Minnesota Guaranty without Pledged Collateral is a type of financial agreement that provides a form of guarantee in which collateral is not required or pledged by the guarantor. This means that the guarantor is legally bound to fulfill the obligations of the debtor without having any assets or property held as security. Minnesota Guaranty without Pledged Collateral serves as an assurance for lenders or creditors who may feel more confident extending credit to borrowers when they have a guarantor backing them up. In the event that the borrower defaults on their obligations, the guarantor becomes responsible for repaying the debt or fulfilling the terms of the agreement. One common type of Minnesota Guaranty without Pledged Collateral is the Personal Guaranty. This occurs when an individual agrees to take responsibility for the debt of another person, typically in a personal or business loan context. The guarantor's creditworthiness and financial standing are evaluated by the lender, ensuring that they have the capacity to fulfill the obligations of the borrower. Another type of Minnesota Guaranty without Pledged Collateral is the Corporate Guaranty. This is a similar concept to the Personal Guaranty, but it involves a corporation or business entity assuming the role of guarantor. In this case, the corporation's financial strength and ability to honor the obligations of the debtor are assessed by the lender. It's important to note that Minnesota Guaranty without Pledged Collateral does not absolve the borrower from their liability. Instead, it provides an added layer of security for the lender by having a guarantor who can be held accountable in case of default. In conclusion, Minnesota Guaranty without Pledged Collateral is a financial arrangement wherein an individual or corporate entity agrees to assume the responsibility for repaying a debt or fulfilling the terms of an agreement without the need for collateral. Personal Guaranty and Corporate Guaranty are two types of this arrangement commonly found in Minnesota.

