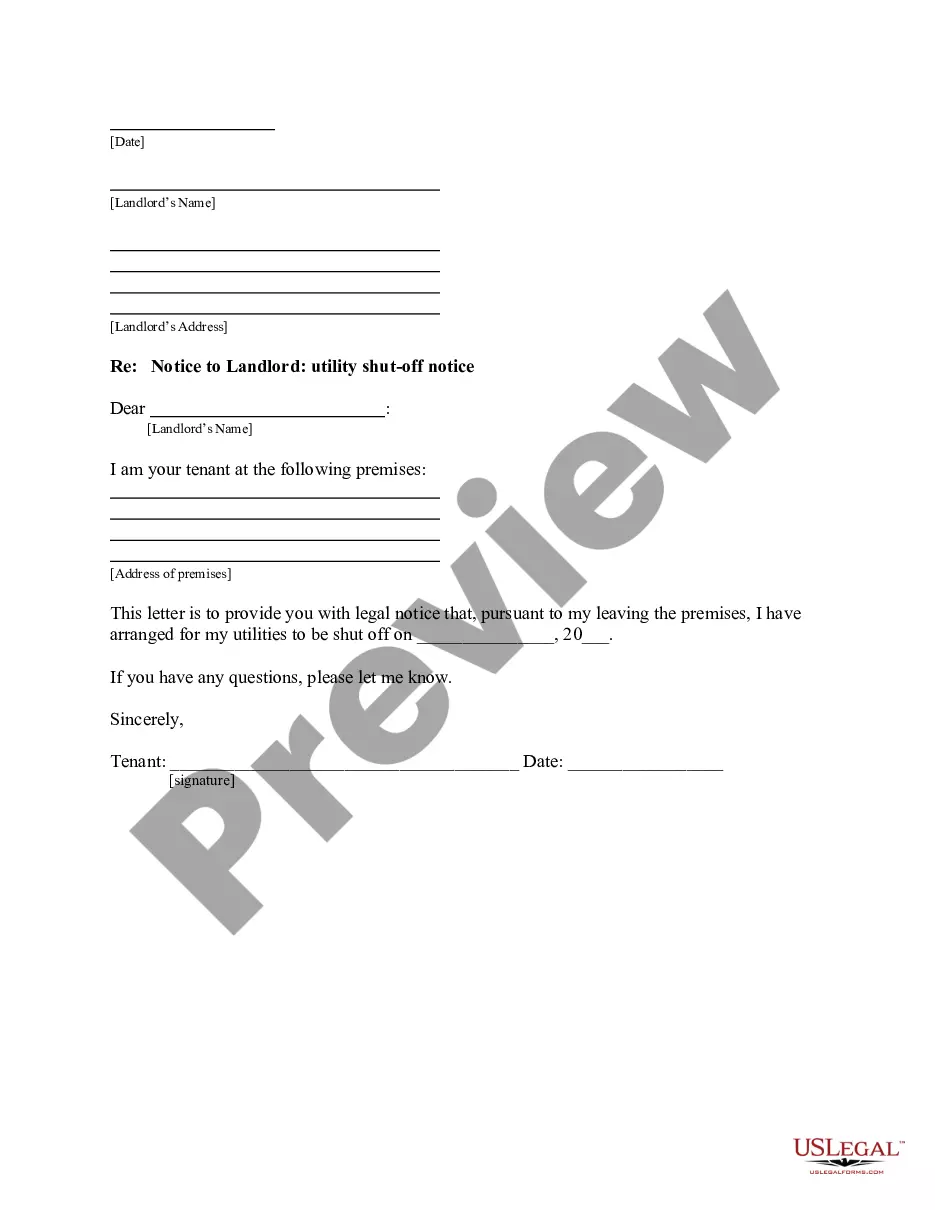

How to fill out Minnesota Employment Agreement With Nonqualified Retirement Plan Funded With Life Insurance?

Choosing the right lawful document template could be a struggle. Of course, there are a lot of templates available online, but how do you get the lawful type you need? Take advantage of the US Legal Forms web site. The services offers a huge number of templates, like the Minnesota Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance, which you can use for business and personal requirements. All of the forms are examined by professionals and fulfill state and federal specifications.

When you are previously authorized, log in for your profile and click on the Acquire key to have the Minnesota Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance. Use your profile to search with the lawful forms you may have purchased formerly. Proceed to the My Forms tab of your profile and have another duplicate in the document you need.

When you are a new end user of US Legal Forms, here are simple guidelines for you to adhere to:

- First, be sure you have chosen the correct type for your town/state. You may check out the shape while using Review key and read the shape explanation to make sure this is basically the best for you.

- When the type does not fulfill your preferences, make use of the Seach area to obtain the right type.

- Once you are positive that the shape is acceptable, click on the Get now key to have the type.

- Select the pricing plan you would like and type in the essential info. Make your profile and buy an order making use of your PayPal profile or charge card.

- Pick the data file format and acquire the lawful document template for your gadget.

- Complete, edit and produce and indication the obtained Minnesota Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance.

US Legal Forms is definitely the largest local library of lawful forms where you can find numerous document templates. Take advantage of the service to acquire appropriately-created paperwork that adhere to state specifications.

Form popularity

FAQ

A qualified benefit plan also: Qualifies for certain tax benefits and government protection, including tax breaks for employers and tax credits for businesses with these plans in place.

A qualified plan is an employer-sponsored retirement plan that qualifies for special tax treatment under Section 401(a) of the Internal Revenue Code.

Qualified retirement plans give employers a tax break for the contributions they make for their employees. Those plans that allow employees to defer a portion of their salaries into the plan can also reduce employees' present income-tax liability by reducing taxable income.

A nonqualified retirement plan is one that's not subject to the Employee Retirement Income Security Act of 1974 (ERISA). Most nonqualified plans are deferred compensation arrangements, or an agreement by an employer to pay an employee in the future.

Examples of nonqualified plans are deferred compensation plans, supplemental executive retirement plans, split-dollar arrangements and other similar arrangements. Contributions to a deferred compensation plan will reduce an employee's gross income, but there's no rollover option upon termination of employment.

Using life insurance in a qualified plan does offer several advantages, including: The ability to use pre-tax dollars to pay premiums that would otherwise not be tax-deductible. Fully funding the retirement benefit at the premature death of the plan participant.

A 401(k) plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the employee's wages to an individual account under the plan. The underlying plan can be a profit-sharing, stock bonus, pre-ERISA money purchase pension, or a rural cooperative plan.

Non-qualified plans are typically funded with cash value life insurance policies. Also known as permanent insurance, cash value policies accumulate cash inside the policy from a portion of the premiums paid. This type of policy becomes paid up once a certain amount of premium has been paid into it.

The non-qualified plan on a W-2 is a type of retirement savings plan that is employer-sponsored and tax-deferred. They are non-qualified because they fall outside the Employee Retirement Income Security Act (ERISA) guidelines and are exempt from the testing required with qualified retirement savings plans.

Whenever life insurance is included in a qualified retirement plan, the insured is receiving an immediate benefit in the form of the life insurance protection. The value of this benefit is reported and added to the insured's taxable income each year.