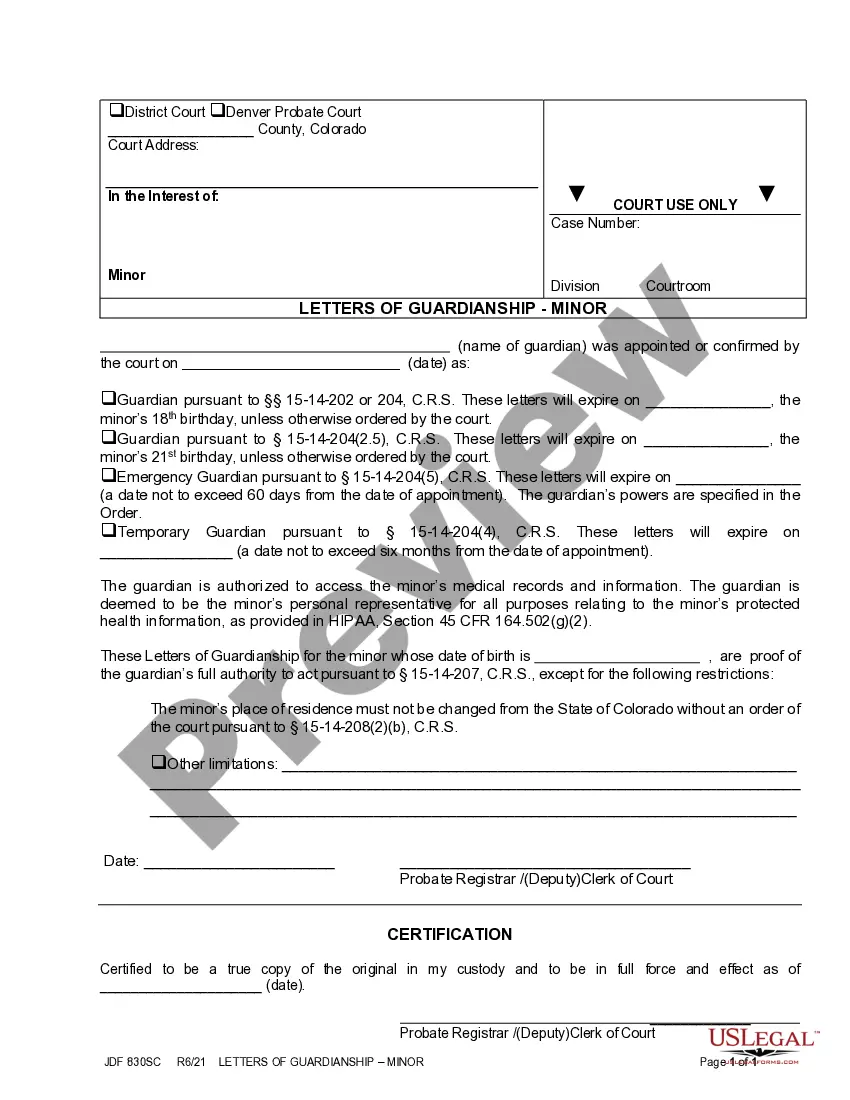

This form is a business type form that is formatted to allow you to complete the form using Adobe Acrobat or Word. The word files have been formatted to allow completion by entry into fields. Some of the forms under this category are rather simple while others are more complex. The formatting is worth the small cost.

Minnesota Yearly Expenses by Quarter refer to the breakdown of financial costs incurred in the state of Minnesota on a quarterly basis. These expenses encompass various aspects of living, working, and businesses operations within the state. Understanding Minnesota Yearly Expenses by Quarter is crucial for individuals, families, and businesses in planning their budgets and managing their financial obligations in this region. 1. Personal Expenses: Personal expenses in Minnesota Yearly Expenses by Quarter include costs related to housing, transportation, food, healthcare, education, and entertainment. These expenses vary seasonally and understanding their patterns helps in effective budget management and long-term financial planning. 2. Business Expenses: Minnesota Yearly Expenses by Quarter for businesses encompass costs associated with utilities, rent or mortgage payments for office spaces or manufacturing facilities, employee wages, insurance, taxes, and marketing initiatives. These expenses fluctuate throughout the year due to market conditions, seasonal demands, and operational requirements. 3. Education Expenses: Minnesota Yearly Expenses by Quarter also include educational costs for students and families. This may involve tuition fees, textbooks, transportation, and other associated expenses. Understanding the fluctuations in these costs is essential for families planning their children's education. 4. Government Expenses: Minnesota Yearly Expenses by Quarter also encompass government expenditures at various levels, such as state and local government budgets. These expenses comprise infrastructure developments, public services, healthcare initiatives, public safety, and social welfare programs. Tracking these expenses helps citizens assess the utilization of tax dollars and make informed decisions regarding public policies. 5. Seasonal Expenses: Minnesota Yearly Expenses by Quarter also take into account seasonal variations in costs. For instance, winter-related expenses like heating bills, snow removal, and warm clothing are more significant during the first and fourth quarters. Similarly, summer expenses related to outdoor activities, vacationing, and energy usage may peak during the second and third quarters. 6. Miscellaneous Expenses: Minnesota Yearly Expenses by Quarter may also include unforeseen or miscellaneous expenses that are not specifically categorized. These can vary significantly among individuals, families, and businesses and may involve expenses such as repairs, emergency medical costs, legal fees, or unexpected events. Understanding Minnesota Yearly Expenses by Quarter is vital for effective financial planning, budgeting, and navigating the diverse costs associated with living, working, and operating a business in Minnesota. It allows individuals, families, and businesses to make informed decisions, allocate resources efficiently, and ensure financial stability throughout the year.