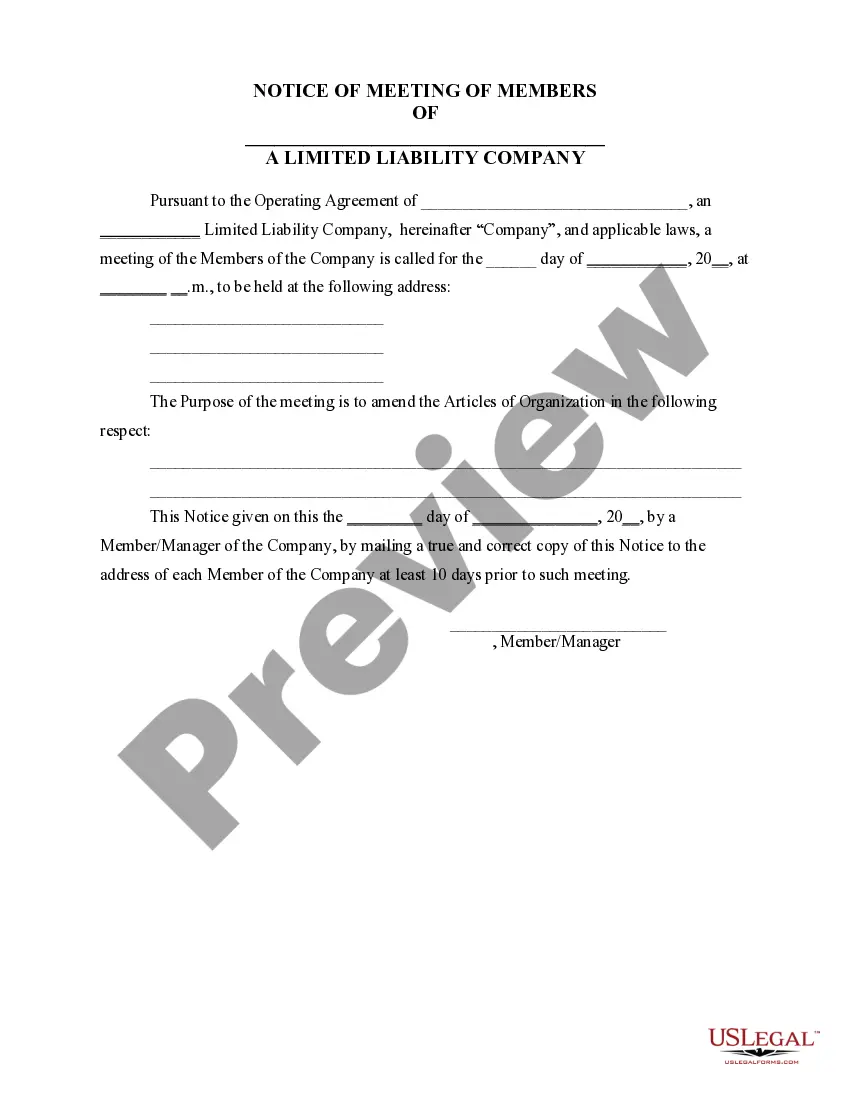

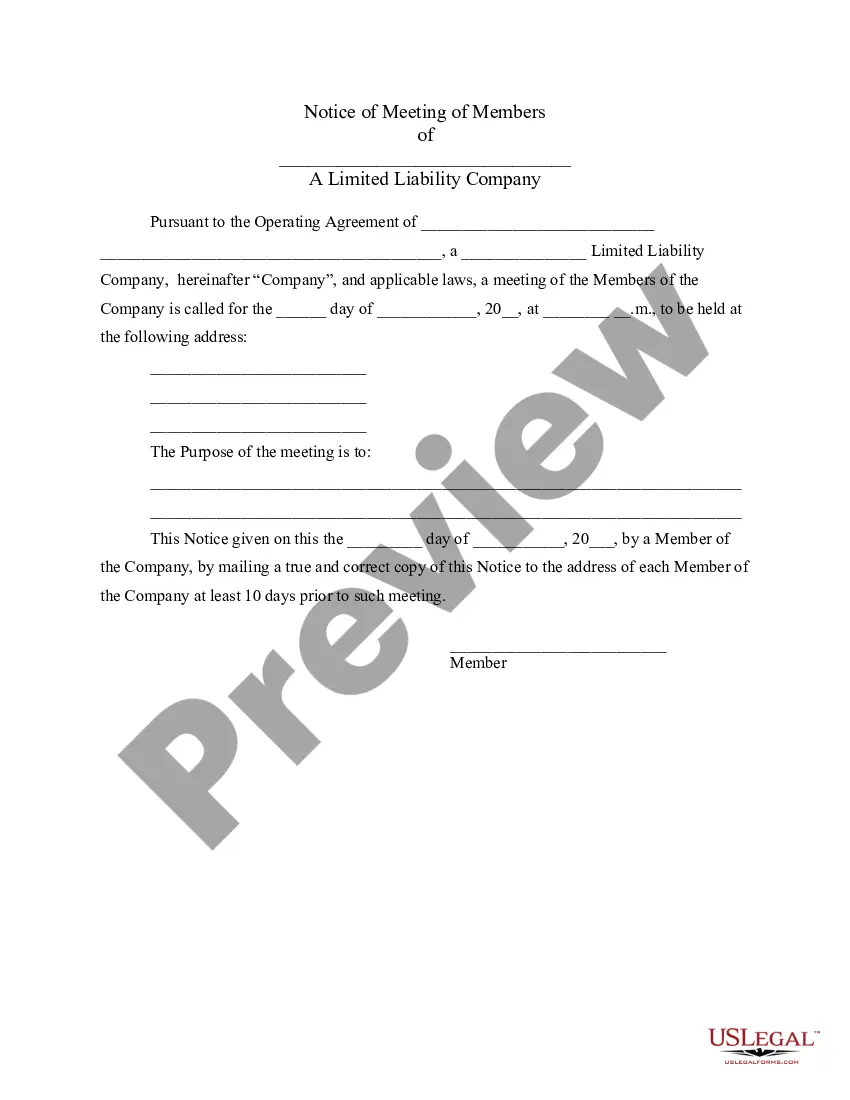

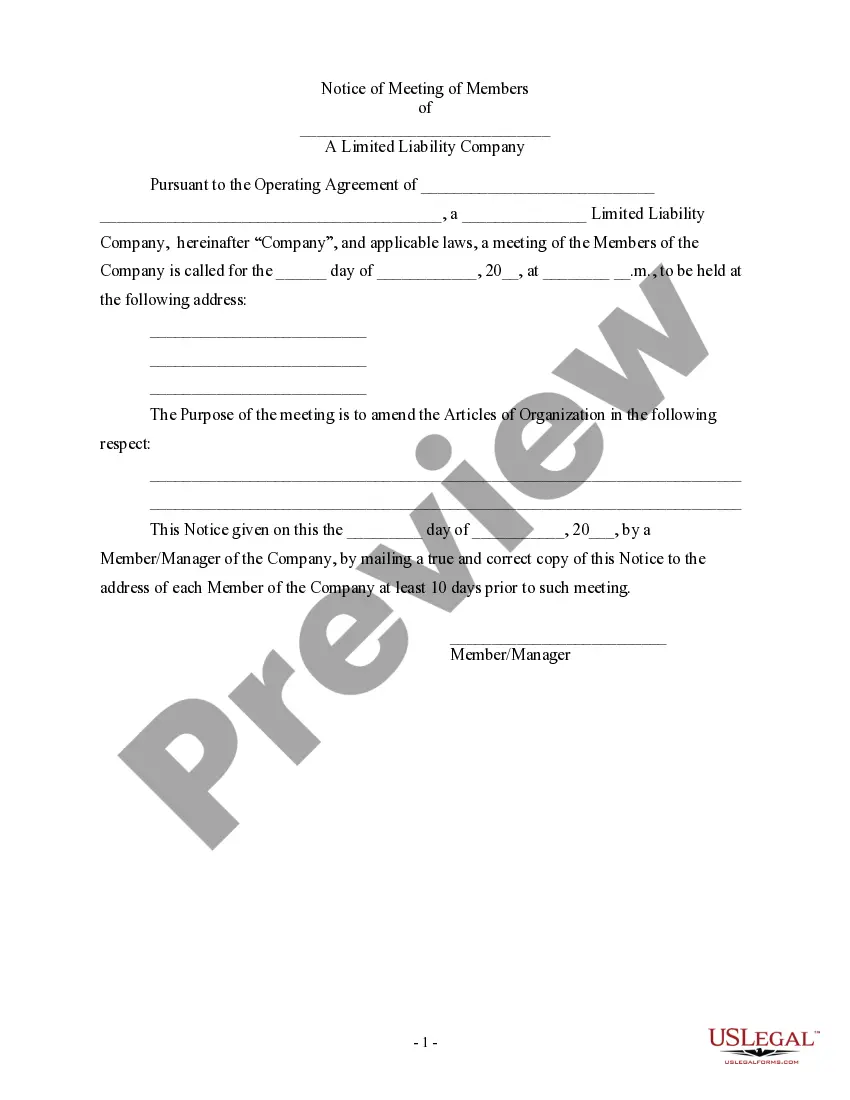

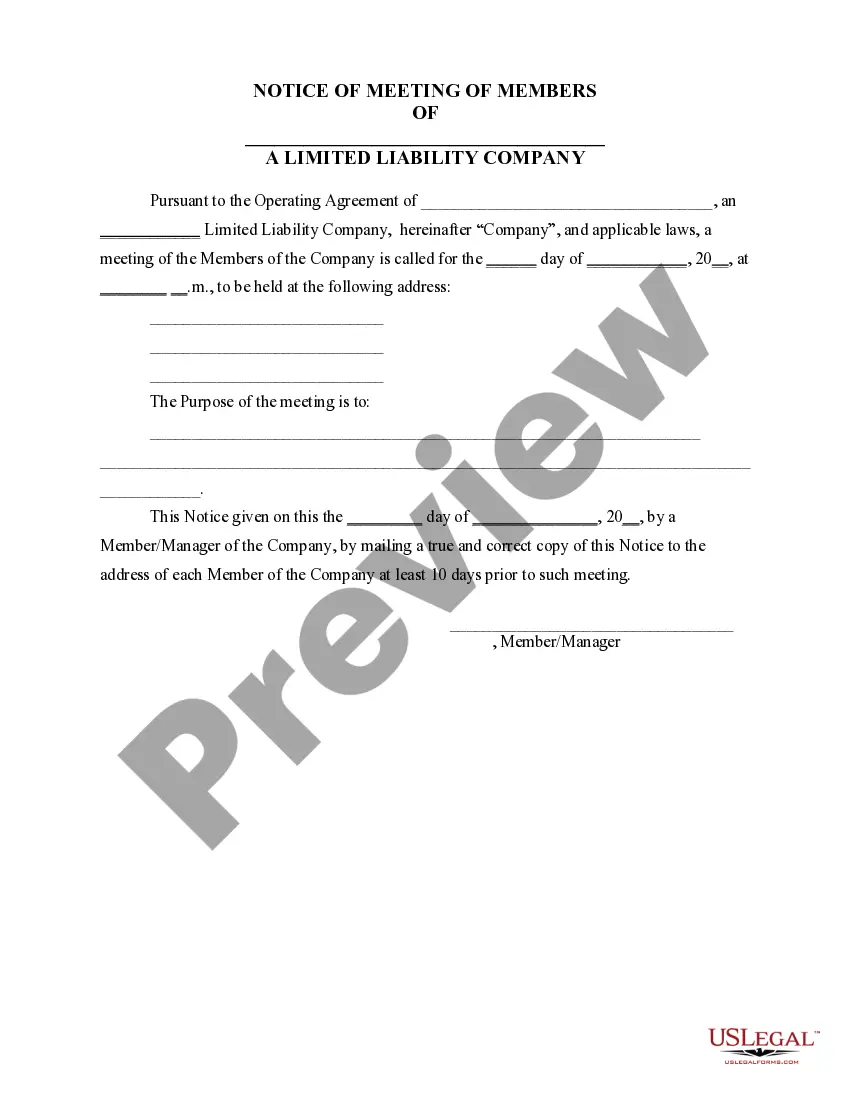

Minnesota Notice of Meeting of LLC Members - General Purpose

Description

How to fill out Notice Of Meeting Of LLC Members - General Purpose?

You may spend hours online searching for the permitted document template that fulfills the federal and state criteria you need.

US Legal Forms offers thousands of authorized documents that have been reviewed by experts.

You can conveniently obtain or create the Minnesota Notice of Meeting of LLC Members - General Purpose from the services.

First, ensure you have chosen the correct document template for the location/city of your choice. Review the form details to confirm you have selected the accurate form. If available, utilize the Review option to examine the document template as well.

- If you possess a US Legal Forms account, you can Log In and select the Download option.

