Title: Understanding Minnesota Final Notice of Past Due Account: Types and Description Introduction: Minnesota Final Notice of Past Due Account is an official document sent by creditors or collection agencies to individuals or businesses in the state of Minnesota to notify them about outstanding debts. It serves as a final notification before legal actions are taken to recover the overdue amount. This article provides a detailed description of what a Minnesota Final Notice of Past Due Account entails, its purpose, and potential consequences. Additionally, it explores different types of such notices commonly encountered in Minnesota. Key Points: 1. Purpose of Minnesota Final Notice of Past Due Account: The primary aim of a Minnesota Final Notice of Past Due Account is to urgently communicate the overdue account status to the debtor. The notice serves as a final attempt to collect the outstanding debt before initiating legal proceedings. 2. Relevance to Minnesota: This notice is specific to the state of Minnesota, adhering to the governing laws and regulations related to debt collection within the state's jurisdiction. It highlights the debtor's obligation to settle the debt in accordance with Minnesota state laws. 3. Contents of a Minnesota Final Notice of Past Due Account: The notice typically includes essential information such as: — Creditor's contact details, including name, address, phone number, and email. — Debtor's information, including name, address, and contact details. — Detailed explanation of the outstanding debt, including the primary account details and the amount owed (including any added interest or penalties). — A clear deadline for payment or response to rectify the default. — Consequences of non-payment or failure to respond may be mentioned, such as legal action, credit reporting, or potential asset seizure. 4. Different Types of Minnesota Final Notice of Past Due Account: — First Final Notice: Usually the initial notification sent to the debtor after the account becomes past due. — Second Final Notice: Sent if the debtor fails to respond or settle the outstanding debt within the time frame specified in the first final notice. — Final Legal Notice: If the debtor fails to respond or remedy the default even after the second final notice, the creditor may send a final legal notice, indicating their intent to proceed with legal actions to recover the debt. 5. Consequences of Ignoring the Notice: Failure to respond or settle the debt within the stipulated time frame may result in severe consequences, including: — Legal action: The creditor may initiate legal proceedings to recover the debt, potentially involving court hearings and judgments. — Asset seizure: Depending on the court's decision, the creditor may obtain a judgment enabling them to seize certain assets of the debtor to satisfy the outstanding debt. — Credit reporting: Non-payment or default may be reported to credit bureaus, negatively impacting the debtor's credit score and future creditworthiness. Conclusion: A Minnesota Final Notice of Past Due Account is a crucial communication tool used by creditors in the state. It highlights the debtor's obligation to settle outstanding debts and warns about possible legal consequences if ignored. It is essential for debtors to promptly address the notice and take necessary actions to avoid the potentially detrimental effects on their financial well-being.

