Minnesota Relocation Expense Agreement

Description

How to fill out Relocation Expense Agreement?

You are capable of spending time on the web attempting to discover the valid document templates that comply with the state and federal requirements you will need.

US Legal Forms offers a wide array of valid forms that are reviewed by professionals.

It is easy to download or print the Minnesota Relocation Expense Agreement from our service.

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you may Log In and then click the Download button.

- Afterward, you may complete, modify, print, or sign the Minnesota Relocation Expense Agreement.

- Each valid document template you purchase is yours to keep for years.

- To obtain an additional copy of a purchased form, visit the My documents tab and click the relevant button.

- If you are utilizing the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document template for the state/region of your choice.

- Review the form details to confirm you have chosen the accurate form.

Form popularity

FAQ

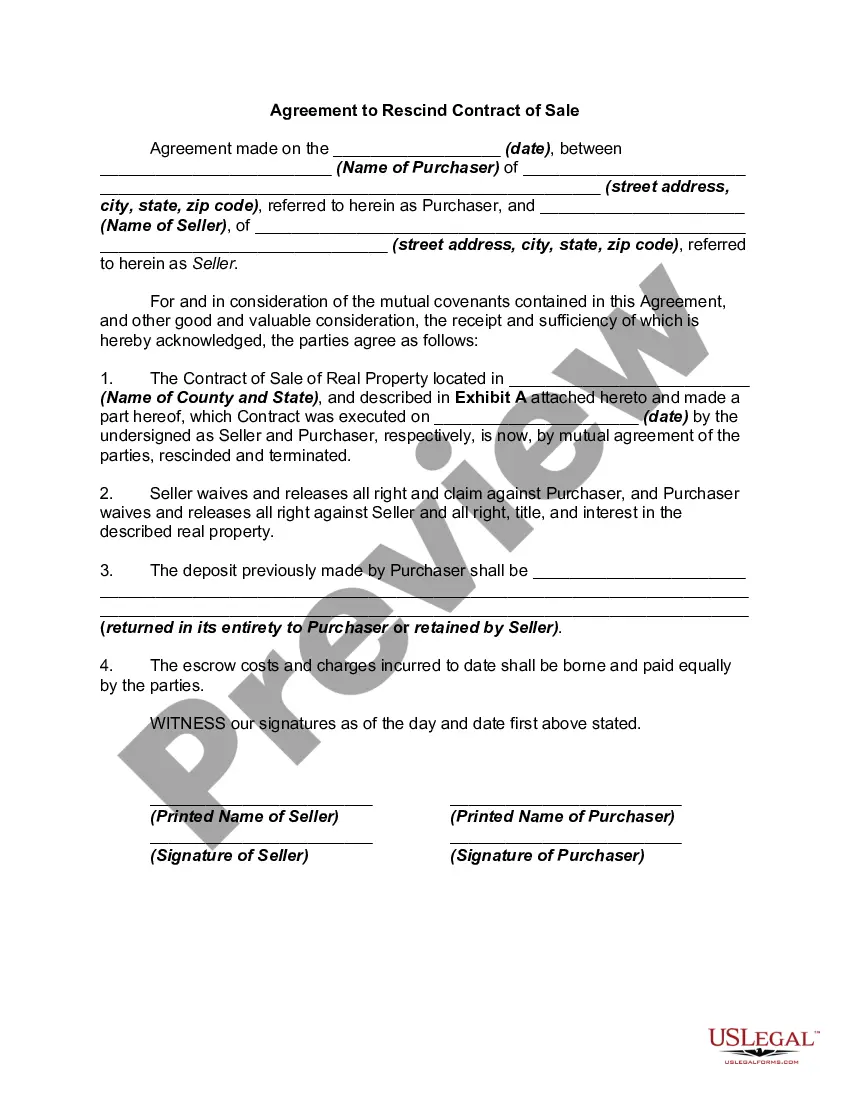

A relocation agreement, sometimes referred to as an employee relocation agreement, is a legal contract executed by an employer and an employee in which the employer agrees to compensate an employee for relocating for business purposes.

These include: The cost of packing, crating and transporting household goods of the employee and family. This includes cars and pets. The cost of connecting or disconnecting utilities.

Moving is costly, so companies can help by offering some financial reimbursement for expenses such as moving services, mover's insurance or transportation. While some companies provide the funds only after the moving employee submits relevant expense reports, others opt for a single lump sum upfront.

Your employer may cover the cost of a trip to find a new home. They will also cover the cost of moving your goods and moving yourself and your family to the new location. This may include either airfare for your family or mileage for you to drive, hotel stays along the way, and maybe a per diem for food.

How much do employers spend on employee relocation options?Travel to the new location.Packing and moving service costs.Moving insurance.Short-term housing.Storage units or other temporary storage solutions.Home sale or purchase.Tax gross up for benefits.Relocation taxes.

For most taxpayers, moving expenses are no longer deductible, meaning you can no longer claim this deduction on your federal return. This change is set to stay in place for tax years 2018-2025.

A typical relocation package usually covers the costs of moving and storing furnishings, household goods, assistance with selling an existing home, costs incurred with house-hunting, temporary housing, and all travel costs by the employee and family to the new location.

Any expense or amount paid for moving expenses, whether or not they are paid directly to an employee, on or after January 1, 2018 are includible in an employee's gross income subject to applicable federal income tax withholding, social security and Medicare taxes.

The expenses must be incurred or the benefit given to the employee within one year following the end of the tax year in which the change to their employment occurred.

The short answer is yes. Relocation expenses for employees paid by an employer (aside from BVO/GBO homesale programs) are all considered taxable income to the employee by the IRS and state authorities (and by local governments that levy an income tax).