In Minnesota, a Partnership Buy-Sell Agreement with Purchase on Death, Retirement, or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death is a legal contract that ensures a smooth transition of ownership interests in a partnership in the event of death, retirement, or withdrawal of a partner. Keywords: Minnesota, Partnership Buy-Sell Agreement, Purchase on Death, Retirement, Withdrawal, Partner, Life Insurance, Fund Purchase, Death. This type of agreement is particularly beneficial for partnerships as it provides a clear plan of action and financial security for all involved parties. By incorporating life insurance policies on each partner, the agreement ensures that funds will be readily available to buy out the interests of the departing partner's estate. Different variations of this agreement may exist based on the specific circumstances and preferences of the partners involved. Some common types of Minnesota Partnership Buy-Sell Agreements are: 1. Purchase on Death Agreement: This agreement outlines the terms and conditions for the purchase of a partner's interests in the event of their death. It ensures that the surviving partners have the necessary funds to buy out the deceased partner's share from their estate. 2. Retirement Agreement: This type of agreement addresses the situation when a partner chooses to retire and seeks to transfer their ownership interests to the remaining partners. It provides a method for valuing the retiring partner's share and allows for a smooth transfer of ownership. 3. Withdrawal Agreement: In cases where a partner decides to withdraw from the partnership for personal or business reasons, this agreement lays out the terms for the remaining partners to buy the departing partner's interests. It helps protect the continuity and stability of the partnership while ensuring a fair and equitable distribution of assets. Each of these agreements will incorporate life insurance policies on each partner to fund the purchase of the outgoing partner's share. The policies are typically structured so that the partnership pays the premiums, and in the event of a partner's death, the proceeds are used to buy their share from their estate. Overall, a Minnesota Partnership Buy-Sell Agreement with Purchase on Death, Retirement, or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death provides a crucial framework for partners to protect their financial interests and ensure the smooth continuation of their business.