- After that, you can complete, modify, print, or sign the Minnesota Notice of Meeting of LLC Members - General Purpose.

- Each legal document template you purchase is yours indefinitely.

- To receive another copy of any purchased form, navigate to the My documents tab and choose the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

Form popularity

FAQ

The 7 documents you need to create an LLCInternal Revenue Service (IRS) Form SS-4.Name reservation application.Articles of organization.Operating agreement.Initial and annual reports.Tax registrations.Business licenses.

How to Start an LLC in MinnesotaChoose a Name for Your LLC.Appoint a Registered Agent.File Articles of Organization.Prepare an Operating Agreement.Comply With Other Tax and Regulatory Requirements.File Annual Renewals.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

LEGAL RECOGNITION OF ELECTRONIC. RECORDS AND SIGNATURES. 302A.015. LEGAL RECOGNITION OF ELECTRONIC RECORDS AND SIGNATURES. APPLICATION.

An LLC operating agreement is not required in Minnesota, but is highly advisable. This is an internal document that establishes how your LLC will be run. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

Under 322C, the ability of a member, or anyone else, to act as an agent of the LLC is to be addressed, if at all, in an operating agreement. An LLC may file statements of authority with the Office of Minnesota Secretary of State (similar to those filed by partnerships) with respect to non-members.

Every Minnesota LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

The cost to start a Minnesota limited liability company (LLC) is $155 online and in-person or $135 by mail. This fee is paid to the Minnesota Secretary of State when filing the LLC's Articles of Organization. Use our free Form an LLC in Minnesota guide to do it yourself.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.