Title: Understanding the Minnesota Resolution of Meeting of LLC Members to Acquire Assets of a Business Introduction: The Minnesota Resolution of Meeting of LLC Members to Acquire Assets of a Business plays a significant role in the acquisition process of a business by a limited liability company (LLC). This legally binding document outlines the decisions made during a meeting of LLC members in Minnesota regarding the procurement of specific assets from another business entity. This article aims to provide a detailed description of the Minnesota Resolution of Meeting of LLC Members to Acquire Assets of a Business, its importance, and its various types. Keywords: Minnesota Resolution, Meeting, LLC Members, Acquire Assets, Business, Document, Legal, Procurement, Business Entity, Importance, Types. 1. Definition: The Minnesota Resolution of Meeting of LLC Members to Acquire Assets of a Business refers to the formal agreement or document drafted and adopted during a meeting of LLC members in Minnesota to approve the acquisition of assets from another business entity. 2. Purpose and Importance: The primary purpose of the Minnesota Resolution of Meeting of LLC Members to Acquire Assets of a Business is to authorize an LLC to proceed with the acquisition of specific assets from another business. This document is crucial as it provides legally binding evidence that all LLC members are in agreement regarding the acquisition. 3. Content and Structure: The Minnesota Resolution of Meeting of LLC Members to Acquire Assets of a Business generally includes the following key components: — Heading: Clearly stating it is a resolution document regarding the acquisition of certain assets. — Introductory Paragraph: Identifies the LLC and the intention to acquire assets. — Purpose Statement: Clearly defines the purpose for acquiring the assets. — Asset Description: Provides a detailed description of the assets involved in the acquisition. — Member Approval: Records the vote count in favor or against the acquisition, indicating the majority consent. — Signatures: Includes signatures of LLC members present during the meeting, affirming their agreement. 4. Types of Minnesota Resolution of Meeting of LLC Members to Acquire Assets of a Business: There are several types of Minnesota resolutions regarding acquisition of assets, including: — General Resolution: Used for acquisitions that involve a broad range of assets or businesses. — Specific Asset Resolution: Pertains to the acquisition of a particular asset or subset of assets. — Merger or Acquisition Resolution: Pertains to the acquisition of an entire business entity. Conclusion: In conclusion, the Minnesota Resolution of Meeting of LLC Members to Acquire Assets of a Business is a crucial document in the acquisition process. It formalizes the decisions made by LLC members during a meeting regarding the acquisition of assets from another business entity. Understanding the content and structure of this document is vital for ensuring a legally valid and binding agreement between parties involved in the acquisition.