Minnesota Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death

Description

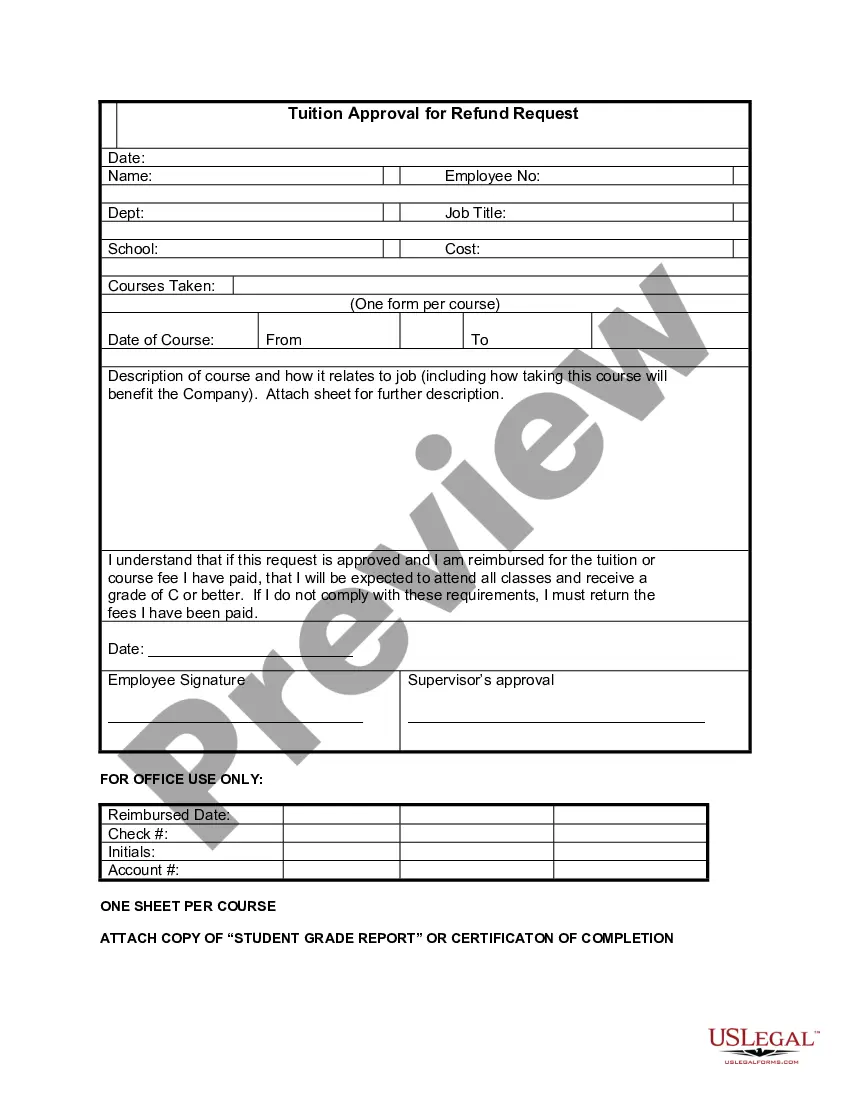

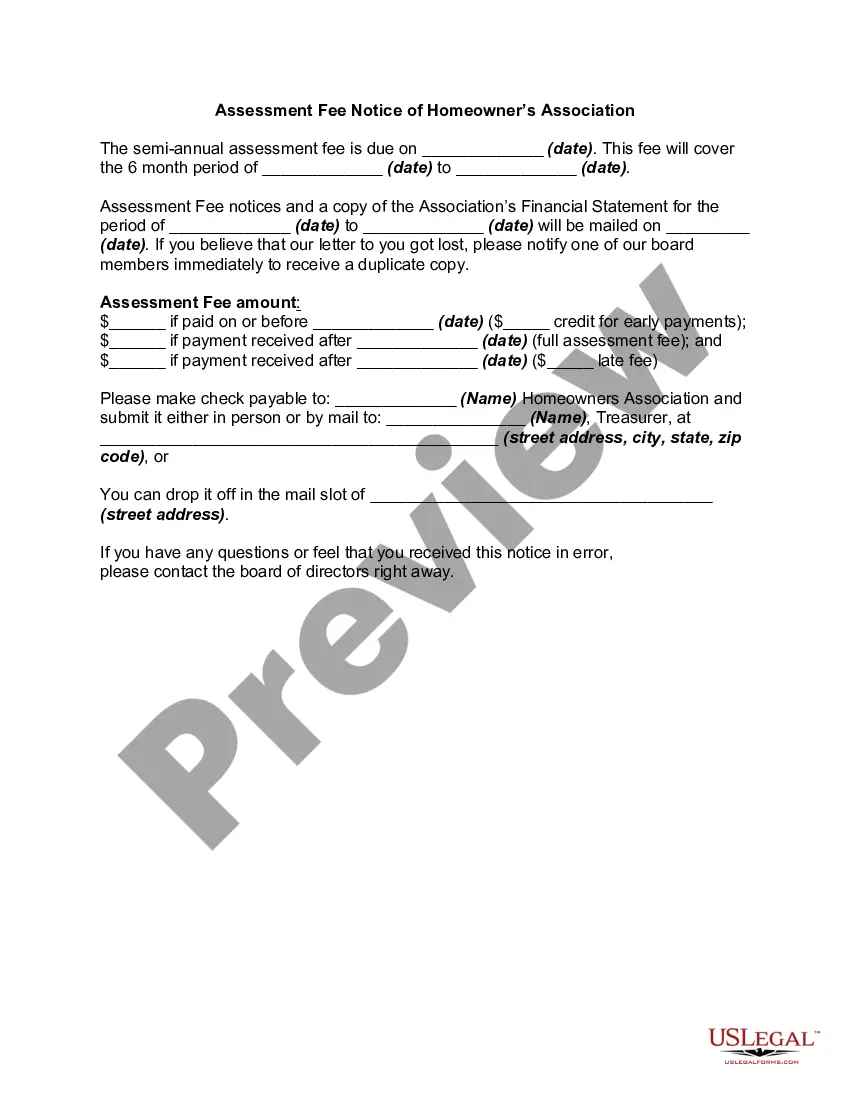

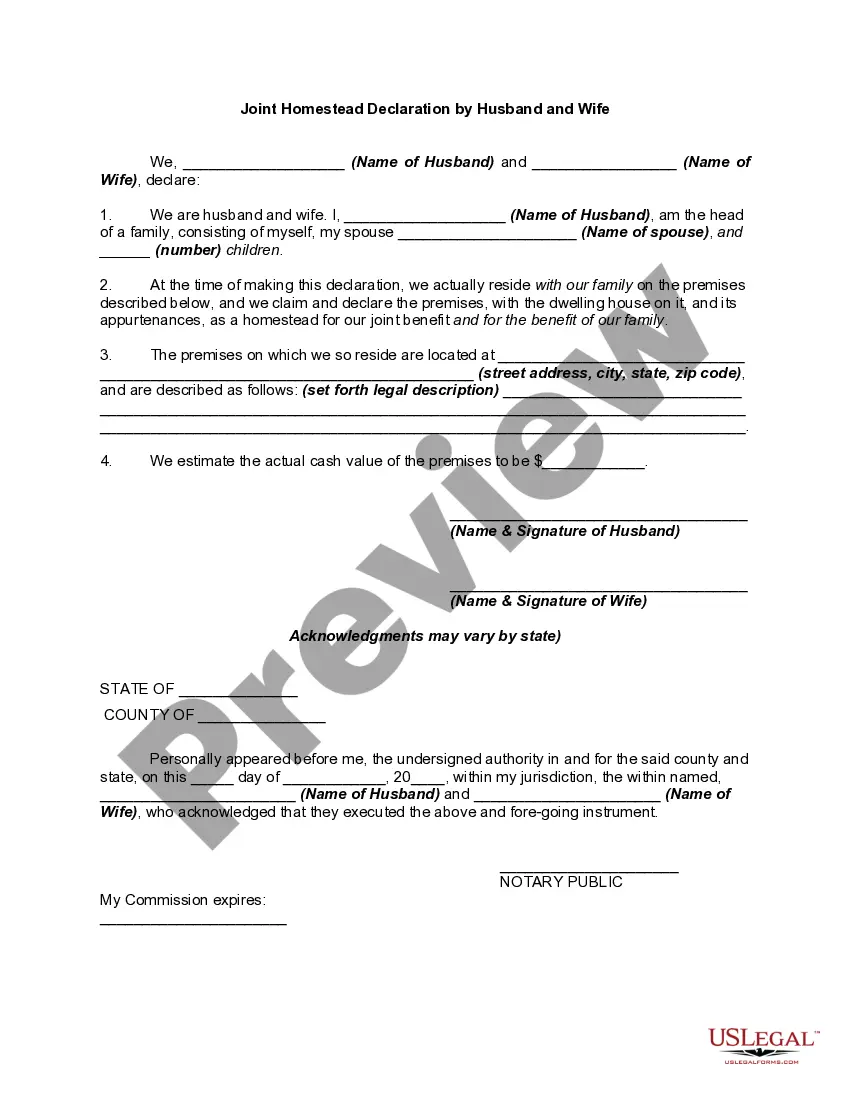

How to fill out Partnership Buy-Sell Agreement With Purchase On Death, Retirement Or Withdrawal Of Partner With Life Insurance On Each Partner To Fund Purchase In Case Of Death?

Finding the right lawful papers template could be a have a problem. Obviously, there are a variety of layouts available on the net, but how would you find the lawful type you want? Take advantage of the US Legal Forms web site. The service provides a large number of layouts, including the Minnesota Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death, that you can use for organization and personal requirements. All the varieties are checked out by experts and meet federal and state demands.

If you are currently registered, log in to the bank account and click the Down load switch to find the Minnesota Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death. Utilize your bank account to search through the lawful varieties you possess purchased formerly. Go to the My Forms tab of the bank account and get one more duplicate of the papers you want.

If you are a whole new customer of US Legal Forms, allow me to share easy directions that you should comply with:

- First, be sure you have selected the proper type to your city/state. You may look over the form while using Preview switch and study the form description to make sure this is the best for you.

- In case the type does not meet your needs, make use of the Seach area to discover the proper type.

- Once you are certain the form is proper, click on the Purchase now switch to find the type.

- Select the rates plan you need and enter in the needed information and facts. Create your bank account and purchase your order using your PayPal bank account or bank card.

- Opt for the submit format and obtain the lawful papers template to the gadget.

- Comprehensive, change and print out and indicator the received Minnesota Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death.

US Legal Forms may be the largest local library of lawful varieties for which you can discover numerous papers layouts. Take advantage of the service to obtain expertly-created documents that comply with state demands.

