Minnesota Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company In Minnesota, a resolution of a meeting of LLC members is a formal document that outlines the agreed amount of annual disbursements to be made to the members of the company. This resolution serves as an essential decision-making tool and is vital for maintaining transparency and accountability within the LLC. The resolution must be made in compliance with the laws and regulations governing LCS in Minnesota. It must clearly state the specific amount of annual disbursements that will be distributed among the members. This amount can be determined based on various factors, such as profits, capital contributions, or a predetermined formula agreed upon by the members. To ensure the effectiveness and legitimacy of the resolution, it is essential that all LLC members participate in the meeting and collectively decide on the amount of annual disbursements. The resolution should accurately reflect the collective decision and be duly recorded in the minutes of the meeting. Different types of Minnesota resolutions of meetings of LLC members to specify the amount of annual disbursements may include: 1. Profit-Based Disbursements: This type of resolution determines the amount of disbursements based on the LLC's profits. The members may agree to distribute a certain percentage or share of the profits as annual disbursements. 2. Capital Contribution-Based Disbursements: In this type of resolution, the amount of annual disbursements is decided based on the members' capital contributions to the LLC. The higher the capital contribution, the higher the share of the disbursement. 3. Fixed Amount Disbursements: This type of resolution specifies a fixed amount that will be disbursed to each member annually, regardless of profits or capital contributions. It provides a predetermined sum that ensures consistency and predictable disbursements. 4. Formula-Based Disbursements: Some LCS may use a predetermined formula to calculate the amount of annual disbursements. The formula can be based on various factors, such as profits, capital contributions, or a combination of both. It is crucial for the LLC members to draft and approve the resolution in compliance with the LLC's operating agreement and the Minnesota statutes outlining the rights and responsibilities of members. Any deviation from these legal requirements may lead to invalidity or legal complications. Overall, the Minnesota Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is a vital document that ensures fair distribution of profits among the members. It promotes transparency, accountability, and fosters a healthy financial environment within the LLC.

