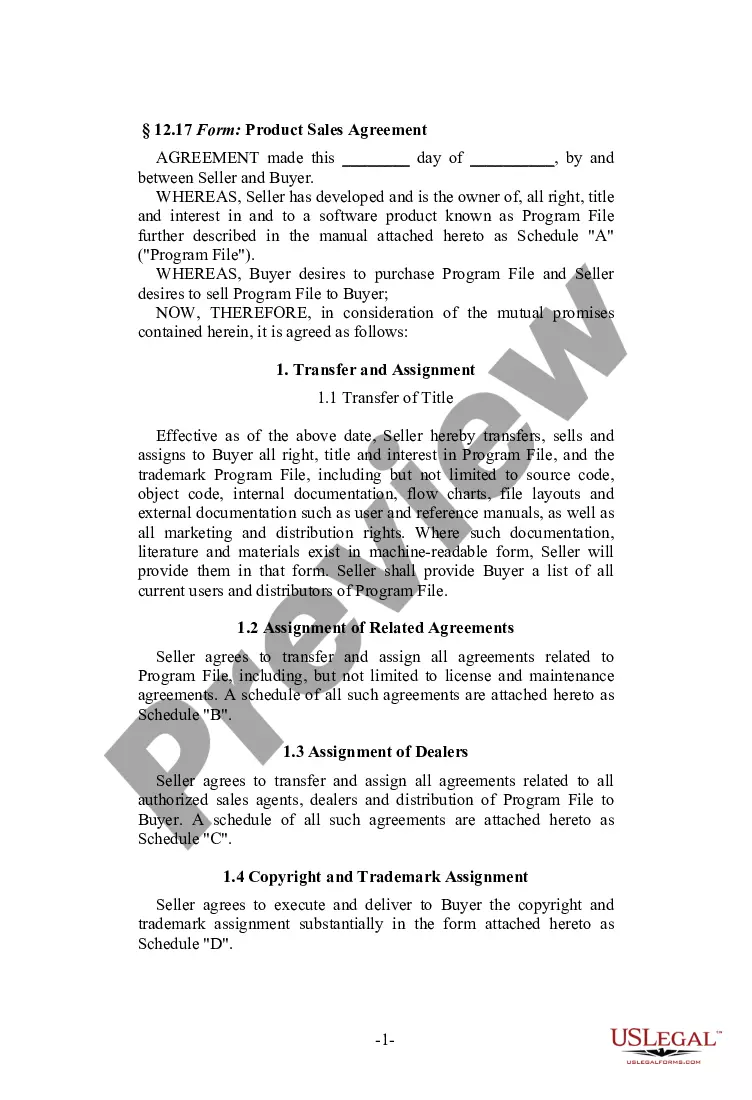

Minnesota Software Product Sales Agreement

Description

How to fill out Software Product Sales Agreement?

Selecting the optimal authorized document template can be a challenge. Clearly, there are numerous templates accessible online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Minnesota Software Product Sales Agreement, suitable for both business and personal needs. All forms are verified by experts and comply with state and federal regulations.

If you are already a registered user, Log In to your account and click on the Obtain button to access the Minnesota Software Product Sales Agreement. Use your account to review the legal forms you have previously purchased. Visit the My documents section of your account to get another copy of the document you require.

US Legal Forms is the largest repository of legal forms where you can find countless document templates. Utilize the service to obtain professionally crafted documents that adhere to state regulations.

- First, ensure that you have selected the correct form for your state/county. You can examine the form using the Preview option and review the form details to confirm it is the right one for you.

- If the form does not meet your needs, make use of the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click on the Buy now button to purchase the form.

- Select the pricing plan you prefer and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card.

- Choose the file format and download the authorized document template to your device.

- Complete, edit, print, and sign the acquired Minnesota Software Product Sales Agreement.

Form popularity

FAQ

So even if your home state (say California) does not collect sales tax on SaaS software, the state where your subscriber lives just might (like New York).

Common examples include: Clothing for general use, see Clothing. Food (grocery items), see Food and Food Ingredients. Prescription and over-the-counter drugs for humans, see Drugs.

Subscriptions to use online-hosted software are not taxable. Charges for maintenance or upgrades to online hosting software are not taxable, even if separately stated. Digital products are products provided to a customer electronically. Usually, a customer is given access to the product through the Internet or email.

Common examples include: Clothing for general use, see Clothing. Food (grocery items), see Food and Food Ingredients. Prescription and over-the-counter drugs for humans, see Drugs.

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

Sales of canned software - downloaded are subject to sales tax in Minnesota. Sales of custom software - delivered on tangible media are exempt from the sales tax in Minnesota. Sales of custom software - downloaded are exempt from the sales tax in Minnesota.

Digital goods, which are nontangible versions of tangible goods, such as e-books, streaming music, and online video games, are not taxable unless specifically included. Intangible personal property, such as stocks and bonds, are not subject to the sales tax.

Minnesota is a destination-based state. This means you're responsible for applying the sales tax rate determined by the ship-to address on all taxable sales.

Subscriptions to use online-hosted software are not taxable. Charges for maintenance or upgrades to online hosting software are not taxable, even if separately stated. Digital products are products provided to a customer electronically. Usually, a customer is given access to the product through the Internet or email.