Form popularity

FAQ

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

Cross-purchase agreements allow remaining owners to buy the interests of a deceased or selling owner. Redemption agreements require the business entity to buy the interests of the selling owner.

Why is life insurance important? Buying life insurance protects your spouse and children from the potentially devastating financial losses that could result if something happened to you. It provides financial security, helps to pay off debts, helps to pay living expenses, and helps to pay any medical or final expenses.

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business. Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership.

Advantages of a Cross Purchase PlanWhen the owner(s) purchase the business interest of their departed or deceased owner, their basis increases by what they pay to the exiting owner or estate of the deceased owner. This then improves the tax consequences of their exit if it occurs during their lifetime.

Life insurance proceeds provide liquidity for ordinary living expenses and estate tax liability. Buy-sell agreements can be structured under various forms, including 1) entity redemption, 2) cross purchase, 3) cross endorsement, 4) wait-and-see and 5) a one-way agreement.

The smartest method for funding a buy-sell agreement is through life insurance. This ensures that funds are immediately available when a death occurs; plus, death benefit proceeds are generally income-tax free.

Each owner would pay the premiums and be the beneficiary of the policy. The face amount of the insurance would be calculated based on the other's ownership interest. Upon the death of one owner, the insurance proceeds would be used to purchase the ownership interests from the deceased owner's estate or family.

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

The business owners individually own the policies insuring each other's lives. When a business owner dies, the proceeds are paid to those surviving owners who hold one or more policies on the deceased owner, and these surviving owners buy the shares from the deceased owner's personal representative.