Minnesota Repossession Services Agreement for Automobiles is a legally binding contract between the lender or lien holder and the repossession services company in the state of Minnesota. This agreement outlines the terms, conditions, and obligations of both parties involved in the repossession process. Keywords: Minnesota, Repossession Services Agreement, Automobiles, lender, lien holder, repossession process The purpose of the Minnesota Repossession Services Agreement for Automobiles is to establish clear guidelines and procedures that adhere to the laws and regulations set forth by the state of Minnesota for the repossession of automobiles. It ensures that the repossession services company operates within the legal boundaries while providing their services. The agreement typically covers essential aspects such as the scope of services provided by the repossession company, responsibilities of both parties, compensation, procedures for repossessing vehicles, liability and indemnification, and dispute resolution. Types of Minnesota Repossession Services Agreement for Automobiles: 1. Voluntary Repossession Agreement: This type of agreement is entered into when the borrower voluntarily surrender their vehicle to the lender due to defaults on the loan or inability to make payments. The repossession company operates with the cooperation of the borrower, making the repossession process smoother. 2. Involuntary Repossession Agreement: In this agreement, the repossession services company carries out the repossession process without the consent of the borrower. It is typically employed when the borrower fails to meet the loan obligations such as missed payments or defaults. The agreement outlines the steps the repossession company can take to repossess the vehicle legally and responsibly. 3. Redemption Repossession Agreement: This agreement is applicable when the borrower wishes to redeem their repossessed vehicle by paying off the outstanding loan balance, accrued interest, and repossession expenses within a specified period. It sets the terms and conditions for the redemption process, including the payment deadline, additional charges, and vehicle release procedures. 4. Sales Repossession Agreement: When the repossessed vehicle is sold to a third party to recover the loan balance, a Sales Repossession Agreement is drafted. It outlines the terms of the vehicle sale, including the sales price, title transfer obligations, and potential liability of the lender or repossession services company. In conclusion, a Minnesota Repossession Services Agreement for Automobiles is a crucial legal document that governs the repossession process in the state. It ensures that both the lender and the repossession services company adhere to the law while performing their roles and responsibilities. The agreement can be tailored to various situations depending on whether the repossession is voluntary or involuntary, and whether the borrower wishes to redeem the vehicle or if it needs to be sold to recover the loan balance.

