Minnesota Use of Company Equipment is a policy that outlines the rules, expectations, and guidelines regarding the use of company equipment by employees within the state of Minnesota. This policy ensures that all employees understand their responsibilities when it comes to utilizing company equipment, contributing to a safe and productive work environment. Key guidelines for the Minnesota Use of Company Equipment policy may include: 1. Authorized Use: Employees must use company equipment solely for authorized business purposes. Misuse or unauthorized use of equipment is strictly prohibited. 2. Equipment Responsibility: Employees are expected to handle company equipment with care and ensure its proper maintenance. Regular inspections may be conducted to evaluate the condition and functionality of the equipment. 3. Reporting Damages or Issues: Employees should promptly report any damage, malfunction, or loss of company equipment to their supervisor or the designated department. This allows for timely repairs or replacements, minimizing disruptions in workflow. 4. Personal Use Restrictions: While limited personal use of company equipment may be permissible, strict limits and guidelines should be in place to avoid excessive personal or recreational use that hinders work productivity. 5. Security Measures: Employees should follow established security measures, such as password protection, locking mechanisms, or encryption, to safeguard company equipment from unauthorized access or theft. 6. Internet and Communication Usage: Policies regarding internet and communication usage through company equipment, including computers, smartphones, or tablets, should be clearly outlined. This may include a statement emphasizing that personal use of such technology must comply with company policies. 7. Remote or Off-site Work: In situations where employees are permitted to work remotely or off-site, they must adhere to the same guidelines as on-site employees regarding the use, security, and maintenance of company equipment. Different types of Minnesota Use of Company Equipment policies may be relevant depending on the organization's specific needs and industry. Examples of specialized policies could include: 1. Vehicle Use Policy: If the company owns or provides vehicles to employees, a separate policy may outline guidelines for their use, maintenance, and safe operation on Minnesota roads. 2. Technology Use Policy: In technology-driven companies, a policy dedicated to the use of computers, software, servers, and other technology-related equipment could be established to regulate their appropriate use, updates, and maintenance. 3. Equipment Loan Policy: Organizations that lend equipment to employees for off-site assignments, such as cameras, tools, or specialized devices, might have a separate policy outlining the rules, responsibilities, and liability for borrowed equipment. By implementing and enforcing a comprehensive Minnesota Use of Company Equipment policy, businesses can ensure the proper and efficient usage of equipment, protect company resources, and maintain a productive and safe work environment for all employees.