Minnesota Guaranty without Pledged Collateral

Description

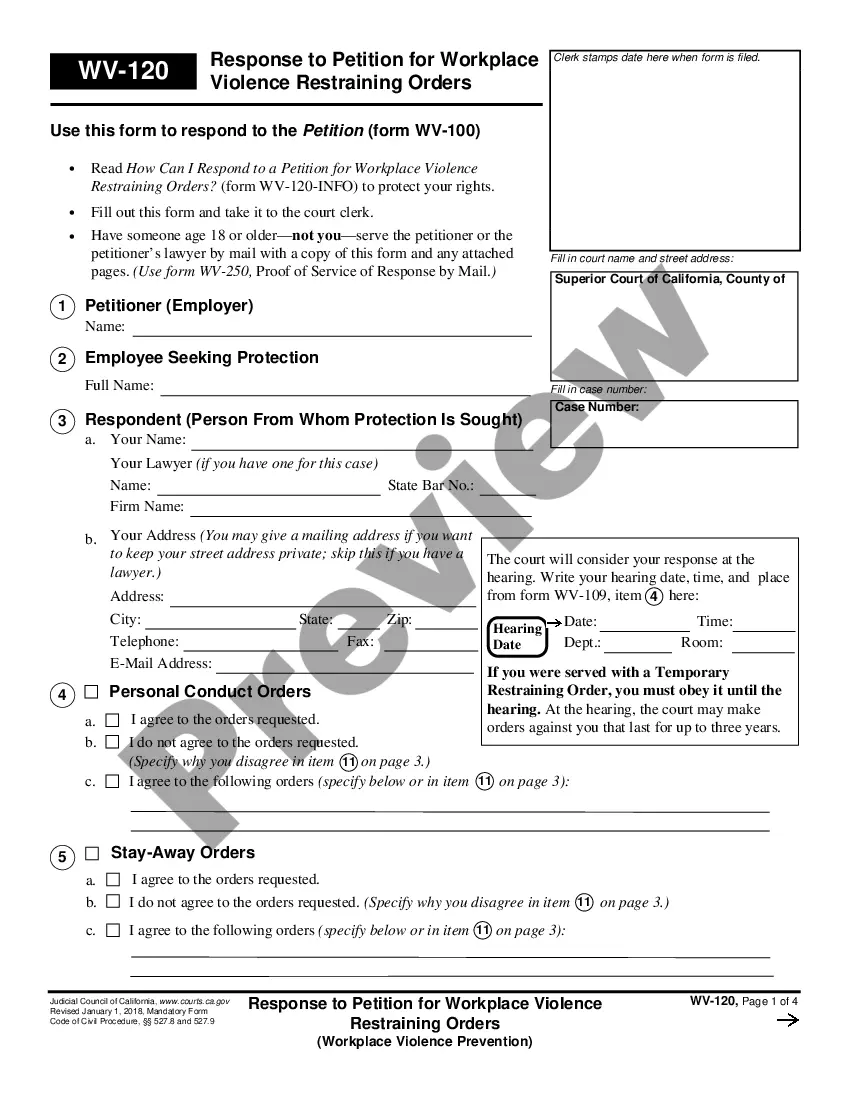

How to fill out Minnesota Guaranty Without Pledged Collateral?

Choosing the right legitimate papers design can be a battle. Of course, there are a lot of themes available on the net, but how do you get the legitimate kind you require? Use the US Legal Forms internet site. The services provides 1000s of themes, like the Minnesota Guaranty without Pledged Collateral, that can be used for company and private needs. Each of the types are examined by professionals and meet federal and state specifications.

In case you are currently listed, log in to the account and click the Obtain switch to get the Minnesota Guaranty without Pledged Collateral. Utilize your account to look with the legitimate types you possess acquired in the past. Check out the My Forms tab of your own account and obtain another version in the papers you require.

In case you are a new consumer of US Legal Forms, listed here are straightforward guidelines so that you can comply with:

- Initially, make certain you have chosen the appropriate kind for your personal town/county. You are able to look through the shape using the Preview switch and read the shape description to ensure it is the right one for you.

- When the kind does not meet your expectations, utilize the Seach industry to obtain the proper kind.

- When you are certain that the shape is proper, go through the Buy now switch to get the kind.

- Opt for the costs plan you would like and enter the required information and facts. Create your account and purchase your order with your PayPal account or Visa or Mastercard.

- Select the submit structure and obtain the legitimate papers design to the gadget.

- Full, edit and printing and sign the obtained Minnesota Guaranty without Pledged Collateral.

US Legal Forms is the greatest library of legitimate types for which you can discover a variety of papers themes. Use the service to obtain expertly-manufactured files that comply with express specifications.