Minnesota Repossession Laws

Description repo car definition

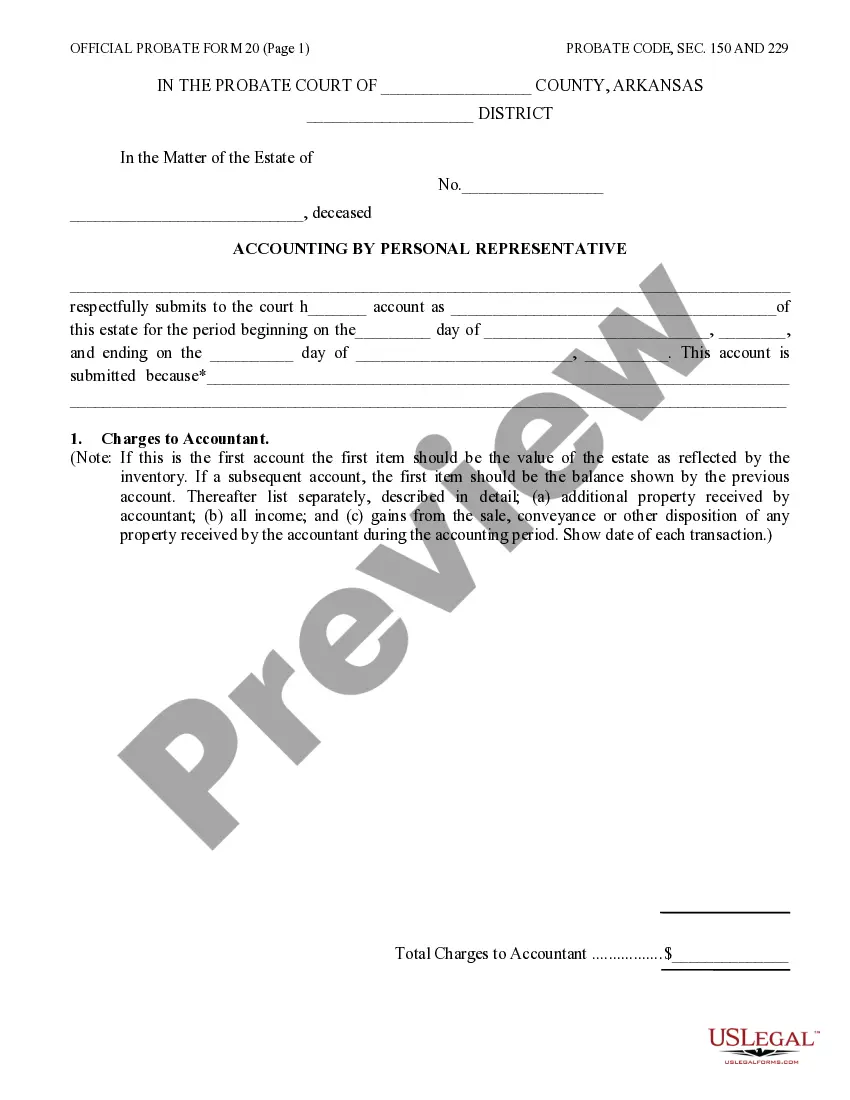

How to fill out Minnesota Repossession Services Agreement For Automobiles?

US Legal Forms - one of several most significant libraries of legitimate kinds in the States - delivers a wide range of legitimate papers web templates it is possible to download or print out. Making use of the internet site, you can get thousands of kinds for business and person reasons, sorted by classes, states, or key phrases.You can find the most recent types of kinds just like the Minnesota Repossession Services Agreement for Automobiles in seconds.

If you have a subscription, log in and download Minnesota Repossession Services Agreement for Automobiles from your US Legal Forms library. The Acquire button can look on each and every develop you perspective. You have access to all previously delivered electronically kinds inside the My Forms tab of your accounts.

In order to use US Legal Forms for the first time, here are straightforward guidelines to help you started off:

- Be sure to have selected the best develop to your city/county. Go through the Preview button to review the form`s content. Browse the develop outline to ensure that you have chosen the right develop.

- In case the develop does not match your specifications, utilize the Lookup industry near the top of the screen to discover the the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, pick the prices strategy you want and give your credentials to sign up on an accounts.

- Process the purchase. Utilize your charge card or PayPal accounts to complete the purchase.

- Pick the format and download the form on your own product.

- Make alterations. Fill up, change and print out and signal the delivered electronically Minnesota Repossession Services Agreement for Automobiles.

Every single design you added to your money lacks an expiry particular date and is yours forever. So, if you want to download or print out another backup, just proceed to the My Forms portion and click in the develop you want.

Obtain access to the Minnesota Repossession Services Agreement for Automobiles with US Legal Forms, probably the most comprehensive library of legitimate papers web templates. Use thousands of skilled and condition-certain web templates that meet your organization or person needs and specifications.

voluntary repossession georgia Form popularity

letter of repossession of vehicle Other Form Names

FAQ

Laws of Minnesota is an annual compilation and is often referred to as the "session laws." It contains all the acts of the Legislature as passed in each year's legislative session.

In Minnesota, this is called a Cobb letter. The letter must give you notice that although your lender has accepted late payments from you in the past without repossessing, it now requires you to strictly comply with the payment due dates or it may repossess. This notice requirement may be unique to Minnesota.

A repossession order is a legal document that grants the lender the right to repossess an asset, which can include a vehicle. Once the repo takes place, a repossession is listed on your credit reports for seven years and lowers your credit score.

Minnesota has no cure notice requirement and no statute (like the one in Wisconsin) has altered the common law definition of default. As a result, if Wisconsin law governs the definition of default, Credit Acceptance prematurely sent the cure notice.

If your car is repossessed, the lender must give you certain notices after the repossession and after it sells the car. But in most cases, it doesn't have to give you notice before repossessing the vehicle.

Hiding Your Car From the Repo Company Typically, recovery companies attempt to find your car for up to 30 days. Some borrowers attempt to keep their car in a locked garage during the search, which is one of the only places where a recovery company can't take your vehicle from.

You can avoid repossession by reinstating or refinancing the loan, selling/surrendering your car, or contacting your lender to ask for other options. If you're having issues handling your car loan or other debt, bankruptcy might be a good option for you.

What is Repossession? The contractual right of repossession is a process where a creditor can legally take possession of a specific asset or property if a debtor fails to meet their obligations on a contract. This right of repossession exists in many different sorts of agreements and transactions.

In Minnesota, as well as many other states, the agent has the right to seize your vehicle without any notice and at any time, late or early, in the day or night. The repossession agent is not required to have a court order, as long as they do not breach the peace.