Minnesota Use of Company Equipment

Description

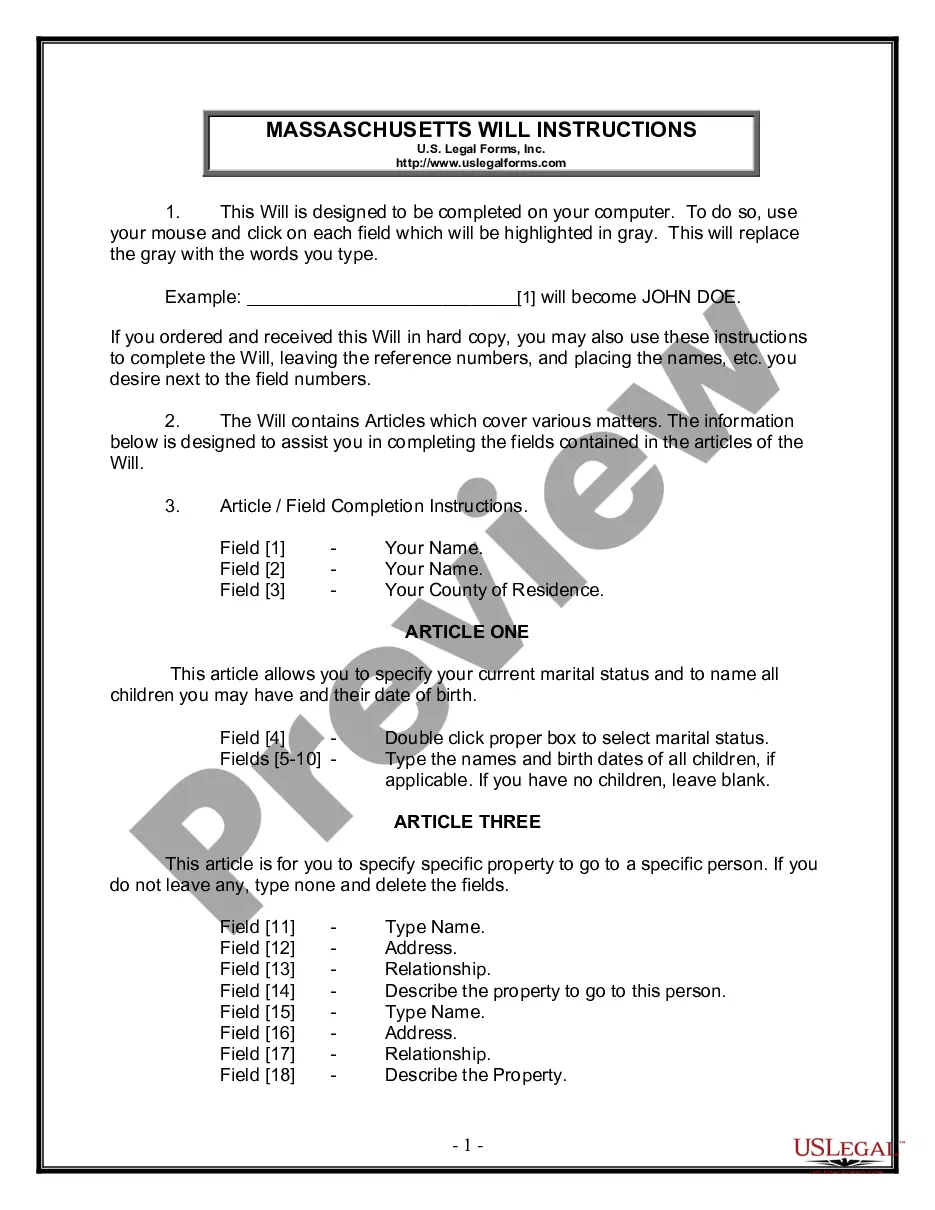

How to fill out Minnesota Use Of Company Equipment?

Are you currently within a placement that you require files for sometimes business or specific purposes just about every day? There are plenty of authorized document themes available on the net, but discovering ones you can rely is not easy. US Legal Forms gives 1000s of kind themes, just like the Minnesota Use of Company Equipment, that are created to satisfy state and federal demands.

When you are already informed about US Legal Forms website and also have an account, simply log in. Following that, you are able to obtain the Minnesota Use of Company Equipment format.

If you do not provide an account and wish to begin using US Legal Forms, follow these steps:

- Find the kind you require and ensure it is for that appropriate metropolis/state.

- Utilize the Preview key to review the shape.

- Look at the outline to ensure that you have selected the correct kind.

- In case the kind is not what you`re trying to find, make use of the Search area to obtain the kind that fits your needs and demands.

- If you get the appropriate kind, simply click Buy now.

- Select the rates plan you need, complete the required details to generate your bank account, and pay for an order making use of your PayPal or Visa or Mastercard.

- Select a hassle-free paper formatting and obtain your duplicate.

Discover all the document themes you possess purchased in the My Forms food list. You can obtain a further duplicate of Minnesota Use of Company Equipment anytime, if possible. Just select the necessary kind to obtain or print out the document format.

Use US Legal Forms, one of the most extensive selection of authorized types, to conserve some time and avoid mistakes. The service gives professionally manufactured authorized document themes which can be used for a variety of purposes. Generate an account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

Common examples include: Clothing for general use, see Clothing. Food (grocery items), see Food and Food Ingredients. Prescription and over-the-counter drugs for humans, see Drugs....For more information, see:Personal Services.Professional Services.Taxable Services.

If you owned the equipment for one year or less, they will charge your regular income tax rate on the gain. If you owned the equipment for over a year, you owe the long-term capital gains rate, which will be 0, 15 or 20 percent of your profit depending on your tax bracket.

Sales and rentals of tangible personal property are taxable unless an exemption applies....Taxable SalesBatteries.Candy and gum.Dietary supplements.Equipment sales or rentals.Jewelry and watches.Office supplies.Pet food.

Common examples include: Clothing for general use, see Clothing. Food (grocery items), see Food and Food Ingredients. Prescription and over-the-counter drugs for humans, see Drugs.

Circular No. 126 dated 22-11-2019 has clarified that ,if manufacturing services are performed on goods belonging to unregistered persons, then tax rate shall be 18%.

Which of the following isn't a typical federal/state adjustment? Meals and entertainment. Meals and entertainment is a typical book/federal tax adjustment rather than a federal/state adjustment.

You do not have to provide any other proof why no tax was charged. Common examples include: Clothing for general use, see Clothing. Food (grocery items), see Food and Food Ingredients. Prescription and over-the-counter drugs for humans, see Drugs.

Sales, leases, and rentals are taxable regardless of quantity or if the item is new or used, unless an exemption applies. See the following table for specific examples.

must pay tax on administrative supplies, most machinery, accessories, furniture, fixtures, and other items used to produce a product. However, ma- terials used or consumed to produce products for sale are exempt from sales tax.

Purchases of prototypes or materials to make prototypes for research and devel- opment activities are exempt from sales tax. This exemption excludes machinery, equipment, tools (except qualifying detachable tools), general operating supplies and construction contracts.

More info

“ One commonly held thought is that personal computers provide personal business and personal use. There is a little more to it. As a basic computer equipment used for personal, business, and other personal use. In reality every computer is a combination of both personal use and business use. For this to be useful it might be helpful to start with my basic definition of business equipment. This definition includes personal use and personal business use. I consider the term “personal computer” to be a generic term. The term “personal computer” does not differentiate between personal use and business use. My goal in this post is to address personal use devices. The primary reason I am proposing the term personal computer is, so I do not have to explain what a personal computer is when using the personal use component. If you do not use the terms personal use and business equipment you will not understand why the personal business unit and personal use unit are the same.