Minnesota Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

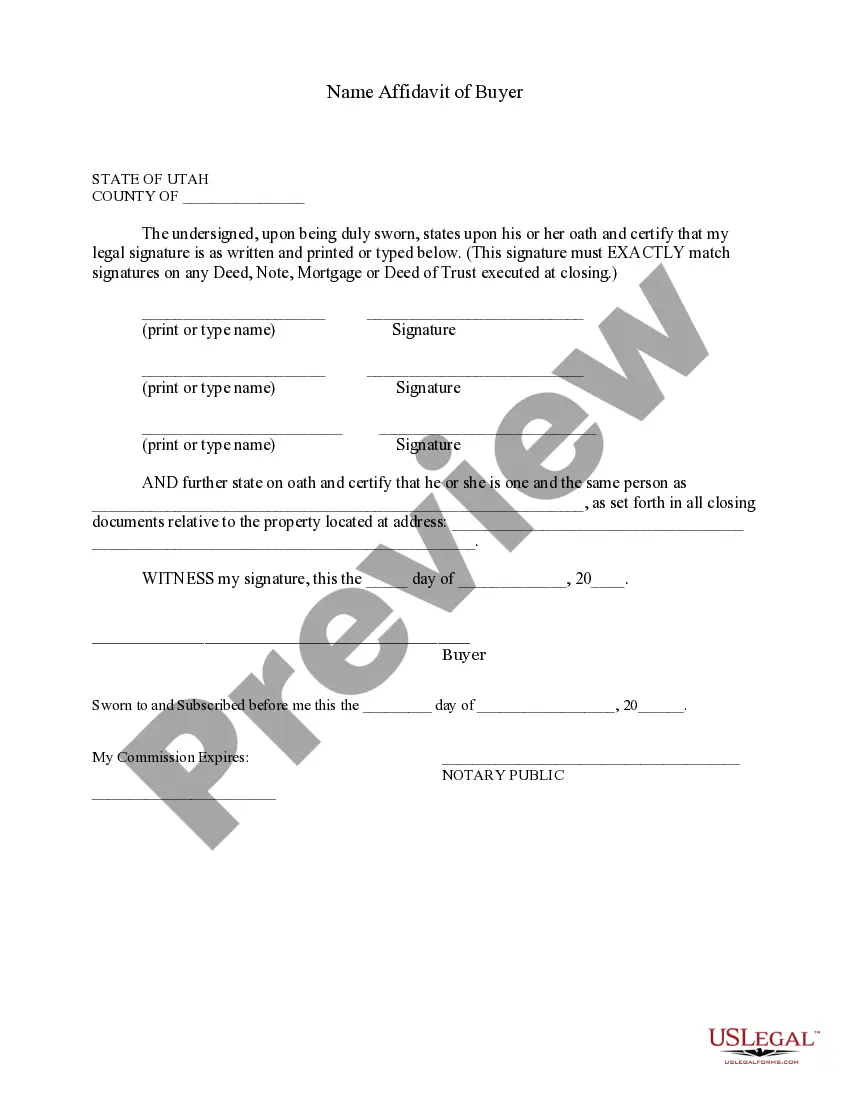

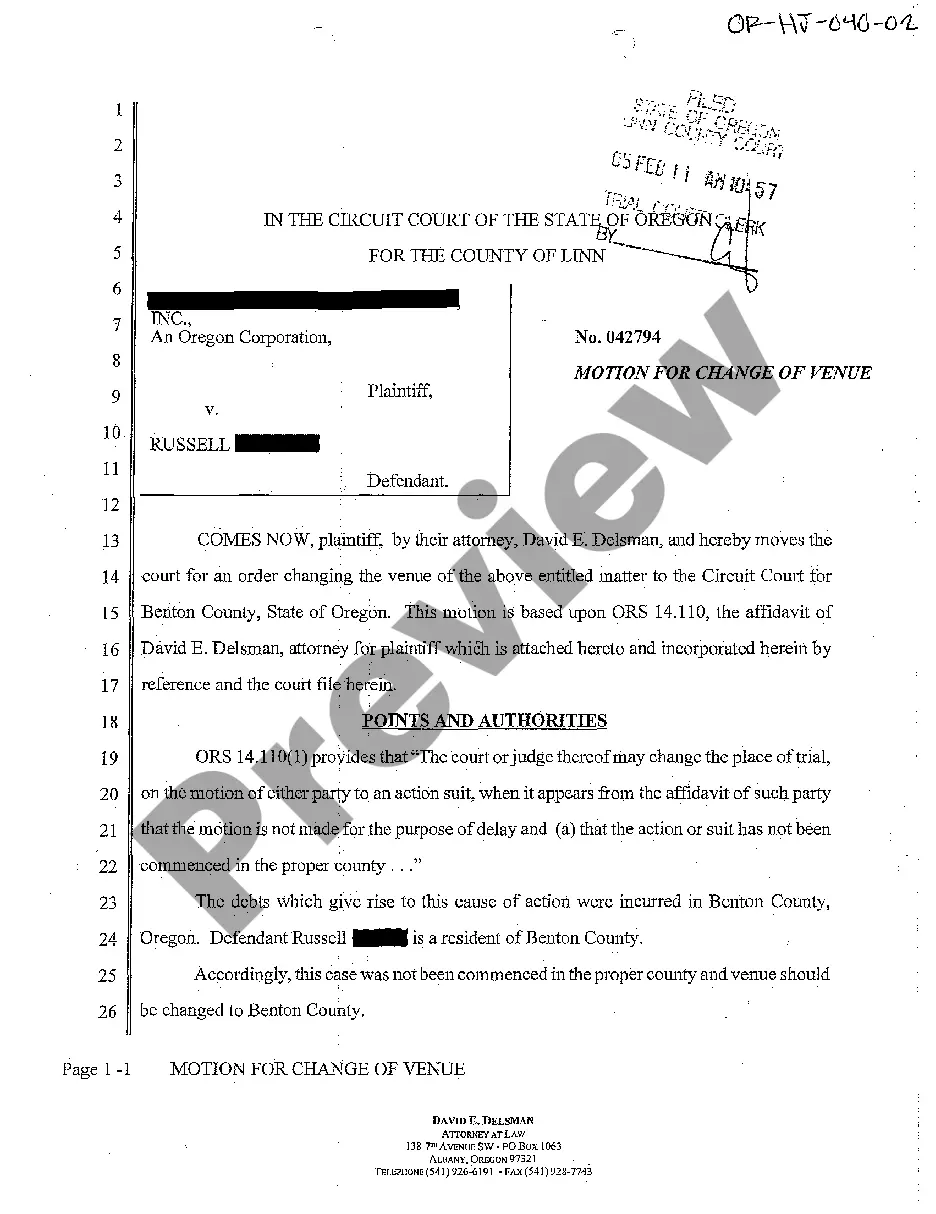

How to fill out Minnesota Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

It is possible to commit hours on the Internet looking for the authorized file design which fits the federal and state specifications you will need. US Legal Forms provides a large number of authorized forms that happen to be analyzed by experts. You can easily obtain or print the Minnesota Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company from your services.

If you have a US Legal Forms accounts, you may log in and click the Obtain key. Following that, you may complete, modify, print, or indication the Minnesota Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company. Every authorized file design you buy is the one you have forever. To have one more duplicate of the obtained form, visit the My Forms tab and click the corresponding key.

If you work with the US Legal Forms web site the very first time, adhere to the basic instructions beneath:

- First, ensure that you have selected the correct file design to the state/metropolis of your choice. Browse the form explanation to make sure you have picked out the correct form. If readily available, take advantage of the Preview key to appear throughout the file design also.

- If you would like locate one more edition from the form, take advantage of the Look for field to get the design that meets your requirements and specifications.

- Upon having identified the design you would like, just click Buy now to continue.

- Find the pricing plan you would like, key in your credentials, and register for an account on US Legal Forms.

- Complete the financial transaction. You should use your bank card or PayPal accounts to cover the authorized form.

- Find the file format from the file and obtain it to the device.

- Make adjustments to the file if necessary. It is possible to complete, modify and indication and print Minnesota Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

Obtain and print a large number of file themes using the US Legal Forms Internet site, which offers the greatest collection of authorized forms. Use skilled and condition-particular themes to deal with your small business or specific demands.

Form popularity

FAQ

MCA means a Member Control Agreement adopted pursuant to Section 322B. 37 of Chapter 322B. operating agreement or bylaws means the bylaws adopted under Chapter 322B, pursuant to Section 322B. 603, which might be confusingly titled Operating Agreement.

LEGAL RECOGNITION OF ELECTRONIC. RECORDS AND SIGNATURES. 302A.015. LEGAL RECOGNITION OF ELECTRONIC RECORDS AND SIGNATURES. APPLICATION.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

Every Minnesota LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

With a SMLLC, you'd only use a resolution to document the most important business matters or actions such as: buying or selling real estate. getting a loan, establishing a bank account, or otherwise working with a financial institution.

(a) Whoever unlawfully by means of fire or explosives, intentionally destroys or damages any building not included in subdivision 1, whether the property of the actor or another, commits arson in the first degree if a flammable material is used to start or accelerate the fire.

Under 322C, the ability of a member, or anyone else, to act as an agent of the LLC is to be addressed, if at all, in an operating agreement. An LLC may file statements of authority with the Office of Minnesota Secretary of State (similar to those filed by partnerships) with respect to non-members.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.