Minnesota Final Notice of Past Due Account

Description

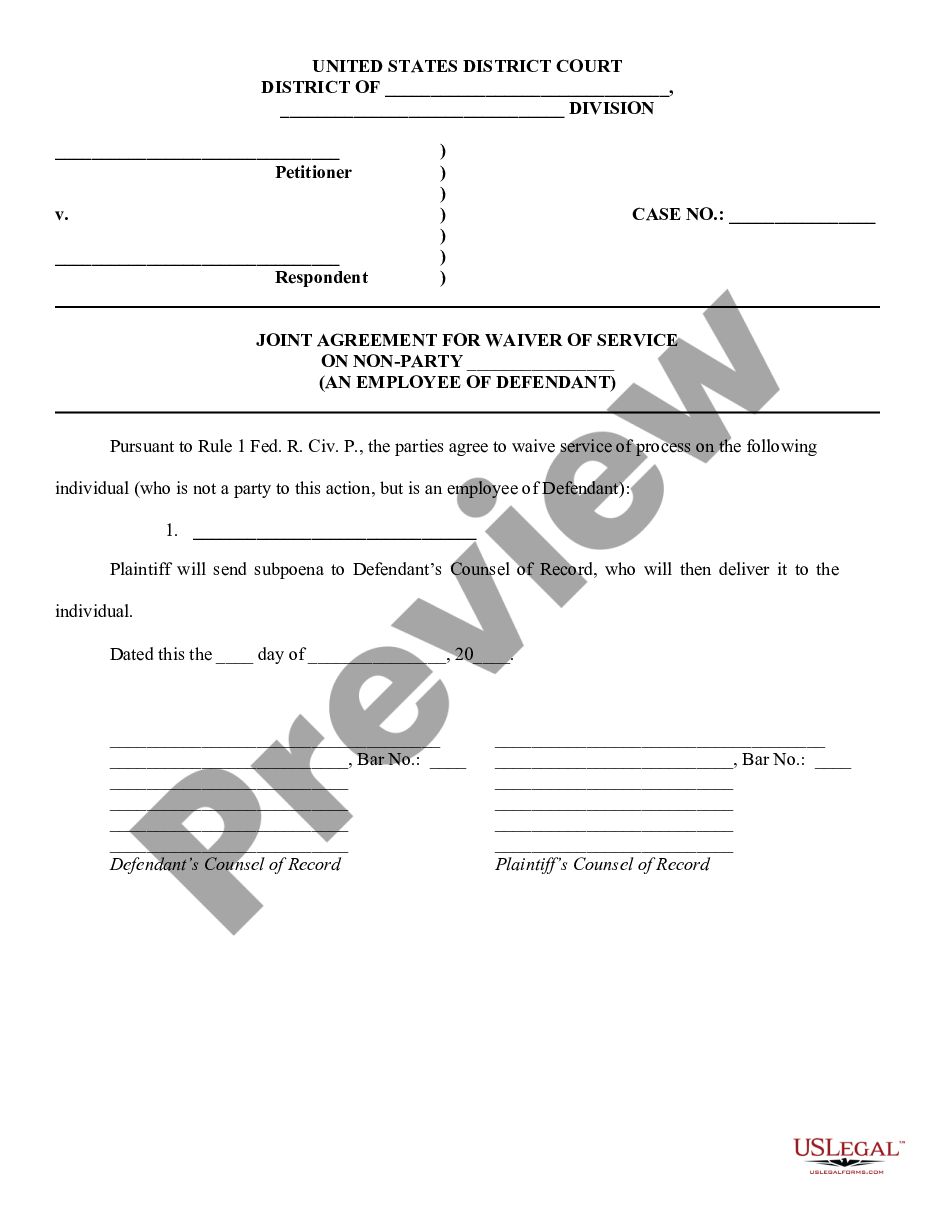

How to fill out Minnesota Final Notice Of Past Due Account?

US Legal Forms - one of many biggest libraries of authorized forms in the United States - provides a wide range of authorized document web templates it is possible to download or print out. Using the web site, you will get a large number of forms for enterprise and personal purposes, categorized by groups, suggests, or keywords and phrases.You will discover the newest types of forms much like the Minnesota Final Notice of Past Due Account in seconds.

If you currently have a membership, log in and download Minnesota Final Notice of Past Due Account from your US Legal Forms catalogue. The Obtain key will appear on every form you look at. You have access to all in the past saved forms from the My Forms tab of your own profile.

If you wish to use US Legal Forms initially, allow me to share straightforward recommendations to help you started out:

- Make sure you have selected the right form for your area/county. Click on the Review key to analyze the form`s content. Look at the form explanation to actually have chosen the appropriate form.

- When the form does not suit your requirements, use the Search area at the top of the display screen to find the the one that does.

- If you are pleased with the form, affirm your choice by clicking on the Acquire now key. Then, pick the pricing plan you want and offer your qualifications to register to have an profile.

- Method the purchase. Utilize your charge card or PayPal profile to complete the purchase.

- Select the format and download the form in your gadget.

- Make changes. Complete, change and print out and signal the saved Minnesota Final Notice of Past Due Account.

Each format you added to your account lacks an expiry time and is your own permanently. So, if you want to download or print out an additional backup, just visit the My Forms portion and click in the form you will need.

Get access to the Minnesota Final Notice of Past Due Account with US Legal Forms, the most extensive catalogue of authorized document web templates. Use a large number of expert and condition-specific web templates that satisfy your organization or personal needs and requirements.

Form popularity

FAQ

5 years (to file a lien. Lien remains in place for 10 years.) As you can see in the chart above, debt collectors in Minnesota have between four and six years from the last payment to pursue legal action, depending on the type of debt. After the statute of limitations runs out, the debt becomes known as time-barred.

120 - 180 Days Past Due After 120 days, in addition to any other steps made to recover their losses, the lender may turn your outstanding debt over to a collection agency. Once that happens, you can no longer work with your original creditor to make good on the debt.

The time limits for civil claims and other actions in Minnesota vary from two years for personal injury claims to 10 years for judgments. Fraud, injury to personal property, and trespassing claims have a six-year statute of limitations, as do both written and oral contracts.

Minnesota Answer to Summons Forms.Steps to Respond to a Debt Collection Case in Minnesota.Create an Answer Document.Respond to Each Allegation in the Complaint.Determine Whether You Can Assert an Affirmative Defense.File the answer with the court and serve the plaintiff.What is SoloSuit?More items...?

In California, the statute of limitations for consumer debt is four years. This means a creditor can't prevail in court after four years have passed, making the debt essentially uncollectable.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.

The statute of limitations for bringing a lawsuit for breach of contract under Minnesota law is six (6) years. This means that a creditor or debt collector can sue you anytime within six (6) years from the date of your last purchase or last payment, whichever was later.

Once a judgment is docketed, a judgment lien in Minnesota generally lasts for 10 years.

Minnesota Statutes of Limitations on Debt As you can see in the chart above, debt collectors in Minnesota have between four and six years from the last payment to pursue legal action, depending on the type of debt. After the statute of limitations runs out, the debt becomes known as time-barred.