Form popularity

FAQ

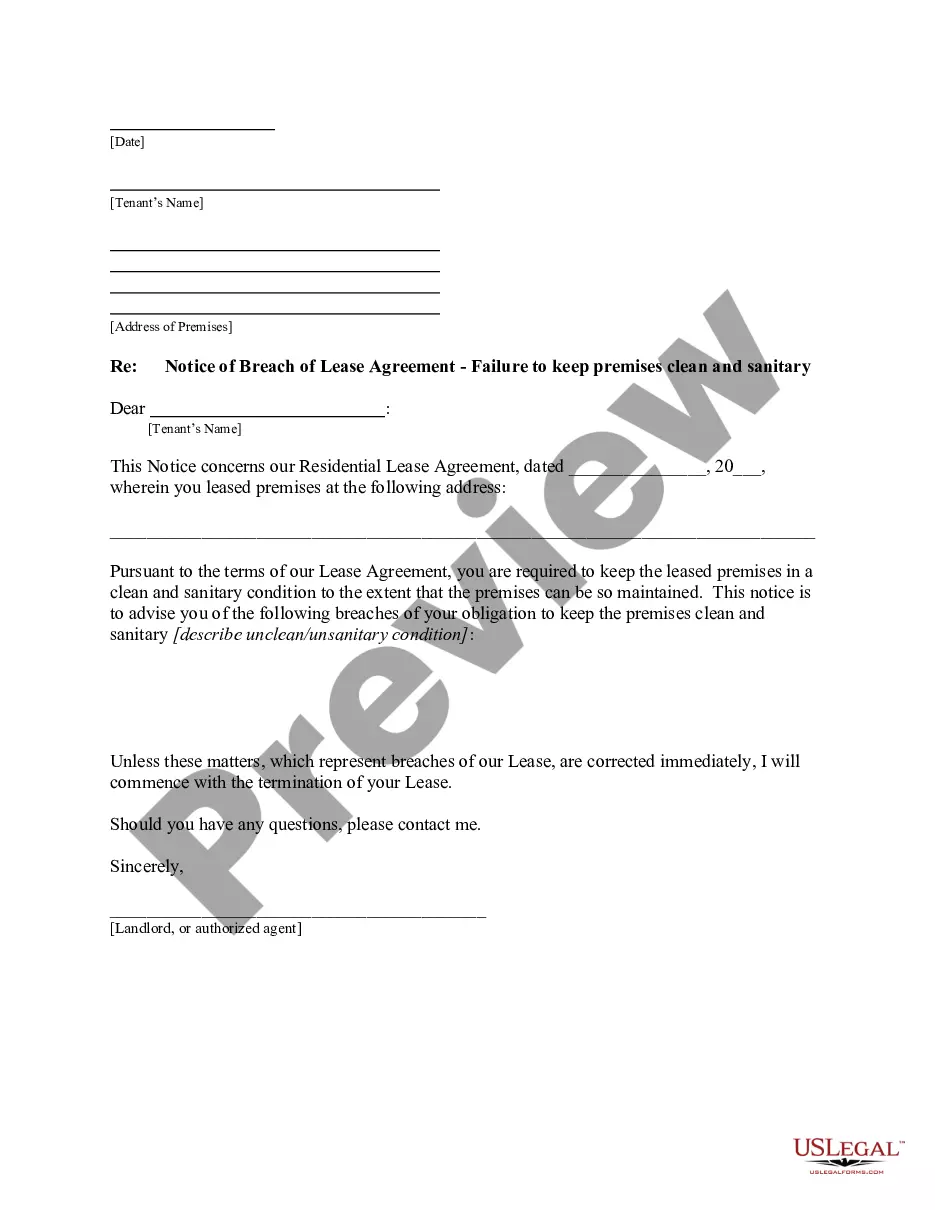

The main disadvantage of a personal guarantee is very simple. If your business becomes unable to pay its debt, you become personally liable for it. That means the lender can pursue you personally and that puts your personal assets (including your home) at risk.

A personal guarantee is an unsecured written promise from a business owner and or business executive guaranteeing payment on an equipment lease or loan in the event the business does not pay. Since it is unsecured, a personal guarantee is not tied to a specific asset.

