Minnesota Merchandise Return Sheet

Description

How to fill out Merchandise Return Sheet?

US Legal Forms - one of the most prominent repositories of legal documents in the United States - provides a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Minnesota Merchandise Return Sheet in just moments.

If you already hold a membership, Log In and download the Minnesota Merchandise Return Sheet from the US Legal Forms database. The Download button will be visible on every form you examine. You can access all previously downloaded documents in the My documents section of your account.

Select the format and download the form onto your device.

Make adjustments. Fill out, modify, print, and sign the downloaded Minnesota Merchandise Return Sheet. Each template you add to your account has no expiration date and belongs to you indefinitely. Thus, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

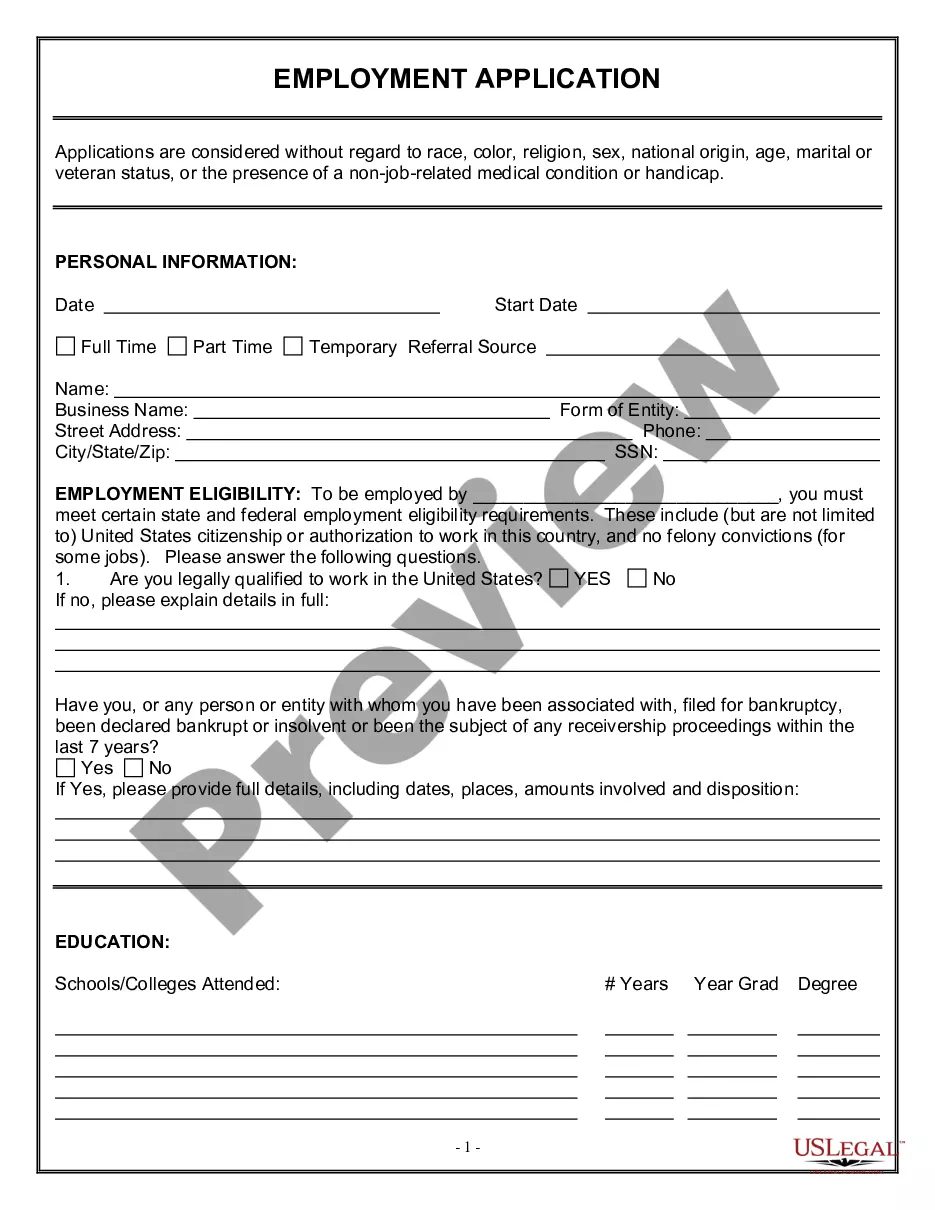

- Ensure you have selected the right form for your region/state. Click the Preview button to review the form’s details.

- Read the form description to confirm that you have chosen the correct form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that suits you.

- If you are satisfied with the form, validate your choice by pressing the Purchase now button.

- Next, select the pricing plan you prefer and provide your credentials to create an account.

- Process the payment. Use your Visa or Mastercard or PayPal account to complete the purchase.

Form popularity

FAQ

Do not mail the federal and state returns together in the same envelope! They do not go to the same place. When you print out your returns there should be instructions that tell you where to mail them. When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2's or any 1099's.

Baby clothing (including receiving blankets used as clothing) is not taxable. Or, as Minnesota sales and use tax rules put it, baby blankets and receiving blankets must be used as babies' clothing to be exempt from sales tax.

The 2021 Minnesota State Income Tax Return forms for Tax Year 2021 (Jan. 1 - Dec. 31, 2021) can be e-Filed together with the IRS Income Tax Return by April 18, 2022.

You can make payments for taxes and fees online, from your bank account, or in person. If you received a bill from the Minnesota Department of Revenue and cannot pay in full, you may request an installment plan. For more information, see Payment Agreements. You may make a payment directly from your bank account.

You have three options for filing and paying your Minnesota sales tax:File online File online at the Minnesota Department of Revenue. You can remit your payment through their online system.File by phone Call 1-800- 570-3329 to file by touch-tone phone.AutoFile Let TaxJar file your sales tax for you.

You have three options for filing and paying your Minnesota sales tax:File online File online at the Minnesota Department of Revenue. You can remit your payment through their online system.File by phone Call 1-800- 570-3329 to file by touch-tone phone.AutoFile Let TaxJar file your sales tax for you.

Yes. Wisconsin requires a complete copy of your federal return. Payment If you owe an amount with your return, paper clip your payment to the front of Form 1, unless you are paying by credit card or online.

When mailing your return: You must include a copy of your federal income tax return (including schedules) and any income tax returns you filed with other states.

If you are a full-year Minnesota resident, you must file a Minnesota income tax return if your income meets the state's minimum filing requirement. (See the table on this page.) If you are a part-year resident or nonresident, you must file if your Minnesota gross income meets the state's minimum filing requirement.

Common examples include: Clothing for general use, see Clothing. Food (grocery items), see Food and Food Ingredients. Prescription and over-the-counter drugs for humans, see Drugs....For more information, see:Personal Services.Professional Services.Taxable Services.