Minnesota Resolution of Meeting of LLC Members to Acquire Assets of a Business

Description

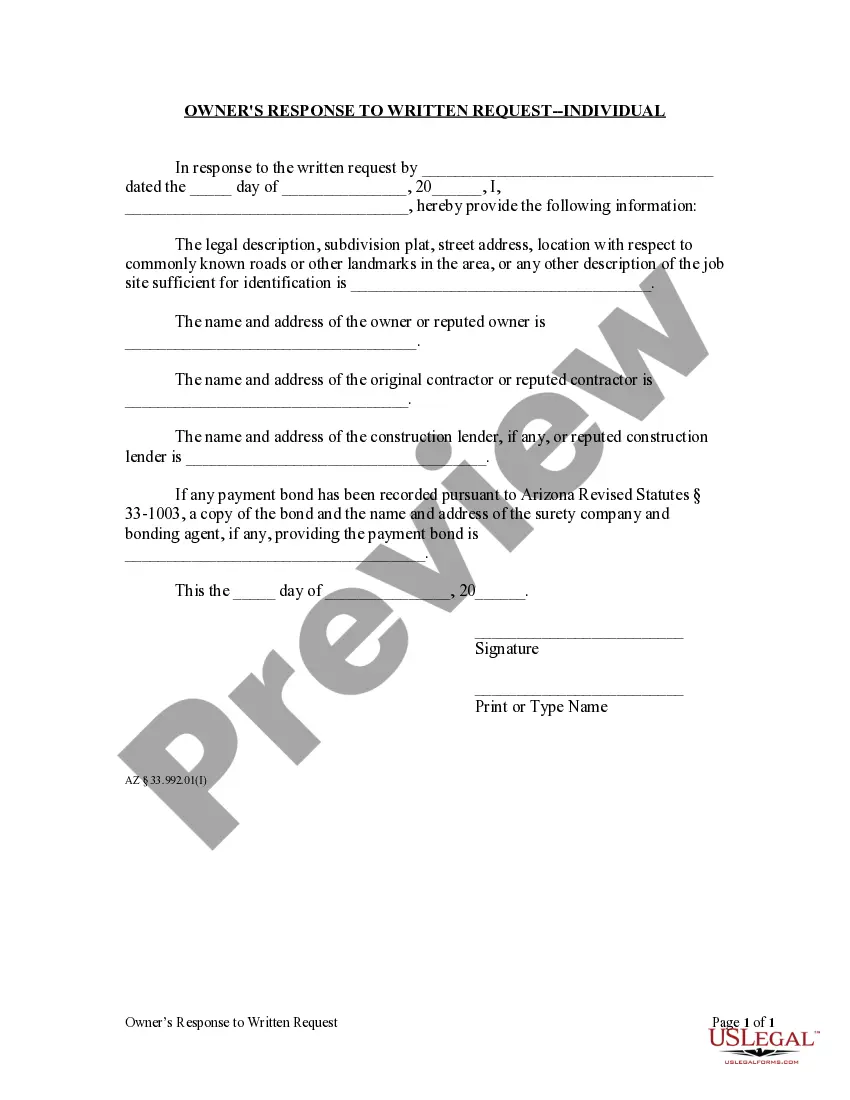

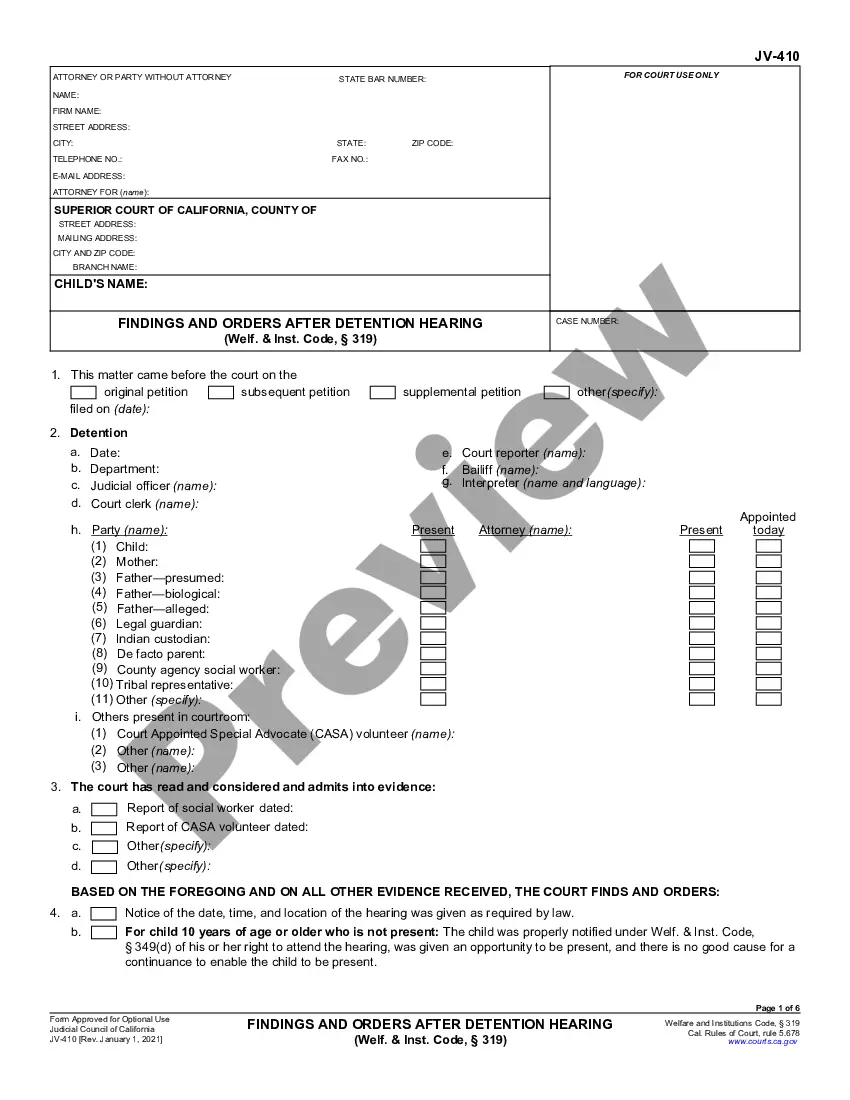

How to fill out Minnesota Resolution Of Meeting Of LLC Members To Acquire Assets Of A Business?

If you need to full, download, or printing lawful papers templates, use US Legal Forms, the largest assortment of lawful kinds, which can be found on-line. Utilize the site`s simple and convenient look for to find the paperwork you will need. Different templates for company and specific uses are categorized by categories and states, or key phrases. Use US Legal Forms to find the Minnesota Resolution of Meeting of LLC Members to Acquire Assets of a Business within a number of click throughs.

When you are already a US Legal Forms buyer, log in in your bank account and click the Download key to have the Minnesota Resolution of Meeting of LLC Members to Acquire Assets of a Business. You may also accessibility kinds you previously delivered electronically in the My Forms tab of your respective bank account.

If you are using US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have selected the shape for the proper city/nation.

- Step 2. Utilize the Review option to check out the form`s articles. Never neglect to learn the outline.

- Step 3. When you are not happy with all the type, utilize the Search area at the top of the display screen to locate other versions in the lawful type template.

- Step 4. Upon having discovered the shape you will need, select the Buy now key. Choose the pricing program you prefer and add your accreditations to sign up for the bank account.

- Step 5. Procedure the financial transaction. You should use your Мisa or Ьastercard or PayPal bank account to complete the financial transaction.

- Step 6. Find the formatting in the lawful type and download it in your gadget.

- Step 7. Comprehensive, change and printing or sign the Minnesota Resolution of Meeting of LLC Members to Acquire Assets of a Business.

Every single lawful papers template you get is your own permanently. You possess acces to each and every type you delivered electronically in your acccount. Click on the My Forms section and pick a type to printing or download once again.

Contend and download, and printing the Minnesota Resolution of Meeting of LLC Members to Acquire Assets of a Business with US Legal Forms. There are thousands of specialist and status-distinct kinds you may use to your company or specific demands.

Form popularity

FAQ

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

LEGAL RECOGNITION OF ELECTRONIC. RECORDS AND SIGNATURES. 302A.015. LEGAL RECOGNITION OF ELECTRONIC RECORDS AND SIGNATURES. APPLICATION.

LLC authorization to sign is generally assigned to a managing member who has the authority to sign binding documents on behalf of the LLC. When signing, the managing member must clarify if the signature is as an individual or in their capacity to sign as the representative of the LLC.

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.

What should a resolution to open a bank account include?LLC name and address.Bank name and address.Bank account number.Date of meeting when resolution was adopted.Certifying signature and date.