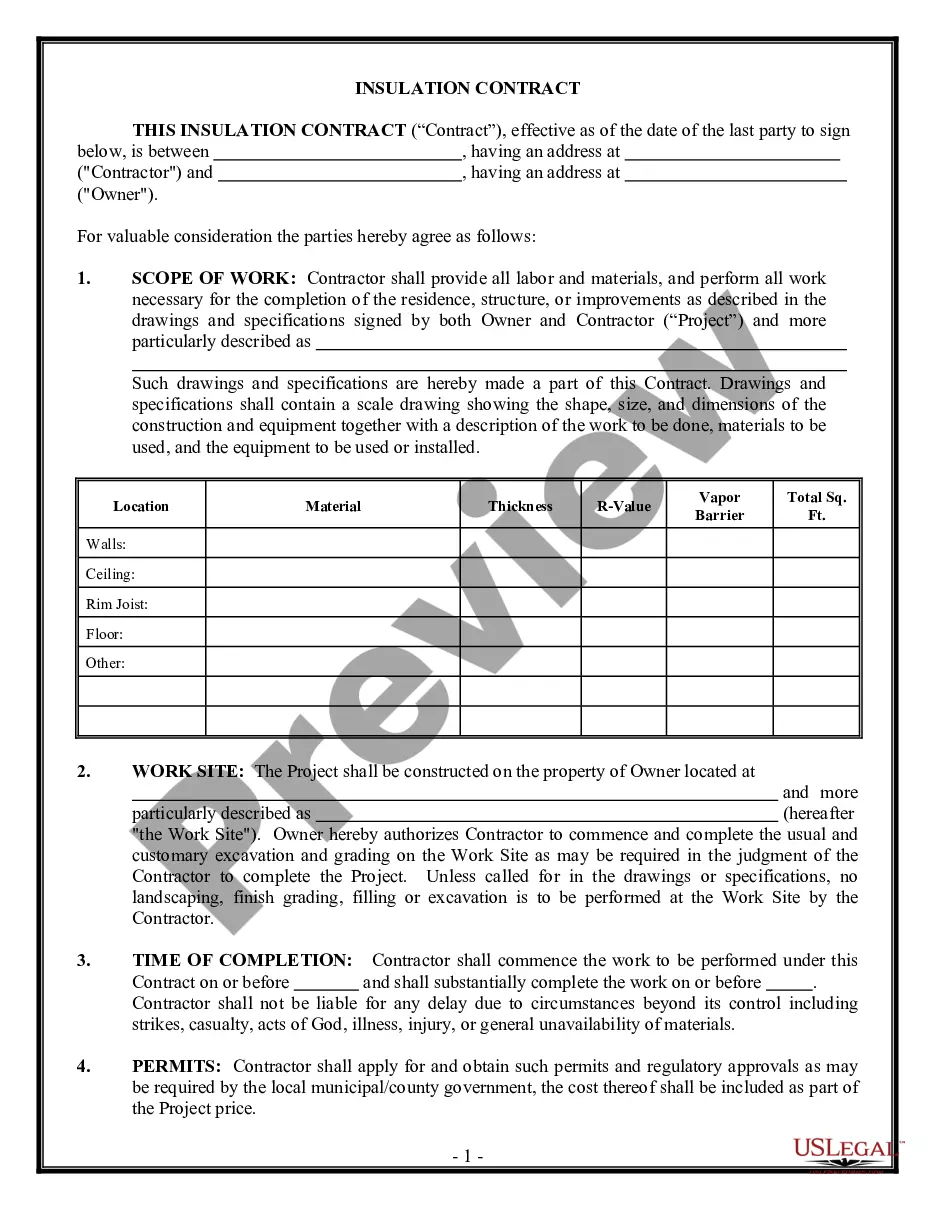

Pledged-Asset Mortgage Homebuyers can sometimes pledge assets, such as securities, to lending institutions to reduce or eliminate the necessary down payment. With a traditional mortgage, the house itself is the collateral for the loan.

In writing The guarantee must be evidenced in writing to be enforceable. Signed The document must be signed by the guarantor or their authorised agent. Their name can be written or printed. Secondary liability The document must establish that the guarantor has secondary liability for the debt.

A personal guarantee is an agreement that allows a lender to go after your personal assets if your company, relative, or friend defaults on a loan. For instance, if your business goes under, the creditor can sue you to collect any outstanding balance.

A personal guarantee is an agreement between a business owner and lender, stating that the individual who signs is responsible for paying back a loan should the business ever be unable to make payments.

Lenders consider the value of the property and other possessions that you're pledging as security against the loan. In the case of a mortgage, the collateral is the home you 're buying. If you don't pay your mortgage, the mortgage company could take possession of your home, known as foreclosure.

Hypothecation. Hypothecation is another term for pledging collateral to secure or guarantee a loan or other debt obligation. The borrower, or hypothecator, pledges, or hypothecates, property to the lender. The creditor then has a non-possessory claim against the hypothecated assets.

7 Ways to Avoid a Personal GuaranteeBuy insurance.Raise the interest rate.Increase Reporting.Increased the Frequency of Payments.Add a Fidelity Certificate.Limit the Guarantee Time Period.Use Other Collateral.26-Mar-2015

Collateral is an asset or property that an individual or entity offers to a lender as security for a loan. It is used as a way to obtain a loan, acting as a protection against potential loss for the lender should the borrower default.